Reserve replacement suffers as world wildcatting declines

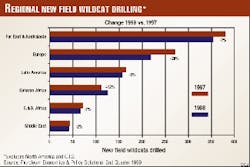

World new field wildcat drilling outside North America and the Former Soviet Union declined in 1998 in all areas except North Africa.

NFW drilling in Saharan Africa last year was up 12% from 1997, IHS Energy Group`s World Petroleum Trends 1999 report concluded.

The rest of the world covered by the report showed declines ranging from 2% in the Middle East to 20% in Europe.

North America, which accounts for 60% of worldwide NFW drilling, experienced a 24% drop in 1998 vs. 1997.

The report summarizes 1989-98 reserves, exploration performance and activity, licensing, production, and hydrocarbon balance for more than 150 countries.

Wildcatting, success rates

Within the Saharan Africa regional figure, Algeria and Tunisia experienced significant increases in NFW drilling. Libya and Egypt showed marginal decreases.

Europe`s wildcatting was down 20% overall. The U.K. suffered more than others, with a 25% decrease. With only 55 NFW drilled in 1998, the level of exploration in the U.K. was only a third that of 1990.

The success rate of global exploratory drilling excluding North America also fell markedly in 1998 to 29% from 38% in 1997. Only 300 new field oil and/or gas discoveries were made in 1998, down nearly 30% from the previous year.

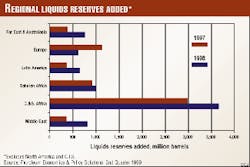

Liquids reserve additions

More than 50 countries had discoveries, but the volumes found exceeded 100 million bbl of oil equivalent in only 21 countries.

The global addition of 7.6 billion bbl of oil in 1998 excluding North America represented only 34% of the 22.3 billion bbl of oil that was produced during the year, thus maintaining the trend of failing to replace reserves produced that has continued since 1986.

In the past 5 years, only 38% of global oil production excluding North America has been replaced by new discoveries-a cumulative shortfall of more than 50 billion bbl.

No country among the top 10 non-OPEC oil producers outside North America and Russia replaced its 1998 production with liquids reserves from new discoveries. During 1994-98, Brazil is the only country to have accomplished this.

Brazil`s 1994-98 replacement ratio is 298%. Next were Colombia with 79% and China with 54%.

West Africa predominated in 1998 and 1997 in terms of new liquids reserves added. Angola retained its 1997 place as the country with the largest increase in oil reserves added through new discoveries with 2.3 billion bbl added in 1998. Nigeria at 1.2 billion bbl was second in the global table.

IHS figures show that with cumulative production of 540 billion bbl and remaining reserves of 356 billion bbl at yearend 1998, the known reserves of the non-OPEC countries are 60% depleted. This contrasts with cumulative production from OPEC countries of 341 billion bbl and remaining reserves of 648 billion bbl, representing a depletion status of 34.5%.

Gas reserve additions

Global gas reserve additions exclusive of North America ran at 40.5 tcf, or 67% of the gas produced in 1998.

During 1992-98, 1997 is the only year in which gas reserves additions exceeded production.

Of the top 10 gas producers outside Russia and North America, only Saudi Arabia managed to replace 1998 production with reserves from new discoveries.

Outside the top 10 producers, China, Trinidad, Pakistan, Egypt, Algeria, and Bangladesh discovered significantly more gas than they produced during the year.

The largest gas discoveries occurred in China with a combined 7.6 tcf, Pakistan 4.2 tcf, and Saudi Arabia 3.4 tcf.

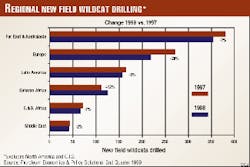

The number of NFW needed by the top 10 "exploration performers" to add new reserves in 1998 varied considerably, however. Similarly, the resources added by the 10 most intensely explored countries also varied (Fig. 3).

Global gas reserves remain abundant, but it is interesting to note that OPEC countries are building up a strong position there, too. That applies especially to Iran, Qatar, and Saudi Arabia. OPEC countries account for 43% of the world`s gas reserves (and Russia for a further 27%) but only 16% of global production.

The known gas reserves of non-OPEC countries are 41.3% depleted, while those of OPEC countries are only 11.7% depleted.

Outlook for 1999

A few countries enjoyed success with the drill bit in 1998, but the returns to many of the most prolific explorers were minimal in terms of reserves added.

Such results, coupled with the low oil price in the first half of 1999, are likely to result in an even more dramatic reduction in wildcat drilling this year than experienced in 1998. Early estimates of exploration drilling in the first half of 1999 suggest between 20% and 50% decreases in most countries on the same period last year, the report concluded.

Despite the trend in the countries with the highest exploration drilling rates toward discovering smaller and smaller reserves per well (Fig. 2), several of these countries remain the most popular with companies seeking new E&P licenses.

"The wide spread of interest in different types of acreage suggests that, despite the focus of the majors on fishing for elephants in ultradeep water, many smaller companies are establishing alternative niches in which they can compete by developing much smaller reserves at low cost.

"Political changes at domestic or international level have resulted in increased interest in Brazil, Libya, and Iran, and companies will continue to monitor Iraq, Mexico, and even Saudi Arabia in anticipation of future opportunities in these countries," the report said.