Revenue, net income drop sharply in 3Q12

Don Stowers, Editor, OGFJ

Laura Bell, Statistics Editor, Oil & Gas Journal

Revenues for the group of publicly-traded US-based companies tracked by Oil & Gas Journal and Oil & Gas Financial Journal continued their decline in the third quarter of 2012. They dropped $23.4 billion (8%) from the previous quarter and were down $77 billion (24%) from the third quarter of 2011. The declining revenues for the group go back to the first quarter of 2012.

In the previous quarter, net income increased despite a revenue decline. Not so this time. Income fell $18.2 billion (55%) for the collective companies from the prior quarter and $16.2 billion (52%) from the same quarter in 2011.

The number of reporting companies stayed the same as last quarter (136). For these companies, total revenue for the 3Q12 was $241.1 billion, a significant drop from the $318.2 billion in the 3Q2011 and $264.5 billion the 2Q2012. Revenues are obviously moving in the wrong direction for many companies in the group.

Year-to-date capital spending stood at $150.5 billion for the third quarter of 2012. This represents a $22.4 billion (17%) increase over the YTD spending in same quarter in 2011 of $128.1 billion.

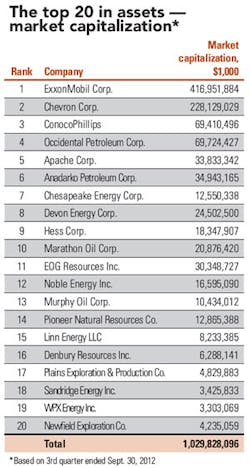

Total asset value for the OGJ150 group of companies grew to nearly $1.324 trillion from $1.290 year over year, representing about a 2% rise in value. Compared to the previous quarter, asset value grew by more than $26 billion, also representing about a 2% increase.

Stockholder equity for the entire group grew by nearly $13 billion (2%) from the same quarter in 2011 and by more than $1.5 billion (less than 1%) from the second quarter of 2012.

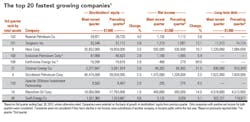

Largest in net income

The 20 largest companies ranked according to net income had $21.4 billion in collective net income for the third quarter of 2012. This compares with $35.1 billion the previous quarter and $31 billion for the third quarter of 2011.

This huge drop in income was led by the three largest companies – ExxonMobil Corp., Chevron Corp., and ConocoPhillips. Exxon dropped from $17.7 billion the previous quarter to $10 billion in the 3Q; Chevron fell from $7.2 billion to $5.3 billion; and Conoco dipped from $2.3 billion to $1.4 billion. Of the top 20 companies, only Occidental Petroleum Corp., Hess Corp., Marathon Oil Corp., and Murphy Oil Corp. saw income increases. Kinder Morgan CO2 Co. LP had the same net income as the previous quarter.

Although the largest 20 companies in net income saw a significant decrease for the quarter, they still outperformed the entire group by a substantial margin. For example, ExxonMobil's net income of nearly $10 billion represents almost 70% of the net income for the entire group.

In fact, the $21.4 billion the top 20 companies in net income earned is more than $7 billion higher than the $14.4 billion earned by the entire group of 136 companies. This is because more than half (70) of the companies on the OGJ150 list reported a net loss for the quarter. The previous quarter, 50 companies reported a net loss.

Among the larger companies reporting a loss are: No. 7 Chesapeake Energy ($1.97 billion); No. 8 Devon Energy ($719 million); No. 15 Linn Energy LLC ($430 million); No. 17 Plains Exploration & Production ($44 million); No. 18 SandRidge Energy ($160 million); No. 19 WPX Energy ($61 million); No. 20 Newfield Exploration ($33 million); No. 21 QEP Resources ($2.1 million); and No. 24 Southwestern Energy ($145 million).

In many cases, low natural gas prices were instrumental in the income loss. Some companies have been able to cope with the low prices better than others either with price hedging or by divesting gas-weighted assets in favor of liquids-rich resources.

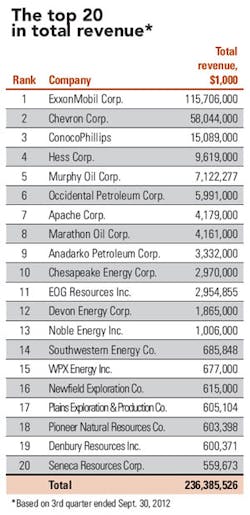

Largest in total revenue

The top 20 companies in total revenue had $236.4 billion in revenue compared to $253.6 billion for the prior quarter (a 6% decline) and $305.6 billion for the third quarter of 2011 (a drop of 22%). This compares to $241.1 billion in revenues for the entire group, giving the top 20 companies roughly 99% of the total revenue for the OGJ150 group of companies.

The top three companies in total revenue (ExxonMobil, Chevron, and ConocoPhillips) together had 79% of the revenue for the group, and Exxon alone had nearly half (48%) of the revenue for the group.

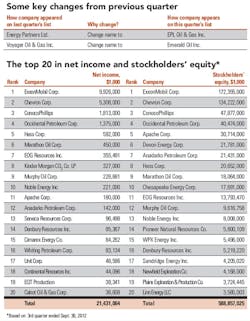

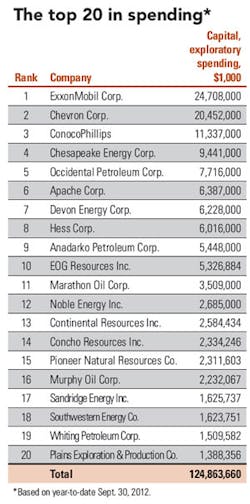

Top spenders

Spending by the top 20 companies in the second quarter grew to $124.9 billion. It increased by a little over $20 billion (up 19%) compared to the same quarter in 2011. The top spenders were, in order: ExxonMobil ($24.7 billion); Chevron ($20.5 billion); ConocoPhillips ($11.3 billion); Chesapeake Energy ($9.4 billion); Occidental ($7.7 billion); Apache Corp. ($6.4 billion); Devon Energy ($6.2 billion); Hess Corp. ($6.0 billion); Anadarko Petroleum ($5.4 billion); and EOG Resources ($5.3 billion).

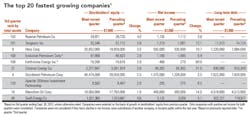

Fastest-growing companies

This category may be a little misleading this quarter. As measured by growth in stockholders' equity, the changes from the preceding quarter were not very large. Nevertheless, the fastest-growing companies ranked by stockholders' equity are: No. 103 Reserve Petroleum Co. (4.0% change); No. 101 Tengasco Inc. (3.8% change); No. 9 Hess Corp. (3.5% change); No. 100 Evolution Petroleum Corp. (2.9% change); Earthstone Energy (2.8% change); Cimarex Energy (2.6% change); Occidental (2.3% change); Apache Offshore Investment Partnership (2.0% change); Marathon Oil Corp. (1.6% change); and Swift Energy Co. (0.8% change).

Among this group, Hess, Occidental, and Marathon are the most impressive because of their size. It's easier for small companies to show growth, but harder for multi-billion-dollar enterprises to do so. New York-based Hess is the fourth-largest company by total revenue and ninth-largest by market capitalization. Oxy, headquartered in Los Angeles, is sixth-largest by total revenue and fourth-largest by market cap. Houston-based Marathon is eighth-largest by total revenue and 10th largest by market cap.