Romania seeks foreign investors for range of petroleum projects

Romania's government is pushing a program aimed at liberalizing the country's economy and restoring its petroleum prowess.

A key part of the program calls for attracting foreign investments in all sorts of oil and gas projects.

The country made it a point to display the welcome mat for an influx of U.S. investments and petroleum technology late last year. That's when Romanian President Ion Iliescu led a delegation of key officials to Houston.

The group met with U.S. oil and gas equipment, research, refining, and exploration and production companies for talks on investment opportunities in Romania's petroleum industry.

Iliescu estimated that capital spending in the next 7-10 years by U.S. companies in Romania's upstream and downstream oil and gas sectors could amount to about $1.4 billion.

The idea that Romania in the next decade could emerge as a leading market for U.S. oil and gas investment and equipment exports garnered support in a U.S. Trade & Development Agency (Ustda) report released in Houston.

The study cited 20 oil and gas projects suited for U.S. investors.

Investment opportunities included licensing of exploration acreage, rehabilitation programs in existing fields, upstream and downstream equipment and technology sales, pipeline construction, refinery upgrades, and roles in reorganizing Romania's retail distribution network.

Key to revitalizing Romania's oil and gas industry is a new petroleum law considered by the national parliament in a package of investment and institutional reforms. Iliescu said the framework was to be in place by yearend 1995.

In anticipation of a more favorable investment climate, the U.S. Department of Energy plans to lead an oil and gas trade mission to Romania this month.

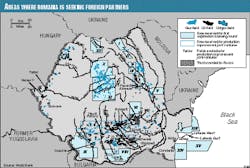

Later in first half 1996, Romania's National Agency for Mineral Resources (NAMR) plans to open an exploration licensing tender, with presentations planned in Houston and London. Tracts are to be included in each of Romania's six main petroleum provinces.

Reform at the core

Ustda said Romania as an investment option combines opportunities of a developing market with advantages of an established oil and gas sector and an experienced, low cost workforce.

Iliescu underscored those points in Houston.

With the process of building new social institutions well advanced, Iliescu said prospects are good for a new era of friendship between Romania and the U.S. He pledged Romania will aspire to sustain economic reforms while maintaining world standards of environmental protection.

"Completion of the economic reforms is the core of our efforts in Romania," Iliescu said.

Because Romania is positioned as a crossroad between Europe and the Middle East and has substantial natural resources and a well-educated workforce, Iliescu said, reforms will enable the country to take part in the process of globalization, creating new economic ties among nations.

He said Romania's new petroleum law will give foreign companies access to exploration and production prospects in Romania, onshore and offshore.

A World Bank map distributed at the Houston meeting showed 15 areas being considered for inclusion in the first exploration licensing tender and six tracts open for enhanced recovery joint ventures. In revitalizing its petroleum industry, Romania plans to emphasize use of modern technologies to increase recovery in all fields.

The country's sweeping petroleum industry restructuring is to include modernizing its largest refineries to improve product yield and quality, reducing energy consumption, and increasing environmental safeguards. Cost of the upgrades is estimated at $700 million.

Officials also plan to modernize and expand Romania's pipeline network and connect it with those of neighboring countries. In that context, Iliescu said Romania supports laying a pipeline in the region to transport oil produced near the Caspian Sea to world markets.

World Bank has approved a $175 million loan to help pay for Romania's petroleum industry rehabilitation. The European Investment Bank pledged $52 million cofinancing to the loan.

Preparing for privatization

Romania was one of the world's first petroleum producing nations, dating from the country's first oil discovery in 1857.

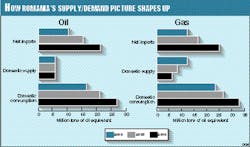

The country historically has been an important oil producing country with reserves estimated at 1 billion bbl. That accounts for about 70% of Europe's oil reserves. The country also has gas reserves estimated at 4 tcf.

Romania's oil and gas industry grew steadily in the 20th century, and foreign oil companies were active in the country until after World War II. While under Communist rule, Romania invested heavily in its hydrocarbon resources, but the country's production has been declining since the mid-1970s. As a result, Romania must import oil to maintain even 50% utilization of its refining capacity.

The country in the past 2 decades has imported about 30% of the oil it consumes. Romania in 1994 imported 25.4 million bbl of oil, including 10.1 million bbl from Russia and most of the balance from Iran.

Communist economic programs left Romania with an oversized, inefficient system of state owned petroleum enterprises.

Officials also aim to liberalize pricing policies to pave the way for privatizing Romania's petroleum industry.

The report listing key oil and gas projects was prepared by Spears & Associates, Fountainhead Enterprises, and Haylett Innovative Solutions with Ustda funding.

Romanian E&P activity

Foreign oil and gas companies already are making modest investments in scattered upstream Romanian projects.

Romania in 1992 offered exploration acreage in an international petroleum tender. Three companies in August of that year signed production sharing contracts (PSCs) for tracts, all with 5 year exploration periods and work programs worth a combined $77 million:

- Amoco Corp., under a PSC reportedly requiring a $20 million work program on a tract in the South Carpathian Mountains, at last report had acquired seismic data and was drilling a 5,000 m test.

- Enterprise Oil on two tracts in the Black Sea had acquired seismic data and drilled three wells in the past 2 years, one of which flowed 17.5 MMcfd of gas. Work commitment under the PSC was $17 million.

- Shell on a Transylvanian tract had acquired seismic data and planned three wells beginning in 1995 under a PSC requiring outlays of $40 million for seismic surveys and drilling.

In addition, Amoco Romania Petroleum Co. during the Ustda meeting in Houston said it had agreed to jointly evaluate an unspecified number of fields in Romania to identify opportunities for commercial reserves and production enhancements. Signing the agreement with Amoco was Petrom RA, which manages Romania's oil reserves on behalf of the state.

The new petroleum law is expected to open development of Romania's oil and gas resources by treating foreign and domestic investors equally. Because of that, some of the acreage to be included in the 1996 tender likely will be more prospective than the tracts where Amoco, Enterprise, and Shell are working.

NAMR will oversee the tender, reserving some producing fields and exploration areas for state companies Petrom and Romgaz RA.

At last report, Romania's Chamber of Deputies had approved the law, and members of the Romanian Senate were considering the proposal.

Romania's prospectivity

Exploration opportunities in Romania include prospects for small and large companies because most production to date has come from zones above 10,000 ft. Romanian state enterprises shunned deeper horizons because they lacked exploration and production technology to work at such depths.

Areas of Romania with geological characteristics indicating oil and gas prospectivity cover about 125,000 sq km onshore and 16,000 sq km offshore on the Black Sea continental shelf.

A report prepared for Ustda by Gustavson Associates, Boulder, Colo., said three regions likely to become most important in oil and gas exploration in Romania are:

- Subtle stratigraphic traps in the eastern pre-Carpathian depression.

- Deep structures on the Moesian platform.

- The Black Sea.

Exploration and production has been under way in the pre-Carpathian depression for the past century.

The district of Ploiesti has accounted for most of the oil produced in Romania, and more than 40 productive structures have been discovered in the region. Gustavson said new structural features are not likely to be found in the district, but deeper pays in existing fields or more subtle stratigraphic traps might yet yield additional oil and gas reserves.

Future onshore exploration on the Moesian platform likely will focus on targets lying below today's producing intervals. Gustavson said there is a chance unconformities or other subtle stratigraphic traps might be found in the regions.

Gustavson found that exploration in the Romanian Black Sea still is in its early stages, and more discoveries are expected. The most prospective areas are largely in the Babadag basin and to a lesser extent in the Moesian platform's offshore extension.

Romanian officials are eager for help in the Black Sea from companies using modern marine seismic technology. Romania also needs technical support to drill in water deeper than 100 m.

Here are the key agencies in Romania's petroleum industry

Operating entities

- Petrom RA is Romania's main exploration and production enterprise for oil and associated gas. Petrom has 25 onshore operating centers, one offshore center, two procurement units, and one research institute.

- Romgaz RA is the vertically integrated state gas enterprise. Romgaz's responsibilities include exploration and production of nonassociated gas, transportation and distribution of all domestically produced and imported gas, and administration of Romania's domestic and international gas pipeline system.

- Conpet SA ships and stores all domestic and imported crude oil and natural gas liquid as a common carrier. It operates rail tank cars and a 4,500 km pipeline system.

- Rompetrol SA provides exploration, drilling, production, and other services, mainly abroad. Rompetrol has offices in the Middle East, North Africa, and South and Central Asia. The company was privatized through an employee buyout in 1994.

- PECO SA is the state owned retail company, selling gasoline, diesel fuel, heating oil, and LPG through 435 retail stations and offices.

Regulatory authorities

- National Agency for Mineral Resources (NAMR) is responsible for conducting exploration bidding rounds, negotiation and awarding exploration and production contracts, establishing fees and royalties, and setting common carrier tariffs.

- Ministry of Industries formerly had overall policymaking and regulatory responsibility for the entire petroleum sector and represented the government's interests in state owned enterprises. Creation of NAMR was intended to separate the regulatory function from the state's ownership interests, thus eliminating potential conflicts of interest.