Low polyester demand hurting feedstock margins

Currently, polyester and its feedstocks are in oversupply, according to the latest analyses of paraxylenes, terephthalates, and polyester from Chemical Market Associates Inc. (CMAI), Houston.

And while boding ill for profits or reinvestment, says the firm, those who can sustain their businesses through the challenging period ahead will likely see profits rise again once the need for polyester and its feedstocks improves.

CMAI sees 1999 as the "bottoming-out" period for the polyester market, with no substantial improvements occurring until 2000-01. Paraxylene and terephthalates markets, on the heels of polyester recovery, will overcome hard times by 2002.

Feedstock outlook

"Over the last 5 years," says CMAI, "the terephthalates and polyester chain has moved more toward a truly commodity market. Typical of a classic commodity, polyester is now experiencing the antithesis, and indeed result of, the strong margins and product shortages seen in the middle of the decade."

The excessive buildup of supply in response to positive demand growth is responsible for this weak market. Although the difficulties in 1998 were amplified by the currency crisis that began in Southeast Asia in 1997 and subsequently spread to South Korea and the rest of the world, CMAI believes weak margins this year were inevitable.

Low polyester demand caused paraxylene and terephthalate producers to suffer from poor margins in 1998, and CMAI expects that the producers will experience even lower margins before this year is over.

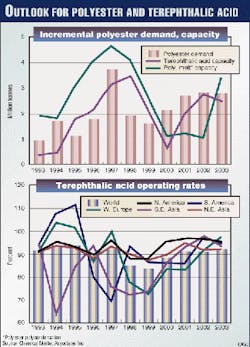

In the near-term, world terephthalate markets should show signs of tightening in North and South America and Northeast Asia. By 2002, CMAI expects all regions to experience a tight supply and even require 3.5 million tons of added capacity to meet new demand.

Polyester supply, demand

For the forecast period 1998-2003, almost 14 million tons of incremental new polyester polymer demand is anticipated, says CMAI. By 2002, new polyester polymer facilities will be required to meet derivative demand.

World polyester demand grew by about 44% during 1995-98, while, at the same time, polyester polycondensation capacity and terephthalic acid (TPA) capacity grew by a respective 55% and 70% (Fig. 1).

CMAI notes: "The Asian crisis has not affected the fact that prices were going to be near cash cost, but has added some 'salt to the wound' by extending the length of time it will take to recover."

The firm believes weak demand for end uses within the Asian countries led those producers with efficient new plants and a relatively low-cost labor force to seek export opportunities. These companies wanted to keep the plants running and service newly acquired debt.

These exports, says CMAI, have reached the booming Western Europe and the U.S. economies. The combination of pricing pressures from cheap imports and the sheer physical volume of imports has exacted its toll. While tariffs and quotas are still in place, the levels have not been particularly onerous and have done little to stem the tide of trade.

Ultimately, this margin pressure led to capacity rationalization, mergers and acquisitions, and divestitures.

"To survive, the focus of business managers has changed to one of servicing growth, to survival via cost control. Capital spending has all but dried up, with many players choosing to purchase competitors' facilities and optimize the overall system rather than build new. While the current strategies of cost control and optimization are generally always valid, they are brought into more focus by the extreme pressure on margins and profitability today," says the firm.

Future demand is certain to experience a setback, given the recession is Asia and elsewhere, predicts CMAI. In 1996, global polyester polymer growth was 10.3%, and in 1997, growth was 20.4%. In the continuing recession, forecasts for growth in world demand in 1998 and 1999 are 8.4% and 6.6%, respectively, which CMAI considers "impressive," given recovering market conditions.

Import pressures on Western Europe and North America should be eased by 2001, says CMAI, as the Asian market swings back to recovery.

CMAI said, "With some tightening returning to the market, margins in each market should begin to recover, as higher throughput and a more balanced supply-demand scenario combine to give better return on capital employed. At that point, the focus will likely once again turn to growth and reinvestment requirements."