Iran to build world-scale, flexible-feed olefins unit

Iran's National Petrochemical Co. (NPC) is adding a new world-scale olefins plant and derivatives units at its massive Bandar Imam petrochemical complex.

The project is in the basic-engineering stage and slated for start-up in mid-2002.

The basic olefins unit was designed by Germany's Linde AG. It will employ seven Linde-designed furnaces-five of one type and two of another-and will crack as many as nine different feedstocks from various sources in the Bandar Imam area.

The project is part of a major, multiyear expansion NPC is undertaking (OGJ, May 24, 1999, p. 41). The new olefins and derivatives complex will be operated under the name Amir Kabir Petrochemical Co.

Details of this project, which NPC calls its sixth and seventh olefins units, were revealed at the first Iran Petrochemical Forum, held in Tehran in April (OGJ, Apr. 26, 1999, p. 31).

Background

Aldo Belloni, managing director of Linde's process engineering and contracting division, described the events that led up to Linde winning the design contract for NPC Olefin Plant Nos. 6 and 7.

In early 1996, said Belloni, NPC and Linde negotiated a contract for engineering and construction of a 200,000 metric ton/year ethane cracker, which was to be NPC's sixth olefins unit. The following April, NPC decided to merge its sixth and seventh olefins plants into a single 520,000 ton/year unit.

This new plant would combine the planned ethane cracker with a liquid-feeds cracker that Belloni says was a challenge for all qualified bidders. But the combination of a liquids and a gas cracker would increase the plant's size and allow NPC to take advantage of economies of scale.

"NPC had also decided that an Iranian engineering contractor would be the main contractor, with a foreign engineering company as a nominated subcontractor," said Belloni.

NPC chose Linde and Iran's Energy Industries Engineering & Design Co. (EIED), which he calls "highly reputable." Linde was to perform basic engineering, procurement of foreign equipment and materials, and some assistance services.

In March 1998, after a competitive international bidding process, a group comprising EIED, Linde, and Iranian firm Petrochemical Industries Development Management Co. signed two contracts with NPC. One covered process licensing, basic engineering, and assistance services; the other, supply of all non-Iranian equipment and materials.

Feedstocks, products

The new olefins plant will be built next to Bandar Imam Petrochemical Co.'s (BIPC) complex; with 4.14 million tons/year of total production, it is Iran's largest.

The Nos. 6 and 7 olefins plant has design capacities of 520,000 tons/year of ethylene, 154,000 tons/year of propylene, 134,000 tons/year of pyrolysis gasoline, 104,000 tons/year of mixed C4s (from which butadiene will be recovered), and 23,000 tons/year of fuel oil.

The plant's feedstock mixture will comprise 35% aromatics raffinate, 30% light ends, 20% ethane, 10% C4 cut, 3% LPG, and 2% C5 cut. The ethane and C4 cut will come from BIPC's NGL fractionation units.

What NPC calls "Raffinate 1" will come from the existing BIPC aromatics complex. Raffinate 2, LPG, C5 cut, and light ends will come from NPC's planned Aromatics 3 complex to be built at Bandar Imam and operated by Abu Ali Sina Petrochemical Co.

In turn, this third aromatics complex-expected to start up at about the same time as the Amir Kabir plant-will use pyrolysis gasoline from the sixth and seventh olefins unit as feed.

Although the two aromatics raffinates will come from different sources, they will be similar in composition, according to Linde official Heinz Zimmermann.

The fact that Olefins 6 and 7 will link several upstream and downstream plants indicates the importance of olefins in Iran's rapidly developing petrochemical industry.

The olefins plant will be part of the larger Amir Kabir complex, which will include a 140,000 ton/year high-density polyethylene (HDPE) plant, a 208,000 ton/year linear low-density polyethylene (Lldpe) plant, a 160,000 ton/year polypropylene (PP) plant, and a 268,000 ton/year ethylene glycol (EG) plant (Fig. 1). EG will be produced by reacting ethylene oxide (EO) with water.

Other by-products will include 53,000 tons/year of 1,3-butadiene and 20,000 tons/year of 1-butene. NPC says it is considering converting the butadiene to produce polybutadiene rubber of styrene butadiene rubber.

Technology licensers for the key derivatives units are: HDPE, Hoechst AG; Lldpe, BP Amoco plc; polypropylene, Montell Polyolefins Co. NV; and butene-1, Institut Fran?ais du P?trole.

On average, about 66% of the plant's output will be allocated to domestic markets, says NPC, with the rest being exported.

Belloni put the Amir Kabir Petrochemical Co. olefins complex into perspective: "The new ethylene plant for the Bandar Iman complex will be the backbone of this petrochemical site, upgrading low-value feedstocks into monomers and by-products. These products are upgraded further to polymers and other high-value products such as ethylene glycol."

Design criteria

The ethylene plant is designed for wide feedstock flexibility, which allows the operator to select from different feedstock sources and thus minimize feedstock costs.

"The plant is a unique combination of a gas cracker and a liquids cracker," said Belloni, "with one third of the ethylene produced from ethane. The ethane feedstock has to be processed in an MEA [monoethanolamine] wash unit in order to remove CO2 before entering the cracking section of the plant."

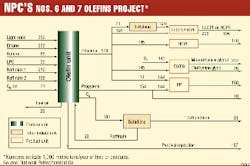

All other feeds are sent directly to the cracking section, he says, which consists of furnaces with designs tailored for the separate cracking of liquid and gaseous feeds. These furnaces have several interconnections, as shown in Fig. 2.

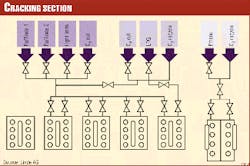

The cracking section will employ five of Linde's proprietary Pyrocrack 1-1 furnaces. During normal operation, four of these furnaces will process liquid feedstocks, with one Pyrocrack 1-1 furnace in standby mode. It will operate during furnace decoking or in case of scheduled or unscheduled maintenance shutdown.

The gas cracking will be done in two dedicated furnaces of the Pyrocrack 2-2 type.

As can be seen in Fig. 3, the designs of the furnace types are quite different. They employ different cracking coils and are customized for their respective applications. The liquids furnaces are twin radiant-cell furnaces, whereas the ethane furnaces are single radiant-cell furnaces.

"The technology applied here represents the most advanced technology [available]," said Belloni. "[It] offers the advantage of high selectivities and high run length, as well as maximum availability.... This is an important feature, since the furnace section represents the backbone of the cracker and sets the basis for the economics of the plant."

The cracked gas will be immediately quenched in parallel, transfer-line heat exchangers. This will arrest the free-radical reactions and recover waste heat for steam generation.

The indirectly quenched cracked gas will flow to a direct water-quenched tower, where dilution steam and heavy gasoline will be condensed.

The water-washed gas will be compressed to 37 bar in five stages, cooled to 13° C., and dehydrated with molecular sieves. Between the fourth and the fifth stage of the cracked gas compressor, the gas is caustic washed.

The recovery system, as shown in Fig. 4, is based on Linde's front-end de-ethanizer process, with front-end hydrogenation followed by a demethanizer and a heat-pumped C2 splitter. After C2 splitting, the unreacted ethane will be recycled.

Special features of this scheme are the simplicity of the process and a sequence that allows low reboiler temperatures, thus minimizing fouling in the plant, according to Belloni.

In addition, several measures will be implemented to reduce fouling rates further in different sections of the plant. These features add to the system's high on-stream factor and availability.

A key feature of the separation scheme is its high energy efficiency, Belloni added.

A view of the plant model is shown in Fig. 5.

"This plot has been optimized with respect to accessibility and total investment costs," said Belloni. "Furthermore, the plant can be easily expanded in a later stage."

Utilities

Because the Amir Kabir Petrochemical Co. olefins complex will be built in Iran's petrochemical special economic zone at Bandar Imam, it will be connected to an external utilities center for the area. This center will provide at low-cost: cooling water, demineralized water, electric power, nitrogen, plant air, and swing steam supplies.

The plant's utility requirements are as follows:

- Cooling water, 322 million cu m/year

- Process water 300,000 cu m/year

- Steam, 22,000 tons/year

- Electricity, 421 million kw-hr/year

- Natural gas, 25 million cu m/year

- Inert gas, 16 million cu m/year

- Demineralized water, 80,000 cu m/year

- Plant air, 13.2 million cu m/year.

Much of the olefins plant's steam requirements will be generated internally.

"The energy system is based on a reliable four-header steam system that integrates all drivers of major compressors and pumps," said Belloni. "This system is supplied by a large quantity of super-high-pressure [SHP] steam that is produced in the cracking furnaces and fulfills most of the plant's demand."

Only a small amount of steam-"a few tons per hour," according to Belloni-will be imported from the Bandar Imam utility center to balance the system.

Steam will be available at the following pressure levels: 115 bar, 40 bar, 16 bar, and 6 bar. For plant start-up, about 130 tons/hr of high-pressure steam will be imported.

Process cooling will be performed entirely with cooling water obtained from, and returned to, outside battery limits. No air cooling will be used in the plant.

Imported demineralized water will be treated in an inside-battery-limits polisher to meet the high water quality demanded by the SHP steam generation system in the transfer-line exchangers of the cracking furnaces.

The energy consumption of the plant will be very low, says Belloni, as a result of the use of high-efficiency furnaces and the energy-efficient process sequence.

"The Bandar Iman olefins plant is absolutely competitive, with respect to specific energy consumption," said Belloni. "Since two thirds of the ethylene is produced from naphtha and one third from ethane, the energy consumption has to be between [that of the two feeds]."

A highly efficient naphtha cracker consumes 5,800 kcal/kg of product, he says, vs. 3,900 kcal/kg for a modern ethane cracker. Using a weighted-average calculation, the energy consumption of the Bandar Imam unit would be 5,100 kcal/kg.

Project issues

The project schedule for the Amir Kabir olefins plant is shown in Fig. 6.

"An important issue in this project is the division of work...," said Belloni. "Linde will be responsible for process design, the basic engineering package, and imported equipment and materials, whereas EIED is responsible for detailed engineering and supply of Iranian equipment and materials."

Construction will be performed by an Iranian contractor, to be chosen by NPC. Commissioning and start-up supervision will be carried out by Linde.

"A challenge for the construction is the poor soil condition, which requires special measures, such as piling," said Belloni.

The Bandar Imam location offers a number of advantages to the Amir Kabir Petrochemical Co. complex. Integration with other petrochemical units in the BIPC complex will add value to them, and to the Amir Kabir plant's products. And, because the plant will be built in Bandar Imam's petrochemical special economic zone, an existing and extensive infrastructure in the area will reduce project costs.

In addition to ready utility supplies, the plant will have access to the port of Bandar Imam Khomeini, Iran's largest.

Economics

NPC estimates the total capital cost of the Nos. 6 and 7 olefins plant at $1.074 billion.

Comparing this project with similar ones gives an idea about its feasibility, says Belloni.

"With respect to scale, the plant is on the low end of what is considered world-scale for ethylene plants. At present, plants in execution in the Middle East are in the range of 600,000 tons/year of ethylene capacity, and all (are) based on ethane or ethane-propane feedstock. The plants take advantage of economies of scale and have a minimum amount of parallel equipment."

With 520,000 tons/year of ethylene capacity and 154,000 tons/year of propylene capacity, NPC's Nos. 6 and 7 olefins plant is similar in size to other plants being built in the region. "But, compared with the ethane crackers of [Saudi Basic Industries Corp. subsidiaries] Sadaf, Petrokemya, [and] Kemya, and [the Abu Dhabi National Oil Co.-Borealis AS joint venture] Borouge, the Bandar Iman plant has got the additional sections of a liquids cracker, which are relatively small," said Belloni.

"This includes C3 processing and separation, C4 processing, and pyrolysis gasoline processing sections, as well as primary fractionation, which a gas cracker typically does not have. This additional equipment increases the investment cost for the cracker, compared to competitive crackers in the area."

NPC projects that about 64% of the engineering work, 30% of equipment and materials procurement, and 100% of equipment installation will be done by Iranian firms. Belloni says that this should counterbalance the plant's increased capital cost compared with competing units in the region: "As a result, we consider the Bandar Iman ethylene plant outstanding, with respect to the TIC [total installed cost]."

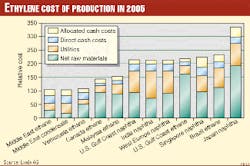

A comparison of ethylene production costs for various feedstocks and locations is given in Fig. 7.

"The cost of production at the Bandar Iman site should be competitive, due to the fact that a major portion of the ethylene is based on ethane, which...is the most economic feedstock," Belloni said. "The remaining portion produced from liquid feedstocks should be below the production costs in Europe for a naphtha cracker, due to reduced transportation costs. Based on this, it is clear that the production cost at the Bandar Imam olefins plant must be competitive, compared to other areas of the world."

According to NPC's feasibility study for the complex, the project will have an internal rate of return of 20.3%, thus allowing it to complete the payback period during its fourth year of operation.

"The plant is based on latest technology, combining the key features energy efficiency, selectivity, and high availability. We trust that this combination matches perfectly with the market scenario in this area," said Belloni.

"The economics of the plant operation seem to be absolutely competitive in today's environment."