Pemex plans large program to expand Burgos basin gas output

Pemex hopes to acquire 7,500 sq km of 3D seismic lines, perform basin studies, and ultimately drill more than 50 exploratory wells and more than 1,000 development wells.Pemex's strategy appears to be to bring new Burgos basin production on line quickly enough to compete with U.S. producers, who are also eyeing the potentially lucrative industrial market in northeastern Mexico.

Petroleos Mexicanos has initiated an ambitious multiyear plan to develop the Burgos basin gas fields in northeastern Mexico.

Pemex hopes to raise production levels at the Burgos basin fields from 500 MMcfd in fall 1997 to 760 MMcfd next year and a peak of 1.4 bcfd by 2001, a level it hopes to sustain for at least 7 years.

Although Burgos basin fields have been in production since 1945-maximum production rate to date was in 1970 with just over 600 MMcfd-Pemex officials are optimistic the basin has sufficient reserves to warrant further exploration.

In a June 13 press conference, Burgos Project Director Pedro Silva estimated that drilling in the R!o Grande basin of Texas-part of the same geological trend as Mexico's Burgos basin-has yielded about 16 times the amount of gas produced at Burgos.

Rather than just explore for new fields and pools, Pemex aims to use 3D seismic technology to get a better picture of existing reservoirs and use new drilling techniques and hydraulic fracturing to boost production levels.

Because gas reservoirs in the Burgos basin and in the R!o Grande basin of Texas tend to be compact, it is unlikely any cross-border production issues-such as those still to be settled between the two countries in the Gulf of Mexico-will arise.

Burgos development

Pemex plans to invest $2 billion during 1997-2000 in four major endeavors: exploratory wells, development wells, 3D seismic surveys, and upgrading surface facilities.Officials hope to acquire 7,500 sq km of 3D seismic lines, perform basin studies, and ultimately drill more than 50 exploratory wells and more than 1,000 development wells. Pemex will delegate almost all of this work to Mexican and international companies.

Of the planned development wells, 72 are programmed for 1997, 150 more for 1998, and about 400 each in 1999 and 2000 to hit the 2001 production target of 1.4 bcfd.

The bidding process had yet to begin on the 1997 drilling program at this writing in fall 1997. A bid on 31 exploratory wells was finalized in April, with the contract going to a consortium of three companies: Schlumberger, Perforadora M?xico, and C!a. Mexicana de Exploraciones. Details of the contract have not been made public by any of the companies or Pemex.

Pemex has not publicized details of future contracts up for tender. Normally information is released by a notice in the Diario Oficial de la Federaci?n, the Mexican government's official publication, although sometimes Pemex gives advance notice.

Aware of the rapid fall-off in production levels at natural gas wells if a steady drilling pace is not maintained, Pemex officials have said they aim to speed up the bidding process for wells, but it remains to be seen if they will be successful, and whether financial support for the project continues past 2000, when a new government will be voted into office.

Short-term financing seems assured, in part from a recently announced $1 billion credit line to Pemex from a group of 26 banks, led by Citibank, Chase Manhattan, and J.P. Morgan, a large portion of which is to be dedicated to the Burgos project. Future funding will depend in part on whether the natural gas market in northeastern Mexico develops as Pemex evidently hopes.

Domestic vs. U.S. gas

Pemex's strategy appears to be to bring the new Burgos basin production on line quickly enough to compete with U.S. producers, who are also eyeing the potentially lucrative industrial market in northeastern Mexico.Air emissions standards are due to take effect in Mexico in 1998 that will force many factories to stop using fuel oil and convert to cleaner burning natural gas.

In addition, Mexico's Comisi?n Federal de Electricidad (CFE) plans to contract out the construction of as many as a dozen new gas-fired electric power plants in northeastern Mexico during the next few years, and several privately financed plants are also being considered.

These factors, combined with the overall industrial growth of northeastern Mexico, should boost natural gas consumption in the region considerably during the next decade. As the tariffs on U.S. natural gas exports to Mexico are dropping by 1 percentage point/year under North American Free Trade Agreement rules from the current level of 6%, it is in Pemex's interest to hike Burgos production as quickly as possible, to better compete with U.S. imports.

In fact, Pemex's inability to fill the north's gas needs has already allowed U.S. gas to penetrate several regions, including the planned Samalayuca gas-fired power plant in Chihuahua, designed by the Mexican government.

The plant is to be supplied by an $18.2 million, 23 mile, 219 MMcfd trunk pipeline from El Paso. The line likely will be extended farther south to provide natural gas to the La Laguna region around Torre?n when gas distribution is privatized there.

Apparently, say industry observers in Mexico, Pemex Gas y Petroquimico Basica (PGPB), which distributes gas, and Pemex Exploration & Production, which is in charge of the Burgos project, have not coordinated with each other to find buyers for the expected production from Burgos.

The major industrial market of Monterrey will likely be supplied by U.S. gas, as will much of the rest of the inland industry, but the Gulf Coast will be a good market for Pemex, particularly the booming port town of Altamira in Tamaulipas.

Another option is for Pemex to try to export a portion of its gas production to the U.S.

Chad King, president of Amoco Energy Marketing, thinks that with growing U.S. demand and the maturity of U.S. gas fields, there's room for Mexico to export to its northern neighbor.

"The U.S. market could fairly easily absorb an additional 1 bcfd of incremental deliverability," King said, assuming the infrastructure at the Reynosa interconnect station could be upgraded. "But that's close enough to all the ship channel markets and all the pipelines going up to the Midwest and the Northeast that if there were gas there, somebody would expand to come down and get it."

King also suggested the gradual reduction of the gas tariff on U.S. exporters to Mexico would not signal a massive penetration by U.S. gas into Mexico. "Clearly, over time, the elimination of a 6% tariff is 10?/Mcf, and that will make that a lot more attractive market, but in the short term, I don't think that will have a tremendous effect," King said.

Beyond the near-term dilemma of finding a market for Burgos production, the Mexican government evidently views the project as part of a long-term strategy to reduce dependence on U.S. natural gas in the north.

One Pemex official involved in the project commented, "It's not competitive, but it is strategic. The Burgos basin cannot compete (in terms of profit) with these giants we have in southern Mexico, where you can extract a million barrels per day of oil. But gas is one of the most important aspects in northern Mexican industry, so in spite of the fact that it's not as profitable as some of the projects in southern Mexico, it is strategic."

Geologic framework

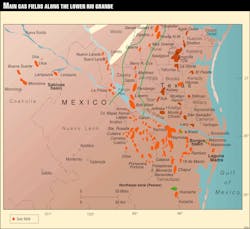

The Burgos basin province has a surface area of 49,800 sq km in the northeastern portion of Mexico, bordered by the R!o Grande (R!o Bravo) on the north, the Gulf of Mexico to the east, to the west and south by the Sierra Madre Oriental, and to the south by the parallel 24? 30' N. Lat.The basin, located mainly in the state of Tamaulipas and overlapping into Nuevo Le?n and Coahuila, is that portion of the R!o Grande embayment that extends south into Mexico.

The Burgos basin is divided into five elongated belts, generally parallel and running north-south. From west to east they are: Jurassic-Cretaceous, Paleocene, Eocene, Oligocene, and Miocene. According to a Pemex official involved in the project, the most important production horizons in the basin are Paleocene, Eocene, and particularly Oligocene in age.

The Paleocene belt is in the western part of the province and has a surface area of about 15,500 sq km. The principal productive sands to date are two in the Eocene Midway formation and 16 in the Eocene Wilcox formation. The major field in this horizon is the Oasis-Pandura-Corindon complex, covering 550 sq km on the border 40 km south of Nuevo Laredo.

The Eocene belt covers 7,500 sq km in the center of the basin, with production from 18 sands, four in the Wilcox, three in Reklaw, six in the Queen City, one in the Cook Mountain, two in the Yegua, and two in the Jackson. Culebra field, one of the most productive in the basin to date, is in the Eocene belt. About 70 km west of Reynosa, Culebra covers 350 sq km. Historically, the field's wells have had initial production of 1-2 MMcfd, with declines in 3-5 years, stabilizing at 500-700 Mcfd and depleting in 10-15 years.

The Oligocene covers about 10,000 sq km in the central-eastern portion of the basin and produces from 34 sands, 14 in Vicksburg and 20 in the nonmarine Frio. Large Reynosa field, considered by Pemex to be the most important in the basin, is in the Oligocene. It covers 600 sq km under the city of Reynosa and extending south and east.

The principal source rocks for gas in the province are Tertiary marine lutites, widely distributed through the basin. The rocks contain a moderate to high percentage of organic material that is mainly continental in origin and has led to the production of dry gas, condensate, and some light oil. Reservoir rocks are the intercalated sands in the shale-sand sequence, which have variable shaliness and maturity. Sealing rock is an argillaceous-sandy sequence with predominantly thick sections of marine shale, considered to be an excellent seal to the reservoir sands.

Fields are generally elongated north-south and are combined stratigraphic-structural types, mainly associated with growth faults and/or low relief anticlines, often transected by normal gravity and post-depositional faults.

Petroleum exploration began at Burgos in the 1920s, when foreign companies established production at four fields: La Presa, Rancheras, Lajitas, and Laredo, all in the north-northeast section of the basin. Pemex began exploring in 1939 and sank its first producing well in 1945 in Oligocene sandstone about 30 km west-northwest of Reynosa.

Since then more than 2,800 wells have been drilled in the basin, of which 750 are currently producing gas. Roughly 5.3 bcf of gas has been produced since 1945, and 181 fields have been identified. The Burgos basin is Mexico's largest discovered nonassociated gas producing area.

Other gas needs

Mexico's gas infrastructure needs many other changes, including processing, transportation, and storage capacity.About 84% of the country's gas processing and sweetening capacity is in southeastern Mexico, Marcos Ramirez, president of PGPB, told the Access Mexico '97 symposium in Houston last month. He said PGPB sees the need to build a 300 MMcfd cryogenic plant at Reynosa and expand and debottleneck several existing plants.

Ramirez said PGPB was starting construction in October of the world's largest supervisory control and data acquisition system on its 11,877 km gas pipeline system. The system consists of 1,628 km of distribution mains in 22 cities and 10,249 km of transmission lines.

Mexico has no underground natural gas storage fields. PGPB is evaluating gas storage in salt domes, aquifers, and depleted fields near Tehuantepec, on the Pacific Coast southwest of Villahermosa, and at Monterrey and Reynosa. Private investment is sought to establish and operate gas storage capacity, Ramirez said.

Copyright 1997 Oil & Gas Journal. All Rights Reserved.