EnCana banking heavily on unconventional gas, oil

Unconventional gas and oil plays represent the future for EnCana Corp. and the North American oil and gas industry, EnCana said May 27.

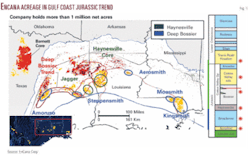

EnCana has established a portfolio of nine gas and four enhanced oil resource plays, said Jeff Wojahn, executive vice-president and president of EnCana’s USA division. Wojahn and other principals discussed its positions in the high-pressure, high-temperature established Jurassic Deep Bossier sand and emerging Haynesville plays in East Texas and North Louisiana (Fig. 1).

Gas deliveries by all operators have grown to more than 7 bcfd in January 2009 from 2 bcfd in January 2006 from the Barnett, Fayetteville, Woodford, and Haynesville shales alone, EnCana said. Of that, the Barnett supplies about 5 bcfd.

North America consumes about 25 tcf/year of gas, and close to half of that comes from unconventional reservoirs including tight sands, shales, and coalbed methane, the company noted.

The Deep Bossier play in East Texas has the best returns in EnCana, and the Haynesville could become the company’s leading resource play, said Paul Sander, vice-president, Midcontinent business unit.

Haynesville shale

EnCana, like many operators, has a 2009 priority to demonstrate the commerciality of its Haynesville shale acreage and hone its strategy to drill and prove its holding.

EnCana has diverted $290 million of its 2009 budget to retain land in the Haynesville play, most of it in the company’s core area in Red River and De Soto parishes.

Efforts to prove and hold acreage are likely contributing to the current rig count of 75-80 rigs in the Haynesville, EnCana said. Nevertheless, only a few Haynesville wells have more than 6 months of production history.

In the Haynesville, EnCana has divided its drilling staff into teams each responsible for a particular section of hole. The company has drilled 16 horizontal Haynesville wells.

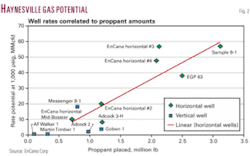

EnCana has stepped up efforts to multiply and enlarge its Haynesville frac stages after noticing a direct relationship between the volume of proppant placed and initial flow rates and estimated ultimate recovery (Fig. 2).

The company has moved from 1 million lb of proppant and eight fracs/well initially to more than 3 million lb of proppant in 12 stages.

The Haynesville could rival the quality and scope of the Barnett, Sander said.

EnCana also plans to exploit the Mid-Bossier shale. Just above the Haynesville in Louisiana, it is 180 ft thick with gas in place and development costs similar to those of the Haynesville. EnCana didn’t specify EURs for the Mid-Bossier but said they could be comparable to those in the Haynesville.

The Texas side of EnCana’s Haynesville holding is less well known but has great potential and the company is seeking a partner to better define it.

Bossier shale

Deep Bossier activity in 2009 centers on Hilltop South and West fields, where the formation is 2,000-3,000 ft deeper than at Amoruso field, where development continues. EnCana is also completing Reagan sands deeper in the Jurassic section.

EnCana, with nine rigs running as of late May, is also exploring adjacent areas and has identified 250 locations, enough for 6 years of drilling.

The company had 94,000 acres in the play and 79 wells on production.

Almost 15 bcfd of gas pipeline capacity is to be built in the Texas Midcontinent and Gulf Coast region in 2007-12, said Renee Zemljak, vice-president, USA midstream and marketing. EnCana holds sufficient downstream capacity for all of its gas, she said.

The other gas plays in which EnCana is established are the Barnett shale in the Fort Worth and Delaware basins, Eagle Ford and Pearsall shales in the Maverick basin, Niobrara shale in the Piceance basin, Muskwa shale in the Horn River basin, and the Montney tight sand in Northeast British Columbia.