Global petchem market due rebound in long term

The outlook for global petrochemicals markets is one of tough times in the near to mid-term, followed by robust recovery in the longer term.

That's the general forecast suggested by a series of recent studies by Chemical Market Associates Inc., Houston.

Specifically, the studies concluded:

- Worldwide demand for polyolefins will continue to enjoy robust growth in the years to come, but a persistent capacity surplus will undermine margins in the near to mid-term.

- Methanol producers in the years to come will find themselves increasingly focused on niche markets as profitability hinges more and more on geographic location and feedstock costs.

- Chlor alkali producers face a tough time in the next 2 years as global rationalization proceeds in this sector.

Polyolefin supply, demand

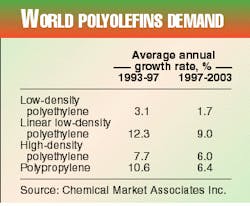

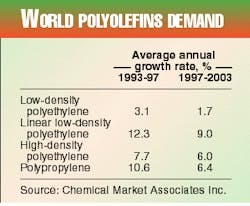

Among polyolefins, linear low-density polyethylene (Lldpe), high-density polyethylene (HDPE), and polypropylene (PP) have all illustrated robust demand growth that is expected to continue into the future. Growth will lag somewhat, however, for low-density polyethylene (LDPE).

Demand for Lldpe was found to be the fastest-growing of all the polyolefins in the study, according to CMAI, with an average worldwide growth rate of more than 12%/year during 1993-97 (see table).

Through 2003, demand for the low-cost resins-such as PP and the linear polyethylenes-is expected to grow at an average rate of 6-9%/year worldwide. This rate is about double the forecast world gross domestic product rate of growth, said CMAI.

CMAI notes: "Conventional LDPE will grow at a fraction of GDP, reflecting the market penetration of linear polyethylene and the maturity of LDPE markets."

In comparing the per capita consumption of polyethylene and poly- propylene in various areas of the world, CMAI found some notable distinctions (Fig. 1).

More-industrialized areas, says the research firm, are "high users" of the polymers. "Countries that export significant quantities of products requiring packaging, such as Taiwan, South Korea, and Malaysia, have an artificially high consumption that does not reflect actual use within the country.

"Generally, higher usage per capita for polyethylene is a function of the product's maturity. Polyethylene has been around longer and has had a higher market penetration due to more applications developed for its use. Also, since polyethylene was essentially invented and developed in the U.S., its U.S. consumption is high compared to Western Europe and Japan," said CMAI.

In comparison, the use of poly- propylene increased considerably in both the industrialized and newly developing countries. "This is a result of the extensive use of polypropylene in applications where engineering plastics were formerly used. The U.S. has lagged somewhat in material substitution but is expected to improve during the forecast period," said the firm.

During 1997-2003, worldwide polypropylene usage per capita is estimated to increase by 1.4 kg, or 33%. This indicates an increase of about 11 million tons.

Increases in world polyolefins capacity continue to surpass growth in demand, reckons CMAI, which has resulted in an oversupply and low operating rates and margins. The drastic change in the size of the production units also contributes to this oversupply situation.

CMAI notes: "The 100,000 ton/year new facilities are no longer built but are replaced by plants in the range of 250,000-450,000 tons, depending on the product. It takes only a few of the larger units to cover a year's growth in demand."

CMAI figures that almost 20 million tons of new polyethylene capacity will be added to the world market by 2003, which would be an increase of about 40% over 1997 levels (Fig. 2). More than one third of this capacity growth is expected to come on line in Asia, and about 20% is expected to come from the Middle East, says the firm.

World polypropylene capacity is forecast to increase by over 13 million tons by 2003, or about a 50% increase above 1997 levels. As with polyethylene, about one third of the new capacity is being built in the Asia-Pacific region. CMAI made particular note of a substantial amount of capacity coming on stream in Western Europe and North America by 2003.

"With the global oversupply condition, world operating rates for Lldpe will decline during 1999-2000 to about 75% before improving in 2002-03, when demand catches up with supply," predicts CMAI. The peak of the next business cycle is expected to occur during 2004-05. Demand for Lldpe is expected to increase to 17 million tons in 2003 from 10 million metric tons in 1997.

The low point in the cycle for HDPE is expected to occur in 2000, with operating rates not expected to drop below 80%. HDPE demand is expected to increase to more than 26 million tons in 2003 from 19 million tons in 1997, and the peak of the next business cycle is expected during 2004-05, similar to that of Lldpe.

Demand for LDPE is expected to increase to more than 17 million tons in 2003 from about 15.5 million tons in 1997, said CMAI, with little change in operating rates throughout the forecast period.

World polypropylene demand is expected to increase to about 34.5 million tons in 2003 from about 24 million tons in 1997. According to CMAI, trade patterns are changing as new polymer facilities are starting up in Asia and the Middle East. The Middle East and Southeast Asia are gradually replacing the long-established Asia suppliers-namely North America and Western Europe.

"In fact," said CMAI, "the U.S. and Western Europe are projected to become importers of Lldpe and HDPE during the forecast period. South Korea will remain the largest polyethylene supplier to China due to its geographical location, but the Middle East share of polyethylene supply to China will continue to increase."

Likewise, polypropylene production as well is starting to shift toward the Middle East and Southeast Asia.

CMAI predicts: "South Korea will maintain its position as the world's largest net exporter while being challenged by Saudi Arabia. Southeast Asia will change from a net importing to a sizeable net exporting position. Both North America and Western Europe become net importers by 2003, despite fairly significant increases in capacity."

Overall, and as operating rates decline and monomer prices soften, CMAI projects that polyethylene and polypropylene prices, in general, will continue to fall.

"Short-term ethylene tightness and higher ethylene prices will push resin prices up in the U.S. for 1999 before leveling or slightly declining in 2000. By 2002, the industry will be moving out of the business cycle trough, and prices are expected to improve. Prices will then peak during 2004-05, likely somewhat dampened from previous highs. This dampening effect is due to industry consolidation and the overall knowledge of the industry from the resin producers through the product chain," said CMAI.

Methanol cost study

In order to compete in world markets, existing and new methanol producers must be aware of both feedstock values and geography, according to a recent methanol cost study conducted by CMAI.

The three major global methanol markets considered in the study were Western Europe (Rotterdam), the U.S. Gulf Coast, and Northeast Asia. According to CMAI, these three regions consume the vast majority of global imported merchant methanol. It discovered that not all of the remote methanol producers could economically or competitively reach all three of these markets.

CMAI found that feedstock values ranged from nearly nothing to over $2/MMBTU of natural gas. "The lower value is more represented by the availability of feedstock in remote regions of the world, whereas the higher value applies more to the consuming regions that have indigenous gas but also have other higher-valued alternatives as a feedstock to produce methanol," said the firm.

The world average feestock value--the calculation of which excluded a zero value for Norway--was $1.10/ MMBTU of natural gas. The value for Trinidad and Tobago was 85¢/ MMBTU.

CMAI noted, "In the future, it is very possible that the value placed on methanol feedstock gas will decline. There is a possibility that there could even be BTU credits for disposing of associated gas through the production of products like methanol."

Also key to producing competitive methanol is geography, because ocean transport is generally required to ship product to consuming areas, adding substantially to the product's final cost.

Freight costs were found to be $9.80/metric ton for trips to the U.S. Gulf Coast, $18.41/ton for Western Europe, and $42.48/ton for Northeast Asia, according to CMAI.

The study, said CMAI, is based on "as much hard data as possible," and certain assumptions have been made for labor costs, feedstock, operating rates, catalysts, and chemicals.

Chlor alkali outlook

Chlor alkali producers have a very challenging 2 years ahead of them, said CMAI in its recent study of world chlor alkali supply and demand.

"Rationalization of the chlor alkali industry on a global basis is expected. Eventually, fully integrated chlor alkali producers with downstream derivative production will dominate the market.

"As gross domestic product performance improves in all regions (included in this study), demand for chlor alkali will improve and supply-demand balances will tighten, allowing prices and margins to improve quickly. If capacity additions are managed prudently, the industry should experience a sustained period of profitability beyond (the) forecast period," said CMAI.

World market demand for chlorine increased an average 3.4%/year during 1993-97, and the demand for caustic soda grew 3.6%/year, according to CMAI. Meanwhile, worldwide chlorine capacity grew 2% during the same time period, while world capacity for caustic grew 2.1%/year.

In 1998, says the research firm, a decrease in chlor alkali demand occurred, just as capacity was on the upswing, which reduced world operating rates to 83% of capacity.

"These lower operating rates placed downward pressure on prices and margins. Chlorine prices in North America for the vinyls end-use market fell from $215/short ton at the end of 1997 to $55/short ton by the end of 1998.

"In early 1999, it became evident in the North American market that increased chlor alkali capacity, coupled with weak demand for caustic, caused producers to fight for caustic market share, resulting in negative-to-low electrochemical unit margins," said CMAI.

And CMAI forecasts a cycle of both weak prices and thin margins for chlor alkali producers will continue through 1999.

As the financial crisis in Asia continues to right itself throughout 2000, North American GDP will continue to grow, says CMAI. At that time, demand for vinyls products will increase at about 5%/year, predicts the firm.

"Demand growth for chlorine derivatives is the result of stable and improving economic conditions in most areas of the world. This growth will be led by the construction industry in all regions of the world; however, those regions that have lagged in terms of industrialization and have large populations will show the strongest growth.

"This improved demand for chlorine derivatives will consume additional chlorine, causing operating rates and prices to improve.

During 2001-02, higher prices and margins will return to the chlor alkali industry."

According to CMAI's analysis, during 1997-2003, world chlor alkali operating rates are expected to linger below those of U.S. producers (Fig. 3).

After 2000, both U.S. operating rates and world operating rates will sustain levels that will support strong price increases, says the research firm.

"These high operating rates during 2000-03 are the result of improving economic conditions in all regions of the world and a lack of capacity additions in the latter portion of the forecast period, allowing demand to catch up with supply, (thus) increasing operating rates."

While CMAI considers regional capacity additions for chlorine substantial-totaling about 7.3 million metric tons during 1997-2003, or 1.7%/year-demand will increase more rapidly, at a rate of about 2.6%/year, or 8.3 million metric tons over the forecast period (Fig. 4).

And although there will be about 6 million dry metric tons of capacity additions of caustic soda, these additions will occur during the early part of the forecast period.

Demand for caustic soda, however, will grow more strongly during the latter part of the forecast period and will catch up to the capacity that was added, says CMAI.

"This supply-demand squeeze is reflected by steadily increasing operating rates on a worldwide basis, from 83% in 1998 to more than 88% in 2003 for chlorine and from 81% in 1999 to more than 87% in 2003 for caustic soda. Of particular interest is the emergence of the Middle East as a major supplier of chlorine derivatives (vinyls) and caustic soda to world markets. This will have an impact on international trade for both vinyls and caustic soda."