U.S. Fuels Mix to Change in the Next 2 Decades

The profile of the U.S. transportation-fuels industry is set to undergo dramatic change in the next 2 decades.

An analysis of fuel demand, technology, and regulations generates three future fuel scenarios: a base case using today`s conventional fuels or fuels infrastructure, a mandated case based on government-imposed fuels, and an economic-conversion case using future advances in technology that make unconventional fuels competitive.

Although conventional fuels are expected to remain a dominant player at the beginning of the 21st century, different fuel standards and different technologies will represent growing portions of transport requirements.

Fuel demand

For decades, the large, mature U.S. transportation fuel market dominated global petroleum supply and acted as a benchmark for industry standards elsewhere.

Population growth and continued economic expansion produce an ever-increasing demand for road transportation against the background of restricted atmospheric emissions from both state and federal regulation and international political pressure.

U.S. road transportation is characterized by three main modes: private passenger vehicles (cars), public passenger vehicles (buses), and commercial vehicles (light-duty and heavy-duty trucks).

By far, passenger vehicles make up the largest sector with respect to both number of vehicles and fuel consumption. U.S. passenger vehicles are, for the most part, fueled by gasoline in conventional combustion engines. They consume about 8.5 million b/d of gasoline, or 12% of global petroleum demand.

Diesel combustion represents the next largest component of the transportation fuels. About 2.2 million b/d of diesel are consumed in the road-transportation market. Only a very small portion of road transportation, well under 5%, is fueled by other products, such as LPG and CNG.

While the underlying volume of the market is large, domestic production-capacity constraints already exist. The crux of the expected changes lies with the mix of fuels and vehicle technology. To determine how the mix will evolve over the next 20 years, the possibilities and alternatives must first be identified.

Future-fuel options

Global abundance of fossil fuel energy sources, such as crude oil and natural gas, are generally considered to be sufficient to provide the bulk of raw energy supply for transportation (both in the U.S. and overseas) during the forecast period. Accordingly, the focus is likely to remain on using existing fuels-production technology from these sources, as far as possible.

Development efforts will center around alternate conversion methods to produce the fuels that will be required by new vehicle technology. Consequently, fuel-production methods that need to be included in the supply options for the next 2 decades consist of

- Reforming of natural gas

- Gas-to-liquids (GTL) conversion using Fischer-Tropsch and catalysis-based technology

- Gas processing

- Crude oil refining.

While biomass fuels currently represent only a minimal part of the mix, they are renewable energy alternatives that will continue to be developed further and production volumes increased. Accordingly, ethanol production from corn and biodiesel plant technology also must be considered as lesser contributors to the overall fuel production scheme.

With the fuel-production options in mind, propulsion technology requirements (such as combustion engines and fuel cells) set the fuel types that will power road transportation during the forecast horizon. Eight existing and potential fuel streams will subsequently represent the fuel mix: hydrogen, methanol, compressed or liquid natural gas (CNG/LNG), liquid petroleum gas (LPG), gasoline, ethanol, biodiesel, and diesel.

Quantum improvement efforts are focused on low, ultra-low, and zero-emission vehicle technology outside the bounds of current fuels supply.

Two main sources of energy are at the forefront of consideration for mainstream future transportation: abundant, low-cost natural gas and on-board fuel-cells for electric-power generation.

There are several alternatives for integrating these two elements into the overall fuels supply and transportation industry. These alternatives carry various technological barriers and economic hurdles but contribute to the projection of the road transportation fuels mix to 2020.

Supply options

Supply options can be broken down into four stages to fuel a vehicle:

- Raw energy source

- Fuel-production method

- Distribution infrastructure

- Propulsion technology.

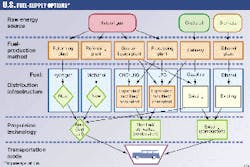

Fig. 1 illustrates the model of fuel supply options for private passenger vehicles (cars). The routes for each fuel stream are presented in a flow diagram which shows the elements and their status, applicable for each of the four stages.

Supply options for the eight notable fuel streams can be broken into these four stages. Each stage contains various elements, some individual to a particular fuel and some common to several fuels (such as refining or GTL conversion), that will be part of the overall fuel-supply industry.

Key to the potential of each supply route, in terms of both logistics and cost, is the status of the alternate elements of each stage with respect to development of the technology and infrastructure. Consequently, the elements can be categorized under one of the following:

- Existing-Systems/technology are already in existence and are fully functional.

- Expanded/modified/converted-Systems/technology exist but require expansion or modification.

- New-Systems/technology are either under development or require development.

Existing supply routes

The main existing fuel stream is, of course, gasoline.

Capacity limitations in the domestic U.S. refining industry, and growing dependence on incremental foreign supplies, raise two major issues for gasoline: volume availability and quality.

Removing sulfur from gasoline and lowering olefins and aromatics content are the main hurdles that conventional refining must overcome to continue its dominance over fuel supply. Ultimate engine emissions standards are likely to require the equivalent of a sulfur free, or less than 10 ppm(wt), gasoline with combined olefins and aromatics content below 20 vol %. In short, a heavily hydrogenated, ultra-sweet gasoline, characterized by isoparaffinic/naphthenic composition, can be expected as the standard.

A much lesser, but also fully established fuel stream is ethanol, which currently combines with gasoline upstream of the consumer.

Conversion route

Modifying the existing vehicle fleet to expand the use of LPG and CNG presents an alternative route that has considerable viability, especially for urban areas where distribution infrastructure can readily be implemented. The volume replacement of the conventional car fuel (gasoline), however, would be limited as a result of the limits on available supplies in the medium term and lead time on infrastructure expansion.

However, emissions improvements due to the clean nature of these fuels, ready production increases, and existing technology keep this alternative firmly in contention.

New supply options

Potential new supply routes encompass two different approaches.

The first approach uses new fuel streams (hydrogen, methanol) in new distribution infrastructure and vehicle propulsion technology (fuel cells) but from existing production technology (reforming of natural gas).

The second provides a cleaner version of an existing fuel stream (gasoline) with existing distribution systems and vehicle technology (combustion engines) but from a new production method (GTL conversion).

In either case, significant investment is required, not just in volume capacity but in the technology itself. The net result is, however, emissions reductions on a large scale and fuels sourced from natural gas, not crude oil.

Handling and storage of hydrogen, while ideally suited to the fuel cell, for on-board use presents many obstacles. From an initial standpoint, methanol is the preferred fuel route. Natural gas and LPG are also potential fuels for fuel cells but are less suitable.

Another new element for vehicle propulsion considers the gasoline fuel cell, for which the attraction is existing delivery systems. This option has the burden of on-board conversion-technology development and an extremely high quality requirement.

A similar diagram to Fig. 1 can be constructed for public passenger vehicles (buses) and commercial vehicles (trucks) whereby diesel and biodiesel fuel streams represent fuel flows similar to that for gasoline, alongside CNG/LNG and LPG.

Just as for gasoline, existing infrastructure and production capability for diesel by refining crude oil represents the main fuel supply route. Improving quality will be the main issue surrounding diesel fuel from this source. Specifically, removal of sulfur (an eventual specification of 50 ppm(wt) or less is already mooted for urban areas), lowering of aromatic content, and raising ignition performance (a minimum cetane number of 55 is likely) will need to take place at the fuel production method stage (refining).

Expansion of CNG use by buses and trucks, even extension into LNG use for greater vehicle range, is the most promising lower-cost option. Existing vehicles would require modification while a major expansion of distribution facilities would be needed. Massive emissions improvements are attainable through this route, for which buses and light-duty trucks are most suited.

A potential new fuel supply option is for diesel from GTL conversion. This route would provide high quality (low or no sulfur and high cetane) fuel but for which production capacity would have to be established, and further technology development is needed.

Additionally, a new option is the hydrogen/fuel cell technology route (currently under trial in Europe) for buses in particular, which requires production capacity and infrastructure development.

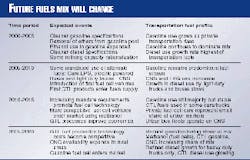

For each of the fuel streams under consideration, key comparative factors act as determinants in the conceptual matrix that can describe U.S. transportation fuel supply in the future. Table 1 presents the pros and cons of each fuel stream under consideration, setting the stage for the alternatives that are likely to be favored in the coming 20 years.

Alternative scenarios

Typically, economics drive the ultimate long-term outcome of fuel choices. However, environmental requirements and politics governing use of resources are expected to sway transportation fuel supply in the direction of alternate technology.

Determination of the course for the future to 2020 is based on the feasibility of known alternate fuels sources. Basically, three scenarios arise from the fuel comparison. Each one represents change to differing orders of magnitude:

- The base case using conventional refined products

- The mandated case

- The economic conversion case.

Base case

Given the sheer size of the road transportation sector in the U.S., a base case assuming continued use of predominantly conventional refined products is the first and most likely scenario.

The main concern with this scenario is the quality issue, with regard to providing "cleaner" fuels that perform to higher environmental standards in existing or modified combustion engines. The added cost component for this requirement is anticipated to be included in the refining step.

However, a new option, and one that would conceivably represent a key source of incremental fuel supply, can contribute in this scenario; namely, GTL conversion to provide high quality, clean gasoline and diesel.

Mandated case

Political and environmental pressure to reduce vehicle emissions grows in the mandated case. The use of natural gas and gas liquids-powered cars, buses, and light-duty trucks is expanded beyond just government vehicle fleets. Conversion incentives are offered (primarily through fuel tax structures) concurrently, or closely following, the introduction of the first generation of fuel-cell powered vehicles.

Conventional refined products will continue to represent the lion`s share of the market. However, quality standards for the mandated fuels are expected to be so high that production volumes of conventional fuels are limited. Demand for the mandated fuel supply will grow and occupy the incremental growth share of the market as well.

Problematic here is that the mandate climate will force an artificial cost structure over an underlying open market. While designed to provide incentive and accelerate technology development, a supply option that is not competitive, even inefficient, depresses the overall market.

In the long term, the mandate could prove difficult to keep in place while the technology remains behind the economics of alternative routes.

Economic-conversion case

In the economic-conversion scenario, technology developments in propulsion technology and fuel production methods attain the breakthroughs necessary for a competitive fuel supply with conventional, existing, or modified supply routes.

A realistic case exists for this to eventuate, to some degree at least, during the 20-year forecast period under review; especially in light of the pace of existing technology change, and cooperative research efforts being established by traditional foes: auto and oil. Of prime focus here is reducing the cost-per-volume basis for production of GTL gasoline and diesel and lowering the production cost of fuel cell-powered vehicles.

Current methanol capacity is in excess and likely to be forced into large-scale rationalization. As (methyl tertiary butyl ether) MTBE is likely to be removed as an additive for the U.S. gasoline pool, this route for methanol use will be gone. An economically viable methanol-powered, fuel-cell vehicle, however, could present a new outlet for methanol production, return mothballed capacity to operation, and initiate new capacity construction.

This scenario presents the opportunity for the most drastic alteration to the fuel mix. Once fuel-cell vehicle and natural gas conversion technologies are competitive with combustion engine-powered vehicles and crude oil refining, these supply options will supplant the current dominant giants of transportation-fuel supply.

Plan for cleaner fuels

Transportation-fuels suppliers can be certain that the U.S. fuel mix will experience substantive change over the next 2 decades. What can be expected has its origins in what is currently known and the technology currently under development. The conceptual definition of the changing fuel profile will probably be a hybrid of the alternatives suggested in Table 2.

The distribution stage will benefit in any event. Existing fuels supply (gasoline, diesel) delivery systems will expand, and more natural gas and gas liquids delivery infrastructure will also be needed. New distribution systems to handle different fuels (that is, methanol, even hydrogen) will ultimately require development.

While conventional fuels and crude oil refining are expected to be around throughout the forecast horizon, contingency for an appreciable change by the later stages of this period would only be prudent for industry participants. Maintaining flexibility will be of paramount importance.

While the quantitative "how much," "what," and "when" remain unknown, even the conservative strategic planner should be considering the emerging long-term image for transportation fuels in the U.S.: a new type of vehicle powered by cleaner, natural gas-sourced fuels. n

The Author

Louella E. Bensabat is vice-president, market analysis, for Bonner & Moore Associates Inc. in Houston. She provides ongoing supply, demand, and price forecasts for petroleum and has conducted numerous strategic assessments of oil industry opportunities for companies and government agencies.

Prior to joining Bonner & Moore, Bensabat was a consultant with Wright Killen & Co., Houston, where she worked extensively with the reformulated fuels program in the U.S. and downstream petroleum projects in Asia.

Bensabat holds a bachelors degree in chemical engineering from the University of Melbourne, Australia. She is also a member of the Institution of Chemical Engineers in the U.K.

Georgetown University develops first commercially viable fuel-cell bus

The fuel-cell system sits on a NovaBus RTS platform in the back of the 40-ft bus. The electric motor is in front of the rear axle. An electronics bay located forward of the fuel-cell compartment resulted in three less seats, 40 rather than 43 (Photo courtesy of IFC; Fig. 1).

GEORGETOWN UNIVERSITY (GU) introduced the first commercially viable, liquid-fueled, fuel-cell vehicle in May 1998.

This 40-ft electric bus, fueled by methanol, uses a 100 kw phosphoric acid fuel cell (PAFC) manufactured by International Fuel Cells LLC (IFC), South Windsor, Conn.

The project is being funded by the Federal Transit Administration (FTA).

The design of the 40-ft bus was largely based on operational tests of three 30-ft buses, which were part of a former GU research program. In 1994, GU developed three 30-ft, "proof-of-concept," fuel cell-powered test bed buses with 50-kw PAFC systems to verify that a fuel cell operating on liquid fuel could power a commercial 40-ft bus.

Table 1 (at right)lists general specifications of the 40-ft bus. Fig. 1 shows the fuel-cell system in the back of the bus.

Bus design

GU chose the PAFC technology because IFC had proven PAFC application in more than 150 stationary-power applications. For the 40-ft bus, IFC produced a 100 kw PAFC power system, which weighed 4,000 lb, to fit into the rear engine compartment of a standard transit bus.

According to Jim Larkins, program manager of advanced vehicle development for Georgetown University, the life of the new fuel cell is expected to be 25,000 hr, which is 5 years of transit bus operation.

The fuel cell is capable of producing 102 kw of net power and achieving power transients of 20 kw/sec. Thus, the cell can respond from idle to full output within 5 sec.

Overall electrical efficiency is greater than 41% at rated power.

The bus is actually a hybrid-electric vehicle because it incorporates a traction battery. The battery allows for acceptable acceleration, provides surge power, and recaptures kinetic energy from the bus through regenerative braking.

The battery is unacceptably heavy, however, as a result of the high voltage required by the electric power and propulsion system. Smaller and lighter proton exchange membrane fuel cell (Pemfc) systems should eliminate the need for these batteries because more fuel-cell power can be packaged aboard the transit-bus platform.

Water recovery will also be a thermal challenge for nonhybrid operations, said Larkins. Today, product water is mixed with methanol in the reformer to maximize hydrogen production. On the 40-ft PAFC bus, over 50% of the roof-mounted radiators are dedicated to condensing water from the fuel cell, which is used in the reformer.

For a nonhybrid operation, additional radiators will be needed to condense more water as well as to cool the motor, power electronics, and fuel cell. Lack of room on the existing roof will require fuel-cell bus designs to have more-efficient radiator designs or employ innovative cooling techniques.

Test results

GU tests on the 30-ft buses include dynamic emission testing by West Virginia University, route operation in the Washington D.C. area, and fuel-efficiency monitoring.

Table 2 shows the results of these emissions tests with those for the new 40-ft bus. The table also compares the emissions from fuel cells with buses powered by internal combustion engines.

The CO and HC emissions for the 30-ft bus (94 Fuji fuel cell) were higher than anticipated because incomplete combustion occurred when neat methanol was combusted to augment the tailgas hydrogen used to maintain reformer temperature. This design was not employed in the 40-ft bus (98 IFC fuel cell), which allowed for much lower emissions.

GU intends to repeat the tests for the 40-ft bus in an emission facility this summer.

The fuel cell is quiet, clean, and more efficient than internal combustion engines. Based on the performance of stationary plants, GU expects that these cell should also require less maintenance.

Future

Because of the advantages of Pemfc technology, the original FTA grant has been modified to develop a Pemfc vehicle.

A second transit-bus Pemfc system has been developed by DBB Fuel Cell Engines Corp., Poway, Calif., a joint venture of DaimlerChrysler AG, Ballard Power Systems Inc., and Ford Motor Co.

DBB developed a 100 kw Pemfc operating on liquid methanol, based on technology already demonstrated in the Daimler-Benz A-Class Necar 3 fuel cell automobile. Testing on this unit began in August 1998. The fuel cell has been acceptance tested, and the bus is expected to be complete in late 1999.

"Pemfc has the promise of being a robust, lightweight, cost-effective automobile power plant with operational advantages," said Larkins. "However, the Pemfc still must demonstrate reliable, long-term operation on liquid fuel to satisfy the transit-bus market."

Larkins believes fuel-cell transit buses should go into commercial use in the largest U.S. cities, especially those that experience the highest levels of smog, within the next 5 years.