Winds of Change Mexico's Hydrocarbon Renaissance

This sponsored supplement was produced by Focus Reports. Report Publisher: Ines Nandin. Editor: Eric Watkins. Project & Editorial Director: James Waddell. Project Coordinators: Chiraz Bensemmane, Zuzana Kudelova. Editorial Researcher: Cameron Rochette. For exclusive interviews and more info, plus log onto www.energy.focusreports.net or write to [email protected] |

In the hands of its new steward, Mexico seems to be at the brim of a prodigious reincarnation that promises to usher in an era of wealth and a better life for Mexicans. While such pledges are ubiquitous in the political rhetoric of this country, the first five months of Enrique Peña Nieto's presidency have revealed a decisive leader willing to rattle the status quo and initiate changes that could drag the country out of economic stagnation illustrated by its average .7% annual growth over the last decade. Criticized by some for his manicured playboy charms and a passion for populist theatrics, the new president and his posse are hardly histrionic in recognizing the need to jumpstart Mexico's economy by transforming its state-controlled oil sector that generates one-third of the nation's income. His presidential platform focused on constructing a more competitive Mexico, partly through a reform of the energy sector, PEMEX included, by allowing greater participation of private companies in order to generate efficiencies through competition.

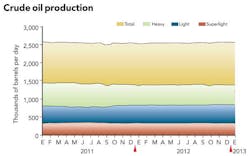

Being the world's fourth largest oil producer, PEMEX has fallen from grace over the last few years due to a deadly cocktail of declining production, failed exploration attempts, mismanagement of funds and assets, and an inability to curb a local black market of crude oil. For the past five years the company has been reaping in losses financed by the state. As if by divine intervention, in October and November 2012 PEMEX announced three new discoveries – two in deepwater and one onshore – holding a combined estimated 27.5 billion barrels of oil.

The opportune news is bolstered by the new political wave which could possibly be the springboard for PEMEX to rise above and beyond all expectations. Indeed, Mexicans are familiar with celebrating death in order to revere new beginnings, such as through the popular dia de los muertos celebrations. These recent changes appear to be chanting: "out with the old, in with the new PEMEX". The mythical phoenix rising out of the ashes.

Defining Change

Sure, this is easier said than done. Mostly because Mexico's oil belongs to the people of Mexico, as established by the constitution, causing labor unions and leftist political factions to condemn Peña Nieto's energy reform as an attempt to privatize PEMEX and sell off that which belongs to the people. On the other hand, there is great support from the private sector who understands the immeasurable opportunities that would emerge from an aperture in the state's control of the oil & gas market.

"The energy sector needs a lot of media coverage to be fully understood. I think the energy reform should take place, but at the ministerial level, not at the level of PEMEX. The main point is that PEMEX should be left alone to do its work, as it has never failed in its mission to provide the country with fuel", states Oscar Vazquez, founder and general manager of Grupo Diavaz. With more than 40 years experience, Grupo Diavaz is one of the most prominent and respected Mexican service providers to the oil & gas sector. The company specializes in submarine construction and engineering projects, but offers a portfolio of services that spans the entire value chain, from assisting production to the transportation and distribution of hydrocarbons.

As a key player in the industry, Mr. Vazquez agrees that a reform is in need, however, he affirms that any changes should not affect PEMEX's operational capacity, particularly in exploration and production. "We need a good reform in Mexico, starting with the National Hydrocarbons Commission (CNH). The Commission should be reinforced to generate competition in the sector; this should not be up to PEMEX. It is essential that we allow PEMEX to continue their regular work, while companies like ours can be assigned to do the specialized work under the supervision of the CNH."

Oscar Vazquez, CEO, Grupo Diavaz

The CNH was established in 2008 as an independent and objective entity that would advise PEMEX and the government in the development of the national oil & gas sector. "Everyone knows that PEMEX is not perfect, but we must still support it in its mission as the national oil company. I like to think of PEMEX as an unattractive wife, whom we must love and kiss on a daily basis, even if it is not appealing to us", concludes Vazquez.

After all, it makes sense that local giants such as Diavaz welcome the increased participation of private companies as they would surely be able to fare well in the ensuing competition. Nonetheless, local newcomers are also embracing the idea that PEMEX delegate more of its operations, which today are divided amongst four subsidiary entities: Exploration & Production, Refining, Gas and Basic Petrochemicals and Petrochemicals. Indeed, one of the first targets of the energy reform is to streamline this structure by amalgamating the four entities into one giant PEMEX as a means to gain greater control over decision-making processes.

"I believe we are currently experiencing a generational change in the industry, not only here in Mexico but throughout the world", says Jaime Gallegos, founder and ceo of Share Oil Services. As a Harvard MBA graduate and innate entrepreneur, Gallegos founded Share Oil Services in 2011 in direct response to the needs of the Mexican industry that generally lacks the technology and expertise to tackle challenges such as mature fields and new offshore discoveries.

Share Oil began as a service provider that uses computer and mathematical models to find solutions to their client's operational problems – whether technical or administrative. "The group today has four main divisions: our drilling services unit, another dedicated to the creation of software, another to simulation and modeling that also offers consulting services, and finally our human resources development section that serves mostly as a training center", boasts Gallegos. As part of his strategy, he has opted not to serve PEMEX directly and only to work for contractors. The proposed energy reform would only mean an increased client base for him.

Jaime Gallegos, CEO, Share Oil

The idea of an energy reform is no novelty. Former President Calderon initiated this trend in 2008 when his administration devised a system of incentivized contracts for third parties to assist PEMEX in E&P. These contracts were created to attract private investment with the promise of greater payouts when production objectives were surpassed by the contractor – hence the incentive to produce as much as possible. Global players, such as Petrofac, sprung at the first glimpse of a more open and competitive Mexico. The model is largely hailed as a success, but is perceived only as a small step in a long journey to fully transforming the industry.

Today's trend is to look at what regional counterparts, such as Brazil and Colombia, have achieved with their NOCs, and gather the best practices from those experiences and apply them to the Mexican context. "With the new presidential administration, maybe we will emulate the Brazilian model which will allow PEMEX to focus much more on core business and on having a reduction in their production and extraction costs, and a huge improvement in terms of storage and distribution", opines Carlos Sandoval, president of the ORSAN group of companies. ORSAN started out a single gas station in the northern city of Monterrey and today comprises several business, including the storage and transportation of diesel and a chain of convenience stores for their 110 gas stations throughout the country. Sandoval is certain his company could assist PEMEX in becoming more efficient by taking over some of their distribution activities. "We don't want PEMEX to lose control of the oil but we know that they can sell it in a slightly different way. This would involve the private sector to help PEMEX with the storage and distribution of their oil", he concludes.

It is evident that hopes are high for a reform to take place, and as of early March Peña Nieto was greasing the cogs of change by having his political party vote to eliminate its ban on modifying the country's constitution to allow for fundamental changes to PEMEX's structure. This consensus is impressive as it defies heavy resistance from labor unions. Ultimately, the unions must have been swayed to think that more investment, whether private or public, means more jobs for everyone.

The President has also made a bold move by replacing the head of PEMEX with a young business-minded economist, Emilio Lozoya Austin, whose experience includes founding a number of international investment funds and serving as senior director for Latin America at the World Economic Forum. The new Secretary of Energy, Pedro Joaquin Coldwell, also boasts an impressive resume including his stint as Secretary of Tourism where he successfully marketed Mexico as a desirable vacation destination. Paradoxically, the recent oil discoveries could prove to be unwanted obstacles as conservative interests will question the need for drastic change given these successes to boast about.

New Discoveries Beget New Challenges

Mexico's rise to fame as a global oil producer began with its discovery of the enormous Cantarell Field in 1976, which produced 3.4 million barrels per day at its climax in 2004. Ever since then, PEMEX's production has been in a continual decline as most of its assets are maturing and the oil left is harder and more expensive to extract.

Fernando Lozano, General Manager, Forza Steel

"Back in 2008, it became evident to us that the oil and gas industry has a lot of monitoring needs, especially in oil fields where there is a great prevalence of salts, water, sands and viscous oil, which have to be addressed with specific engineering solutions. Nowadays, the hydrocarbon is not just extracted and sold in its raw form, but rather it must be conditioned to meet certain requirements before it can be used", explains Fernando Balderas, director general of Grupo SSC. The company evolved from being a distributor of Ansys software in the 90s to becoming one of the leading monitoring and simulation companies in Mexico. "Based on our simulations and monitoring services, we work together with the industry to provide operational solutions. This is why we have been growing the way we have because we have been able to provide better results for our clients and their projects", he asserts. "Our advantage is that we count with state-of-the-art technologies in order to meet the engineering requirements to be able to condition hydrocarbons of different qualities and compositions."

However, with new deepwater discoveries, at Trion-1 and Supremus-1 wells, there is a steep learning curve for the local industry to be able to obtain the level of expertise that is required of deepwater operations. Extracting the crude from these sites will not be as simple as Cantarell where the oil lay so shallow that it was originally discovered by a fisherman. Estimates predict that investments up to USD$35 billion may be necessary to extract the newfound resources – an amount that PEMEX cannot fork over by itself. In March, PEMEX announced its most ambitious investment plan yet, which includes approximately US$20 billion for upstream activities. The reality is that Mexico lacks the technology and capital to drill and extract in deepwater, which only reinforces the need for foreign assistance and investment.

Slowly this expertise has been seeping into the country by way of entrepreneurial outfits mostly run by expats, but this will hardly be enough for what lies ahead. DTK Group, for example, emerged from a group of engineers, geologists and businessmen with extensive experience in the hydrocarbon sector. "We developed our company with 3 main business lines; initially we were just material suppliers to the drilling business; then, in 2010, we started to do mud logging and, finally, in 2011, we got back into the lab services business", recounts Englishman John Lawrence, ceo of DTK-Group. "We are not a drilling company, we support those companies by monitoring the drilling operations and providing technology to support drilling services in terms of evaluating the conditions of rocks or fluids in the rocks, all of which is meant to increase the overall efficiency. We have done many projects related to the offshore wells. As we speak, we hold the contract for the core analysis of several offshore wells and that gives us the opportunity to be part of amazing on-site discoveries and to be the first to provide fresh information coming out of these wells."

John D. Lawrence, CEO, DTK-Group

It is technology such as this that has assisted PEMEX in more successful exploration efforts such as in the new deepwater discoveries. DTK-Group is now betting on their experimental technology "E-Core", that allows for modeling of rock formations from tiny samples. Lawrence describes it as the "microscopic imaging of the internal structure of the rock after which these images are converted into mathematical models. The internal structure and the models are scaled up to represent a full sized piece of rock and the analysis is done on the model instead of being done on the original piece of rock." Such innovation will certainly push exploration efforts to new bounds, but the needed technologies for production will only come once the sector has been opened up to major investors.

In the meantime, medium-sized international service providers are already flocking to Mexico to capitalize on the country's potential to become a true global oil & gas powerhouse. Petrolink is an oilfield support company dedicated to managing data in order to optimize the performance of production wells. By aggregating data from multiple sources and IT platforms, Petrolink can seamlessly deliver the information to any location in the world so that decisions can be made remotely.

Pablo Perez, Country Manager Mexico, Petrolink

"We like to think of Mexico as the opportunity of endless opportunities, because technologies such as ours are only in their early stages here and generally this is a massive market. Especially now at this time that PEMEX is initiating a transformation, we look forward to becoming a strategic ally to newcomers in the industry", states Pablo Perez, Mexico country manager for Petrolink. "As PEMEX develops new methods of operating, such as for deepwater and horizontal drilling, our added value will become more evident. Ultimately, our products and services exist to prevent any preventable eventuality that could affect operations and cost our clients millions of dollars. With operations in over 40 markets across the globe, we have the advantage of our experiences in all possible conditions and terrains. This knowledge is something that we would like to bring to PEMEX in order for them to attain their full potential."

Who is Emilio Lozoya Austin?

With a mere 37 years of age, Emilio Lozoya Austin, has been charged with the arduous task of leading PEMEX into its new incarnation. While the newcomer has little experience within Mexico's political ranks, he is his family's third generation to embrace public office and assert himself a part of the milieu.

Emilio Lozoya Austin, Director General, PEMEX

Having achieved a Bachelor's degree in Economics and a law degree from Mexican academic institutions, Lozoya Austin later went on to obtain a Master's in International Development and Public Administration from Harvard. Notable work experiences include being an analyst for the Central Bank of Mexico and serving as the Director for Latin America at the World Economic Forum (WEF). It was in his role at the WEF that he was able to work closely with now President Enrique Peña Nieto, to collaborate in bringing investors to the State of Mexico while Peña Nieto served as its governor.

More recently, Lozoya Austin founded Luxemburg-based investment fund, JH Holding, where he was able to swell his portfolio from 50 million Euros to 1.2 billion Euros in little over a year. With a deep understanding of global macroeconomics, great things are expected of PEMEX's new general director, who will certainly aim at streamlining Mexico's oil & gas sector to make it as profitable as possible. If his investment track record is any indication, PEMEX should soon become a central piece of the world's oil and gas arena.

Not surprisingly, some of the first multinational companies to bet on the resurgence of Mexico's oil & gas industry are coming from cash-flush China. China Oilfield Services Limited (COSL) first entered the Mexican market in 2007 when speak of an energy reform was already beginning to brew and PEMEX was heightening its offshore exploration. As the leading integrated oilfield service provider in China's offshore segment, COSL's expertise is precisely the kind of collaboration that PEMEX needs to succeed in unchartered deep waters.

"Since the beginning, our strategy has been to bring the best equipment to Mexico because this is where COSL can add value to local exploration. We have steadily been making ourselves known and currently have four offshore modular and two self-elevating rigs operating in Mexican waters. We also expect to bring our semi-submersible rigs to Mexico in the near future", says MingChuan Deng, president of COSL Mexico. "COSL is very pleased to assist PEMEX in its search for new oil reserves and to share our knowledge and expertise with them. Now that the company has announced the impressive new discoveries, we are looking forward to be a partner in their deepwater ventures."

MingChuan Deng, President of COSL Mexico

Even though Deng is generally optimistic about COSL's future in Mexico, he also concedes that "the country needs to open itself up to greater foreign participation and investment. We understand that this is not a simple process and will not happen overnight, but it is something that most companies around the world are anticipating. Currently, some of the regulations of the industry can be confusing and overbearing. With greater international collaboration, I have no doubt that most of PEMEX's challenges could be leveled over time." Indeed, global majors are sitting at the edge of their seats lingering on Mexico's next move to boost its oil & gas industry.

Patching Up a Broken Network

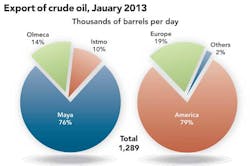

Setting E&P aside, PEMEX's other weakness lies in its inadequate refining and distribution infrastructure. Mexico currently exports part of its oil production to the US for refinement only to then import the finished product. Over 52% of the country's reserves are considered to be heavy oil, which only exacerbates the need to install new refineries and pipelines and revamp ageing infrastructure as production is set to increase. "PEMEX's problem was that they didn't know anything about their own assets. Nevertheless, I believe that nowadays PEMEX recognizes its mistakes and already knows what has to be done", opines Victor Mackissack, president of Enduro Pipelines Mexico. Last year PEMEX increased its investments in refining infrastructure by 24% - a clear indication that they are now trying to catch up with lost time. PEMEX's new general director, Lozoya Austin, has also stated that increasing distribution and refining capacity is a major priority for the company. Whether these projects will be carried out entirely by PEMEX or if some of them will be handed over to the private sector is something that many are anxious to discover.

The Shale Gas Carrot StickLed by the American example of a shale gas boom, Mexico is restless to exploit its own shale gas deposits that promise to reverse its status as a net importer of energy. In late October 2012, the country announced its discovery of vast shale gas reserves in the northeastern part of the country, which could double Mexico's current gas production. Conservative estimates on behalf of the government have declared that the country counts with 297 trillion cubic feet of shale gas reserves. It is presumed that shale deposits span through the states of Chihuahua, Coahuila, Nuevo Leon, Tamaulipas, Veracruz and San Luis Potosi. Similar to the recent deepwater discoveries, PEMEX is only at its infancy in acquiring the knowledge and expertise to drill shale gas wells. So far the company has successfully drilled four wells in the Burro-Picachos field that presumably taps into the same reserves found at Eagle Ford in Texas. In order to hasten its exploration of shale gas, PEMEX will have to collaborate with foreign companies under its incentivized contract scheme, as they are the only ones that can provide the necessary technology within a short timeframe. Beyond technology sharing, the country will also have to inject considerable amounts of capital into its shale gas endeavors – former Secretary of Energy Herrera estimated an average of US$10 billion annually. As of March 2013, there were plans to drill between 20-25 new shale gas wells this year alone, but PEMEX will also require partners to invest in these new sites. Ultimately, the shale gas storm is also betting on Peña Nietos energy reforms to allow for quicker and greater participation of foreign capital in shale gas exploration. With the recent trend of gas prices increasing, the pressure to tap into these resources is mounting as the gas import bills pile up. Higher gas prices, however, also mean that the costly drilling of new shale gas wells are justified and welcome investments as they will bring greater returns. |

Mackissack founded Enduro Pipelines, a pipeline inspection company, in 2011 after realizing that PEMEX's pipeline infrastructure had been neglected for years, and that many new hydrocarbon transportation projects were soon to be developed. Most notable is the Los Ramones gas pipeline stretching over 1,100 kilometers from the border of the US all the way to the state of Aguascalientes. In total, PEMEX is planning an investment of US$8 billion in extending its pipelines network over the next years.

Victor Mackissack, Director, Enduro Mexico

"We are an inspection company, who sees a big opportunity in the market that exists in Mexico, mainly with PEMEX. Pipeline inspection has to do with environment security, which has a big impact, and also with city security, because many of the pipelines run through the cities and it is evident that inspection is a high risk job. After analyzing PEMEX' needs and some of our competitors, I should emphasize that we can cover a 15% of the mechanic inspection market, which means that the market is sufficient in Mexico, especially when you count with new technologies such as ours. Enduro uses Magnetic Flux Leakage (MFL) inspection tools and we are also implementing ultrasonic testing (UT) inspection tools. Nowadays, PEMEX has around 65.000 km of pipelines and 60% of these, according to for PEMEX head Reyes Heroles, should be replaced within approximately 5 to 6 years."

Lazaro Martinez, Production and Sales Manager, Rinsa

The offshore discoveries will also require new pipelines to be built in order to transport the crude oil to refining facilities. Recubrimientos Integrales del Norte SA (RINSA), a pipe coating and welding specialist, has identified this as their target niche that they are looking to conquer by partnering up with a Canadian company that will provide them with innovative technologies. "In 2005 when the company was created, the coating market was entirely dominated by international players because Mexican companies didn't have the appropriate technology. In just 7 years we have been able to take 80% of the coating market share due to our competitive pricing", recounts Lazaro Martinez, production and sales manager of RINSA. "We are aware that times will soon change and that we will be facing increased competition once the market has been opened up to foreign participation. This is precisely why we are looking to forge international partnerships at this time, so that we can be prepared once the energy reform follows through. It is essential for us to be at the cutting edge of coating technology to offer PEMEX the best products with the highest safety and performance benchmarks."

Ciudad Pemex, Tabasco, courtesy of Pemex

It has only been until recently that concerns for safety standards and adequate maintenance of pipelines have taken center-stage. This is particularly true in light of a pervasive black market for fuel that involves thousands of clandestine tapping points across PEMEX's pipeline network. This black market is so entrenched into daily operations that even companies such as Shell and ConocoPhillips have been charged with being involved in the trade of stolen fuel in one way or another.

Aside from the estimated US$1 billion in lost revenues this represents, the illegal tapping of pipes is mostly detrimental in the safety hazards they pose causing fires and explosions that have claimed lives, as well as leaks that contaminate land and water sources. In some cases, environmental remediation costs are likely to be higher than the price of the stolen fuel. Overall, PEMEX's safety record is far from admirable and has recently been placed on the spotlight after an explosion that rocked the company's headquarters in Mexico City on January 31st leaving 38 dead.

"What has been discovered throughout the years is that much of the clandestine sale of fuel was happening with assistance from within PEMEX at different levels of the organization", explains Share Oil's Gallegos. "One innovative project that we came up with for PEMEX is a remote monitoring network that serves to alert whether there are any disruptions in the flow of hydrocarbons. We devised software that collects and compiles all the monitoring data from all the sensors throughout their network. This software connects to PEMEX's IT network in order to have 24-hour supervision of the pipelines. As soon as there is any disruption, the system automatically alerts the necessary people via email or other methods, so that the problem can be solved immediately. This also assists in increasing transparency throughout the company".

Companies such as Enduro and Share Oil illustrate that Mexican entrepreneurs are not only embracing a reform of the sector, but are in many ways the vehicles of change themselves. "Everything that allows for the best and most profitable exploitation of natural resources in the country is welcome. If the government determines that the participation of foreign companies is needed in some areas, then this should be under clearly defined rules. For RAM-100 the most important element is that pipeline expansion plans and the maintenance and rehabilitation of the national pipeline network is unhindered", states Teodoro Gutierrez, general manager of RAM-100 del Sureste.

Teodoro Gutierrez, Director, Ram 100 del Sureste

RAM-100 is specialized in everything related to pipes, from anti-corrosive coatings and welding to the installation of over and underground pipelines. In line with current conditions, "we have developed an aggressive marketing plan to demonstrate to engineering firms and end users that RAM-100 offers the most comprehensive warranty in the market and we have the service of qualified inspectors to oversee the management of pipes during construction and operation. At the site of installation, we test for areas to repair damage caused during the transport or handling of the pipes. We also offer comprehensive coating of welding points making the coating uniform so that area does not become a point of corrosion or leakage in the future."

Undoubtedly, an added benefit of the proposed energy reforms is the development of a national industry that until now has been somewhat shy to express its full potential, not only locally but also on an international scale. Being a part of the OECD and the 13th largest economy in the world, it would only seem natural that Mexican companies would be more visible and vibrant in the global arena. "I would like to see Mexican companies compete with the giants. I believe one problem we as Mexicans have is fear. We should have more vision to provide quality jobs for our people and accept more challenges as business men, because we certainly have the potential to be a global power", declares Enduro's Mackissack. If any single sector of Mexico's economy has the capacity to make this leap, it would be that of the oil & gas industry.

"The government's strategy is to leverage private investment in PEMEX to achieve greater development and to enhance the ability of the Mexican state. These investments will foster market growth and economic development, while at the same time raising the standards under which companies will operate, especially in the aspect of quality, safety and environmental protection", explains Telesforo Segura, founder and ceo of Consultoria en Obras SA (COBSA). As an engineering and construction firm dedicated to the oil & gas sector, COBSA is betting on the surge of new infrastructure projects for its future growth. They also embrace an energy reform as the defining moment for Mexico's hydrocarbon development. "This is the turning point, and it will require not only intensive capital but also the will of all those involved in this industry. Otherwise we would be living just one more false episode like many that continually happen in our country", concludes Segura.

Beyond the financial opportunities that will come with a greater openness of the market, Peña Nieto's reform is serving as a catalyst to shape up and improve Mexican businesses so that they may compete at an international level. From environmental awareness to quality standards and human resources practices, there is a tangible renovation of the local industry that will also attract investment in the form of international partnerships and joint ventures. Segura believes that "it is very important to lead by example. As a company active in the Mexican Chamber of the Construction Industry, we continually express the benefits of being a human-minded company that is also concerned about our environment. We transmit these values by actively participating in seminars and congresses across the country. This ensures a permeability of this culture in the industry – not only in the construction industry – but also in all other sectors and in society in general."

SME's Leading a Mexican Revolution

Based out of colonial San Miguel de Allende, Grupo SSC is a pioneer in modeling and monitoring technologies that can be applied to foresee potential operational challenges before they even emerge. While the company's origins date back 23 years, it has only been in the last five years that they emerged a champion in the Mexican oil & gas industry, bringing to the sector world-class expertise that highlights the capabilities of local entrepreneurs. Fernando Balderas, director general of Grupo SSC, speaks of his journey to success:.

Fernando Balderas, General Manager, Grupo SSC

How did you adapt to specialize on providing services to the oil & gas industry?

We tried to attract PEMEX as a client for many years, but our approach was incorrect. We discovered that PEMEX does not have an engineering department; it is an operational company, so what we had to do, was to provide solutions rather than simply try to sell them a product for them to implement. Therefore what we offer today is a package development of state-of-the-art thermodynamic, rheological and numerical technology, in order to give PEMEX added value. We also provide solutions that demonstrate performance through numerical profiling. With this technology, not only is equipment performance enhanced but also operational conditions.

With such unique technology there is no doubt that there will be heightened interest in your company, even in the form of M&As. What are your thoughts on such opportunities?

Grupo SSC is not for sale. We don't want to change the direction of our work and we would hate to see all these years of effort disappear. All along we have desired to build a sustainable project that continuously evolves. We want to make little big steps.

We are a small company with huge ambitions and we are really excited with all the business opportunities and technology that are developed in-house, including the evolution and training of our people. Some of the things that we have learnt and that define Grupo SSC are that we love big challenges and we still believe that this is the right way. We will take these on.

We also have to be thankful for PEMEX, because they are the ones that require these types of solutions, therefore opening doors for us. There is no question that much of Mexico's wealth comes from the oil and gas industry. Obviously, PEMEX is not our only client but it is our main and key one, therefore we have to look for solutions to help this good and beautiful company that has always contributed to the welfare of our country.

New beginnings

Now more than ever, Mexicans are embracing their full capabilities and building the necessary confidence to take greater risks that will accelerate economic and industrial development. Entrepreneurs are becoming more bold and visible.

We have to position ourselves at the highest level by understanding what are the needs that our country has," says Marcial Meneces, founder and general director of Bombas Industriales Mexicanas SA (BIMSA). Meneces created BIMSA and starting designing and manufacturing pumps on his own after realizing that foreign companies were overcharging PEMEX for something that could easily be made in Mexico. "We must take to the field and get off our desks to really feel what we can do for PEMEX and Mexico as a whole. Many of our oilfields have matured and therefore the process to extract this oil is different than before. This will require new technologies, new pumps that perhaps the Germans or the French are very good at manufacturing, but I must then take the extra step to design my own pumps that will be made in Mexico. I will prove that they work just as well as the European counterparts and they will cost a fraction of the price."

Even though BIMSA is already a trusted supplier to PEMEX, Meneces wants to keep focusing on the Mexican market rather than taking his innovations abroad. "I have a very particular way of thinking, because I know most businessmen want to make as much money as possible and take their companies abroad, but this is not my objective. I am of the opinion that we should keep doing more things locally so that the money stays in the country and we can therefore create more jobs. As businessmen is our responsibility to give back to our country before we think of filling our pockets with cash."

Marcial Meneces, Director, Bimsa

In contrast, Fernando Saldivar, general manager of helicoidal steel pipe-maker Forza Steel, tells of his success in turning around his company that suffered greatly during the financial crisis of 2008. "We were originally in the business of selling steel slabs to the automotive industry, but then when the crisis hit our sales dwindled. At that time I realized that perhaps the only industry that will always grow despite economic hardships is the energy sector, and so we shifted our entire business model to sell steel pipes to this market." They first began importing the pipes to then distribute them locally, but business was so good that they decided to manufacture their own pipes.

Floating Production Storage and Offloading, FPSO, courtesy of Pemex

So far business has been steadily growing and they set up an office in Houston 2 years ago to launch their international expansion. They are soon looking to target South American markets and demonstrate that Mexico can be an important player in the production of steel pipes. Saldivar's vision is ambitious but not naïve. "As the next step of our expansion, we are planning to build a plant for coating our pipes so that we can sell a fully finished product that will be ready to install. Currently we must depend on other companies to apply these coatings". The new state-of-the-art plant is being built under international standards in order to prepare for their international exports.

Another segment of the oil & gas sector that is resurging due to international influence is that of environmental standards and technologies. "Mexico right now is in the spotlight of the world due to its healthy economy and higher expected growth rates in the coming years, similar to what happened to Brazil 8 or 9 years ago. All this expected growth will be translated in an increasing and stronger demand for responsible environmental services of all types, as well as the development of new or emerging sectors in Mexico like used-oil re-refining, battery recycling, industrial waste water treatment among other. The combination of the current solid foundations for a strong development of the environmental industry and the good moment of Mexico represent a big business opportunity for international players if they are able to identify good local partners", elucidates Javier Campos, founder and general manager of SITRASA. Sitrasa offers a wide array of services to the oil & gas industry, including the handling of their hazardous and industrial non hazardous waste streams for recycling, revalorization or stabilization and treatment for ultimate disposal. They also offer customized on-site services of sludge and waste water treatment.

Juan Carlos Hernandez, General Manager, Industrias Energeticas

At the core of the company's strategy is to bring European technology to Mexico, including for the recycling of batteries and fluorescent lamps. They are the first company in Latin America approved under international standards to recycle these materials safely. "From my own perspective, the development of the environmental industry in Mexico has taken more time, than what probably took in other countries, but today I believe we are finally at a point where we have solid foundations for a strong development, like good laws, fairly good enforcement, more ethical competition, increasing corporate responsibility, amongst others", concludes Campos.

"We perceive that the oil & gas market has a lot of potential for us, and that's because of the new environmental regulations created by the government. Generally, we are witnessing a shift away from older methods of operating, which are harsher to the environment", says Juan Carlos Hernandez of Industrias Energeticas. His company provides service solutions in the technological application of integrated power generation and electricity through the use of microturbines that are manufactured by US-based Capstone Turbine Corportation. "We are considered to be a clean company; the percentage of carbon dioxide emitted by our microturbines is really low. This is because our products don't use any oils or lubricants whatsoever, nor any liquid for that matter; their system is based on air bearing technology, with frictionless motion and, providing very low noise levels, zero vibration and very low maintenance costs."

"The only downside to bringing innovative products like this is that many people are not willing to investment in them initially since they are more expensive than the regular technologies. It's something in the way people think that needs to change towards a cleaner and more environmental friendly method. Over time, we are confident that the big companies and the people in charge of the machinery will be convinced that the quality of the energy, the maintenance, and the technologies are worth the extra investment." Industrias Energeticas is also betting on PEMEX's need to fulfill recent environmental requirements in order to have their microturbines become staples on offshore platforms.

Jalil G. Alva, CEO, Grupo Comunicador Alba

Beyond bringing new technology and products to Mexico, other companies thrive on enticing foreign companies to come to this market and set up local operations. Grupo ALBA is a unique marketing agency that is entirely devoted to the oil & gas sector. "Our concept today is to serve as a bridge between international companies and PEMEX, by providing all kinds of communication and marketing services to them. From organizing meetings to discuss business opportunities, to designing and building stands for conferences and events, today we are capable of fulfilling all the communication needs of a company interested in Mexico. Ultimately, we think of ourselves as networking specialists that offer complete solutions for oil & gas companies to enter this market," explains Jalil Alva, general director of the group.

Many international companies complain that PEMEX is an incomprehensible behemoth that can be extremely daunting to approach. Any seasoned businessman will be quick to tell you that the only way to do business with PEMEX as a foreigner is to find yourself a Mexican partner that has close ties to the company. Alva alleges that he has "access to all the right people at PEMEX and this is precisely what our foreign clients need to be successful in this market, at least at the initial stages. No one can assure the kind of access to the Mexican market that Grupo Alba does, and this is the edge that we have compared to any other event organizer, whether foreign or local. In this way, we informally became the local representatives for those foreign companies as we would link them together with the right people in the industry, especially at PEMEX."

With promises of a new PEMEX and an incursion of foreign investors, several Mexican companies are devoting themselves entirely to the business of easing this transition. This is particularly so regarding the availability of experienced and well-trained human resources that can take on the new challenges of deepwater, shale gas and modern hydrocarbon infrastructure. In fact, most companies express human resources scarcity as one of the industry's greatest obstacles for development. Compounded with an insufficiency of adequate technologies, the lack of capable engineers has forced some companies to take on the education of their own people.

SCADA, courtesy of Pemex

Balderas of Grupo SSC claims that "one of our big advantages is that we train our own people and that we count with research and development teams in order to keep the position that we have right now. We have actually set up a technological university, called Instituto Tecnológico Sanmiguelense de Estudios Superiores, where we train and educate most of our recruited employees. After the studies, 100% of our students already have a job position assured in Grupo SSC and sometimes our clients want to take them to their companies. We are firm believers that we grow through our people."

On the other hand, other companies have made it their core business to recruit and retain the right employees for the oil & gas industry. Grupo PAE, is a human resource expert that offers a wide range of services, from headhunting and payroll management to catering services. "The company began providing outsourcing services to a number of industries, because in Mexico an employer's responsibility is very complex. When you take into account your payroll, social security, all these sorts of issue, it can be a discouraging experience for newcomers. All this creates a significant administrative burden for the employer and for the resource provider, so we try to address that problem through our services", says Ulises Muñiz, vice president for North America of Grupo PAE. "We like to use our local knowledge to make way for people who come to invest seriously in Mexico. Many foreigners are unaware of the problems, in terms of human resources, that they will encounter when coming here."

Rather than acting as a passive outsourcing firm, Grupo PAE likes to think of themselves as active partners and collaborators to their clients. "The idea is that we grow hand-in-hand with our clients and anticipate their needs so that they can focus entirely on their core business. This is in fact how our catering services emerged, because we realized that one of our clients could not cope with the logistics of feeding its people on the field on a daily basis. We took on the burden and now have a subsidiary that only provides these types of services. As a next step, we are looking to find and offer continental services, allowing us to explore international markets. This will happen when one of our clients here in Mexico is satisfied enough with our performance that they request us to provide the same services to their international operations. Many customers have told us that our services are more expensive than our competitors, but they are glad to pay them because they solve all their problems. Based on these examples I can safely say that we have achieved our goal and vision."

Clearly, efforts such as those of Grupo Alba and Grupo PAE are only small steps to attracting relevant foreign investors to Mexico's oil & gas sector. The emergence of a business-savvy Mexican industry is certainly necessary to assist PEMEX in its transformation to become a globally admired NOC, but it will not be enough unless politics governing the industry follow through with a radical reform. In a country where promises are made a dime a dozen, 2013 will prove to be a decisive year for the future of PEMEX and for the leaders of Mexico. All heads are now turned towards President Peña Nieto, anxious to issue a verdict on whether his lofty words are more than just another Mexican letdown.