GOM DRILLING AND PRODUCTION ON THE UPSWING

On April 20, 2010, the horrific Deepwater Horizon explosion in the Gulf of Mexico brought a halt to most new drilling in the Gulf as the US government imposed a six-month moratorium on drilling activity while trying to sort out the problem and determine how to prevent another such event. Even after the moratorium was lifted, permit delays and the global economic malaise kept drilling down significantly during 2010 and 2011. Now, three years later, the rig count is finally back to normal and oil and gas production in the Gulf of Mexico is humming.

Drilling and exploration activity in the deepwater is also on the rise. An example is the recently announced Coronado prospect about 200 miles south of the central Louisiana coast. Chevron and its partners struck oil in a well drilled more than six miles deep (31,866 feet) in an area known as the Lower Tertiary Trend. Pacific Drilling's Santa Ana drillship, operating in 6,000 feet of water, bored through a thick subsurface salt layer to find 400 feet of net oil pay. Few wells have been attempted in this part of the Gulf in part because the salt layer makes seismic scans difficult to read.

At a time when the whole world seems focused on onshore shale deposits, the deepwater discovery highlights the continuing importance of the Gulf of Mexico as a source of oil and gas production for the United States. A test well at a nearby location produced oil at a rate of 13,000 barrels per day.

Chevron holds a 40% stake in the Coronado prospect well. Other owners include ConocoPhillips (35%), Anadarko Petroleum (15%), and Venari Offshore (10%).

The rise in GOM drilling activity is driven in no small part by sustained high oil prices. However, following the 2010 Macondo well blowout and the subsequent oil spill that caused substantial environmental damage along the coastline of Louisiana and adjacent states, the federal government has placed increased emphasis on convincing the offshore industry to be better prepared both in preventing future blowouts and containing spills when they occur.

To date, offshore operators have funded two firms to deal with such spills – Marine Well Containment Co. and Helix Well Containment Group. Each has teams of highly trained personnel ready to act quickly to deploy specialized emergency equipment intended to cap subsea wells. The creation of these firms has played no small part in convincing regulatory agencies that operators were prepared to deal with future emergencies and that drilling activity should resume.

Since the historic new safety standards were put in place, the pace of permitting is finally back at pre-spill levels and millions of offshore acres have been made available to the industry.

As a result, Central Gulf of Mexico Lease Sale #227 drew $1.2 billion in high bids in March, as 52 companies submitted 407 bids on 320 tracts. Conducted by the Department of the Interior's Bureau of Ocean Energy Management (BOEM), the sale included 7,299 blocks, covering around 38.6 million acres, located from 3 to about 230 nautical miles offshore, in water depths ranging from 9 feet to more than 11,115 feet (three to 3,400 meters).

BOEM estimates the areas available for sale could result in the production of up to 890 MMbbl of oil and 3.9 trillion cubic feet of natural gas.

Tommy Beaudreau, director of BOEM, which ran the auction, called it an "extremely successful and an extremely robust sale" – the sixth-highest grossing since the Gulf of Mexico auctions began decades ago. The increase in individual bids is believed to indicate a focus on a smaller number of promising tracts, all guided by seismic data.

The top five bidding companies by dollar amount were as follows:

- ExxonMobil Corp. – 7 high bids totaling $220,254,446

- Shell Offshore Inc. – 38 high bids totaling $139,925,720

- BHP Billiton Petroleum (Deepwater) – 24 high bids totaling $107,160,240

- Plains Exploration & Production Co. – 11 high bids totaling $92,575,000

- Venari Offshore LLC – 15 high bids totaling $86,796,442

Outgoing US Interior Secretary Ken Salazar has overseen the drilling moratorium and the recent comeback. His reviews from the offshore industry are mixed, but he has said that the current administration "will continue to push domestic oil drilling."

Despite environmentalists' misgivings, Salazar has urged continued use of hydraulic fracturing in onshore shale plays and more deepwater exploration offshore. He has heaped praise on the offshore industry for its improved safety standards.

"We need to power our economy," said Salazar. "We also believe that we need to make sure we're taking maximum advantage of clean energy sources. But even if we were doing everything we possibly could to harness the power of the sun and the wind and geothermal and biofuels – even if we did all that, we're still going to need oil and gas."

President Obama's choice to head the Interior Department after Salazar's departure this year is business executive Sally Jewell, who is currently awaiting Senate confirmation.

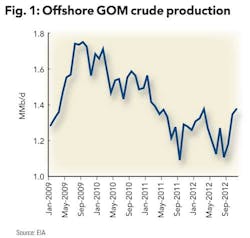

To appreciate how much drilling and production activity has increased since Macondo, it's necessary to understand how sharply crude oil production in the offshore Gulf of Mexico declined during 2010 and 2011 (see Figure 1).

Sandy Fielden of RBN Energy notes that before Macondo in March 2010, GOM crude oil production was 1.6 MMb/d. During 2011, average production dropped to 1.3 MMb/d and continued to fall to a low of 1.1 MMb/d in June 2012. The latest EIA data indicates that production has recovered since then, increasing to 1.4 MMb/d by November 2012. The increase was driven mainly by the initiation of production at new deepwater fields with a combined expected peak production of about 195 Mb/d.

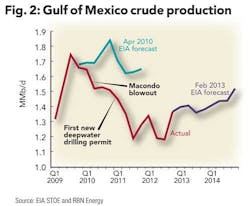

Fielden continued: "The EIA short-term energy outlook published in April 2010, just before the Macondo accident, indicated that after a decline in the first half of 2010, new GOM production expected online during the second half of that year would boost production above 1.8 MMb/d." That April 2010 forecast is the blue line in Figure 2.

In the same graph, you can see that actual production (red line) was falling before Macondo and that instead of the forecasted uptick, production continued to fall after Macondo. The chart also shows the latest February 2013 forecast (purple line) that GOM crude production will continue its recovery in 2013 and 2014 to reach 1.5 MMb/d by the end of 2014.

The expected increase in 2013 comes from six new start-ups and a redevelopment project. In 2014, several relatively high-volume deepwater projects are expected to come on stream.

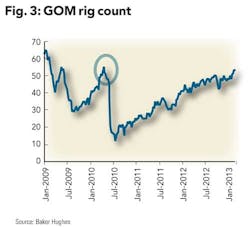

The expected recovery in production over the next few years is confirmed by drilling rig count data from Baker Hughes in Figure 3. "The rig count fell off a cliff after Macondo (circled above) and stayed low during the moratorium but has now recovered to 53 rigs – just two below the level immediately before the accident," said Fielden.

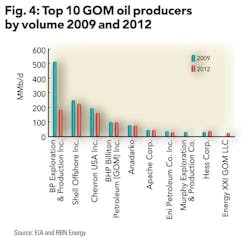

"We can also look at GOM production data for individual companies published by BOEM," he continued. "Figure 4 shows the output in 2009 (before Macondo) and 2012 for the top 10 oil producers in the Gulf. Before Macondo (blue columns), BP was by far the largest producer with more than double the output of its closest rival, Shell. Last year, shell was the biggest producer as a result of the drilling moratorium and BP not requesting new drilling permits until the end of 2011 (Note: BP did not bid on any of the leases in the recent auction.)."

Fielden continued, "Interestingly, the profile of the top 10 GOM offshore producers did not change dramatically during this three-year period. At the same time, onshore US crude production was revolutionized by tight oil shale production – led largely by independent producers. Significant differences in development costs and return on investment horizons for deepwater drilling make the GOM a very different environment from the US shale plays."

Transocean is building four new ultra-deepwater DP drillships, like the as-yet-unnamed model depicted in this rendering, which will be leased to Shell under four 10-year contracts worth a total of $7.6 billion. The rigs will be built at the Daewoo Shipbuilding and Marine Engineering yard in South Korea, with delivery of the first scheduled for 2015. Image courtesy Transocean

US crude oil production topped 6 MMb/d by the end of 2012 – up by 790 Mb/d during the year, the largest increase in annual output on record. Most of that increase was in the Bakken and Eagle Ford shale plays and in the Permian basin. Prior to the shale revolution, increases in US crude production between 2007 and 2010 came from offshore GOM fields. The Macondo accident halted production growth, and recovery has slowly returned to near pre-Macondo levels.

The recovery proves that deepwater drilling risks are still considered worth taking by producers. GOM offshore production may not be headline news like shale oil, but it still represents 20% of US production, and that number looks set to increase in the next two years, Fielden concluded.

Ziff Energy, a North American energy consulting group, has been conducting benchmarking studies in the GOM for more than a decade. The firm's latest deepwater study, launched in January, will evaluate 2012 operations for more than three dozen producing deepwater assets.

Ziff says that prior deepwater studies have found a "surprisingly wide range" of uptime reliability, which represents an opportunity for the industry to add tens of millions of dollars in annual revenue.

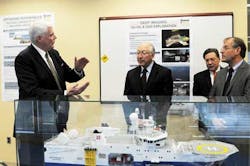

Secretary Salazar (center) speaks with Secretary of Natural Resources, Commonwealth of Virginia Doug Domenech, Tom McNeilan (left) and Ray Wood from Fugro Atlantic with a model of an offshore geophysical vessel in front of them.Tami A. Heilemann-Office of Communications, US Department of the Interior

The firm's last study in 2011 assessed results for 2010. It found that, compared to other deepwater areas, such as Brazil and West Africa, the US has the broadest types of deepwater production systems and diversity of operators, and therefore is the leading "incubator" for the worldwide deepwater industry.

Compared to the pioneer deepwater days of the 1990s, the ranks of leading players has expanded beyond the original super-majors (Shell and BP) to include leading independents such as Anadarko and Murphy Oil, both operators of spars and semi-submersibles. The world-class potential of the Gulf of Mexico deepwater has also attracted foreign-headquartered companies such as Petrobras, Eni, BHP Billiton, and Statoil.

Petrobras is the world's largest deepwater producer with extensive heavy oil assets in Brazil. Petrobras is now operating the first FPSO in the GOM. Statoil, while not currently operating in the GOM deepwater, has positioned itself for future growth in that area.

Ziff's recent analysis of field-level operations of 190 GOM producing assets found "significant" opportunities for improving operating efficiency by reducing downtime. Total planned and unplanned production efficiency in the Gulf was found to be 88%.

This result indicates that significant potential exists to increase production by reducing the frequency and duration of unplanned downtime, says the firm.

The E&P sector is historically a 10% to 15% rate-of-return business, which means the last 10% to 15% of production is profit. If an operator could eliminate or reduce half the GOM's unplanned production loss, it could potentially double the rate of return from assets, said Ziff.

While hurricanes impacted oil and gas production in 2005, 2006, and 2008, production in 2009 surged by more than 250Mb/d with the start-up of many new assets, including the Atlantis, Thunder Horse, Blind Faith, and Thunder Hawk semi-submersibles, the Tahiti spar, and the Neptune and Shenzi TLPs.

Additional assets began production in 2010, including the Perdido and ATP Titan spars, the Droshky subsea asset, and Helix's Phoenix FPU. The GOM deepwater has continued to have new world-class discoveries and significant new field developments, although, as previously noted, production suffered post-Macondo in 2011 and 2012.

A majority of deepwater production is associated with oil, and growth in deepwater oil production has been essential to partly offset gas production declines this decade in the mature GOM shelf.