The OPEC uncertainty premium

There may be a new risk premium in crude oil pricing.

The market has seen the evolution of risk premiums from geopolitics to civil unrest to war and to terrorism.

Now we seem to have the OPEC uncertainty premium, inaugurated with the Feb. 10 ministerial meeting of the Organization of Petroleum Exporting Countries in Algiers. More than a few analysts were surprised by the result of that meeting, which was a twofold agreement to rein in current production over quota and then institute a 1 million b/d cut in the group quota effective Apr. 1. Most market-watchers (this one included) expected the group to just roll over their current accord and at the most pledge to curb quotabreaking. Our gullibility was stoked by several comments by some OPEC ministers ahead of the meeting suggesting that, as prices were pretty high already, no further quota cuts were likely but production restraint might be needed. But in the days that followed the meeting, as prices drifted back up to almost $35/bbl (US benchmark), there were more-tangible signs that OPEC members are doing anything but cutting back.

The market generally has reacted strongly in response not only to OPEC quota actions but also to OPEC words. With the latest accord, OPEC ministers pledged to be "sensitive" to concerns over high oil prices, but they cited some market analyses that show current oil supplies as ample and in danger of turning into surplus. At the same time, however, they blamed high oil prices on market speculators bidding up prices in response to some reports that had global inventories at extremely low levels. Some OPEC ministers also have suggested that refiners are able to get along comfortably with a lower level of inventories than in the past, and that much of the anxiety over low stocks is unwarrantedhence the unseemly "speculation" by traders being the cause of high prices.

But early indications are that some key OPEC members, including Saudi Arabia, have not slackened in their contract volumes for lifting in March.

What's a confused market to believe?

Mixed signals

Some of the confusion comes from mixed signals from OPEC ahead of the meeting. While the Saudis reaffirmed their support for the group's official $22-28/bbl price band for an OPEC crude basketsuggesting a rolloverthe Kuwaitis called for a substantial production cut plus a quota reduction.

The Feb. 10 accord produced a result just like the one the Kuwaitis had called for. Is it possible the Saudis now are thinking in terms of a $22-28/bbl band actually being priced in euros, instead of the sagging US dollar? While OPEC has toyed with the notion of oil being priced in the stronger euro, no serious moves have materialized. But it would appear that the group now is taking into consideration the dollar's weakness, and while not abandoning it nominally, in fact are embracing a euro-equivalent price for dollar-denominated crude. In other words, the actual OPEC price band today, reflecting the weak dollar, may be closer to $28-33/bbl.

Market needs

OPEC by now has established firmly that it will preemptively move to defend oil prices rather than risk an oversupply that would drive prices down. It now just remains to be seen which price level will move it to act.

We may be seeing the new official OPEC basket benchmark of $30/bbl vs. the former unofficial benchmark of $25/bbl. After all, the OPEC basket has spent the better part of the last 2 months above the old price band ceiling of $28/bbl, and the global economy is still on a robust growth path, while demand has yet to slacken.

Merrill Lynch analysts, in a research report completed shortly after the Feb. 10 OPEC meeting, noted that fourth quarter and full-year 2003 showed a sharp increase in oil demand, driven mainly by countries outside the Organization for Economic Cooperation and Development.

"We have adjusted our supply-demand balance to incorporate higher non-OECD demand and to reflect a higher global [gross domestic product] growth outlook," or 3.4% for 2004 vs. a previous 3%, the Merrill Lynch analysts said.

Merrill Lynch also sees non-OPEC supply growth falling short of expectations this year and contends OPEC has underestimated the second quarter call on its oil, which the analysts put at 1.4 million b/d above the group's new quota.

Could it now take $35/bbl (US benchmark), sustained for weeks, to see the latest OPEC cuts reversed at the next meeting, in March?

(Author's e-mail: [email protected])

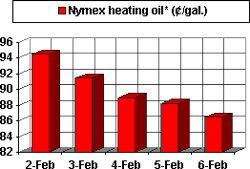

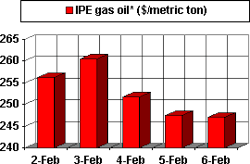

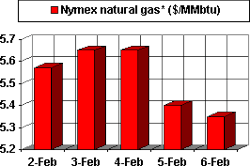

OGJ HOTLINE MARKET PULSE

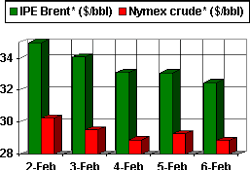

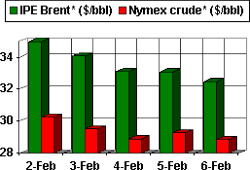

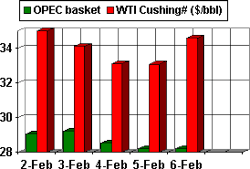

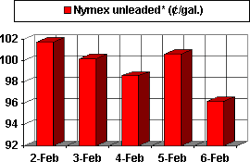

Latest Prices as of Feb. 16, 2004

null

null

null

null

null

null

NOTE: Because of holidays, lack of data availability, or rescheduling of chart publication, prices shown may not always reflect the immediate preceding 5 days.

*Futures price, next month delivery. #Spot price.