Deal pace picking up as companies shuffle portfolios in pursuit of growth

Brian Lidsky, PLS Inc., Houston

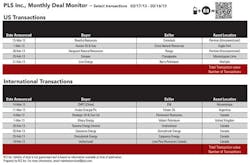

PLS reports that, from February 17th to March 16th, global upstream deal activity totaled $13.1 billion bringing the first quarter 2013 tally (through March 16th) up to $20.2 billion. Helping drive deal flow are relatively robust commodity prices which at press time (market close on March 25) saw front months for WTI at $94.56/bbl and for Brent at $108.17/bbl – compared to $92.27/bbl and $111.11/bbl at December 31, 2012, respectively. In the US, natural gas prices have improved with front month Henry Hub at $3.87/MMbtu and the 12-month strip at $4.06/MMbtu – up 15% and 13%, respectively from December 31, 2012. In addition, the US equity markets have risen nicely thus far in 2013 with the S&P 500 up 8.8% and the Dow up 10.3%. With the backdrop of improving commodity and equity prices, companies are picking up the pace of deal activity.

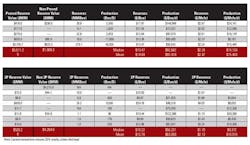

In the US, the most notable deal is the $4.3 billion stock-for-stock acquisition of Berry Petroleum by LinnCo LLC, which in turn will be followed by the acquisition of the Berry assets by Linn Energy LLC. By utilizing LinnCo equity (which IPO'd in October 2012) to initiate the transaction, the deal is the first ever acquisition of a C-Corp by an upstream LLC or MLP and clearly adds another arrow in the quiver for value seeking upstream MLP's and a new market dynamic.

The Linn/Berry transaction is expected to be immediately accretive to Linn's distributable cash flow per unit by ~$0.40 (not including operational synergies) and improves Linn credit metrics. Berry's assets have a long reserve life (>18 years) and a low decline rate and boosts Linn's proved reserves 34% and production by 30%. For Berry shareholders, the deal represents a 20% premium to the prior-day closing share price and a 23% premium to the prior 30-day average. PLS analysis values the deal at $93,000 per flowing BOE (80% oil) and $13.50 per proved BOE (74% oil) and allocates $630 million to undeveloped land ($3,125 per acre). Berry's assets are in California (Linn will become the state's 5th largest producer), Permian Basin (Linn doubles Wolfberry inventory), East Texas and Uinta Basin (new core area for Linn).

The Permian Basin continues to be a hot area for M&A activity with Rosetta Resources buying out all of Comstock's assets in Reeves and Gaines counties for $768 million. In Reeves County, Rosetta gets 40,000 net acres in the core of the vertical Wolfbone play currently on 40-acre spacing with further down-spacing possible. PLS values the deal at $145,000 per flowing BOE (73% oil) and $18.00 per proved BOE (76% oil). PLS also values the acreage at $7,300 in Reeves County (38,000 net acres) and $1,000 in Gaines County (13,000 net acres).

In another Permian deal, MLP Vanguard Natural Resources picked up 2,800 boepd (59% oil/liquids) and 22.8 MMboe (59% oil/liquids, 78% PDP) for $275 million from Range Resources. PLS values this deal at $97,000 per flowing BOE and $12.00 per proved BOE.

Outside of the Permian, in another high profile US deal, Sinopec paid $1.02 billion to buy outright an undivided 50% interest in ~850,000 net acres in the Mississippian Lime play of Oklahoma from Chesapeake, who will remain operator. The upfront cash payment is a departure from the traditional cash and carry JV's Chesapeake has struck historically. After attributing $85 million to the existing production, PLS estimates Sinopec acquired the acreage at an attractive $200 per acre.

In Canada, deal activity remains slow with just $430 million announced from January 1 to March 16 setting up perhaps the slowest quarter of activity since 2007. The activity that is taking place is largely smaller bolt-ons as the overall market environment remains impacted by natural gas prices and higher than normal oil differentials. There are numerous packages and companies on the market and contrarian buyers may well look to Canada as a strong value play.

Internationally, China once again stepped up as CNPC paid $4.2 billion to acquire a 20% interest in Area 4, offshore Mozambique from Italy's ENI. Post transaction, other owners include ENI (50% and operator), Galp Energia (10%), Kogas (10%) and ENH (10%). According to ENI, "CNPC's entrance into Area 4 is strategically important for the project thanks to the worldwide relevance of the new partner in the upstream and downstream sectors". Area 4 contains the Mamba gas discovery. There are no proved reserves, but according to Galp Energia disclosure, there is ~24 Tcf of contingent resource, implying a value of $0.87 per Mcf contingent reserves. Production is expected by 2018 with two trains, at 5 Mpta each, planned for LNG export.

The markets remain well-supplied with deal inventory. Recent large new deals-in-play include packages from Laredo Petroleum (selling Anadarko basin assets), Cenovus (selling Saskatchewan oil assets), Talisman (selling its North Sea assets) and RWE (putting its entire global E&P portfolio on the market).