Value-focused asset management

An approach for deriving maximum business benefits from physical assets

John Paisie, JEA Consulting Group, Houston and Holland, Ohio

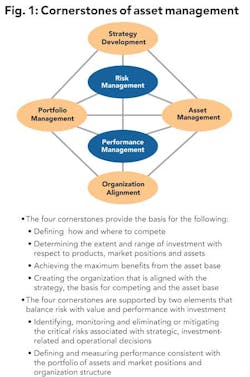

Asset management is one of the core capabilities for sustainable business success as indicated in Figure 1. Without effective asset management, a company will ultimately stumble no matter how clever its strategy, no matter how attractive its portfolio, no matter how strong its asset base and no matter how unique its organization structure. Furthermorethe lack of effective asset management cannot be overcome by risk management, no matter how rigorous, and by performance management, no matter how sophisticated.

The objective of asset management is to derive the maximum business benefits by increasing the robustness of operations through a continuous process that involves a proactive and integrated approach. The approach entails the development of operational strategies that are aligned with the business strategy. It also entails the effective management of operating inputs to allow for the reliable and predictable production of outputs required to satisfy the business requirements. Operating inputs refer to all inputs of production – feedstocks and utilities, as well as the execution of key supporting functions: engineering, maintenance and administrative.

Given the level of asset intensity, asset management is a critical capability for companies operating in the oil and gas sector. The assets for these companies include tangible assets (production facilities, logistical assets, support systems) and intangible assets (reputation, external relationships, work culture, organizational knowledge). The effectiveness of the asset management, however, of many of these companies can be improved. One reason that asset management programs do not deliver the intended benefits is that while rigorous in nature the programs are not designed from a strategic perspective nor adjusted proactively in response to changing market and competitive conditions. Consequently, many of the programs are not aligned with business requirements, nor are the programs focused on the addressing the issues that will have the biggest impact on the future competitive position and business performance. Instead of helping to drive performance, many asset management programs end up being a collection of disparate activities and checklists – which are not systematically designed to enable a higher level of business performance.

The benefits of asset management

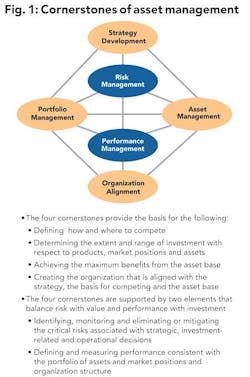

Effective asset management can improve financial performance through two methods. The first method focuses on increasing the ability to operate the physical assets at their economic level. With physical assets, the objective is to operate at an optimal production level that generates the maximum profits – at an increased frequency. The second method is to identify and eliminate existing bottlenecks which constrain production levels. In many cases the optimal production level is not achieved, as production limits (instantaneous and average) are reached at a lower level than the profit-optimizing level. The bottlenecks can be in the form of physical bottlenecks and availability bottlenecks. Physical bottlenecks refer to production limitations that occur when the actual operational limits of the physical assets are reached. Availability bottlenecks refer to the production limitations that arise because the inputs to the production assets cannot be maintained at optimal levels and/or because of mechanical deficiencies.

The objective is to move the actual performance closer to the desired production level in a more consistent and more predictable manner. The resulting benefits include a higher average production level that stems from improvement in the availability of the assets. Another benefit is an increase in the potential peak performance that stems from the debottlenecking of the operations.

The operational benefits translate into financial benefits because the business will actually shift to a new cost curve at higher production rates. The new cost curve will represent a lower cost structure because the marginal cost associated with the additional production is less than the previous average cost. Figure 2 illustrates the results of eliminating the bottlenecks.

Solutions to bottlenecks and improvement in availability can have an enormous financial impact. In effect, the resources employed in the effort to increase the effectiveness of asset utilization leverages the entire asset base of the business. The return on capital employed (ROCE) will increase as the profits increase at a greater rate than capital employed because the improvement in availability and debottlenecking can be achieved with little or no capital. Working capital can also be reduced with the increased level of operational predictability, which will strengthen the ability to respond to changes in market conditions while also allowing for the reduction of inventories across supply chain.

Additionally, the required investment has a favorable risk-value profile because the efforts are focused on current operations for which companies have hands-on knowledge of the market environment and the competitive landscape, which reduces the level of uncertainty associated with achieving the expected benefits. Because of these two factors, the potential upside has a lower level of uncertainty.

The foundational requirements

The requirements for instilling a value-focused asset management approach across the entire scope of the business include the following: utilization of a comprehensive framework; development of a production view; and establishment of the proper focus of the effort.

Comprehensive framework

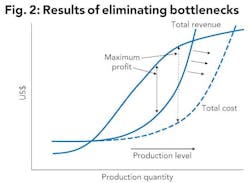

A comprehensive framework needs to integrate each of the critical elements of asset management in such a manner to focus the entire effort on value creation. Each of the critical elements is explained below.

The Ownership Approach refers to the management of the asset lifecycle. The focus needs to be on making the appropriate decisions pertaining to the design, acquisition/divestment, upgrade/expansion and replacement/retirement.

- The Maintenance Approach involves the entire scope of maintenance activities including the application of reliability, availability and maintainability principles; the implementation of monitoring, testing and inspection programs; and the mitigation of lost opportunities.

- The Production Approach addresses the production process from deciding on the characteristics of the inputs, the sourcing of the inputs, the characteristics of the outputs, and the distribution of the outputs. A critical decision is the degree of operational flexibility that will be associated with the production approach.

- The Operating Philosophy considers the level of centralized control and integration between production assets, and the development and implementation of the appropriate procedures, processes and training programs.

In addition to the above elements, the framework needs to have the following attributes:

- Encourage the management to assess the business from a forward-looking perspective – internally and externally. This attribute will prevent the program from being focused solely on addressing issues that have historically hampered performance without considering the impact of the potential changes in the market environment and the competitive landscape.

- Address the degree of alignment between business strategies and the operating strategies and the structural position of the production assets. For instance, if the business strategy is based on efficiency, the strategy will only be successful with the appropriate cost structure. Conversely, if the business is based on differentiation the production capabilities need to have the corresponding level of complexity and flexibility.

- Consider the internal capabilities including the financial wherewithal, organizational competencies and the supporting systems.

¤ The financial wherewithal refers to the strength of the balance sheet and the share price. While greater financial wherewithal allows provide greater flexibility, priorities will still need to be established to ensure that the program delivers material business results in a timely manner.

¤ Organizational competencies refer to the knowledge, experience and skills represented by the organization. Significant gaps will need to be addressed to ensure that the asset management program can be implemented and executed effectively. Strengths and unique skills offer the opportunity to create a competitive advantage.

¤ The status of the supporting systems also needs to be considered. The supporting systems include information technology platforms, the accessibility and timeliness of financial and operational information and the transparency of the information across the entire scope and levels of the business operations. Gaps will need to be resolved to ensure the effectiveness and the sustainability of the asset management program.

- Take into account the supply chain requirements associated with the production capabilities. The availability of critical physical inputs needs to be considered, as well as inputs from critical service providers. The output requirements also need to be considered with respect to supply/demand and quality requirements. As with respect to the availability of the critical inputs and the output requirements, it is important that the logistics are considered from a forward-looking perspective that takes into account future developments including changes in supply/demand flow patterns and the potential for bottlenecks, which would affect the value of logistical assets.

The framework is illustrated in Figure 3.

Production view

A method for focusing the organization on production is to develop a production view of the company through the identification of production chains at all levels of the company – across business units, between production facilities and within each of the production facilities. Production chains are determined by the inter-linkages between inputs and outputs of production elements and the supporting logistics, which in total represent the sourcing and supply of production inputs, the production activities and the delivery of production output to customers.

The production chains need to be identified, managed and coordinated in an explicit manner. Maximum profit potential is achieved by being able to operate each of the production chains at optimal production levels.

To reach this point the mismatches in the production capabilities of the linked elements need to be addressed. Mismatches often exist because of the piecemeal way that the production facilities (as well as the supporting infrastructure and the supply chain logistics) have been expanded and modified over the years. For instance, a production asset unit that provides input to another production asset may not be sized such that its production level is sufficient to fulfill the maximum capacity of the linked production asset (or vice-versa). An opportunity then exists to either de-bottleneck the undersize production asset through capacity modifications, or by buying (or selling) the input from (to) an outside customer. An important point to remember is that even if the increased production capabilities are not normally needed, it provides the advantage of additional operational flexibility.

Proper focus

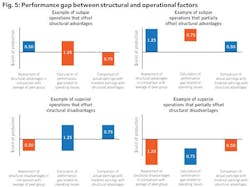

A method for determining the appropriate focus is to identify the underlying reasons for the financial performance gaps in terms of structural factors and operating factors. Without this knowledge, it is impossible to determine the appropriate focus. Addressing structural factors require modifications to the portfolio of assets or modifications to assets through capital expenditures. Conversely, addressing operational factors can be accomplished through initiatives that are focused on improving efficiency and effectiveness of business activities. The determination of the underlying cause of the performance gap will identify the appropriate focus of the asset management approach. Examples of typical structural and operational factors along each level of operations are provided in Figure 4 below.

The breakdown of the performance gap between structural factors and operational factors can be determined through a quantitative approach. The approach entails the modeling of the expected performance at each of the business levels by utilizing the market conditions and assessing the extent of the advantage and disadvantage associated with each of the key structural factors in comparison with the industry average (in terms of the appropriate set of competitors) and the average of the industry profit margins to determine the expected performance with the current set of assets. The expected performance (given the structural advantages and disadvantages) then can be compared with the actual performance. The difference in the results is the performance gap (which can be positive when the actual performance results is greater than the calculated performance results) and represents the extent of the operating deficiencies (or in the case of a positive performance gap, the operating efficiencies).

The results of the analysis will indicate the extent of performance gap stemming from structural advantage/deficit and the performance gap associated with the operating performance, as illustrated in Figure 5.

The quantitative approach can be utilized to assess historical performance and to determine the underlying factors driving performance. Even more useful results can be gained by also undertaking the analysis from a forward-looking perspective. This can be accomplished by assessing the performance making use of forecasted prices and margins – in conjunction with the asset base associated with the business plans and the relative level of operating performance that is consistent with the current level of operating capabilities. Additionally, the impact of improvements with respect to different structural factors and operating factors can assessed within the context of different industry scenarios to test the robustness of the improvement efforts.

About the author

John Paisie is the CEO and managing partner of JEA Consulting Group, which provides strategic consulting and advisory services for clients involved in or affected by developments in the energy sector. Clients include government, financial, and operating entities. Paisie’s professional career spans 25 years and includes experience with operating companies as well as service firms. As a strategy consultant, he has covered the manufacturing, oil and gas, petrochemical, power, and transport sectors. His global business experience includes work and residency in Southeast Asia, China, the Middle East, Europe, and Latin America. Prior to joining JEA, he was a partner and member of the executive committee at PFC Energy, a consulting firm based in Washington, DC. Before that, he worked at IBM Consulting Services (formerly PriceWaterhouseCoopers, PwC Consulting). Prior to becoming a consultant, he held several management and technical positions in industry and started his career as an engineer. Paisie has an MBA from Purdue University and is certified as an Energy Risk Professional by the Global Association of Risk Professionals.