Foreign PSAs help boost Turkmen oil production

This third of four articles on Turkmenistan features an official Turkmen perspective.

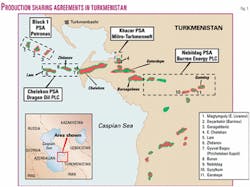

Turkmenistan's ambitious production targets are getting a boost from four projects under production sharing agreements.

Part 1 of this three-part series described the production targets and transportation-export challenges (OGJ, Oct. 14, 2002, p. 43).

This second part describes the active PSAs, which include two offshore and two land projects. Three are producing oil, and the fourth is still at its exploration stage.

Plans of foreign companies for all these projects for 2002 called for an increase in oil production by 1.6 times compared with 2001. Production, which in 2001 totaled 940,000 tons/ year (18,800 b/d), is to go up in 2002 to 1.5 million tons/year (30,000 b/d). The "foreign" share in the total oil production in Turkmenistan is to increase this year to 15% from 10%.

Cheleken project

The Cheleken offshore development project made up of the Chelekenyan- gummez (Cheleken dome), Dzheytun (Lam), and Dzhygalybeg (Zhdanov) fields (Fig. 1).

The fields have total explored reserves of around 85 million tons (620 million bbl) of oil and 62 billion cu m (2.2 tcf) of gas.

Cheleken was the country's first project with a non-Turkmen entity. The block has been under development since 1993, when JV Cheleken was formed between Holland's Larmag Energy Assets Ltd. (50%) and production association Chelekenmorneftegaz, a subsidiary of Turkmenneft.

Succeeding Larmag in 1998 was Dragon Oil PLC of the United Arab Emirates and UK, in which the UAE national oil company owns a 75% controlling interest. In November 1999 Dragon Oil changed its form of participation by signing a 25-year PSA with the government, extendable for at least 10 years. The PSA took effect in May 2000. Dragon is project operator.

Commercial oil production occurs at two fields, Lam and Zhdanov. In 2001, production exceeded 320,000 tons (6,400 b/d) of oil.

In the same year Dragon drilled two production wells, Lam 22-101 and Lam 22-102. Both wells revealed important oil and gas horizons. The first, drilled to 3,700 m, flowed 250 tons/day (1,825 b/d) of oil, while the second, drilled to 4,100 m, produced in excess of 350 tons/day (2,555 b/d). Both wells have been brought onstream.

Dragon planned to drill three more production wells in 2002. In July the first of these was tested at around 400 tons/day (2,892 b/d) of hydrocarbons. All drilled and planned wells end in several pay horizons, allowing commingled production (single-tubing string two-zone production), which enhances the flow rate and recoverability of hydrocarbons, improving development efficiency and profitability.

Dragon planned to produce 570,000 tons/year (11,400 b/d) of oil in 2002. Investment, $60 million in 2001, was to grow to $80 million this year. Specialists believe that the factor limiting further growth of oil production is utilization of associated gas.

Block 1 project

Another project in the Caspian Sea Turkmenistan sector implemented by Malaysia's Petronas Carigali on contract territory Block 1 remains in its development and production preparation stage.

The block includes Garageldeniz (Gubkin), Deyarbekir (Barinov), and Magtymguly (East Livanov) fields. The project is based on a PSA signed in 1996 for 28 years.

In 1998-99, Petronas drilled two exploration wells that flowed oil and gas. The well at East Livanov field produced 770,000 cu m/day (27.2 MMcfd) of gas and 400 tons/day (2,920 b/d) of condensate, while the Barinov field well flowed in excess of 600 tons/day (4,380 b/d) of oil and 300,000 cu m/day (10.6 MMcfd) of gas.

In summer 1999 Petronas suspended exploration drilling due to an accident at the offshore drilling rig the company had leased in Iran. After repairs, it resumed drilling in November 2001 and in February 2002 finished drilling the third exploration well, Ovez-IX, drilled to over 4,400 m. Test rates were commercial at 770,000 cu m/day (27.2 MMcfd) of gas and more than 300 tons/day (2,190 b/d) of condensate.

These results met the expectations of specialists who had predicted that the hydrocarbon zone extends farther northeast of the contract territory. Petronas specialists are of the opinion that the occurrence in deposit cross sections of several oil and gas bearing horizons suggests that flow rates in the area may reach or exceed 1,000 tons/day (7,300 b/d).

In February 2002, the company began drilling a fourth exploration well, Makhtumkuli-2A. In August the well flowed 1,937 tons/day (more than 14,000 b/d) and 539,000 cu m/day (in excess of 19 MMcfd). Now the company plans to launch full-scale field development. This year the company planned to invest $80 million.

In addition to proved reserves on Block 1 estimated by independent experts at over 350 million tons of oil equivalent (2.6 billion boe), the territory holds substantial unexplored potential. On the other hand, since the contract territory harbors predominantly gas reserves, Petronas' future plans for commercial development of the field emphasize commercial utilization of gas.

Nebitdag project

Burren Energy PLC of Great Britain operates the onshore Nebitdag project.

Burren Energy took over in August 2000 from former contractors Mobil Oil Corp. and Monument Oil PLC, which had joined the project in 1997. The project spans 25 years and calls for confirmation exploration and oil and gas production on an onshore contract territory located in the vicinity of the town of Balkanabat (former Nebitdag).

The contract area includes five oil deposits: Burun, Nebitdag, Gumdag, Gyzylkum, and Garatepe, whose reserves are to be confirmed in the course of additional exploration currently under way. Recoverable volumes are estimated at 22 million tons (160 million bbl) of oil. Commercial production is under way at Burun field.

Burren Energy is rehabilitating wells, switching wells to gas lift, and recompleting wells with a view to raising oil production. The company is also studying options for drilling new wells both in the production zone and on new exploration tracts. Calculations by company specialists indicate that this may help raise production as early as 2002 to 530,000 tons/year (10,600 b/d) compared with 410,000 tons/year (8,200 b/d) last year.

The company is to invest $25 million this year, up from $16 million in 2001.

Khazar project

Khazar is the first project in which the Turkmen side, represented by the State Concern Turkmenneft (52%), works as operator. The foreign partner, Panama's Mitro International Ltd. (48%), is a financial donor.

Turkmenneft contributes to the project over 70 years of work experience, infrastructure, equipment, technologies, and personnel. The foreign investor ensures timely and flexible investing.

The project, calling for rehabilitation and further development of East Cheleken field, was launched in mid-2000. Within half a year the consortium invested in excess of $23 million, mostly into well rehabilitation.

That enabled the partners to nearly double oil production, which totaled 210,000 tons (4,200 b/d) last year. In 2002 the companies plan to invest another $65 million. Investments will finance the drilling of new vertical production wells. The consortium plans to raise oil production this year to 400,000 tons (8,000 b/d).

Fiscal aspects

By now Turkmenistan has rather an extensive body of investment legislation that gives foreign companies broad rights and solid guarantees.

The principal laws regulating the legal regime of foreign investments are the Law on Hydrocarbon Resources of Turkmenistan (1996), the Law on Investment Activities in Turkmenistan (1992), the Law on Subsoil of Turkmenistan (1992), the Law on Foreign Investments in Turkmenistan (1992), the Law on Foreign Concessions (1993), as well as a number of ordinances issued by the president.

Under applicable legislation, natural resources that in Turkmenistan belong to the state may be developed only on the basis of a license. The Law on Hydrocarbon Resources of Turkmenistan requires both local companies and international legal entities to obtain licenses.

A license authorizes a certain type of work, such as exploration (a license is issued for a term of up to 6 years and may be extended twice for 2 years), production (a license is issued for a term of 20 years and may be extended for 5 years), and exploration and production (a combined license is issued that provides for maximum periods allowed by each of the separate licenses).

Licenses are issued by the Authorized Organ, based on results of open or closed tenders or direct negotiations with companies. In recent years Ashgabat has given preference to direct negotiations with potential investors.

The most effective forms of operations for international companies working in Turkmenistan are the production-sharing agreement and the joint operation agreement. Most production projects in Turkmenistan involving foreign investors are based on production-sharing agreements. Joint operation agreements are mostly used in service operations performed by an alliance of international and local companies. These forms of operations ensure the most favorable taxation, production, and income sharing regimes.

The development policy for the oil and gas complex is determined by the president of Turkmenistan, Saparmurat Niyazov, who is head of the Authorized Organ for the Use of Hydrocarbon Resources, of the State Agency for Caspian Sea Issues, and of the State Fund for Development of the Oil and Gas Industry and Mineral Resources.

It is the president, through his ordinances and decrees, who authorizes national companies to sign contracts with foreign partners. The Authorized Organ conducts negotiations, issues hydrocarbons exploration and production licenses, and oversees these operations.

The State Agency for Caspian Sea Issues works out and implements state programs of developing natural resources of the Turkmen sector of the Caspian Sea and conducts negotiations with companies on offshore oil projects.

The State Fund for Development of the Oil and Gas Industry and Mineral Resources accumulates financial resources that it then allocates to sectoral and national companies.

The Ministry of the Oil and Gas Industry and Mineral Resources produces long-term development plans and state programs for the industry and ensures implementation of government policies in areas related to development of deposits.

Next: Working out oil and gas export transportation issues is another challenge for Turkmenistan.