Funding Energy Infrastructure

Alternative financing for midstream development

Elizabeth L. McGinley and Vivian Y. Ouyang, Bracewell & Giuliani LLP, New York, NY

The demand for energy infrastructure in the United States is growing at a rapid pace. The expansion of shale gas development has created tremendous demand for midstream assets to transport and store the rising volumes of natural gas production. Historically, much of the midstream asset development has been financed with private debt or equity or with public financing through a master limited partnership (MLP). However, changes in the sources of capital and an increased demand for yield have led to the development of alternative financing vehicles.

A significant portion of the capital currently available for oil and gas midstream infrastructure development is from US tax exempt investors, such as pension plans, and foreign investors. Further, in the current low interest rate environment, investors of all types are seeking higher yields than currently available through traditional low-risk investments. Both of these trends are driving change in the structures employed to raise capital for investment in US oil and gas infrastructure.

The MLP

The MLP traditionally has been a popular vehicle for raising capital for oil and gas midstream development. Capital raised by MLPs can be applied to develop new midstream assets or acquire existing midstream assets from midstream businesses, for cash or MLP interests, providing the seller with liquidity for the development of new midstream assets.

Midstream MLPs are attractive to investors because they typically distribute a large portion of their cash earnings and provide investors with steady returns. Further, MLPs are not subject to federal income tax if most of their income is qualifying income, which includes income from transportation of natural resources. Instead, the MLP allocates its taxable income among its partners who are treated as if they earned the income directly. Accordingly, for federal income tax purposes, holders of interests in MLPs are deemed to be directly engaged in the trade or business of the MLP.

The REIT

Real estate investment trusts (REITs) also can be employed to raise capital to purchase or provide debt financing for oil and gas midstream assets. REITs can provide capital to midstream businesses for new midstream development through direct purchases of midstream assets, sale-leaseback arrangements for completed midstream assets or secured debt financing.

REITs must derive the large majority of their income from real property, either as rents or interest on debt secured by real property. The Internal Revenue Service has ruled that rental income from the lease of gas pipelines and storage facilities qualifies as income from real property. In addition, REITs are required to distribute at least 90% of their annual taxable income. As a result, like MLPs, REITs commonly pay significant cash dividends, satisfying investors' desire for yield.

Unlike MLPs, for federal income tax purposes, REITs are separate taxable entities and taxable domestic REIT shareholders are subject to tax only on dividends and gain on the sale of REIT stock. However, unlike most corporations, REITs are permitted to deduct distributions made to their equity holders. Accordingly, the deduction for the amount required to be distributed has the effect of largely eliminating federal income tax on the REIT, so the income is taxed only once, at the shareholder level, similar to an MLP.

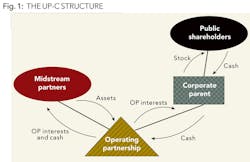

The Up-C

The Up-C is a partnership-corporation combination structure (see Figure 1). Generally, a corporate parent is formed with a partnership subsidiary that will own all of the assets and conduct the business of the enterprise. One or more midstream businesses contribute midstream assets to the partnership in exchange for cash or equity in the partnership exchangeable for stock of the corporate parent. The corporate parent issues stock to the public and applies all of the cash proceeds to acquire interests in the operating partnership, either from the partnership or the contributing partners.

Thus, the contributing partners can receive cash upon formation for the construction of additional midstream assets or the partnership can utilize the cash for the development or purchase of midstream infrastructure. The corporate parent has no assets or operations other than its interest in the partnership, so distributions from the partnership are immediately paid by the corporate parent to its public shareholders.

The corporate parent pays federal income tax on the income allocated to it by the operating partnership. However, allocations of partnership income can be structured to maximize the deductions allocable to the corporation and minimize the income subject to corporate taxation. In addition, the taxable domestic shareholders of the corporation are subject to federal income tax on distributions paid from the corporation's undistributed earnings, and gain on the sale of stock. In the ideal Up-C structure, the corporate partner has little or no taxable income and, neither the corporation nor the shareholders pay material federal income taxes. Unlike the MLP or REIT, there are no restrictions on the assets or income of the Up-C and no distribution requirement.

Tax considerations for tax exempt and foreign investors

US tax exempt investors are subject to federal income tax on income from unrelated business taxable income (UBTI). UBTI generally is income from the conduct of a trade or business unrelated to the entity's tax exempt purpose. Dividends, interest, and capital gains from investments generally are not taxable to tax exempt investors, unless earned with respect to a debt-financed investment.

Similarly, foreign investors are subject to federal income tax and required to file a federal income tax return if they have income effectively connected with a US trade or business (ECI). Similar to UBTI, ECI generally includes income from the conduct of a US trade or business, but not passive income such as dividends, interest and gains on the sale of US investments (other than real property interests) unless the foreign person is otherwise engaged in a US trade or business.

Because MLPs are not separate taxable entities for federal income tax purposes, rather the partners are treated as conducting the business of the MLP, MLPs generate both UBTI and ECI, subject to federal income tax. Accordingly, all of a tax exempt investors' allocable share of MLP income and gain on the sale of MLP interests may be subject to federal income tax at a rate of 35%, plus state income tax in the jurisdictions where the MLP owns assets or conducts business. The effective federal tax rate on income and gain from an MLP earned by a foreign corporation can reach nearly 55%, including both federal income and branch profits taxes.

REIT dividends paid to tax exempt and foreign investors, however, generally are not taxable as UBTI or ECI, respectively. Dividends paid to foreign persons may be subject to withholding, but the receipt of REIT dividends, alone, will not subject a foreign person to federal income tax and reporting, which is a significant benefit. Further, foreign persons are not subject to federal income tax on gain on the sale of REIT shares provided that the REIT is domestically controlled, or the foreign person owns less than five percent of the REIT shares. Accordingly, an investment in a REIT can be far more tax efficient than an investment in an MLP for a tax exempt or foreign investor.

The Up-C structure also is attractive for tax exempt and foreign investors, as they can avoid federal income tax and filing requirements by owning stock in the corporate partner and receiving dividends and recognizing gain on sale, which generally are neither UBTI nor ECI.

Each of the MLP, REIT and Up-C can be structured to provide consistent, periodic cash flow to investors. However, the REIT and the Up-C structure may provide greater after-tax yields to foreign and tax exempt investors. Thus, as the sources of capital for oil and gas infrastructure shift from taxable domestic investors to tax exempt and foreign investors, the number of REITs and Up-C structures employed to develop infrastructure are expected to rise. OGFJ

About the Authors

Elizabeth McGinley is a partner and head of the tax practice and Vivian Ouyang is an associate in the tax group at Bracewell & Giuliani LLP. They represent a variety of clients in the oil and gas and electric power industries, including private funds investing in oil and gas exploration, production, and infrastructure. McGinley and Ouyang are based in New York.