UOG chief maps scope of Dolphin project

The U.A.E. Offsets Group (UOG), Abu Dhabi, is building momentum for a massive web of gas supply projects and gas-based industrial projects, focused on the southern shore of the Persian Gulf (OGJ, June 21, 1999, p. 30).

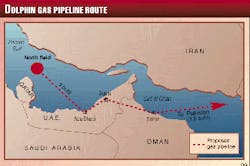

Initially, the plan is to deliver gas by pipeline from Qatar to feed a number of downstream projects in Abu Dhabi, Dubai, and northern Oman. In the longer term, the so-called Dolphin initiative could extend across South Asia.

UOG Chairman Amin Badr el Din told OGJ that the Dolphin initiative was conceived when UOG-a government-funded development body-began planning for industrial development within the U.A.E. but recognized a problem in securing long-term gas supplies from Abu Dhabi.

"Although Abu Dhabi has lots of gas reserves," said Badr el Din, "most of this is earmarked. Hence the U.A.E. gas market will outstrip indigenous supply. This same situation occurs in Dubai, Oman, and South Asia.

"The Dolphin program kicked off from the market side. UOG decided that, without a secure supply of gas feedstock, it would not invest in a number of planned petrochemicals, industrial, power, and gas reinjection schemes. But we saw that nearby Qatar has the largest, nicest, and cheapest gas available."

Project details

In March 1999, UOG secured an agreement with Qatar General Petroleum Corp. (QGPC) for the supply of gas from supergiant North field in the Persian Gulf, initially to Abu Dhabi, Dubai, and Oman but in the longer term to Pakistan.

In the latest move, UOG signed a memorandum of understanding with Mobil Oil Qatar Corp. for the supply of 300-500 MMcfd of gas as the first step in the Dolphin project (OGJ, July 5, 1999, Newsletter).

The first phase of Dolphin is expected to cost $8-10 billion over 6-7 years and will include the construction of a gas pipeline from North field to a gas processing plant in Abu Dhabi, plus an onshore pipeline to Dubai and on to Sohar (see map).

This first phase is expected to require the supply of up to 3 bcfd of gas from North field. First gas deliveries are anticipated in 2002, and a number of power plants and other projects are being lined up for development in parallel. Details of the downstream projects are yet to be confirmed.

South Asia prospects

In the longer term, UOG is looking to extend the Dolphin network into South Asia. Badr el Din said the group is looking at opportunities to invest in Pakistani power projects and has already been short-listed as a bidder for the Karachi Electricity Supply Co.

"We are also looking to invest in Pakistan`s Sui North and Sui South distribution grids," he said, "and we are looking farther afield to investment in India, where we are already in talks about upstream and downstream opportunities.

"India is part of Dolphin`s natural hinterland. There is a potentially huge market for gas in India. A whole raft of investment opportunities in the subcontinent could add value to Dolphin."

Badr el Din said the bulk of investment in Dolphin would be for downstream projects, which provide the greatest value. These would include power schemes in particular, but also petrochemical plants and heavy industrial projects, such as aluminum smelters.

He said there are a number of power plants planned throughout the Persian Gulf region and the Indian subcontinent, all of which are "anxiously waiting on somebody to open the taps," and all of which are looking for investors.

UOG will be looking to these and to other planned projects, with a view to investing as part of a mix of local and foreign venturers. The amount of equity UOG would take would vary from project to project.

"We are open to commercial negotiations," Badr el Din said. "There are no limits to how much we invest in each project. We will judge according to what investments look most competitive."