EIA: China, US lead future long-term oil demand growth

Over the next 2 decades China and the US will fuel much of the new global oil demand, a long-term analysis by the US Energy Information Administration predicts.

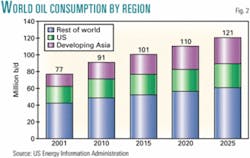

EIA projected world oil use will increase to 121 million b/d in 2025 from 77 million b/d in 2001, according to the agency's base reference case.

"Much of the increase in oil demand is expected to occur in the United States and in developing Asia," EIA said in its International Energy Outlook 2004, released Apr. 14.

The US, China, and the rest of developing Asia account for nearly 60% of the projected growth in world oil use, EIA found. Although producers from the Organization of Petroleum Exporting Countries are expected to capture the bulk of expanding markets, non-OPEC supply should remain very much in the game, EIA reported.

"The projected increment in worldwide oil use would require an increment to world productive capacity of more than 44 million b/d over current levels.

"Although OPEC producers are expected to be the major suppliers of increased production requirements, non-OPEC supply is expected to remain competitive, with major increments in supply coming from offshore resources, especially in the Caspian Basin, Latin America, and deepwater West Africa," EIA said.

Consumption, pricing patterns

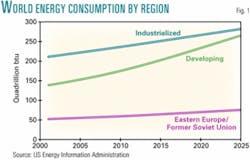

Although industrialized nations still consume more of the world's petroleum and related products compared with developing countries, the gap is projected to narrow by 2025. In 2001, developing nations consumed 64% as much oil as industrialized nations; by 2025 they are expected to consume 94% as much as their industrialized counterparts.

"Gross domestic product in developing Asia is expected to expand at an average annual rate of 5.1%, compared with 3%/year for the world as a whole. With such strong growth in GDP, demand for energy in developing Asia doubles over the forecast, accounting for 40% of the total projected increment in world energy consumption and 70% of the increment for the developing world alone," EIA said.

EIA reported that despite increasing demand, oil prices will fall after 2004 to $25/bbl (in 2002 dollars) and then rise slowly from 2006 onward to 2025, reaching $27/bbl in 2002 dollars (in nominal dollars $51/bbl).

By comparison, a recent International Energy Agency forecast expects oil import prices to be slightly lower than what EIA envisions through 2010. EIA acknowledged that its 2004 outlook contains price projections that are generally at the high end of the spectrum of price forecasts across the 2010-25 timeframe.

EIA noted that IEA did not publish a price projection of its own for 2015 or 2025 in its World Energy Outlook 2002; however, IEA does state that prices are assumed to rise in a linear fashion after 2010, to $30.03/bbl in 2030 from $21.75/bbl in 2010.

EIA noted that a "simple interpolation" of IEA data results in oil price projections of $23.82/bbl in 2015 and $29.96/bbl in 2025, a number slightly higher than what EIA itself foresees.

Shorter term, EIA agrees with some private analysts that US and global prices could temporarily soften in 2005 provided gasoline demand follows seasonal trends and inventories rise.

Natural gas demand

Meanwhile, EIA said that natural gas remains the world's fastest-growing energy source, although the agency's demand projections are lower than last year taking into account certain geophysical and economic factors.

Over 2001-25, global consumption of natural gas is projected to increase by 67% to 151 tcf by 2025. Last year, EIA predicted natural gas demand would climb to 176 tcf/year.

EIA said the change reflects "slightly lower assumptions for worldwide economic growth, a slower projected decline in the world's nuclear power generation, and concerns about the long-term ability of natural gas producers to bring sufficient resources to market at prices competitive with those of other fuels."

Worldwide natural gas use is expected to equal coal use (on a btu basis) by 2010, and by 2025 it is expected to exceed coal use by 12%.