Number of high-impact offshore discoveries poised to increase

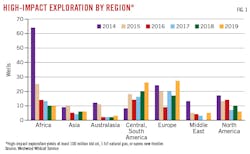

Oil companies announced six high-impact offshore discoveries of conventional oil and gas during first-quarter 2019, nearly half the total high-impact estimated resources discovered worldwide in 2018. High-impact discoveries are defined as those greater than 100 million bbl of oil, 1 tcf of natural gas, or that open a frontier area.

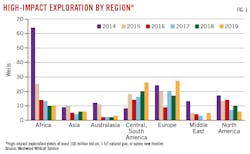

The early 2019 high-impact discoveries are Glengorm in the UK North Sea, Haimara and Tilapia offshore Guyana, Brulpadda in deepwater off South Africa, Agogo in Angola, and Glaucus, offshore Cyprus. Westwood Global Energy identified 80 high-impact wells that will be drilled in 2019, testing 24.6 billion boe of anticipated resources, half of which are in deep water. Analysts are optimistic that new deepwater oil plays could emerge this year based on operators’ pre-drill expectations.

Graeme Bagley, Westwood Global Energy Group’s head of global exploration and appraisal in London, estimated around 2.6 billion boe of resources was discovered through 2019 high-impact exploration by Mar. 31 compared with 5.3 billion boe discovered worldwide throughout 2018. The discoveries indicate a recovery in offshore exploration following the oil price slump that started in late 2014, he said.

Fig. 1 shows that Westwood Energy analysts believe 2019 could have the most high-impact exploration in northwest Europe in 5 years.

Glengorm offshore UK

China National Offshore Oil Corp. (CNOOC) announced the Glengorm gas-condensate discovery in the UK North Sea in February. CNOOC’s partner, Total SA has estimated Glengorm resources at 250 million boe, which would match the size of the Culzean discovery in 2008, although they have not specified whether this is proved or probable.

The operator, CNOOC has not commented on Glengorm estimates. The only larger North Sea discoveries made in the last 20 years are Buzzard field with 1.1 billion bbl and Rosebank (West of Sheltands) with 292 million boe in 2004.

Westwood analysts note that Upper Jurassic turbidites are highly variable in terms of both thickness and quality across the Central North Sea. They said uncertainty exists on the resource estimate.

“Glengorm reignited excitement for the high-pressure, high-temperate (HPHT) play of the Central North Sea,” Bagley said. “Eni’s Rowallen well has been announced as a dry hole. Eyes will now be on Edinburgh, which is one of the largest undrilled prospects on the UK Continental Shelf.”

The Edinburgh prospect, which straddles the UK-Norway border, is operated by Faroe Petroleum with 45% interest. Partners are subsidiaries of Royal Dutch Shell PLC, 40%, and Spirit Energy Ltd., 15%.

Edinburgh was identified years ago, but drilling has been delayed by the complex commercial arrangements associated with a prospect that covers 4 licenses across two countries. License partners have agreed to equalize equity across the UK and Norwegian blocks. Drilling is expected in 2020.

Meanwhile, executives said the CNOOC-Total joint venture could develop Glengorm via subsea tiebacks to either Elgin-Franklin (24 km to the northwest) or Culzean (44 km to the west). Total operates both Elgin-Franklin and Culzean and holds 25% interest in Glengorm.

Culzean field is in the East Central Graben of UK North Sea in Block 22/25a (License P111) about 145 miles east of Aberdeen in 88 m of water. Total took operatorship of Culzean through its Maersk Oil acquisition, effective Mar. 8, 2018 (OGJ, Aug. 6, 2018, p. 36).

Culzean is expected to come on stream in 2019, and Westwood expects the field to come off plateau in 2023 which could provide the capacity required to allow Glengorm to be developed.

Keith Myers, Westwood Energy president of research, said that another development option for Glengorm would be a subsea tieback to the Eastern Trough Area (ETAP) infrastructure (35 km northwest of Glengorm). BP PLC operates six fields in ETAP while Shell operates three fields.

Myers said that CNOOC might prefer a standalone development if estimated resources of 250 million boe are confirmed. The joint venture is appraising the discovery, which Westwood analysts said is likely to be compartmentalized like many Central Graben HPHT fields.

Offshore Africa

Fig. 2 shows that Total is expected to drill the most high-impact exploration wells worldwide in 2019. In February, Total announced that the Brulpadda-1AX well, on Block 11B/12B in the Outeniqua basin 175 km off southern South Africa, encountered 57 m of net gas condensate pay in Lower Cretaceous reservoirs.

After success with its initial target, Total drilled the well to 3,633 m where it reported success with the Brulpadda-deep prospect.

“Brulpadda has opened a new frontier oil and gas play. The potential of which may be confirmed with the acquisition of 3D seismic data,” Bagley said, adding “Total estimates Brulpadda resources at up to 1 billion boe of gas and condensate.”

Discovery of the Liza Upper Cretaceous offshore Guyana was the industry’s most recent frontier discovery before Brulpadda. ExxonMobil discovered Liza in 2015.

“With a mapped area of about 3,500 sq km, the play fairway that may have been opened by Brulpadda is potentially larger,” than Liza’s currently proved area, Bagley said.

Total and partners are acquiring 3D seismic data on the license. Plans call for drilling up to four exploration wells.

Block 11B/12B covers 19,000 sq km in 200-1,800 m of water. Total operates the block with 45% working interest. Partners are Qatar Petroleum, 25%; CNR International, 20%; and Main Street, a South African consortium, with 10%.

“The market for Brulpadda’s gas has yet to be established,” Bagley said, adding that commercialization may not be straightforward.

Offshore Guyana

Guyana remains an exploration hot spot with multiple discoveries on the Stabroek block. ExxonMobil affiliate Esso E&P Guyana operates Stabroek block with a 45% interest. Hess Guyana Exploration Ltd. holds 30% interest, and CNOOC Nexen Petroleum Guyana Ltd., 25%.

ExxonMobil Corp. recently increased its estimated recoverable resource for the Stabroek block to more than 5 billion boe.

“The Stabroek license continues to deliver,” said Bagley, adding that Haimara and Tilapia discoveries of early 2019 brought the total number Stabroek block discoveries to 12 as of March 31.

Tilapia-1 encountered 305 ft of oil-bearing sandstone reservoir and was drilled to 18,786 ft in 5,850 ft of water. The Noble Tom Madden drillship began drilling Tilapia-1 on Jan. 7 and will next drill the Yellowtail-1 well, 6 miles west of Tilapia-1 in the Turbot area.

The Haimara-1 well encountered 207 ft of gas and condensate-bearing sandstone reservoir. The well was drilled to 18,289 ft in 4,590 ft of water. The Stena Carron drillship began drilling Haimara-1 on Jan. 3 and plans to return to the Longtail discovery to complete a drillstem test that, according to Bagley, will provide information regarding potential development.

Liza Phase 1, scheduled to come on stream by early 2020, will use the Liza Destiny floating production, storage, and offloading (FPSO) vessel to produce up to 120,000 b/d of oil. Construction of the FPSO and subsea equipment is well advanced, partners said in late 2018.

Pending government and regulatory approvals, Phase 2 is targeted for sanction in early 2019. It will use a second FPSO designed to produce up to 220,000 b/d of oil and is expected to come on stream during 2022.

A sanction decision is expected this year for a third development, Payara. If sanctioned, Payara would use an FPSO designed to produce 180,000 b/d of oil starting as early as 2023.

Speaking in New Orleans in March 2019 at the Scotia Howard Weil Energy Conference, Hess Corp’s Chief Executive John Hess compared offshore Liza costs with onshore Permian basin costs.

Hess has spent $12.8 billion to produce 120,000 boe/d in the Permian compared with estimates to spend $3.7 billion in Guyana to produce that same amount. The company noted costs are play specific rather than universal.

Eastern Mediterranean ExxonMobil announced a 5-8 tcf discovery, Glaucus, on Cyprus Block 10 this year, saying it plans to drill more exploration wells in the block. ExxonMobil holds 60% and is partnered with Qatar Petroleum, 40%.

Tristan Aspray, Exxon Middle East vice-president, told reporters on Feb. 28, 2019, that Glaucus appraisal drilling won’t occur until 2020 because engineers need time to analyze the data already gathered.

Meanwhile, Exxon wants to possibly expand its Eastern Mediterranean holdings, Aspray said.

Israel launched a bid round in November 2018 (OGJ. April. 1, 2019, p. 36). Israel’s energy officials met with executives of various companies during the IHS CERAWeek in Houston during March.

Noble Energy of Houston and Greek independent Energean were the only international companies with significant current interests offshore Israel as of early April.

Total and Eni are partners in two blocks offshore Lebanon where drilling is planned later this year. They also are partners on two blocks offshore Cyprus.

Noble Energy holds a production-sharing contract for the Aphrodite discovery in Cyprus water on Block 12. The 2011 discovery was estimated at 4.5 tcf. Aphrodite field is 30 km northwest of Leviathan field in about 1,700 m of water.

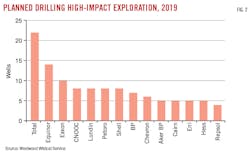

Project sanctions

Westwood forecasts 90 final investment decisions will be made for offshore projects worldwide in 2019 compared with 51 offshore projects sanctioned in 2018.

“Conventional deepwater is fighting back, stimulated by exploration success, particularly in Guyana,” Myers said. “The influence of Guyana on the exploration community shouldn’t be underestimated, even though only Exxon, CNOOC, and Hess are benefitting directly so far.”

He said that the number of deepwater frontier wells drilled worldwide increased to 29 in 2018 from 20 in 2016. The 29 frontier prospects in 2018 resulted in only two commercial discoveries, both in Guyana.

“In 2019, the company to watch is Total who is planning to drill by far the highest number of [anticipated] high-impact wells at 22, of which eight are frontier play tests,” Myers said.

About the Author

Paula Dittrick

Senior Staff Writer

Paula Dittrick has covered oil and gas from Houston for more than 20 years. Starting in May 2007, she developed a health, safety, and environment beat for Oil & Gas Journal. Dittrick is familiar with the industry’s financial aspects. She also monitors issues associated with carbon sequestration and renewable energy.

Dittrick joined OGJ in February 2001. Previously, she worked for Dow Jones and United Press International. She began writing about oil and gas as UPI’s West Texas bureau chief during the 1980s. She earned a Bachelor’s of Science degree in journalism from the University of Nebraska in 1974.