Activity sees an early-year pause after a frenzied year-end rush

Brian Lidsky, PLS Inc., Houston

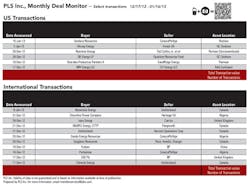

PLS Inc. notes that late-year 2012 global upstream M&A activity reached a frenzied pace as buyers and sellers rushed to complete deals, announcing $38 billion in deals in 86 transactions during December 2012. For comparison, from January 1 to January 15, the market total slowed to just $1.6 billion in 24 deals. The big seller shown below is ConocoPhillips – with three deals for $4.6 billion.

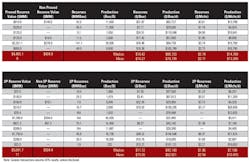

In the US, two recent deals provide excellent benchmarks for valuation and insight into market dynamics. On January 15, Denbury agreed to pay $1.05 billion to buy producing conventional oilfields along the Cedar Creek Anticline, a major geologic structure in North Dakota and Montana and an area where Denbury already operates. This deal provides a good look for oil deal valuations in today's market. The reserves (42 MMboe, 91% PD) and production (11,000 boepd) are 99% oil and have an R/P ratio of 10.5 years. PLS values the deal at $83,000 per boepd of production and $21.67 per boe of proved reserves (after allocating $140 million to probable and possible reserves mostly associated with future CO2 recoveries). Denbury plans to fund the purchase using tax-advantaged like-kind exchange treatment from its $1.3 billion sale of Bakken assets to ExxonMobil. The LKE treatment is expected to allow Denbury to defer more than $400 million of the $500 million in cash taxes originally due on its Bakken sale.

On January 2, Hilcorp agreed to buy the South Texas conventional gas assets of Forest Oil for $325 million. The properties exclude Forest's Eagle Ford oil properties. This transaction provides a good view for current US conventional gas values. Forest's South Texas assets produce 66 MMcfe/d (86% gas) and have proved reserves of 272 Bcfe (85% gas). The R/P is 11.3 years. PLS values this deal at $1.20 per Mcfe for proved gas reserves or $5,000 per daily Mcfe produced.

Another landmark deal shown below is SandRidge's sale of its core conventional and mature Permian basin oil assets for $2.6 billion cash to privately-owned Sheridan, led by Lisa Stewart. PLS values this deal at $95,000 per boepd, $16.50 per proved boe and $2,500 per undeveloped acre. The assets produce 24,500 boepd (82% oil/liquids) and have proved reserves of 141 MMboe (77% oil/liquids). While the merits of this deal raised much debate among investors and analysts, PLS notes that SandRidge's proceeds compare favorably to Chesapeake's Permian sale in September 2012 for $3.3 billion. PLS valued the Chesapeake sale (40,000 net boepd) at $58,000 per boepd and $1,000 per undeveloped acre, though it is noteworthy that Chesapeake's Permian assets were more gas-weighted (42% gas, 58% liquids) than SandRidge's Permian assets.

In Canada, Pengrowth sold a non-operated 10% interest in the Weyburn field (net 2,500 bbl/d, 100% oil) in Saskatchewan for US$319 million at $160,000 boepd to Omers Energy and the Ontario Teachers' Pension Plan (OTTP). Pengrowth is expected to sell up to another $700 million in 2013 to devleverage, fund capex and pay the dividend.

Internationally, just days apart, ConocoPhillips announced two large deals. On December 18, COP sold its Algerian assets to Indonesia's NOC, Pertamina, for $1.75 billion and two days later announced a $1.79 billion sale of its Nigerian assets to Oando Energy.

In the UK North Sea, Carrizo closed out 2012 by selling its interest in the Huntington field for $184 million cash. According to Carrizo CEO Chip Johnson, "our reinvestment opportunities for the net proceeds from this sale are so compelling that we have made the decision to harvest our investment". Proceeds will be used to help fund 2013 capital expenditures.

As of January 1, 2013, PLS estimates that over $85 billion of assets are on the market globally, $39 billion of which are in North America.