IEA updates EOR project data, doubling output forecast

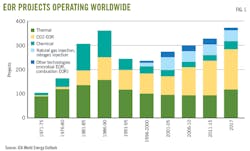

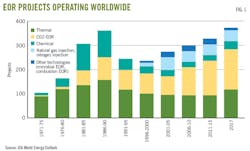

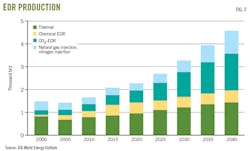

The International Energy Agency (IEA) estimated about 375 enhanced oil recovery projects worldwide produced slightly more than 2 million b/d in 2018. They forecast this could grow to 4.5 million b/d, or around 4% of world production, by 2040.

EOR projects accounted for about 2% of world oil production since 2014. IEA analysts expect modest EOR production growth until about 2025, noting industry currently focuses on shale production growth in US, Brazil, and Canada.

They also suggest carbon dioxide (CO2) EOR could address climate change concerns. IEA expects CO2 EOR to play an increased role in carbon capture, utilization, and storage (CCUS) projects.

IEA released an updated list of EOR projects1 and evaluated the outlook for future EOR in different scenarios presented in its World Energy Outlook.2

Fig. 1 shows IEA’s tally of EOR production to be 700,000 b/d higher than an Oil & Gas Journal EOR survey reported in 2014 (OGJ, May 5, 2014, p. 92). While updating EOR production statistics from the OGJ database, IEA added new projects and reviewed EOR in regions sparsely covered previously, such as China and the Middle East.

Industry traditionally used EOR primarily for US and Canadian projects but the technology increasingly is being used worldwide, both onshore and offshore. IEA reported 15 offshore EOR projects worldwide as of 2018.

ExxonMobil Exploration and Production Malaysia Inc. started EOR production at Tapis field offshore Malaysia during 2017.

The Tapis EOR project marked Malaysia’s first large-scale EOR project and remains one of the largest offshore EOR projects in Southeast Asia. ExxonMobil’s joint venture partner is Petronas Carigali Sdn Bhd (PCSB). Each holds 50% interest.

IEA’s EOR update lists projects in the United Arab Emirates, Kuwait, Saudi Arabia, India, Colombia, and Oman.

Oman has increased its oil production since 2007 through steam injection, polymer injection, miscible gas injection, and other EOR methods. Oman is evaluating large-scale solar EOR projects to save natural gas. Petroleum Development Oman (PDO) is working with GlassPoint Solar. After a pilot, PDO and GlassPoint are building Miraah solar plant (OGJ, Jan. 1, 2018, p. 46). A separate solar EOR technology center is being developed in Muscat, Oman. PDO reported 16% of its oil production came from various types of EOR in 2016 compared with 3% in 2012.

Abu Dhabi National Oil Co. Onshore (ADNOC Onshore) injects CO2 into Bab-Rumaitha field. ADNOC uses low-molecular-weight hydrocarbon-immiscible (HC) gas injection to increase production from Abu Al Bukhoosh (ABK) field offshore Abu Dhabi. UAE’s goal is to expand EOR production 30% by 2020 from 2014.

Currently, North American EOR accounts for 40% of all EOR projects compared with 75% of 2013 EOR projects, which provided 800,000 b/d.

EOR incentives

While EOR projects can be cost competitive with other production, they frequently involve high upfront capital requirements and long payback periods. Consequently, EOR production historically relied on financial incentives such as tax breaks.

More than 80% of world EOR production benefits from government incentive programs. National oil companies prioritize EOR in efforts to maximize production and profits.

IEA said US policy demonstrates how government can promote EOR projects. Faced with declining US oil production, the Crude Oil Windfall Profit Tax Act of 1980 promoted EOR by reducing producers’ EOR-related taxes.

Last year, a federal tax credit was amended under section 45Q of the US tax code to promote underground carbon storage. The amendment increased the amount of money available to companies willing to capture and store carbon emissions in geologic formations or to use CO2 EOR on existing wells.

The tax credit was amended to provide a tax reduction of $35/tonne of CO2 for 12 years for CO2 stored in EOR operations. Previously, the tax credit was $10/tonne but it will increase to $35/tonne by 2024.

Yet, EOR project growth has been slower than expected. IEA analysts found no one reason for this, but possible explanations included:

• Resource scarcity concerns. These traditionally drive EOR projects, but ample world oil supplies have discouraged new EOR projects since 2014.

• Industry desire for fast returns. An EOR project requires time to plan, test, and implement, meaning that EOR adds incremental production only late in a field’s life.

• Limited availability of EOR skills, technologies, and expertise. The technology has become a niche business among oil and service companies.

• Relative expense. EOR costs have declined since 2014, but costs of other projects—including shale plays and offshore developments—have declined more quickly. EOR technologies struggle to compete with other investment opportunities.

EOR outlook

IEA analysts evaluated EOR prospects in the World Energy Outlook. They estimated that systemic application of all EOR technologies across conventional crude oil resources could, in theory, unlock up to 300 billion bbl of crude oil.

In the WEO’s New Policies Scenario projections, only a fraction of that 300 billion bbl is produced. By 2025, IEA analysts foresee larger production related to EOR projects. US tight oil will near its production plateau and numerous regions and countries also will have become mature production provinces by 2025, making them more inclined to pursue EOR to maintain production or slow declines.

Numerous measures and initiatives will need to gain momentum before EOR production growth forecasts can materialize. Examples of such efforts include:

• Concerted effort by governments and industry to screen fields and determine EOR potential in resource-rich areas.

• Timely EOR pilots in countries where EOR has not yet been used.

• Continued fiscal incentives, including emissions credits for CO2 EOR.

• Technological advances such as decreasing the volume of chemicals injected and using digitalization to grasp a better subsurface understanding.

In the WEO Sustainable Development Scenario, total EOR production grows to around 4 million b/d in 2040. This is smaller than WEO’s New Policies Scenario because oil demand and prices are lower.

However, CCUS advancements could support much larger CO2-EOR production. In this scenario, climate imperatives emerge as a key driver behind EOR technologies. Given suitable geology, companies can use CO2 EOR to reduce their CO2 emissions intensity. If CO2 is captured and injected in enough quantities, negative-emissions carbon credits could be available for oil. Oil produced from a CO2-EOR sequestration project can be carbon neutral or carbon negative, depending upon the source of the CO2 emissions.

IEA analysts evaluated the possibility of negative-emissions oil in the World Energy Outlook and expect to publish a future commentary on it.

References

1. Han, M., McGlade, C., and Sondak, G, “Commentary: Whatever happened to enhanced oil recovery,” Nov. 28, 2018, International Energy Agency web site.

2. IEA, “World Energy Outlook 2018.”

Adapted with permission from International Energy Agency’s “World Energy Outlook 2018” commentary.