Bringing oil and gas reserves to book

Alejandro Primera, SPE, London

Ahead of the annual SPE London Conference, Alejandro Primera, senior reservoir engineer and continuing education chair for SPE London examines the uncertainties surrounding sub-surface characterization and how it impacts on an oil and gas firm's future performance.

Estimating quantities of reserves and resources to provide a ‘book value' (total assets of a company) is mandatory for any publicly-listed oil and gas firm. The primary objective of this process is to arrive at a consistent volume and associated value assessment for companies, investors, lenders, and government agencies.

The book value of reserves and resources – i.e. the amount of hydrocarbons that can be economically recovered from the field – is the net capitalized costs associated with developing oil and gas properties. This calculation is critical, as accountants equate the book value of reserves and resources directly to reserves value, which together with level of production and commodity price at the time of assessment are the key metrics used to arrive at the book value of an oil and gas firm.

Therefore, book value has a direct bearing on both the share price of an oil and gas firm and the approach it takes to portfolio management. Likewise, the forecast techniques employed to arrive at book value exert indirect, but considerable influence on commercializations and how all stakeholders, potential investors, and lenders approach investment.

However, the complexity of reservoirs pushes at the boundaries of computational power, and limitations associated with handling uncertainty from geology up to fluid flow behavior continues to result in risk in terms of the potential production associated with the volumes in place in oil and gas fields.

Moreover, the global nature of an oil and gas firm and the increasingly diverse types of plays managed within its portfolio presents a major challenge in terms of making the right investment decision with the given financial resources and incorporating technical and non-technical risk and uncertainty.

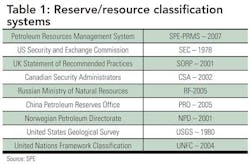

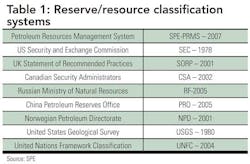

Ensuring compliance with the reporting requirements across multiple agencies and jurisdictions [as shown in Table 1] globally also presents a considerable challenge. Numerous rules are applied and a great deal of latitude exists with their interpretation, which again results in uncertainty when booking reserves and resources.

Uncertainty analysis

There are many uncertainties with respect to calculating book value as it is greatly influenced by hydrocarbon in place and its recovery factor forecast. These are highly affected by the inherent uncertainty of the reservoir, the data gathered, and the interpretation analysis.

Sub-surface characterization tools developed by oil and gas firms can be applied to determine and optimize hydrocarbon recovery. These are used to comprehensively assess the reservoir formation and its fluids and are the driving force behind effective reservoir management leading to reserve growth.

There are multiple models of sub-surface characterization employed, and there continues to be evolution of both high-end numerical techniques that characterize fluid flow within the porous media, as well as the techniques that model the most fundamental physical behavior of obtaining a geological understanding of the reservoir. Yet historically, reservoir engineering and geosciences have been treated in silos: geology deals with the rock formations from a static perspective; whereas reservoir engineering focuses on evaluating the performance of a well or field through the understanding of the fluid flow behavior.

This has resulted in uncertainty in terms of accurately forecasting reserves and resources, due to factors such as the uncertainty surrounding seismic interpretation, the geology of the reservoir between the wells, and fluid flow behavior within the wells. Similarly, there is a certain degree of uncertainty in assessing actual production and injection rates and pressure in the multiple wells across a field, and how these metrics ultimately impact the accuracy of the production volumes being forecasted.

Gaining an accurate understanding of a reservoir's reserves and resources using sub-surface characterization therefore presents a key challenge in respect to portfolio management. With the advent of different types of reservoirs that must be produced in different ways – e.g. tight gas, shale gas, tight oil, heavy oil, onshore, offshore, and conventionals in hostile environments – it is simply not possible to adopt the same approach for them all.

Disparate models

Today, there are several analysis techniques employed to a varying degree by oil and gas firms when researching and forecasting production:

- Volumetric – this method is widely used in early stage developments and entails determining the size of the reservoir, pore volume, and fluid content. Recovery factor is later applied based on analogous cases.

- Decline Curve Analysis – shows how the oil and gas production rate decreases over time based on past performance, but has the limitation that it doesn't incorporate any knowledge of the geology of the field.

- Production Analysis and Well Performance – reserves estimates can be complemented with sophisticated analysis of pressure/rate analysis to determine formation and properties in the vicinity of wells.

- Material Balance – the analysis of pressure behavior as reservoir fluids are produced and injected. These estimates may provide erroneous results in more complex situations, and it also assumes a unique set of properties across a reservoir.

- Numerical simulation – uses geological data and computer models to predict the oil and gas flow behavior of a reservoir. This is a good tool when used properly, but there is a risk of combining production data with erroneous geological information and ending up with optimistic or pessimistic forecasts.

- Integrated asset modelling – combines surface knowledge in terms of the restrictions of the facilities, with the results of sub surface characterization. This is a high-end technique that is rarely used due to its configuration complexity.

Oil and gas firms can use any of these models for developing and creating an understanding of the behavior of their assets. However, when reporting to regulators, only a two are widely accepted. These are Decline Curve Analysis, and Material Balance. Indeed, the rules become much more obscure when it comes to other types of techniques.

One of the major barriers today is that techniques such as Numerical Simulation and Integrated Asset modeling are more difficult to corroborate and audit. This is why oil and gas companies need to focus on ensuring that their internal procedures are both traceable and auditable. In addition, they need to work more closely with industry bodies to ensure regulators understand why more sophisticated and high end techniques are necessary – especially where unconventional plays such as shale gas are concerned.

Holistic approach

By definition, portfolio management encompasses having a good understanding of uncertainty – as there is a risk of political uncertainty, or tax regimes changing from one day to the next, and these uncertainties must be factored into investment decisions.

Uncertainty is also a key factor in the research and forecasting of reserves and resources. Analysis techniques aside, there is still a lot of work to be done both in terms of geosciences and reservoir engineering in order to understand the uncertainty of a reservoir, the uncertainly of the sub-surface, the range of capacity that surface facilities can handle, and the level of investment necessary to realize that capacity.

At c-level, the conventional approach to forecasting reserves and resources to arrive at book value is still deterministic and based largely on the production volume for the previous year. However forecasts – and therefore investment decisions – would likely change dramatically if they had a more probabilistic view of performance.

What's needed is a more probabilistic model for estimation that understands how the uncertainty within the reservoir and how recovery of the potential range of oil or gas in place affects a firm's future performance – or indeed, what the future range of production is likely to be. Moving forward, any model will also need to incorporate all past data gleaned from data acquisition campaigns and previous technical analysis.

This is why the work of professional organizations such as the Society of Petroleum Engineers (SPE) is so important in realizing the overall vision of having ‘a set of reserves & resource definitions (and an associated set of estimating guidelines, which are current best practices with continuous review) widely adopted by the oil industry, international financial organizations, and regulatory reporting bodies. Estimating reserves and resources and portfolio optimization are core topics running through this year's SPE London Conference.

About the author

Alejandro Primera is a senior reservoir engineer with 10 years' experience in reservoir simulation and subsurface modeling. He currently works at a major operator on assets in the North Sea and Irish Sea specializing in forecasting and reserves. Alejandro started his career at Schlumberger where he worked on a wide range of projects and rose to become Project Champion of Reservoir Simulators. He holds a Petroleum Engineering degree from Universidad Central de Venezuela.

About SPE London Conference

With the purpose of bringing together key members of the oil & gas and financial community, the SPE London Section is organizing its second two-day annual conference titled ‘Managing Oil & Gas Portfolios in Uncertain Markets', to be held on 22-23 May at Savoy Place. For more information go to www.SPELondonConference.com.

*The views represented in this article are not necessarily those held by SPE