Sedco Forex Offshore to merge with Transocean

Schlumberger Ltd., Paris, has agreed to spin off its offshore contract drilling unit, Sedco Forex Offshore, in order to unite it with Transocean Offshore Inc., Houston.

The merger will create the world`s largest offshore drilling company, to be called Transocean Sedco Forex. The firm is projected to be the fourth largest oil field service company, in terms of market capitalization, behind Schlumberger, Halliburton, and Baker Hughes Inc.

The deal gives Sedco Forex new operations in the Gulf of Mexico and Norway and offers Transocean added strength in West Africa and Asia.

The transaction is expected to be tax-free and will be accounted for as a purchase, with Sedco Forex Offshore as the accounting acquirer. Under the terms of the merger agreement, Schlumberger stockholders will receive one Transocean Sedco Forex share for every five shares held. The 109 million shares to be issued are valued at an estimated $3.2 billion, based on the Transocean Offshore closing price on July 9, 1999.

Schlumberger stockholders will own 52% of the fully diluted stock in the new company, and Transocean`s will own 48%. Both companies boards have approved the deal, which the partners expect to be completed by yearend.

Victor E. Grijalva, vice-chairman of Schlumberger, will become chairman of Transocean Sedco Forex. Transocean Chairman and CEO J. Michael Talbert will be president and CEO of the new firm.

Transocean Offshore says the merger will be "modestly dilutive" to its earnings for 2000 and accretive thereafter. Talbert pointed out, however, that, while zero cost savings was the assumption used in the partners` projections, it is not their goal.

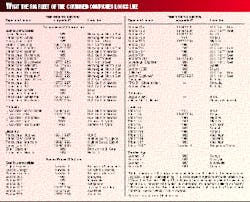

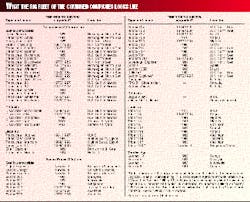

In 2000, several newbuilds will enter the firms` joint fleet (see table). Trans- ocean`s newbuilds will come on line earlier than Sedco Forex`s, which is why the merger will be slightly dilutive for Transocean in 2000. Once all newbuilds are operating, says Talbert, the transaction will be accretive for his firm.

Schlumberger Chairman and CEO Euan Baird said, "ellipseThis deal is not premised on the earnings of the year 2000, because I don`t think anybody has much idea as to exactly what that`s going to be. It is premised on the fact that, over the next 3 or 4 years, there is going to beellipsea strong recovery in the oil field industry, and the offshore sector will be one of the main beneficiaries."

The combination

"The merger of Transocean Offshore and Sedco Forex Offshore will bring together two of the most modern and versatile fleets in the offshore drilling industry and create a truly global offshore drilling company," said Transocean.

Talbert calls the new firm "a merger of equals." With 75 drilling rigs-including 7 under construction-the new company`s offshore rig fleet will include 47 semisubmersibles, 7 deepwater drillships, and 17 jack ups.

Its next largest competitor in the offshore contract drilling market would be R&B Falcon Corp. Including rigs under construction, R&B Falcon`s fleet contains 12 deepwater drillships, 12 semis, 42 jack ups, 3 submersible rigs, 3 platform rigs, and 15 drilling barges.

Although Transocean Sedco Forex will be the largest offshore drilling company, the partners do not expect the merger to raise any antitrust issues, because their share of the total offshore and floating fleets "is not that great," in the words of Talbert.

Talbert said, "The mergerellipseis advantageous due to the rising capital costs for new rig construction, the increasing size and needs of our customers, the expanding geographic diversity of offshore drilling, and the technical challenges posed by new deepwater drilling activities."

The firms expect to achieve 10-15% cost savings eventually, but none are projected in the first year due to the costs of integration. Cost savings are ultimately projected to be $25 million/year.

Baird said, "The drilling industry has, as a whole, been characterized by volatile earnings and weak balance sheets. Today, as the industry goes to deeper water and harsher conditions, with even higher investments in equipment and technology needed to meet customer requirements that now include global sourcing of services, the structure of the industry has to change." He calls this merger "the first decisive move to create industry leadership."

Baird said the merger will create benefits for Schlumberger in that it "will permit (us) to focus our resources on further extending our leadership in value-added reservoir optimization services.

"Furthermore," said Baird, "the transaction includes a provision for a global alliance between Schlumberger and Transocean Sedco Forex to address, proactively, integrated services opportunities."

Both companies are committed to forming the alliance. "It will not, and cannot, be exclusive," said Baird. "But working together, I think we can achieve quite a lot in the integrated services area."