Resurgent LNG rides wave of new projects

Energy markets, including the LNG trade, have been on a roller coaster ride in the 2 years since June 1997.1

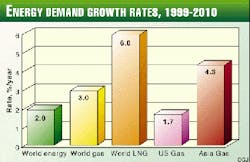

Energy demand in East Asia, which was growing at more than 5%/year, slowed significantly in 1998. Oil prices fell by about 50% but then rebounded in 1999 as East Asian economies started recovering and OPEC curtailed some production.

Some observers have suggested that LNG has reached a critical crossroad and that its future is uncertain. Yet, although some LNG cargoes were postponed in 1998 and early 1999, the LNG trade has been enjoying a significant expansion for much of 1999.

Several new supply and receiving projects are in operation, construction, or the engineering phase. The outlook for the next decade looks bright:

- The Qatar Liquefied Gas Co. (Qatargas) is operating three LNG trains under a 6 million tonnes/year (tpy) contract with Japanese buyers and has also been selling "spot" cargoes to customers in Turkey, Italy, Spain, and the US.

- Atlantic LNG Co., Trinidad, commenced operations of its 3 million tpy train earlier this year, with cargoes being delivered to Spain and the US.

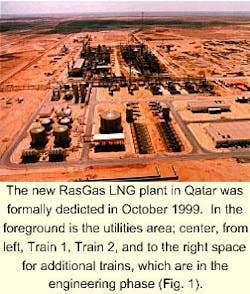

- A second LNG supply project in Qatar, the Ras Laffan Liquefied Natural Gas Co. (RasGas) has started up its first train, under a 4.8 million tpy contract with Korea Gas Corp.

RasGas has also sold five spot cargoes to a US customer and has signed a sales and purchase agreement (SPA) to supply 7.5 million tpy to India's Petronet. The company has also signed a heads of agreement for 2.6 million tpy in potential sales to India's Dakshin Bharat Energy Consortium.

Further negotiations are ongoing with other potential RasGas customers in Europe and Asia, as part of Qatar's vision of becoming one of the world's largest supplier of LNG (Fig. 1-2).

- Oman's 6.6-million tpy project will send supplies scheduled to Korea, Japan, and India. And, in October 1999, Nigeria's 5.9-million tpy project began supplying LNG to Atlantic basin and Mediterranean markets.

- Several other new expansion or grass roots projects are in the engineering or planning phases.

Healthy demand

Worldwide natural gas use continues to grow rapidly, at a rate about 50% higher than the growth rate for petroleum. It could grow faster if environmental drives are translated into economic incentives.

Combined cycle turbines, fueled by natural gas, can generate electricity at up to 60% efficiency and with very low nitrogen and sulfur-oxide emissions. Carbon dioxide emissions per kilowatt are about half that of other fossil fuels.

Natural gas is also replacing LPG for domestic and commercial applications.

The future for natural gas may look even brighter if new applications take off. The use of natural gas as a transportation fuel, while still relatively limited, can grow as fleet users switch to LNG and compressed natural gas (CNG).

One potentially exciting application may be fuel cells in which natural gas (or such natural gas derivatives as methanol) can provide the source of hydrogen fuel. Fuel cells are being considered for transportation, as well as for power generation.

LNG's growth rate in the coming decade has been projected by several studies to average 6%/year, about the same as forecast in 1997 (Fig. 3). LNG contributes about 5% of world natural gas consumption and about 25% of cross-border natural gas trade.

Future success depends upon continuation of the outstanding safety, reliability, and environmental protection records of LNG plants, ships, and receiving terminals. At the same time, LNG prices must stay competitive with pipeline gas, where available, and in most cases, with the prices of competing fuels which do not have the same environmental benefits.

Spot sales

Construction and finance of LNG and natural gas distribution infrastructure still require long-term take-or-pay contracts.

The quantity of LNG sold as "spot" is low, about 2% of total in 1998, according to major studies of the market. These "spot" and short-term sales to European and US markets amounted to about 1.8 million tpy, with Abu Dhabi and Qatar accounting for most of these sales.

The LNG spot market will not displace long-term sales, but it can increase, depending on the availability of LNG ships not committed to long-term trades.

Longer-term, the spot market will not become predominant because of limited availability of non-committed ships, terminals, and liquefaction plants, and the hurdle of financing the billions of dollars needed to increase this infrastructure.

In addition, LNG suppliers and customers have shown the ability to develop more flexible and innovative long-term or medium-term contracts. Still, large LNG suppliers who have spare capacity will be able to provide customers in Europe and the US with spot sales.

For example, Qatar's two LNG supply companies, which have signed sales and purchase agreements for more than 18 million tpy and plan more, will have more than 3 million tpy of incremental LNG available from now until 2005, due to the ramp-up schedules.

It is likely that this volume will be used to bridge to longer term sales or sold into the spot market.

Eastern, Western markets

There are two LNG markets: West of Suez, or the Atlantic basin where the LNG trade began in 1964; and East Asia.

The Atlantic basin LNG market currently includes Belgium, France, Italy, Spain, Turkey, and the US. Plans are underway to import LNG into Greece and Portugal, and possibly into Brazil, Lebanon, and Israel.

The East Asian LNG market includes Japan, South Korea, and Taiwan, soon to be followed by India and China.

Current LNG import volumes along with LNG supply projects underway or possible are shown in Tables 1-4.

Projections for 2010 are averaged from several published sources, including Cedigaz, and the US Department of Energy. Both eastern and western LNG markets are projected to double in the coming decade.

LNG from Algeria has been received at Belgium's Distrigaz LNG terminal in Zeebrugge since 1987. The amount of more than 3 million tpy is supplemented by much smaller quantities of spot sales, in some cases for other customers (such as Gaz de France and Spain's Enagas).

Although Belgium has been growing in importance as a regional gas hub-especially with the completion of the UK Interconnector gas pipeline-LNG imports are unlikely to increase significantly into northwest Europe.

France started importing LNG from Algeria in 1965, and current contracts amount to 7.5 million tpy, imported into the LNG terminals at Fos-sur-Mer and Montoir-de-Bretagne. In addition, Gaz de France (GdF) has agreed with the Italian utility, ENEL, to take 2.5 million tpy of Nigerian LNG at Montoir as part of a swap agreement.

GdF will divert 1 million tpy of Algerian LNG from Fos to the SNAM terminal at La Spezia and will also turn 2 billion cu m/year (bcm/year) of its Russian gas to Italy by way of the TAG pipeline through Austria.

The Italian gas market has more than doubled in the past 2 decades, and demand in 1998 was more than 62 bcm. It is forecast to increase again to more than 90 bcm/year in 2010. Currently, SNAM, the state-owned company, imports 95% of natural gas into Italy, but Italy is moving towards deregulation in line with European Union (EU) directives.

While most gas is and will continue to be imported through pipelines from Algeria and Russia, LNG has an important role. The SNAM terminal at Panigaglia, near La Spezia, which has been in operation since 1971, was modernized in 1992 and now has a capacity of 2.5 million tpy.

The need for additional LNG terminals, particularly in the north, has been recognized for some time. Two attempts to permit LNG terminals, at Montalto di Castro and Monfalcone, were unsuccessful due to local opposition. Therefore, new LNG supplies to ENEL had to be re-routed through France.

Recently, Mobil and Edison Gas have been cooperating on a proposed offshore terminal in the northern Adriatic.10

In Greece, the recently completed Revithoussa LNG terminal will import 0.6 million tpy of LNG from Algeria.

Spain's 1998 Hydrocarbons Law will liberalize the country's gas markets in the coming decade. The law will allow third-party access to the existing Spanish gas infrastructure, including LNG terminals, storage facilities, pipelines, and international gas connectors.

Capacities at the LNG terminals at Barcelona, Cartagena, and Huelva have been expanded, and a new terminal may be constructed in Bilbao.

Neighboring Portugal has been importing natural gas from Algeria since 1997 via Spain. And Transgas has proposed construction of an LNG terminal at Sines.

Turkish natural gas demand has been growing rapidly and is projected to keep increasing in coming years. Turkey consumed nearly 10 bcm of natural gas in 1997, or around 13% of its total energy demand. Natural gas is currently imported via pipeline from Russia, while LNG is supplied from Algeria, Qatar, and soon from Nigeria.

Turkey, which is surrounded by major gas producers, is looking to increase diversity of supply. It is a good example of how LNG can co-exist and competitively supplement pipeline gas. In addition to the existing LNG import terminal at Marmara Ereglisi, Turkey is planning to start construction of another terminal near Izmir.

In the US, the first natural gas liquefaction peak-shaving plant was constructed in the US in 1941. Chicago Union Stockyard and the Continental Oil Co. pioneered the development of LNG as a means of transporting gas in the 1950s, leading eventually to the first commercial international LNG trade between Algeria and the UK in 1964.

The first US LNG receiving terminal was designed as a peak-shaving facility by Distrigas (a subsidiary of Cabot) and started operation in Boston in 1971.

Imported LNG and synthetic natural gas (SNG) were predicted to become major sources of natural gas supply in the US in the 1970s. Three additional LNG terminals were eventually built: at Lake Charles, La., Elba Island, Ga., and Cove Point, Md. The latter two terminals have not been used, while the Lake Charles terminal has been underutilized.

The perceived natural gas shortage of 1970s turned into the "gas bubble" of the 1980s and now seems to have been mostly driven by regulation. Currently, LNG and SNG are not forecast to become major components in the supply of natural gas in North America, but LNG supplies to the US are increasing.

Gas from the Atlantic LNG project in Trinidad is making its way to Boston, spot cargoes of LNG from Qatar and other suppliers are supplementing LNG from Algeria in Lake Charles, and plans are underway to reactivate the LNG terminals in Maryland and Georgia.

A new LNG terminal, coupled to a combined cycle power plant is under construction in Puerto Rico by Enron.

Brazilian demand for natural gas has been growing at about 10% a year. Most gas imports are via pipelines from Argentina and Bolivia, but Brazil is also considering LNG import.

Petrobras and Shell formed a joint venture to develop a terminal south of Recife, with an initial capacity of 1.5 million tpy.

In the Middle East, Israel has been considering options for importing natural gas for power generation and industrial uses. These options include a pipeline from Egypt and possibly an offshore LNG terminal in the Mediterranean. The initial demand is forecast to be about 2 million tpy.

Elf is also pursuing plans to import LNG from Qatar to Lebanon.

LNG in East Asia

Asian economies seem to be recovering from the 1997-1998 crisis. LNG supplier Indonesia and major customer South Korea were among the countries most affected.

If anything, the crisis demonstrated again the robust nature of the long-term LNG trade. Despite wide fluctuations in demand and price, existing contracts were honored as both buyers and sellers exercised flexibility.

Long-term gas demand is likely to grow strongly, according to the US Energy Information Administration.2 In the shorter term, some projects were scaled back and South Korea was postponing cargoes in 1998 from Indonesia and Malaysia.

While historically the Chinese were the first to use natural gas for industrial purposes (brine production in Sichuan, with natural gas transported in bamboo pipes almost a thousand years ago), natural gas has not been a major energy source in modern China.

Gas currently accounts for only 2% of total energy use, but the government plans to triple this rate in the coming decade. Increased domestic production will be coupled with LNG imports, and as the market develops, with long-distance export pipelines.

The central government has approved plans for the first 2.5-million tpy LNG import terminal in Guangdong, in southern China, and LNG imports may commence in 2005. Plans are underway for other LNG terminals, particularly near Shanghai.

India has a large appetite for natural gas, as a clean economically competitive fuel for its growing economy. Domestic supply is insufficient to meet growing demand, and LNG import plans are underway.

The country is planning to become one of the world's largest importers of LNG. Oman LNG has signed a 1.6-million tpy supply contract to Enron's Dabhol power plant in Maharashtra. As noted earlier, Qatar's RasGas this year signed a 7.5-million tpy supply contract with India's Petronet.

This latter contract will supply 5 million tpy of LNG to the new Dahej terminal in Gujarat and 2.5 million tpy to Cochin. In addition, other Indian regions and entities are reported to have begun lobbying Petronet for new LNG facilities.

An international consortium headed by CMS Energy has won a tender for a power plant and an LNG terminal in Ennore, Tamil Nadu, and has signed a heads of agreement with RasGas for the potential supply of 2.6 million tpy of LNG.

Other LNG import schemes have also been proposed. A consortium headed by British Gas is planning an import terminal at Pipavav, and Total is planning a facility at Trombay.

Japan's domestic natural gas production contributes less than 3% to its growing demand for clean energy. All of the gas imported to Japan is currently LNG, of which Japan has long been the world's largest importer.

Despite a recent slowdown in economic growth, LNG imports in 1999 are likely to be higher than in 1998. In the next few years, as the economy picks up, demand for LNG will keep increasing again at a rapid pace.

A major feature of the Japanese natural gas distribution system is lack of an in-country comprehensive distribution grid. There are more than 20 terminals in Japan, each serving a local area, with some regional inter-connections.

Several new LNG terminals are in construction or planning stages. Smaller amounts of LNG are trucked to small satellite distribution terminals. The development of an in-country grid may give support to longer-term plans to import gas by pipeline from Sakhalin Island, Russia, or the Asian mainland.

South Korea's LNG demand in the first half of 1999 rose about 25% from the same period in 1998. Korea has been importing LNG from Indonesia (more than half) and Malaysia (about one third), and smaller volumes from Brunei and Australia.

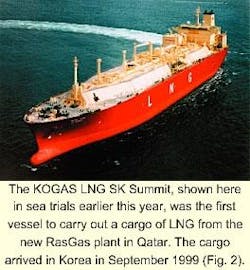

Korea Gas Corp. (KOGAS) received the country's first cargo from Qatar's RasGas in September 1999 under a 25-year contract to import 4.8 million tpy of LNG. The RasGas venture is also an example of a recent trend of further integration between suppliers and customers: KOGAS has acquired a 5% stake in RasGas.

Natural gas use in South Korea has increased by more than 80% since 1980 but still accounts for less than 10% of country's energy consumption. With the Korean economy recovering, KOGAS, which will be privatized by 2002, is continuing its ambitious expansion of the existing terminals (Pyongtaek and Inchon) and is also constructing its third LNG terminal on the Korean Peninsula's southern coast.

Pohang Iron and Steel Corporation (POSCO) has also received a government mandate to import LNG for its own use and is now constructing its own LNG terminal.

KOGAS is developing a nationwide gas grid, and there is also consideration of long-range pipelines from Siberia and Sakhalin.

Taiwan has been importing more than 3 million tpy of LNG in from Indonesia and Malaysia into China Petroleum Co.'s terminal at Yungan, in the south. The capacity of the terminal has been expanded to 4.5 million tpy and is projected to increase to 7.5 million tpy.

Total LNG consumption is projected to reach more than 13 million tpy by 2010 and the government has decided that a new terminal in the north, where most of the demand is, will also be needed.

The terminal will be anchored by an initial supply of 2 million tpy of LNG to the Tatan power plant.

LNG technology: safety, reliability lower costs

The LNG industry has achieved outstanding safety, reliability, and environmental protection records in the past 35 years. These records must be maintained if the industry is going to continue to grow and prosper.

At the same time, there are significant pressures to keep lowering LNG costs throughout the entire LNG value chain. These pressures are caused by the general worldwide trend of convergence of energy prices and continuing deregulation in Asian and European gas markets.

LNG technology has been responsive to these pressures. Natural gas production costs and liquefaction plant costs have come down significantly, in the range of 30-50% in the past decade alone. Shipping costs have also come down recently by more than 20%, as a result of the Asian crisis.

Liquefaction technology

Several commercial liquefaction technologies are in use, and new ones have been proposed.

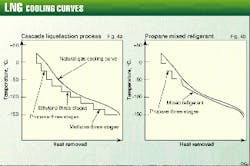

The Cascade process uses three refrigerants, typically with three stages for each, to approximate the natural gas cooling curve as closely as possible. The propane pre-cooled, mixed refrigerant (MR) process uses propane as well, then uses a mixed refrigerant in a spiral-wound heat exchanger to cool the natural gas down to -160° C. (Fig. 4).

Currently, most LNG plants use the propane pre-cooled, MR process and spiral-wound heat exchangers manufactured by Air Products and Chemicals (APCI), Allentown, Penn.

Phillips in Kenai, Alas., has used a cascade liquefaction process since 1969. A new version of the Phillips process, Optimized Cascade, was recently constructed and currently operates at the Atlantic LNG plant in Trinidad.11

A single MR process, PRICO, has also been in commercial operation in Algeria, and Black & Veatch Pritchard, Overland Park, Kan., is offering an updated version for license. Linde and Statoil, Linde and BHP (nitrogen cycle), Technip, the French Institute of Petroleum (Dual MR), and others have proposed other liquefaction technologies and equipment. Each vendor makes claims as to its efficiency and costs.

Several authors have tried to compare various liquefaction processes on a consistent basis. One recent effort compared five generic liquefaction processes: propane/MR, cascade, dual MR, single MR, and nitrogen expansion.7

The study assumed the various processes would be configured to match available power in the different types of gas turbines used. This leads to different LNG production levels and different power requirements. Still, the overall higher heating value (HHV) efficiency was within 2% for the first four, and somewhat lower for the nitrogen-expansion process.

The generic processes in the study are all within 20% of each other's capital costs. Actual costs would depend on location, gas composition, owner preferences, the project developer, and the contracting strategy.

LNG plant costs

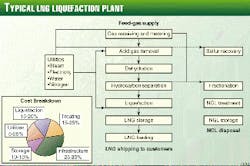

Although the liquefaction section is indeed at the center of the LNG plant, it sometimes gets too much attention. A search for opportunities to cut costs needs to look at the entire plant in approximate proportion to the real distribution of plant costs (Fig. 5). The liquefaction section typically amounts to only 15-20% of the total plant cost.

It's difficult to compare the costs of different LNG liquefaction plants on a consistent basis. In one of the more widely quoted comparisons, LNG plant costs are grouped into 5-year periods and averaged within each period.3 Each period's costs are corrected to 1996 $US (Fig. 6).

There is, however, no correction for gas composition (and hence for the equipment needed to treat the gas). Similarly, no attempt is made to correct for project scope, location specific factors, contracting environment at the time, owner's costs, and the number of trains built at the same time.

There seems to be a declining trend from about $400/tonne in the early days of LNG to an average of about $260/tonne today. (The costs for the Australian North West Shelf project seem higher, largely due to local factors, such as large domestic gas sales.)

DiNapoli and Yost estimate that reduction in LNG liquefaction costs to be 15-35% in the past 20 years.4 They do not think that these cost reductions are the result of any single technical innovation but a combination of various factors realized through the efforts of project sponsors, vendors, equipment suppliers, and EPC contractors.

Supply capacities

Current LNG supply capacity is nearing 90 million tpy. Indonesia has been the largest LNG supplier, with more than 28 million tpy capacity from P.T. Badak and P.T. Arun, followed by Algeria with more than 20 million tpy of capacity following an extensive modernization campaign.

Among newer LNG suppliers, Qatar is well on its way to becoming the world's largest supplier, having the massive North Field reserves (of more than 370 tcf of gas). Other LNG producers are Malaysia (16 million tpy), Brunei (6.5 million tpy), Abu Dhabi (5 million tpy), Australia (7.5 million tpy), Trinidad (3 million tpy) and Libya (2.5 million tpy).

Alaska has been exporting more than 1 million tpy of LNG to Japan for the past 30 years through Phillips's Kenai facility, and some would like a trans-Alaska natural gas pipeline to supply North Slope gas to a proposed new LNG export terminal in the south.

A competing proposal would convert this gas to liquids, through gas-to-liquids (GTL) technology, to be exported via the exiting Trans-Alaska Pipeline.

The two-train, 5.9 million tpy Bonny Island LNG project in Nigeria began deliveries in October 1999. Expansion plans for a third train, similar in design to the first two, were announced earlier this year, while longer-term plans for adding two larger trains are being studied.

Several planned LNG projects have been facing delays. These include Australia's Darwin II, Bayu-Undan, and the Gorgon projects, Indonesia's Tangguh project, Russia's Sakhalin projects, and Yemen's project.

Offshore LNG production

Several proposals to locate LNG production facilities offshore have been made over the years. The main driver is potentially lower cost, particularly for developing distant offshore gas reserves.

Another intriguing idea is the monetization of smaller gas reserves. Traditionally, LNG reserves of about 1 tcf/1 million tpy of LNG sales are needed to satisfy 20+ year contracts. Since an offshore LNG plant, floating or gravity based, can be moved, it may be used to develop a smaller gas reserve, limited only by gas deliverability.

Several offshore development concepts were discussed in the "New Developments" session at LNG 12 (May 1998) by authors from Mobil, JGC Corporation, Bouygues Offshore, and BHP Petroleum and Linde AG. The Mobil concept has been presented elsewhere.6

Most of the benefits of offshore LNG production come from savings in offshore infrastructure (platforms, pipelines to shore) and elimination of harbor facilities. These potential savings are site-specific.

It seems that the safety and reliability of offshore LNG production can be demonstrated successfully, and it is possible that commercial application of offshore LNG production will indeed become a reality in the 21st Century.

Some areas of the world that have been mentioned as particularly attractive for offshore LNG production are offshore Australia and West Africa.

Terminal growth

The growth in the number of LNG terminals mirrors the growth of the LNG industry as the terminals are dedicated to specific long-term trades. Traditional terminals are safe and reliable, but the challenge is to make them more cost-effective while maintaining safety and reliability.

New LNG customers often require innovative approaches to commercial structure, competitive fuel pricing, project financing, and low-cost technological solutions throughout the LNG value chain. These customers require cost-effective LNG terminals that are "fit-for-purpose," expandable, safe, and reliable.

A simplified process for the design of optimized, cost-effective LNG terminals is outlined below.5

- The design must be "fit-for-purpose": What does the customer need? How does the terminal integrate into the entire LNG value chain? What is the best design-onshore or offshore?

- Future expansion must be taken into account.

- LNG storage needs to be optimized with the entire LNG chain, and lower-cost LNG storage is needed.

- A good project execution plan will optimize costs, schedules, and ensure safety and environmental protection during construction and startup.

- If appropriate, integration with a power plant can reduce capital and operating costs and increase reliability of both the power plant and the LNG terminal.

- Occasionally, there are opportunities to use the LNG "cold" for cryogenic industries.

In some cases, offshore LNG receiving terminals can offer potential advantages over terminals ashore. Offshore terminals can offer lower risk because they are further removed from population and ship traffic near shore is reduced.

They can solve the problem of available land, which may be limited due to environmental or political concerns. Dredging and breakwater construction of a harbor for a land-based terminal can be expensive and time consuming or not permissible in environmentally sensitive areas.

Offshore terminals can also offer better earthquake protection, the same or better availability than land-based terminals, quicker construction, lower cost and can be easier to expand.

Islands can be particularly attractive as sites for LNG terminals. The recently completed Revithoussa LNG terminal in Greece is one example.

When a natural island is unavailable, a terminal can be built on an artificial island such as a gravity-base structure (GBS). The elongated shape of the GBS provides a breakwater effect when placed in correct orientation to the prevailing weather.

In some cases, it will be easier for the LNG ship to turn around in high winds, so that a GBS terminal may actually have a higher accessibility than a traditional harbor.

Since the main obstacle to a new LNG terminal in Italy seems to be land use, Mobil and Edison Gas proposed to locate an LNG terminal about 15 km offshore, in the North Adriatic Sea.10 The proposed terminal will be a concrete GBS structure 355-m in length and 55-m wide, resting on the seabed, and having a low environmental impact.

References

- "LNG Report," OGJ, June 2, 1997, p. 49.

- "East Asia: The Energy Situation," US Energy Information Administration, August 1999. (http://www.eia.doe.gov/emeu/cabs/eastasia.html)

- Avidan, A., "LNG technology in support of market development," Hydrocarbon Engineering, April 1998.

- DiNapoli, R.N., and Yost, C.C., "LNG plant costs: present and future trends," LNG 12, Perth, May 4-7, 1998.

- Avidan, A., "Cost-effective LNG Terminals -The Role of Offshore LNG Terminals," 3rd Doha Conference on Natural Gas, Mar. 15-17, 1999.

- Naklie, M.M., "Design advanced for large-scale, economic, floating LNG plant," OGJ, June 30, 1997, p. 66.

- Vink, K.J., and Nagelvoort, R. Klein, "Comparison of Baseload Liquefaction Processes," LNG 12, Perth, May 4-7, 1998.

- Festa, G., "Will deep water pipelines make natural gas competitive with LNG?", Gastech 98, Dubai, Nov. 29-Dec. 2, 1998.

- www.cosell.com/tech2.html

- Bergamaschi, P., Rosati, V., Collins, A., and LaSeur, H.S., "Offshore LNG Receiving Terminal in the Adriatic," OMC99, Ravenna, Mar. 24-26, 1999.

- Houston, M., and Redding, P., "The Atlantic LNG project - A case study," SMI Energy Conference, London. Jan. 26, 1999.

- Voigt, F.R., Silverio, S., Cochrane, D., and Reed, D., "Regionalization of Asian gas demand and supply," LNG 12, Perth, May 4-7, 1998.

The Author

Amos A. Avidan is manager of surface engineering for Mobil Technology Co., Dallas, coordinating natural gas technology, LNG, and gas-to-liquids development efforts. He has worked for Mobil for 19 years and holds a PhD in chemical engineering from the City University of New York.