Costs of new fuel standards may exceed expections

The wave of new regulatory fuel standards, especially the MTBE phaseout, will likely cost refiners more than industry watchers and legislators expect.

In the past, the refining industry has met new regulatory standards (for example, Reid vapor pressure reduction; federal reformulated gasoline, RFG; California RFG; and Environmental Protection Agency, EPA, diesel) at costs well below the industry's own forecasts.

Those accustomed to these pleasant surprises may expect the cost of the new fuel regulations to be less than estimated.

Cost estimates today are less inflated than those of the past, however, and the near concurrent start dates of the new regulations could affect the costs of compliance.

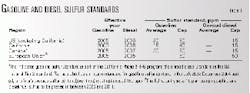

Both US and European refining industries must comply with stringent new sulfur standards for gasoline and onroad diesel fuel (Table 1).

At the same time, the US refining industry must adapt to restrictions on methyl tertiary butyl ether (MTBE) blending in California and other states-and perhaps the entire country. It also may face compliance with new national standards on the driveability index of gasoline.

Although meeting these new standards in the next 5-7 years is technically feasible and within industry's financial capacity, compliance will entail significant capital investments. These investments will increase the refining cost of producing gasoline and diesel fuel, and-at least in the US-increase the need for imports (both blendstocks and finished products) to meet demand.

Some observers foresee supply curtailments and price excursions when the new standards take effect.

Many studies have addressed the refining costs and investment requirements for meeting new sulfur standards and for phasing out MTBE. With the exception of the recent National Petroleum Council study,1 however, few have addressed the economic and supply implications of dealing with multiple new standards concurrently.

This article summarizes recent published estimates of (1) the required investments in new refining capacity and (2) the increases in average per-gallon refining costs (including capital charges) for complying with the sulfur standards and with a prospective US national phaseout of MTBE blending (under various policy scenarios).

These estimates and this discussion apply to the refining sector only; they do not cover downstream facilities such as pipelines and terminals.

Table 2 summarizes published estimates of the refining costs and investment requirements for sulfur control in gasoline and onroad diesel fuel, in the US and Canada, and for a national MTBE phaseout in the US.

Economic estimates

Estimates of refining costs and investments, such as those shown in Table 2, are hard to interpret and compare even when the technology of choice is not at issue. They depend on several premises: economic parameters and assumptions (see accompanying box), technical factors (for example, crude slate or current average sulfur levels), and policy assumptions.

The authors did not adjust the economic estimates to reflect a uniform set of technology and policy premises. Rather, they presented the estimates as they were published because:

- The number of relevant premises makes such an effort beyond the scope of this discussion.

- Published economic analyses seldom display all of the specific premises underlying the results.

- The premises of a given analysis are expressions of the sponsoring organizations' points of view and messages. For example, an organization that sees a given technology as risky and unproven may use different unit investment costs, hurdle rates, and capacity factors than an organization that views the technology as established.

Sulfur standards

The primary rationale for the new sulfur standards is enabling the advanced engine and aftertreatment technologies needed for compliance with new standards on vehicle exhaust emissions (the Tier 2 standards in the US).

From a refining standpoint, these sulfur standards are challenging but technically feasible. Several California refineries produce gasoline with less than 20-ppm sulfur under the state's Phase 2 RFG program, and some now produce diesel fuel with less than 20 ppm sulfur.

Swedish Class 1 diesel fuel (a low-volume premium product) has a 5-ppm sulfur cap. Small volumes of diesel fuel in other European countries are being produced to a 10-ppm sulfur cap.

The sulfur standards in Table 1 are not the end of the line for sulfur control. The European Union (EU) has recently adopted more stringent standards even before implementing those now on the books.

Vehicle and engine manufacturers are seeking sulfur caps at less than 10 ppm for both gasoline and onroad diesel fuel. The EPA is also considering new sulfur standards for offroad diesel fuel.

Over time, many developing countries will likely adopt US or EU standards.

Low sulfur gasoline economics

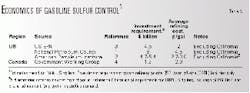

Table 3 breaks down the data in Table 2 to show the source of published estimates of per-gallon costs and investment requirements for meeting the gasoline sulfur standards.

Absent sulfur control, fluid catalytic cracker (FCC) naphtha contributes about 97% of the sulfur in the gasoline pool of a typical North American conversion refinery. Thus, meeting the gasoline sulfur standards means controlling the sulfur content of FCC naphtha.

The established technical approaches for reducing sulfur in FCC naphtha are:

- Reducing the average sulfur content of the crude slate.

- Rejecting the heaviest fraction of raw FCC naphtha to other dispositions.

- Employing a special-purpose FCC catalyst that reduces the sulfur content of raw FCC naphtha.

- Desulfurizing raw FCC naphtha in an FCC naphtha hydrotreater or equivalent process.

- Desulfurizing FCC feed in an FCC feed hydrotreater (also called a gas oil hydrotreater).

These approaches can be used singly or together. Only two options can achieve the necessary sulfur control on their own in most situations: FCC feed desulfurization (via hydrotreating) and FCC naphtha desulfurization (via hydrotreating or other methods, such as sorption or extraction).

Most analyses confirm that for the exclusive purpose of gasoline sulfur control, FCC naphtha hydrotreating is the lowest cost alternative and therefore the method of choice. Advanced FCC naphtha desulfurization processes now coming into commercial use reduce the sulfur content of FCC naphtha to less than 50 ppm with relatively little loss in octane or volume.

The various cost estimates reflect different views regarding the commercial readiness of advanced processes for FCC naphtha desulfurization. For example, the National Petroleum Council estimates1 reflect a more conservative view of commercial readiness of these processes than the American Petroleum Institute estimates.2

Low sulfur diesel economics

Table 4 breaks down the sources of published estimates of per-gallon costs and investment requirements for meeting the diesel fuel sulfur standards.

Producing the ultra low sulfur diesel fuel (ULSD) specified in Table 1 calls for controlling the sulfur content of every constituent blendstock: straight-run kerosine, straight-run distillate, and-depending on the refinery's product slate and sales outlets for onroad diesel or No. 2 heating oil-coker distillate and FCC light cycle oil (LCO).

The necessary sulfur control for producing ULSD can be achieved by distillate hydrodesulfurization (HDS) or a combination of distillate HDS (of straight-run and coker distillate streams) and hydrocracking (of LCO, the most difficult stream to hydrotreat).

The HDS technology of choice for ULSD is severe conventional hydrotreating, using advanced base-metal catalysts (NiMo or CoMo), moderate pressure (700-950 psi), and moderate temperature (600-750° F.). Such hydrotreating specifically aims at sulfur control, with only collateral (not on-purpose) upgrading such as aromatics reduction, cetane-number improvement, and API-gravity increase.

Retrofitting can provide some portion of the necessary desulfurization capacity for producing ULSD in many existing distillate hydrotreaters. The extent to which existing distillate hydrotreating capacity can be adapted to ULSD production industry-wide is a subject of controversy.

The various cost and investment estimates in Table 4 reflect different viewpoints on this issue. In particular, the range of refining costs and investment requirements by the Engine Manufacturers Association reflects various assumptions regarding the nature, cost, and extent of such retrofitting.

Curtailed MTBE economics

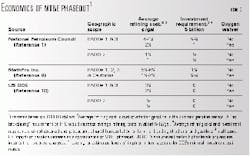

Table 5 shows recently published estimates of per-gallon costs and investment requirements for a national MTBE phaseout under a few assumed public policy frameworks.

In 1999, California banned the use of MTBE in gasoline, effective Jan. 1, 2003. Other states, such as Arizona and New York, have followed. In March 2000, EPA proposed legislative and regulatory action to reduce MTBE use nationwide. It proposed:

- Amending the Clean Air Act to provide the authority to reduce or eliminate the use of MTBE.

- Amending the Clean Air Act to provide the authority to waive the oxygen requirement in RFG.

- Ensuring that air quality gains are not diminished (that there is no "backsliding") as MTBE use is reduced or eliminated.

- Establishing a renewable fuel content requirement for all gasoline (an "ethanol mandate").

As yet, the federal government has taken no action in this respect. In connection with its MTBE ban, California has petitioned EPA for a waiver of the federal oxygen content requirement in RFG. EPA has not yet responded.

Phasing out MTBE has a host of consequences, including:

- Loss of gasoline volume (250,000-300,000 b/d).

- Loss of gasoline-octane barrels.

- Increased call for imports of gasoline or premium gasoline blendstocks, such as alkylate, iso-octane, and C6 isomerate.

- Increased average driveability index.

- Increased demand for ethanol (absent an oxygen waiver) with attendant price effects.

- Increased average and marginal costs of gasoline production.

Assessing the economics of phasing out MTBE is complex and problematic for several reasons.

First, replacing MTBE requires numerous and interacting changes in refinery operations. Second, the prospective supplies and prices of imported gasoline and blendstocks, domestic blendstocks from new or retrofitted capacity, and ethanol are as yet unclear.

Finally, phasing out MTBE would involve a number of policy decisions, addressing at a minimum the issues proposed by the EPA in March 2000: an oxygen standard, backsliding, a renewable fuels standard.

Capturing the range of interactions and possible economic outcomes is impossible in a brief survey such as this. Nonetheless even a brief survey, such as shown in Table 5, can be illuminating.

The table indicates that an oxygen waiver would eliminate more than half the cost of a national MTBE phaseout. Similarly, the differences in estimated costs in Table 5 reflect the effects of different price estimates for ethanol, imported gasoline and blendstocks, and domestic blendstocks.

A renewable fuels standard would increase the cost of gasoline production uniformly, under all scenarios and sets of premises.

Costs and prices

The estimated per-gallon costs are the additional costs averaged over the relevant fuel volume that the refining industry would incur as a consequence of the indicated environmental standards. Such costs are appropriate measures of the overall economic impact of the indicated standards.

They do not directly determine market prices, however. That is, average per-gallon costs of production do not necessarily translate into changes in prices that consumers would pay for gasoline and diesel fuel.

Market prices are influenced less by average costs of supply than by marginal costs of supply. In general, the marginal cost, associated with the "last gallon" supplied, is greater than the average cost of the total volume supplied.

In the long term, the marginal supply of gasoline or diesel fuel will be either imported product or domestic product from new refining capacity. In the former case, the marginal cost of supply will be the delivered CIF (cost, insurance, and freight) price of imported product.

In the latter case, the marginal cost of supply will be the marginal cost of domestic production, including return on investment-as long as the refining sector has not created excess capacity by overinvesting. If the industry overinvests in new capacity as it often does, only part of the marginal cost of production-the direct costs, but not a return on investment-would be embodied in market prices.

References

- "US Petroleum Refining: Assuring the Adequacy and Affordability of Cleaner Fuels," National Petroleum Council, June 2000.

- "Costs of Meeting 40 ppm Sulfur Content Standard for Gasoline in PADDs 1-3, via Mobil and CDTech Desulfurization Processes," report to the API by MathPro Inc., Feb. 26, 1999.

- "Regulatory Impact Analysis: Tier 2/Gasoline Sulfur Regulations," EPA420-R-99-023, December 1999.

- "Setting a Level for Sulphur in Gasoline and Diesel Fuel, Final Report of the Government Working Group on Sulphur in Gasoline and Diesel Fuel," Environment Canada, July 14, 1998.

- "Modeling Impacts of Reformulated Diesel Fuel: 2006 Cases," report to US Department of Energy by EnSys Energy & Systems Inc., June 2000.

- "An Assessment of the Potential Impacts of Proposed Environmental Regulations on US Refinery Supply of Diesel Fuel," report to API by Charles River Associates and Baker & O'Brien Inc., CRA No. D02316-00, August 2000.

- "Refining Economics of Diesel Fuel Sulfur Standards: Supplemental Analysis of 15 ppm Sulfur Cap," report to Engine Manufacturers Association by MathPro Inc., Aug. 16, 2000.

- Hirshfeld, D.S., and Kolb, J.A., "Refining Economics of Producing Federal and California RFG Without MTBE," presentation at DeWitt Global Conference on MTBE/Oxygenates and Methanol by MathPro Inc., Oct. 18, 2000.

- "Regulatory Impact Analysis: Heavy Duty Engine and Vehicle Standards and Highway Diesel Fuel Sulfur Control Requirements," EPA420-R-00-26, December 2000.

- McNutt, Barry D., "No Free Lunch-Understanding ALL Impacts of an MTBE Ban," presentation at Intertech Clean Fuels 2001 Conference by U.S. Department of Energy, Jan. 30, 2001.

The authors

David S. Hirshfeld is president of MathPro Inc. His areas of expertise are refining economics and technology, energy planning and policy analysis, and optimization modeling. His previous experience includes work at Sobotka & Co. Inc., US Synthetic Fuels Corp., Management Science Systems Inc., Orchard-Hays and Co., and Esso (now ExxonMobil) Research and Engineering. Hirshfeld holds a BS in chemical engineering from Rensselaer Polytechnic Institute, Troy, NY, an MS in chemical engineering from the University of Delaware, Newark, Del., and an MS in mathematics from Stevens Institute of Technology, Hoboken, NJ.

Jeffrey A. Kolb is a principal at MathPro Inc. His areas of expertise are refining economics, regulatory economics, and microeconomic analyses. His previous experience includes work at National Economic Research Associates, the EPA, and Sobotka & Co. Inc.Kolb holds a BS in economics from the University of Wisconsin, Madison, and a PhD in economics from the University of Oregon, Eugene.