Drilling in the financial statements

Chris Monk, Protiviti, Houston

Mark Dell'Olio, Protiviti, Atlanta

History has shown that, at times, success in the oil and gas industry has included "drilling for oil on Wall Street." However, in recent years, progressive energy companies have found significant value using a "drilling in the financial statements" approach. It is a strategy well suited to the times as, despite record revenues in 2011, industry profitability remains below 2008 levels.

While many factors have contributed to these recent decreases in profitability, this article focuses on mitigating the effects of three prevailing drivers:

- Increasing total costs of operations at a rate higher than commercial pricing;

- Rising debt levels as a result of increased capital spending while access to lower interest credit lines is tightening; and

- Myopic focus on "cost per well" rather than a complete view of enterprise costs.

Untapped opportunities to enhance bottom line

Industry and investors have long focused on public companies' reserve disclosures or concentrated on the newest imaging technology or fracking procedures, while often glossing over the substantial cash generation or preservation opportunities in financial operations. This focus has caused the industry to overlook untapped cash or savings potential that can have a measurable bottom-line impact. As margins have eroded across the industry, investors have started to look closer at companies that can deliver bottom-line results in what has become a very dynamic business environment.

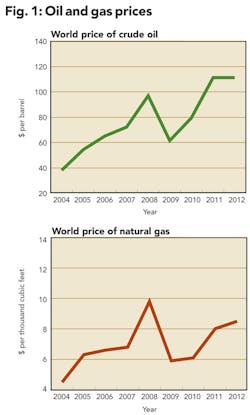

A major factor contributing to the trend of margin erosion within the industry is the commercial pricing of both oil and natural gas. Prices at the pump remain relatively strong, supporting a strong crack spread and good times for downstream companies, but current pricing of crude oil is essentially at the same levels as in 2008, while the global pricing of natural gas has decreased by ~20%, significantly impacting upstream companies. However, it is the overall fluctuation in pricing – which is hypersensitive to global demand trends – that has driven revenue volatility, with an average change of 43.2% over the past five years according to IBIS (Figure 1).

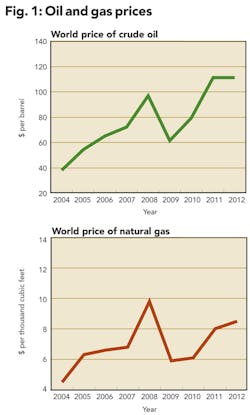

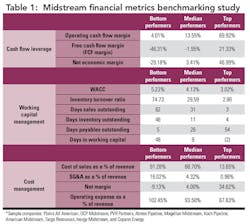

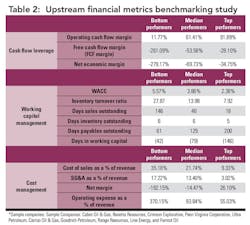

In order to better understand and quantify the improvement opportunities facing oil and gas companies, Protiviti conducted a benchmarking study around key financial metrics for both upstream and midstream oil and gas segments. Each benchmark includes 10 publicly traded companies that operate solely in either the midstream or upstream segment.

The results (Tables 1 and 2) show substantial disparities between laggard and top-performing companies in metrics directly attributed to overall cash management. These disparities indicate a significant opportunity for many companies to improve financial performance through enhanced cash-management practices and cost-reduction efforts.

Executives can create maximum value and strengthen the positions of their firm by challenging the status quo and finding ways to reduce costs through enhanced working capital and strategic cost management. This is particularly the case in capital-intensive industries like oil and gas. For example, according to IBIS, for every $1.00 spent on wages in 2012, the average oil and gas industry company invested $7.58 in capital equipment.

Although the topic of cost management is broad, there are a number of key strategies that companies have applied to successfully add to bottom-line profitability.

Strategic cost reductions

1) Strategic Sourcing

Cost reductions achieved through the successful implementation of strategic sourcing best practices are the single most impactful drivers of improved EBITDA (earnings before interest, income taxes, depreciation, and amortization). Strategic sourcing improves bottom-line performance because every dollar saved through such practices reduces the cost of goods sold by that same dollar, whereas increases in revenue are subject to cost of sales and operating margins to derive bottom-line impacts. Strategic cost-reduction efforts also provide first adopters a significant competitive advantage through the ability to respond more quickly to changes in supply market dynamics.

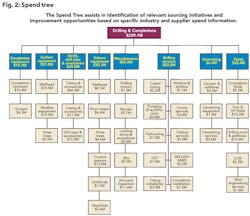

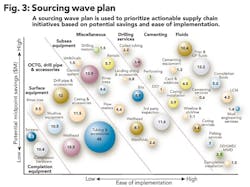

To attain fully leveraged market-based pricing, oil and gas companies should aggregate enterprise wide spend data, often across multiple non-standard purchasing/financial systems, to identify a profile of spending known as a "spend tree." These category profiles can be analyzed against prevailing market trends to create a client-specific sourcing wave plan and category strategies aimed at maximizing cost reduction, while also taking into consideration the level of organizational effort required and other tangible benefits that may be possible (e.g., cycle time reduction, process improvement, improved supplier performance or quality). The adjacent figures depicts a recent example of an oil and gas category tree and sourcing wave plan designed to deliver optimal cost savings (Figures 2 and 3).

A typical upstream, midstream, or oilfield services company that has not previously placed significant emphasis on sourcing and cost management can generally achieve annualized spending reductions in the range of 8% to 14% of addressable spend.

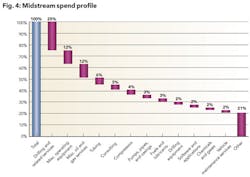

To better understand where these savings are likely to be generated, the adjacent "waterfall diagram" for a typical midstream oil and gas company depicts the spend profile, which is the first step used to identify primary cost drivers and potential savings opportunities (Figure 4). Observe that a majority of the operating expenses addressable through strategic sourcing are associated with drilling and related services, which make up nearly 25% of the total operational costs.

Another significant cost category (12%) is that of miscellaneous operation equipment; this cost bucket consists of all auxiliary mechanical and electrical components that are required to extract oil and gas at well sites. These two categories alone account for 37% of the total spend profile, demonstrating that substantial value can be driven from concerted focus across even a few select categories.

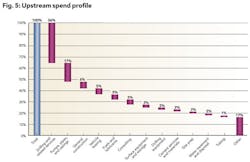

As expected, the spend profile for a typical upstream oil and gas company deviates noticeably from that of a midstream company by both categories and relative percentages. For example, the spend profile below shows drilling and related services accounting for 36% of the total operational costs of an upstream oil and gas company, which is 11% more than such costs for midstream companies. In addition, general construction, which isn't visible in the top 12 midstream categories, is the third highest spend category for upstream companies, accounting for 6% of operational costs (Figure 5).

It should be noted that spend profiles are specific to individual companies and can vary greatly, even within a given segment. Business strategies related to fracking, buy-versus-lease, and state of company maturity, growth and CAPEX spend all will alter the spend profiles referenced above. As such, a company should review the spend profile specific to its organization before deploying resources to undertake any strategic sourcing initiative.

2) Total cost of ownership

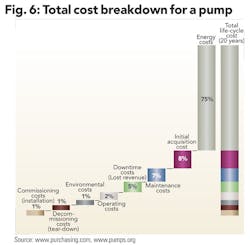

Cost reductions can hardly be measured by looking solely at the prices paid for goods and services. Any well-conceived procurement strategy must account for what is known as total cost of ownership (TCO) optimization. For a multitude of typical oil and gas industry items, initial price only accounts for a fraction of total cost incurred. Factors such as useful life, efficiency, transportation costs, and others must be accounted for in cost calculations, particularly when such factors have a measurable impact on the total cost equation of a given purchase/contract. As an example, consider the total cost associated with industrial pumps used in the oil and gas industry.

As Figure 6 indicates, the initial purchase of a given pump, on average, accounts for roughly 8% of the total cost of the pump over its useful life (20-year estimate). In comparison, energy costs to run the pump over that same lifespan are approximately 75% of total costs. In the case of pump purchases, attributes of a pump's design, such as efficiency, must be assessed in order to identify the pump that will deliver the best value to working capital over time.

Oil and gas companies should fully research all major cost components of a given purchase to develop a total cost model, which will assist them during the selection process and enable them to make better-informed purchasing decisions.

In the total cost model referenced above, if a pump (Pump A) is quoted at an initial cost 5% less than another (Pump B), yet Pump B is 30% more efficient and all other variables are equal, Pump B would be the best value by greater than 20% over the useful life of the purchase.

Does this mean that Pump B in this example is the correct purchase for every organization? Absolutely not, as immediate price reductions may drive a short-term business focus. However, the fatal flaw in many oil and gas organizations' purchasing processes is that no systematic effort is made to assure that the proper information is available so that informed selection decisions can be made based on the overall impact of purchases.

Strategic cost management

1) Financial leakage

One key aspect of proper cost management is to ensure an efficient and accurate accounts payable function that minimizes financial leakage. Companies are often stunned when, after investigation and analysis, they discover the magnitude of overpayments, incorrect payments and duplicate payments made to suppliers. The scale of overpayment to suppliers is often a factor of the overall size of the company (size of spend), its organization model (centralized versus decentralized AP processing), and level of growth and acquisition activity.

However, it is not uncommon to identify overpayments reaching into the millions of dollars. Generally speaking, a common heuristic to measure the potential is one-tenth of 1% of third-party payments can be recovered. Overpayments to suppliers can typically be attributed to one of several root causes:

- Duplicate payments – Multiple payments made to a supplier for the same good or service resulting in an overpayment;

- Unrealized credits – Outstanding credits that should have been received for items such as product returns, deposits/pre-payments and cash calls; and

- Unsupported or erroneous charges – Capital projects and other services-oriented contract charges that are not in line with terms of the agreement, are misallocated per contract terms, or simply are billed incorrectly.

Duplicate payments happen for a variety of reasons: poor maintenance of supplier master data records, inconsistent and/or decentralized invoice processing, recent merger or acquisition, inadequate process controls, and/or enterprise resource planning (ERP) conversions where invoices are paid in both new and legacy systems. Regardless of the specific reason, when an overpayment occurs, it directly reduces bottom-line profits.

The supplier credit process is another accounts payable process that has a direct impact to any company's bottom line. Many supplier contracts that require deposits and advance payments entitle the customer to recoup some, or all, of these costs upon completion of the contract. However, many of these costs are never recovered due to faulty or informal recovery processes. Many companies simply rely on the good faith of their suppliers to issue the credit, while other companies deduct the credit from future invoices that may never materialize. In any case, lost supplier credits erode margin and undermine a company's performance profile in comparison to its competition.

Due to rapid growth and consolidation across the industry, many oil and gas companies lack key controls in the management of their data, processes and systems. In such an environment, regular reviews of supplier payments and outstanding credits are critical to ensure that an organization is not overpaying for goods and services. A comprehensive review of all historical payments and related processes should be performed to determine the appropriate review schedule.

Additionally, supplier contracts should be prioritized based on dollar amount and the nature of contract pricing terms (focus on time and materials or cost plus, rather than fixed price). Companies should conduct an independent review of supplier invoices on high-priority contracts, both during a project and at the completion, including payments dating back a period of one to three years. An accounts payable performance review may also include a third-party assessment that utilizes automated systems to quickly assess the potential recovery of inaccurate payments through robust analytics and "fuzzy logic" beyond standard ERP duplicate payment crosschecking.

2) Working capital management - supplier payment structure

Good management of supplier payment structures is one of the most widely applied yet least leveraged tools to help improve working capital metrics. For many years, oil and gas contracts were negotiated by operational stakeholders in the field with a strict focus on delivery and performance. While delivery and performance should continue to be the primary drivers behind most contract awards, gone are the days where sound commercial decision criteria can be disregarded.

Optimized supplier payment terms are one lever all companies should use to strengthen their working capital position. As the phrase goes, "cash is king," and as a general rule, a purchaser of goods and services should work with a supplier to defer payment as long as reasonably possible without negatively affecting the supplier's liquidity or relationship. This has become particularly true as lines of credit, while inexpensive, have become increasingly difficult to secure.

Throughout the oil and gas industry, many companies are paying their suppliers in net terms of 30 days or shorter, whereas similar goods and services in other industries are being paid in 45, 60, or even 90 days. So what is the impact of optimized payment terms? Let's assume a company spends $500 million annually with a cost of capital (WAC) of 8%. If the organization were to move payment terms for 75% of that spend (realizing that it cannot necessarily control terms for all suppliers for various reasons) from an average of 30 days to 45 days, a days payable outstanding (DPO) improvement of 15 days, it would be realistic to expect a working capital improvement of approximately $1.2 million:

Working Capital Improvement = 15/365*(8%)*($500M*75%) = ~ $1.23M

As this formula shows, even a slight change in supplier payment terms can have a significant impact in working capital performance. This concept can also be utilized when negotiating milestone payments on large capital purchases, or engineering, procurement, and construction (EPC) projects that require payments at various stages of delivery. Often, supplier proposals for these types of contracts are skewed to make the customer cash negative for the duration of the project. However, a thoughtful negotiation approach can often shift this cash burden back to the supplier, producing enhanced working capital performance.

It should be noted that deferred payment is not always the optimal approach. Careful consideration should be given to the supplier's cash position when negotiating payment structures. Suppliers who are "cash weak" and/or "credit poor" tend to offer discounts for early payment from their customers. In these scenarios, it can often be beneficial to secure immediate discounts from the supplier for early payment of invoices because, in many cases, credits can have an even bigger impact on the bottom line than deferred payments.

Regardless of the specifics of a particular award scenario, the critical underlying thrust should be to move away from the legacy behavior of focusing strictly on performance and delivery and toward a thorough understanding of how supplier payment structures can be optimized to improve working capital. For best results, all contracts should be negotiated through a centralized procurement function staffed by individuals trained to maximize working capital positions. By doing this, a company will achieve greater standardization of commercial contracting and improved bottom-line performance.

3) Working capital management – days sales outstanding (DSO) management

Days sales outstanding (DSO) is a benchmark commonly used to assess the efficiency of the overall order-to-cash process. DSO essentially indicates how long it takes a company to receive cash from the day that an order is placed. One of the key successes here is to automate and mitigate as much manual intervention as possible throughout the accounts receivable process. In order to do so, organizations are relying heavily on a number of new technologies.

Perhaps one of the most influential areas, in terms of DSO as it relates to the oil and gas industry, lies within the pre-invoice ticketing process. Traditionally, this has been a highly manual and complex process that is prone to human error and can lead to a number of time-consuming issues related to the capture of accurate, legible and complete ticket information. With today's technology, these issues can be remediated through the implementation and use of an electronic ticketing system. By utilizing such a system, field users have the ability to enter ticket information instantaneously into a tablet with preset requirements, forcing all necessary fields to be populated versus manually writing on a hard copy ticket. This not only will decrease the amount of time spent resolving issues on the back-end, but also will expedite the process of relaying ticket information to the accounts receivable department by replacing manual routing, phone calls and faxing with a more efficient electronic means of transmission. At the same time, the occurrence of inconveniences such as misplaced tickets, duplicate input and three-way match discrepancies will be minimized.

In addition to the implementation of an electronic ticketing system, there are a number of different opportunities that today's organizations are taking advantage of, including the automation of invoice processing, electronic invoice submission, automated workflow and electronic distribution of standardized pricing. With regard to the accounts receivable function, an organization should consider researching every option available to improve working capital.

In closing

Given the oil and gas industry's challenging economic landscape and long-term outlook, it is imperative that company executives focus on all elements of the balance sheet to drive shareholder value. The cost savings that can be achieved through enterprise-wide working capital management and strategic cost reductions can have a substantial impact on the bottom line of any organization willing to adopt this analysis and devote the resources required to implement it.

Specifically, those business leaders who have the foresight to focus on the approaches detailed in this article will most certainly position their organizations for success. To sum up, these approaches include assessing:

- Strategic sourcing of key spend categories to reduce costs through purchased price;

- Total cost of ownership, looking at all elements of cost to determine the best value;

- Financial leakage in the form of duplicate payments, unrealized credits and erroneous charges;

- Supplier payment structures aimed at payment flexibility; and

- DSO management for the reduction of outstanding payments and improved cash positions.

First adopters in oil and gas whose strategic roadmaps include such approaches will differentiate themselves and hold a distinct edge over the competition. Others will simply be left behind to chance the ebbs and flows of commercial pricing markets.

While traditional drilling and possibly even "drilling for oil on Wall Street" will be methods for oilmen to manage their companies' futures, "drilling on the balance sheet" undoubtedly will play a growing role in generating higher investor value and communicating a deliberate focus on maximizing profit on every barrel of oil and cubic foot of natural gas extracted.

About the authors

Chris Monk is a member of Protiviti's global leadership team for supply chain solutions, based in Houston. He has more than 12 years' experience in supply chain and delivering sustainable cost savings for clients in the oil and gas business and other industries. Monk holds a BS in industrial distribution from Texas A&M University where he graduated cum laude. He is a certified internal auditor, certified in production and inventory management, certified purchasing manager, certified supply chain professional, Six Sigma Green Belt, and certified import-export compliance manager.

Mark Dell'Olio is a member of Protiviti's global leadership team for supply chain solutions, based in Atlanta, with more than 13 years of industry and consulting experience in supply chain and operations. He has worked with clients in oil and gas and other sectors to improve working capital and cost metrics. Dell'Olio graduated magna cum laude from the University of Maine – Orono with a BS in mechanical engineering and received his MBA from the University of North Carolina – Wilmington. He is a certified LEAN Six Sigma Green Belt.