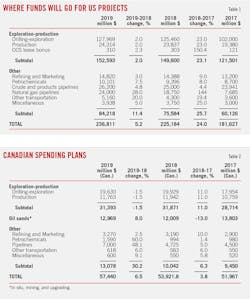

Upstream oil and gas capital expenditures in US this year will increase only 2%, following an 23% increase last year, as independent producers focus on capital discipline and cashflow neutrality.

Total spending for exploration, drilling, and production will total almost $152 billion, OGJ forecasts. Firms’ spending plans show a divergence between US independents and international oil companies (IOC). Combined spending of the US independent group could drop 6-8% from a year ago, while IOCs will expand their activities.

In 2018, upstream spending surged 23% compared with an original guidance of 9% because of increased activity and higher costs as oil prices held firm for most of the year.

Capital expenditures on the other categories—including refining, petrochemicals, and pipelines—continue to increase this year.

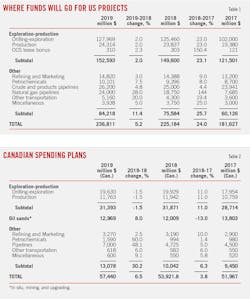

Meanwhile, E&P capital spending in Canada will decline this year, partly because of production curtailments announced by the Albertan government. However, spending for oil sands development there will climb.

International upstream spending outside North America is expected to increase. According to the latest Barclays E&P survey, growth will reach at least 8% from almost every international region, with the exception being Russia and the former Soviet Union. International spending is forecast to reach $286 billion in 2019.

All dollar amounts reported are in US dollars unless otherwise indicated.

US upstream spending

The growth of US independents takes a back seat. Consistent with the commitment to capital discipline and in response to recent volatile commodity price trends, most US E&P companies have announced reductions in rig and frac spread counts and intend to reduce 2019 capital spending.

Most companies made their 2019 budgets assuming a West Texas Intermediate oil price of $50-55/bbl and a Henry Hub natural gas price of $3/MMbtu.

Combined spending of US independents could decline 6-8% this year, based on estimates from their budget releases. Despite the overall capex decline, producers are forecasting strong production gains, as they will decrease the inventory of drilled but uncompleted (DUC) wells.

Meanwhile, IOC activities will expand rapidly this year. IOCs have been building out supply chain and infrastructure to support large, multiwell pad developments in the Permian basin. IOCs’ spending plans are usually with lower commodity price sensitivity.

According to preliminary company data and OGJ estimates, Chevron Corp., ExxonMobil Corp., ConocoPhillips, Royal Dutch Shell PLC, and BP PLC will all increase their US onshore capital spending. BP just completed its $10.5-billion purchase of BHP Billiton’s US onshore assets last October.

Bonus payments related to Outer Continental Shelf lease sales will rise slightly this year. The US Bureau of Ocean Energy Management has scheduled two lease sales, Nos. 252 and 253, to take place during 2019. OGJ forecasts that such payments will total $310 million, up from $303 million last year.

During 2018, BOEM held two lease sales. The first one, No. 250, resulted in $124.76 million in bonus payments. The other, No. 251, produced $178 million in bonus payments.

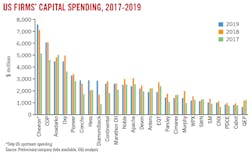

US firms’ spending plans

ExxonMobil expects 2019 capex of $30 billion, up from $25.9 billion in 2018 and $23 billion in 2017. ExxonMobil spent $7.67 billion on US upstream in 2018, up from only $3.7 billion for such outlays in 2017. Key drivers of upstream growth in the US this year are in the Permian, where the company has trebled the size of its resource since 2017.

Chevron has budgeted $20 billion for capital and exploratory expenditures for 2019, with $17.3 billion earmarked for upstream spending. Upstream expenditures were $17.6 billion for 2018 and $16.4 billion for 2017, respectively.

Despite a lower total upstream spending, Chevron’s upstream capital outlays on projects in the US will rise to $7.6 billion this year from $7.1 billion last year and $5.1 billion in 2017. Specifically, upstream spending for the Permian is budgeted at $3.6 billion. About $1.6 billion is allocated to other shale and tight investments.

ConocoPhillips anticipates capital spending of $6.1 billion in 2019, which is flat with the expected full-year 2018 capital expenditures excluding acquisition costs. The company’s full-year 2019 production guidance is 1.3 million boe/d to 1.35 million boe/d, up from $1.26 million boe/d last year. This represents the first production gain since 2015.

About $3.1 billion, or 51%, is allocated to the Lower 48, roughly flat to 2018 spending. About $1.2 billion, or 20%, is allocated to Alaska compared with $900 million in 2018. Capital expenditures in Canada also will increase to $500 million from $300 million last year, reflecting ongoing activity in the Montney unconventional program and Surmont upgrades.

Antero Resources Corp. is trimming its drilling and completion budget to $1.2 billion in 2019 from $1.5 billion last year. The company plans to operate an average of 5 drilling rigs and 4 completion crews, down 1 to 2 crews from 2018. Antero is expecting to increase production by 18%.

Apache Corp. is slashing spending by 22% to $2.4 billion, with 75% allocated to its Permian basin assets. It still expects 6-10% production growth after adjusting for divestitures.

Anadarko Petroleum Corp. expects full-year capital investments ranging $4.3-4.7 billion (excluding WES), which represents a 9% decrease relative to its 2018 program and still delivers 10% oil growth year over year. Specifically, 70% of investments are directed towards US onshore assets, mainly in the Delaware and DJ basins. While spending in the Gulf of Mexico is lower than in 2018, the number of wells and production will be similar.

Continental Resources Inc.’s capital expenditures budget for 2019 is $2.6 billion compared with $2.8 billion spent in 2018, with the majority of 2019 drilling and completion budget focusing on oil-weighted areas in the Bakken and SCOOP. Under the current commodity price environment, planned capital expenditures for 2019 are expected to be funded entirely from operating cash flows.

Chesapeake Energy Corp. plans to reduce its 2019 capital expenditures by lowering its rig count by 20%, expecting to average 14 rigs vs. a current rig count of 18.

Concho Resources Inc. is expecting an increase its capital spending during 2019 to $2.9 billion after closing its $9.5-billion acquisition of RSP Permian last July.

Devon Energy Corp. reported a plan to sell its Barnett shale and Canadian oil assets, which represents more than 40% of its fourth-quarter 2018 production. Devon stated that its upstream capital spending this year will range $1.8-2 billion, with the midpoint about 10% less than in 2018. Devon expects to achieve oil production growth of 13-18% in 2019.

Diamondback Energy Inc. plans capital expenditures in 2019 to reach $2.7-3 billion, including $2.3-2.55 billion for drilling and completion. During 2018, capital expenditures for drilling, completing, and equipping wells were $1.4 billion.

Gas-weighted EQT Corp., embroiled in a spat with Rice Energy Inc. founders, is slashing outlays from $2.7 billion last year to $1.9 billion this year to reduce leverage and return additional free cashflow to shareholders. About 80% of its capital spending will be deployed in the Marcellus shale, with the balance being invested in the Utica shale.

EOG Resources Inc.’s exploration and development expenditures for 2019 are expected to range $6.1-6.5 billion compared with $6.2 billion in 2018. EOG expects to increase US crude oil production by 12-16%, fund capital investment, and pay the dividend with net cash from operating activities in 2019 at $50/bbl oil.

EOG expects to complete about 740 net wells in 2019 compared with 763 net wells in 2018. Activity will remain focused in EOG’s highest rate-of-return oil assets in the Delaware basin, Eagle Ford, Rockies, Woodford, and Bakken.

Hess Corp. is expected to spend $2.9 billion, about 40% more than in 2018, due to higher spending in the Bakken and Guyana. About $1.4 billion will be used to fund an increase to 6 rigs from an average of 4.8 rigs in 2018, and the shift to higher intensity plug and perforated wells in the Bakken.

The company expects to drill about 170 new wells and to bring online 160 new wells in 2019.

Marathon Oil Corp.’s 2019 capital budget totals $2.6 billion, down slightly from 2018. More than 95% of its $2.4-billion development capital budget will be allocated to the four US resource plays: Eagle Ford and Bakken (60%) and Oklahoma and the Northern Delaware (40%). Marathon Oil expects oil growth of 10% in 2019.

Occidental Petroleum Corp. announced a 2019 capital program of $4.5 billion compared with 2018 spending of $5 billion. Upstream spending in the Permian will account for $3.1 billion, down from $3.3 billion spent last year.

US refining, petrochemical outlays

Given their access to low-cost natural gas and price-advantaged crudes, US refiners still face a favorable business environment. Distillate demand growth outpaces gasoline, driven by transportation and industrial sectors and the impact from the International Maritime Organization’s enforcement of a 0.5% global sulfur cap on fuel content from Jan. 1, 2020, lowering it from the current 3.5% limit.

OGJ projects that capital spending at US refining and marketing this year will increase 3% to $15.5 billion from 2018 spending of $15 billion. The growth in investments focuses on upgrading capabilities, yield flexibility, and conversion capacity.

PBF Energy will spend $625-675 million in net capital expenditures during 2019 for facility improvements and maintenance.

Marathon Petroleum Corp. spent $1 billion and $832 million on its refining and marketing business in 2018 and 2017, respectively. The 2018 spending included part of Andeavor’s results since October. In 2019, Marathon Petroleum’s key projects include increasing Garyville coking capacity by 50%, Galveston Bay STAR Program, and others.

Phillips 66’s capital budget, excluding Phillips 66 Partners, is $2.3 billion this year. Phillips 66 plans $923 million of capital spending in refining, with $512 million for reliability, safety, and environmental projects. Refining growth capital of $411 million is for high-return projects to enhance the yield of higher-value products, including an upgrade of the fluid catalytic cracking unit at the Sweeny refinery, as well as other low-capital, quick-payout projects.

Valero Energy Corp. expects to invest about $2.5 billion of capital in both 2019 and 2020, of which 60% is for sustaining the business and 40% is for growth projects. In 2018, Valero’s capital investments totaled $2.7 billion.

US petrochemical manufacturers remain advantaged with access to cheaper and more abundant feedstocks and energy.

Phillips 66’s capital contributions to Chevron Phillips Chemical Co. will rise to $572 million from $339 million a year ago.

Since 2010, 333 chemical industry projects cumulatively valued at more than $200 billion have been announced, with 53% of the investments completed or under construction and 41% in the planning phase, according to The American Chemistry Council.

US pipelines

Many pipeline construction projects are under way in the US to aid in debottlenecking oil and gas from the Permian basin and other plays.

According to OGJ’s most recent Worldwide Pipeline Construction report, plans call for a total of 2,571 miles of gas pipelines to be constructed in the US in 2019, mostly larger than 32 in. (OGJ, Feb. 4, 2019, p. 48). In addition, plans call for the construction of 3,763 miles of crude and product pipelines in the US this year. Many of these lines will be 22-30 in.

The US Federal Energy Regulatory Commission’s annual report of oil pipeline companies showed that investment in US oil pipelines totaled $23.9 billion in 2017 and $23.1 billion in 2016.

Given the strong boom in pipeline constructions, OGJ forecasts that US capital spending on pipelines will increase 5% for crude and product pipelines and 28% for gas pipelines this year from a year ago.

Canadian E&P, oil sands

All Canadian spending figures in this section are expressed in Canadian dollars.

Capital expenditures for oil and gas exploration, drilling, and production in Canada will decline 1.5% to $31.4 billion (Can.) in 2019, following a 11% increase in 2018.

Faced by record discounts for its crude and brimming inventories, Alberta announced mandated temporary production cuts of as much as 325,000 b/d for an initial period of 3 months of 2019.

The Canadian rig count decreased to 212 in February from 342 in the same time last year, with oil rigs down 90 units and gas rigs down 40 units, according to Baker Hughes.

According to OGJ forecasts, oil sands capital spending, which includes funds for in-situ extraction, mining, and upgraders, will climb 8% from a year ago to about $13 billion. This follows a decrease of 13% last year.

The Canadian Association of Petroleum Producers reported that oil sands capital expenditures totaled $13.8 billion in 2017, the latest year for which the association has reported such data.

Suncor Inc. has set a 2019 capital spending program of $4.9-5.6 billion, and average upstream production of 780,000-820,000 boe/d. The midpoints of these ranges represent a flat capital spend compared with 2018 and a year-over-year production increase of 10%, including estimated mandatory production curtailments, from 730,000 boe/d in 2018.

Suncor’s upstream oil sands spending this year ranges $3-3.4 billion. This compares with $3.5 billion and $5 billion for 2018 and 2017, respectively. Upstream E&P spending ranges $1-1.2 billion, up from $9.5 million and $8 million for 2018 and 2017, respectively.

Canadian Natural Resources Ltd.’s 2019 base capital budget is targeted to be $3.7 billion, about $1 billion less than the 2018 forecast due to increased capital flexibility.

The company’s 2019 capital budget for total oil sands mining and upgrading will increase to a base budget of $1.5 billion, up from $1.3 billion estimated for 2018. Budgets for North America E&P will decrease to $1.1 billion from $1.55 billion a year ago, while its international E&P spending will increase to $460 million from $410 million last year.

Husky Energy Inc.’s capital spending budget ranges $3.3-3.5 billion, including $1.8 billion in sustaining and corporate capital. Midrange average annual 2019 production of 295,000 boe/d includes reductions related to government-mandated curtailments in Alberta, and the temporary suspension of operations at the SeaRose floating production, storage, and offloading vessel in the Atlantic region.

Husky’s capital budgets for thermal and oil sands this year ranges $730-760 million, down from $915 million last year. Spending for conventional heavy oil and Western Canada resource play drilling ranges $280-300 million, down from $350 million a year ago.

Cenovus Energy Inc. plans to invest $1.2-1.4 billion in 2019, with much of the budget going to sustain base production at its Foster Creek and Christina Lake oil sands operations. The company also plans to complete construction of the Christina Lake Phase G expansion.

The 4% reduction in total planned capital spending compared with Cenovus’s 2018 forecast is largely the result of efficiency improvements at the company’s oil sands operations and reduced development plans for the Deep basin.

Imperial Oil Ltd.’s capital expenditures totaled $1,427 million in 2018. In 2019, capital expenditures are expected to range $2.3-2.4 billion, including about $800 million associated with the Aspen in-situ project.

Imperial Oil’s $2.6 billion Aspen project in northern Alberta is the first new oil sand development to be greenlighted since 2013.

Elsewhere in Canada

Imperial Oil’s capital spending on Canadian refining is expected to rise from $383 million last year. Cenovus Energy and Husky Energy may also increase their spending on Canadian refining this year.

Suncor’s spending on Canadian downstream ranges $700-770 million this year compared with $856 million for 2018 and $634 million for 2017.

Enbridge Inc., the country’s largest pipeline operator, secured total 2019 and 2020 capital program of $16 billion. The company’s $5.3 billion Canadian Line 3 replacement program is expected to enter service in this year’s second half. The $500-million Spruce Ridge expansion program and $1-billion T-South expansion program are both in preconstruction status.

In 2019, TransCanada expects to spend $8 billion in 2019 on growth projects, maintenance capital expenditures, and contributions to equity investments.

TransCanada’s capital spending on Canadian natural gas pipelines totaled $2.18 billion in 2017 and $2.47 billion in 2018. As a comparison, its spending on US natural gas pipelines totaled $3.8 billion in 2017 and $5.7 billion in 2018. The estimated cost for secured gas pipeline projects in Canada could reach $5 billion in 2019, according to OGJ.

Canada’s petrochemical industry is headed for its biggest surge of expansion spending in 5 years in 2019, thanks in large part to incentive programs by federal and provincial governments.

Several capital-intensive petrochemical projects have been announced in Canada, including Inter Pipeline’s $3.5-billon propane dehydrogenation and polypropylene complex in Strathcona County, Alta., Kuwait Petrochemical’s $4-billion propylene complex, and NOVA Chemical’s $1.2-billion polyethylene plant expansion.

International spending

The latest Barclay’s E&P Spending Survey, released on Jan. 8, expects spending growth of at least 8% from almost every international region, with the exception being Russia and the FSU. International spending is forecast to reach $286 billion in 2019.

Despite the Dec. 6 decision to reduce production by 1.2 million b/d, the Middle East is expected to lead international spending, up 8% to about $43 billion. Spending grew only 2% in 2018, according to the report.

Most of the estimated spend will come from Saudi Aramco, which awarded several notable oil field services contracts in 2018 for onshore and offshore rigs and unconventional gas stimulation services. The amount is more than twice that of the second-highest spender, Abu Dhabi National Oil Co.

Latin America’s spending is expected to grow 11% to an estimated $34 billion (see sidebar, p. 24). This is up from a decline of 6% in 2018. Brazil’s Petroleo Brasileiro SA (Petrobras) and Mexico’s Petroleos Mexicanos (Pemex) are the top Latin American spenders at $13.2 billion (+19%) and $10.5 billion (+15%), respectively. For Petrobras, about 56% of E&P capital is expected to go toward presalt, while the balance will go to postsalt.

In Africa, Barclay’s report shows 12% spending growth for 2019 to about $18 billion compared with 1% spending growth in 2018. The growth is driven by Algeria’s Sonatrach, Nigerian National Petroleum Corp., and Angola’s Sonangol along with Tullow Oil Ltd. and Kosmos Energy Ltd.

Offshore spending is poised to fall another 7% in 2019. Barclays expects 2019 to mark the fifth consecutive year of offshore spending declines, although early signs point to a potential 2020 inflection as the floater rig count is expected to end 2019 at 130 units, up from 116 currently.

Barclays also reported that international upstream spending by NOCs and European IOCs are both expected to rise by 8%. Spending growth from the European IOCs come after international upstream spending fell by 4% in 2018.

BP’s capital expenditures are expected to range $15-17 billion this year compared with $15 billion last year and $16.5 billion in 2017.

Equinor and Total SA’s capital budgets are estimated at $11 billion and $16 billion this year compared with $9.9 billion and $15.5 billion last year.

US-based companies have also released details of their capital budget plans outside North America.

ExxonMobil’s spending for international upstream decreased slightly to $12.5 billion in 2018 from $13 billion in 2017. A key driver of international upstream growth in 2019 is in Guyana, where exploration success has added 3.2 billion boe (gross) of recoverable resource and plans are in place for development and further exploration.

Chevron’s international upstream spending will decrease consecutively to $9.7 billion this year, down from $10.5 billion for 2018 and $11.2 billion for 2017. In 2019, about $4.3 billion is associated with the Future Growth Project at the Tengiz field in Kazakhstan. Global exploration funding is expected to be about $1.3 billion.

About the Author

Conglin Xu

Managing Editor-Economics

Conglin Xu, Managing Editor-Economics, covers worldwide oil and gas market developments and macroeconomic factors, conducts analytical economic and financial research, generates estimates and forecasts, and compiles production and reserves statistics for Oil & Gas Journal. She joined OGJ in 2012 as Senior Economics Editor.

Xu holds a PhD in International Economics from the University of California at Santa Cruz. She was a Short-term Consultant at the World Bank and Summer Intern at the International Monetary Fund.