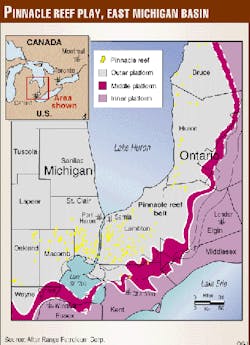

Michigan basin reefs draw focus of Ontario exploration

Silurian pinnacle reefs will be the focus of at least two exploration programs on the Canadian side of the southeastern Michigan basin.

The programs will involve 3D seismic surveys and exploratory drilling. The reefs are prospective initially for oil and gas production, and some could be used later for underground gas storage.

One operator, Range Petroleum Corp., Calgary, completed two reef wildcats as oil discoveries in late 1998 and early 1999 before entering into the two exploration programs described here.

Exploration programs

Manti Resources Inc., Corpus Christi, will spend as much as $7.25 million to earn 50% working interest in most of Range's southwestern Ontario land position.

Range has a prospect inventory of more than 340 Silurian reef prospects, of which about one third are committed to the joint venture with Manti.

Manti, as operator, will acquire 3D seismic surveys and drill wells, mainly into gas-prone Silurian pinnacle reefs at 2,000 ft. Exploration will expand to productive uphole and deeper zones as the play matures.

Manti is a private oil and gas company formed in 1989 by former Exxon drilling engineers and also has a strong exploration group. Several former Amoco Canada Petroleum Ltd. carbonate experts lead Range's geoscience department.

Meanwhile, Range is starting a large scale land acquisition program aimed at more gas-prone reef prospects. Range is already the province's largest onshore landholder with interests in more than 137,000 acres (OGJ, Aug. 9, 1999, p. 82).

Range also entered into a series of seismic option agreements in the same area with a midstream gas marketing company that has more than 5,000 customers in southwestern Ontario. Range will operate six separate 3D seismic programs, four in southwestern Ontario and two in southeastern Michigan, covering about 3,000 acres and 14 gas-prone Silurian reef prospects.

Drillsites will be selected from the seismic. The undesignated partner will earn 50% working interest in the lands by drilling to a depth sufficient to evaluate the Silurian Guelph formation. Capital spending required to earn all the lands should total $2-3 million (Canadian).

Some $2 billion of gas pipelines connecting to the Dawn marketing hub in southwestern Ontario are scheduled for completion by fall 2000, Range points out. This is expected to result in a significant increase in the requirement for natural gas storage capacity in the area.

The Silurian pinnacle reefs, assuming adequate deliverabilities and proximity to infrastructure, could fill part of this need, Range said.