Lemons to lemonade

Water and transport management challenges can be turned into a competitive advantage.

Melissa Stark, Accenture, London

Water plays a significant role in a shale operation and presents different challenges across the five stages of the shale gas lifecycle. About five million gallons of water are required to drill and fracture a well, the equivalent of 1,000 water truck movements.

As illustrated in Table 1, during the civil/site preparation stage, the developer manages the permitting and articulates the proposed approach to water sourcing and disposal, well completions, and fracturing fluid disclosure to ensure regulatory compliance. In the drilling phase, suitable well and casing requirements are implemented to protect groundwater, and water is used in the drilling fluid. The usage is intense and time sensitive, requiring a high level of flexibility. The completion/fracturing stage is where most water is used accounting for about 60% to 80% of the daily road volume during this stage and up to 90% of the total water volume.

In the flowback phase, the challenge is the reuse, disposal, or treatment of the wastewater. The water composition, volume, and therefore, treatment and disposal options differ significantly across plays. In production, the volume of waste water stabilizes, but the produced water still must be treated and disposed of.

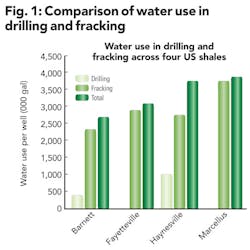

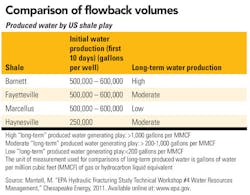

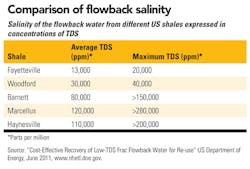

It is important to note that shale plays differ significantly in their water challenges. They differ in availability of water, volume needed for drilling and fracturing, volume and patterns of flowback water, water composition (metals, organics, salinity), and disposal options. Figure 1 compares some of the water characteristics across key US basins.

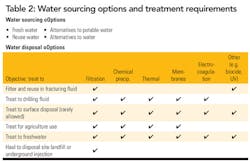

The developer of each shale play selects the lowest cost environmentally acceptable option for water sourcing, water use, and treatment of flowback and produced water. Table 2 illustrates water sourcing options and treatment requirements.

Water movement commercial impact and challenges

An important part of selecting the water sourcing and use and treatment options is the cost of water movements. Water transportation in some operations can account for as much as 40% of total fracturing cost and 20% of total well completion cost, making it a significant contributor to the total cost of operations. This is compounded by rising transport and commodity costs in many of the locations as the scale of operations across the basin increases. Given that many shale gas operations are cost-marginal, effective management of the cost of transportation within these operations can be a source of competitive advantage.

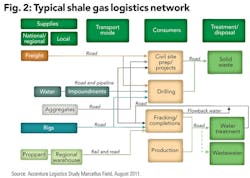

The remote location of many of the shale gas plays and the dynamic nature of the operations make transport by road the most commonly used option, due to its flexibility. Increasing use of pipelines and rail, supported by inventory holding locations, is evolving in some of the more mature plays but even in these operations, road transport is still the de facto mode for the "last mile" movements to the remote and ever-changing drill sites. An overview of the type of material moves and volumes, broken down by phase, can be seen in Table 3, and a breakdown of a typical logistics network to support shale gas operations is provided in Figure 2.

In addition to cost, the volume and intensity of water transportation required for shale gas development present operators with a number of additional challenges.

Regulatory compliance

Growing public concern over the environmental impact of shale gas has led to an increased focus on the way resources, particularly water, are being used, monitored, and controlled. For example, many US states require operators to report on the source, volume, and disposal destination of any water used. Today, this task is typically handled manually by truck drivers and back-office staff, resulting in a costly and sometimes inaccurate end-to-end process. As regulatory requirements and the scale of operations continue to grow, shale gas operators will need to find more efficient and cost-effective ways to comply.

Road transport health and safety

The level of transport activity associated with the movement of water and other modes of transport places operators under considerable exposure to health and safety risks. Driving-related accidents are the single largest cause of fatalities in exploration- and production-related operations. The exposure within shale gas operations is even greater, with remote locations often suffering from poorly maintained roads and limited availability of skilled drivers. As the scale of operations continues to grow, the challenge of complying to global operator health and safety standards will become even greater.

Local community impact

The sharp influx of logistics activities during the drilling and fracturing phases can have a significant impact on local communities. Increased traffic congestion, damage to roads, noise, and air pollution are among the most commonly cited concerns relating to logistics activities. Local governments have to tackle these concerns by restricting shale operation traffic from entering residential areas, by implementing weight limits on certain access roads, and levying maintenance fees for heavy usage of public roads. Such measures can reduce operational flexibility and increase costs. However, failure to properly address community concerns can impact public relations and potentially result in more intrusive restrictions on operations.

Delivery assurance for dynamic, volatile operations

Given that operational techniques associated with hydraulic fracturing are still maturing, there is high volatility in daily activity plans. In some operations, the changes to planned water movements on day of execution are averaging approximately 60%. This is set against a backdrop of limited operational visibility, with metrics and data relating to the operations often difficult to ascertain. Providing delivery assurance for the operations is critical, but oversupply will result in severe congestion of vehicles at the well pad and on surrounding roads, resulting in health and safety exposure, operational challenges in managing congestion, and high lifting costs.

Conversely, a shortage of water can stop the operation, causing considerable cost wastage in an already cost-marginal operation. Therefore, logistics teams face a daily challenge in providing the delivery assurance of water that is critical to the success of the overall operations.

Talent and organization

The concentration of operators working within a shale gas basin and the often remote nature of the locations (away from traditional oil and gas recruitment areas) is resulting in an acute "war for talent," as operators seek to recruit skilled road transport personnel in both execution and management roles. This situation is compounded by the lack of experience in road transport within many operators and the need for a flexible workforce as the operations increase and contract over time. Moreover, with a large local workforce, union relationships need be handled delicately to reduce risk of disruption to operations. This has resulted in many shale gas operators looking for alternative ways of fulfilling their growing logistics talent needs.

Recommendations

Having said all that, depending on the shale play, there are a number of levers than can be used to reduce the number of water truck movements.

Water reuse and recycling

Water reuse and recycling can significantly reduce the volume of water movements. In the Marcellus and Fayetteville shales, some operators are able to reuse 80% to 100% of flowback water. However, in most cases, the flowback volume only accounts for 10% to 20% of the total water needs.

On-site water treatment and disposal

The development of on-site wastewater treatment and disposal technology can reduce the requirement of transporting water. However, mobile water treatment units are not available for all water treatment technologies and the use of reinjection wells is not applicable to all geologies.

Water alternatives

In some areas, there are non-potable water sources close to shale developments (i.e., coal mine water in the Marcellus or brine in the Horn River basin) that could be used as alternative supply points. In particular, the development of closed-loop water systems where non-potable water is sourced, treated, and reused can significantly reduce water transportation costs in addition to having environmental benefits.

Propane gel and nitrogen foam can also be used instead of water. However, there will still be movements associated with these alternatives, and the cost of treating these waste streams could be more expensive.

Alternatives to road transport

Rail cars and overland pipelines are increasingly used in the more mature basins as alternatives to road transport. However, pipelines in particular can be expensive and not all locations are well connected into the national and local rail networks. The use of pipelines and rail as alternative modes of transport allows water to be moved to central coordination points, such as large impoundments. The final movement to the well site, however, still requires road transport.

Logistics management models

Learning from industries where logistics have historically been critical to the business, shale operators are looking to adapt leading logistics practices to help achieve reduction in road transport use. Streamlined efficient processes, targeted use of specialist software systems, deployment of skilled logisticians and better commercial management of the operators are helping achieve significant reduction in truck miles and providing improved delivery assurance.

For example, significant benefits are being realized through targeted use of technology to provide live, real-time information on water inventory levels and vehicle locations. This information allows a team of skilled logisticians to effectively manage the wait times and inventory levels of water across the basin, helping to reduce health and safety exposure, congestion, cost and provide delivery assurance. The detailed metrics generated through the improved data also allow the logistics team to drive targeted continuous improvement initiatives, measure carrier performance and confirm freight payment compliance, all of which help to further improve operations.

Basin-wide collaboration

A more dramatic lever that could reduce the transportation costs of all the operators in the basin is basin-wide collaboration. Many shale gas basins feature a number of operators working in close proximity and in the same regulatory environment.

Cross-basin infrastructure development

Where there are basin-wide infrastructure challenges, such as a lack of heavy vehicle suitable roads and limited central water storage locations, operators should consider developing these infrastructure resources in a collaborative way. Such an approach will provide a holistic view across the basin enabling operators to design their supply chain network in a way that improves performance. This approach has the additional benefits of preventing duplication in infrastructure networks, thereby reducing investment cost and logistics impact on the environment and local community.

Coordinated development of suppliers

In new shale plays where the local market is relatively immature, operators will often need to develop the local suppliers to ensure that they perform to an operational level that is in line with industry standards. Given the potential shortage of skilled workers, it would be beneficial for the operators to collaborate and coordinate. This would be especially beneficial in highly constrained markets where there is limited capacity and likelihood of over competition. Operators should focus on collaborating on indirect services such as water hauling and camp services to help reduce the supplier development effort, while maintaining control and competitive advantage in their core areas of operations.

Sharing excess carriers capacity

The concept of carrier capacity sharing works by creating a market for excess transportation capacity that is accessible by operators working in the same basin. This approach is best suited to shale plays where there exists a pool of mature shale operators working in a volatile operating environment. To benefit from this, the shale operators and carriers should have good visibility of their supply and demand, underpinned by an agile logistics operation and effective communication. Sharing of excess capacity can help reduce operating cost through improved asset efficiency.

Common logistics management platform

At the more advanced end of the collaboration spectrum, operators could develop a basin-wide logistics management platform allowing more information to be available to all operators and resulting in a common reporting platform. The key to this development would be a shared common software backbone, underpinned by a transport management system (TMS) and other leading-class technologies, such as Global Positioning Systems (GPS) and water inventory management tools. Running this platform across multiple transport modes and operators will help optimize operations, delivering benefits across the board.

Conclusion

The challenges of water transport and management in shale gas development can have a significant impact on a company's performance. However, many lessons can be learned from the US experience, and if applied correctly, those challenges can turn into opportunities for competitive advantage. OGFJ

About the author

Melissa Stark is a managing director with Accenture's energy industry group and the lead for the group's new energy practice. She was the research lead for the 'Water and Shale Gas Development, Leveraging the US experience in new shale developments' report on which this article is based. Stark is located in London.