Thai gas consumption set to rise sharply, back out oil

Thailand's consumption of natural gas looks set to increase and substantially back out demand for oil as an important source of fuel in the next several years, according to the Petroleum Authority of Thailand (PTT).

This year, natural gas is projected to represent 28% of the kingdom's aggregate energy demand of about 1 million boed, of which oil accounts for about 60%.

The share of natural gas in Thailand's energy mix is expected to rise to 32% in 2001, leveling off to 29% in 2004 and 24% in the year 2011; however, consumption of natural gas volumes will grow, said Anon Sirisaengtaksin, deputy president of PTT Gas, part of the Thai state-owned oil firm PTT.

Coal will play an increasingly important role in Thailand's long-term energy outlook, boosting its market share from the current level of 10% to 24% in 2011.

Gas demand growth

Rising demand for natural gas is spurred by the economic benefits of natural gas in power generation, especially for independent power producers (IPPs), and by its environmental benefits in the industrial sector, the deputy president said.

The power generation sector is still Thailand's major consumer of natural gas and represents 70-80% of total consumption. Based on the latest electricity demand forecast, the average growth rate of natural gas demand for power generation over the next 10 years is expected to be 5%/year, with a base-year demand of 1.4 bcfd in 1999. Natural gas will continue to account for about half of the energy used in power generation in the next several years.

When adding natural gas consumption by gas processing/NGL fractionation and petrochemical plants to the picture, the outlook for the total demand for natural gas will be even more significant, Anon said. From the base year of 1999, aggregate natural gas demand will increase from the level of 1.8 bcfd to 3.3 bcfd by 2011, representing an average annual growth rate of 6%.

The projected increase in natural gas consumption is also driven by PTT's promotion of the fuel in the industrial sector. The natural gas distribution monopoly has put in place a new natural gas pricing formula that Anon says enhanced its price competitiveness with other fuels. As a result, PTT expects gas demand in the industrial sector to grow even faster, at a rate of 15%/year for the next 10 years.

Aside from the attractive new price formula, PTT is also planning to expand its transmission and distribution networks, including the Bangkok gas-ring distibution grid project and the northeastern Thailand gas pipeline that will extend from Wang Noi, about 70 km north of Bangkok, to the Asean potash mine in Chaiyaphum province. PTT also plans to launch a natural gas vehicle program to spur demand.

Supplies

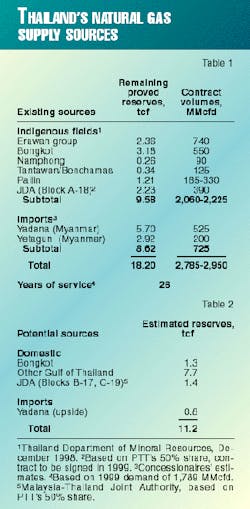

Meeting Thai demand for natural gas are quantities provided under existing supply contracts, including imported gas from Yadana and Yetagun in Myanmar's Gulf of Martaban. Anon says a need for new supply sources will become evident by 2005-06. These additional supply sources should come from either the Gulf of Thailand or from Myanmar (see tables).

As of now, existing natural gas contract volumes that PTT has secured estimated at 18 tcf, equivalent to 28 years of service based on the 1999 demand forecast.

PTT will be able to add more potential supply sources from the Gulf of Thailand, including the Malaysia-Thailand Joint Development Area (JDA), which will raise total potential supplies available to Thailand to 28 tcf (see related story, p. 37). The upside potential from Myanmar represents another supply option, with reserves pegged at 1 tcf.