U.S. INTERSTATE PIPELINES RAN MORE EFFICIENTLY IN 1994

Construction progresses on a 4-mile lateral for Algonquin Gas Transportation Co. near the Sagamore bridge at the Cape Cod Canal. The 18-in. line will deliver 75 MMcfd to the Canal Electric plant, Sandwich, Mass., later next year. (Photograph courtesy Panhandle Eastern Corp., Houston; ©Michael Hart 1995)

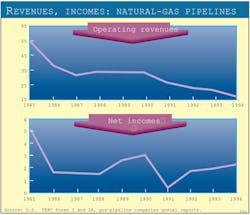

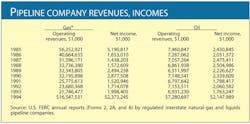

Regulated U.S. interstate pipelines began 1995 under the momentum of impressive efficiency improvements in 1994. Annual reports filed with the U.S. Federal Energy Regulatory Commission (FERC) show that both natural-gas and petroleum liquids pipeline companies increased their net incomes last year despite declining operating revenues (Fig. 1).

And the ongoing shift of natural-gas pipelines to transportation providers was also evident last year as volumes of gas moved for others jumped while volumes sold fell. Liquids pipelines moved nearly the same number of barrels in 1994 as a year earlier but showed a marked jump in barrel-miles, which indicates their improved efficiencies.

Revenues and incomes earned from operations along with volumes moved are among the data annually submitted to FERC and tracked by Oil & Gas Journal year to year in this exclusive report.

Other FERC documents, applications for new gas-pipeline construction filed for a 12-month period ending June 30, showed evidence of a slowdown in U.S. pipeline construction, a trend this report has noted for the last 2 years.

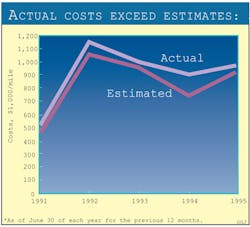

And what natural-gas pipelines actually spend to modify or expand their systems has been running ahead of what they estimated in initial applications to FERC. This trend is evident from companies' final-cost filings with FERC.

U.S. INTERSTATE NETWORK

Revenue, income, and volumes are only part of the data found in the pipeline-company tables at the end of this report.

Included are pipeline mileage operated, crude oil and refined-products delivered, natural-gas sold or moved for other companies, investments and changes made in pipeline carrier prop- erty, and operating revenues and net incomes earned.

With the Pipeline Economics Report for 1987 (OGJ, Nov. 28, 1988, p. 33), the Journal began tracking volumes of gas transported for others by major interstate pipeline systems.

These data have provided a method of keeping track of the changing U.S. gas-transmission industry.

PIPELINE MILEAGE

Comparing any years of U.S. petroleum and natural-gas pipeline mileage must be done carefully because the number of companies required to file reports with the FERC varies each year.

And such comparisons were further complicated for several years after 1984 when FERC instituted a two-tier classification system for companies (OGJ, Nov. 25, 1985, p. 55).

Definitions of the categories can be found at the end of the table "Gas pipelines" (p. 56) and in FERC Accounting and Reporting Requirements for Natural Gas Companies, pard. 20.011.

Only major gas pipelines (about one third of all reporting) are required to file mileage operated in a given year. So-called "non-major" companies may indicate mileage operated, but the information is not asked for specifically.

For 1984 and several years following, many non-majors did not describe their systems. But in recent years most have been providing such descriptions, including mileage operated.

Therefore, this year's report will dispense with the complicated analysis of what majors operated vs. what non-majors reported to have operated.

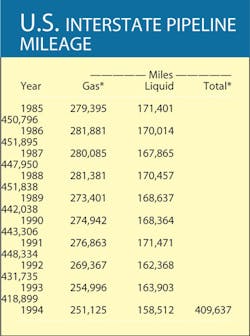

Pipelines operated in 1994 by FERC-regulated natural-gas pipeline companies and by regulated petroleum liquids pipeline companies added to nearly 410,000 miles. This represents a slight decline from the previous year of more than 9,000 miles, or -2.2% (Table 1).

All pipeline mileage operated to move natural gas in interstate service declined nearly 4,000 miles (-1.5%); mileage used in deliveries of petroleum liquids in common-carrier service fell more than 5,000 miles (-2.3%).

Transmission pipeline mileage also remained essentially flat from 1993 to 1994, falling less than 1%. Transmission mileage made up 77.5% of all natural-gas mileage reported to FERC.

Whether FERC designates a liquids pipeline company an interstate com-mon-carrier pipeline determines whether the company must file a FERC annual report (Form 6).

These reports for 1994 show that gathering mileage increased more than 4.6% to top 30,000 miles operated; crude oil lines fell more than 3,000 miles (-6%); and product mileage fell, also by more than 3,000 miles (-4.2%). More than 128,000 miles of crude oil and product trunk lines were in service during 1994, representing more than 80% of all liquids mileage operated.

These figures continue the erratic pattern of liquids- pipeline utilization for the past 10 years (Table 1).

DELIVERIES

The historic shift of natural-gas trails-mission companies- from being primarily merchants of gas in the early 1980s to being mainly transporters of gas today-is nearly complete.

Last year, 10 years after the FERC order that began the shift, natural-gas pipelines moved more than 30 tcf of other companies' gas and sold only 1.67 tcf of gas from their own systems. The gas transported for a fee represented an increase of more than 22% over volumes moved in 1993; tile gas sold, a nearly 50% drop over volumes sold a year earlier.

Throughput for liquids-pipelines companies in 1994 was fiat when compared to 1993, falling by slightly more than 60,000 bbl (-0.5%) to about 12.15 billion bbl. Crude-oil shipments (more than 55% of total liquids movements) increased by nearly 77,000 bbl; product shipments fell by more than 137,000 bbl (-2.5%).

Trunkline traffic for U.S. crude-oil and product pipelines, however, showed a marked increase compared with 1993. This measure of system utilization-1 bbl moving 1 mile-rose by nearly 17% entirely the result of a more than 33% jump in crude-oil traffic.

Product traffic increased by nearly 3% compared to 1993.

TOP 10 COMPANIES

Oil & Gas Journal ranks the top 10 pipeline companies in three categories (mileage utilized, trunkline traffic [bbl-mile], and operating income) for oil-pipeline companies and four categories (mileage, gas sales, gas transported for others, and operating net income) for natural-gas pipeline companies.

These rankings are broken out from the pipeline-company tables and can be seen in the accompanying tables.

For all natural-gas pipeline companies, net income as a portion of gas-plant investment increased for the third year in a row and the sixth time in 7 years.

The term "gas plant" refers to the physical facilities used to move natural gas-compressors, metering stations, and pipelines.

Net income as a portion of gas-plant investment in 1994 was 4.2%, and has been rising steadily since 1991. Ill 1993, the portion was 3.6%; 3.1% for 1992; and 0.5% for 1991.

This indicator of companies' returns on investments stood at 8.7% in 1984, the year the FERC began (with Order 436) its restructuring of the interstate gas-pipeline industry that culminated in 1992 with Order 636.

Beginning with 1985, net income as a portion of gas-plant investment fell precipitously through 1987 then began its gradual comeback.

For 1994, all gas-pipeline companies reported an industry, gas-plant investment totaling more than $57 billion compared with slightly more than $55.6 billion for 1993 and $55.5 billion for 1992.

For interstate common-carrier liquids pipeline companies ill 1994, net income as a percentage of investment in carrier property rose to 8.2% compared to 5.5% for 1993, 7.6% in 1992, 6.6% in 1991, and 9% in both 1990 and 1989.

Actual investment in carrier property fell slightly by more than 2.7% in 1994 after rising nearly 16.7% in 1993. The 1994 movement was the first decline in 3 years.

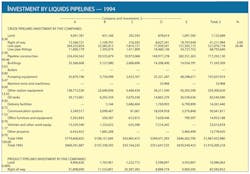

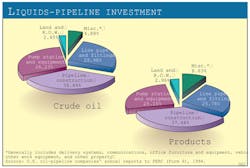

In this annual report, Oil & Gas Journal has for several years been tracking carrier-property investment by five crude-oil pipeline companies and five products-pipeline companies.

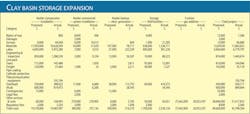

Table 2 indicates that investment by the five crude-oil pipelines stood at $1.9'7 billion at the end of 1994 compared with $1.91 billion at the end of 1993, $1.87 billion for 1992, and $1.89 billion for 1991.

Investment by the five product pipeline companies in 1994 was $3.3 billion, compared with $3.2 billion in 1993, $3.1 billion for 1992, and $3.07 for 1991.

Fig. 2 illustrates the investment split in the crude-oil and products pipeline companies.

Another measure of the profitability of oil and natural-gas pipeline companies in recent years is the portion net income represents of operating income (Table 3).

Through 1987, trends for liquids-pipeline companies and for natural-gas pipeline companies had been heading in opposite directions for 10 years.

For liquids-pipeline companies in 1994, income as a portion of operating revenues was 29.5%, up from 25.4% in 1993, 28.8% for 1992, and 26.3% for 1991. In 1989, this figure was 34.2%.

Income as a portion of revenues for all natural-gas companies was 14.3% in 1994, up from 9.1% in 1993.

CONSTRUCTION ACTIVITY

Regulated interstate gas-pipeline companies must apply to FERC for approval for any modification or expansion of transmission facilities in interstate service. Except under special circumstances, those applications must contain estimates of what such modifications will cost.

A tracking year-to-year of the mileage and compression horsepower applied for and of the estimated costs indicates future construction activity. That% exactly what Oil & Gas Journal has been doing in this report since its inception nearly 30 years ago (OGJ, Nov. 21, 1994, p. 19).

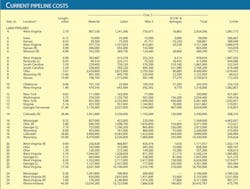

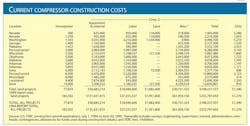

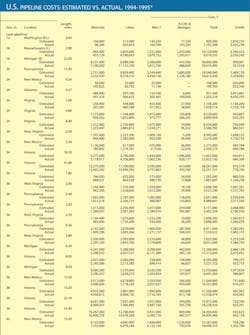

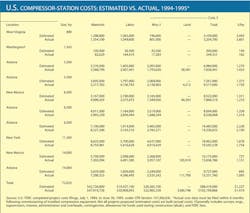

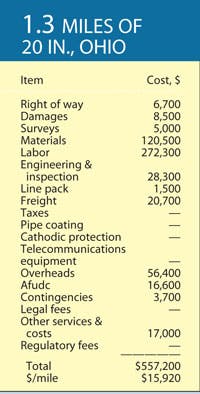

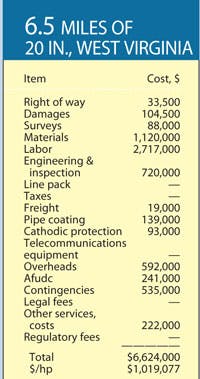

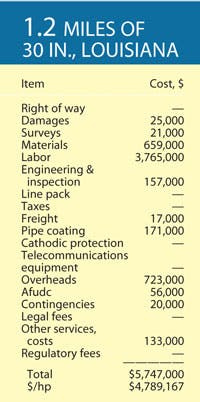

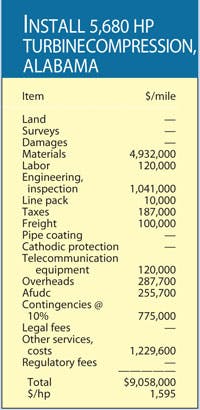

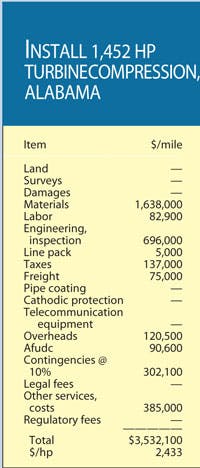

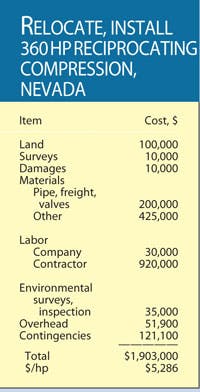

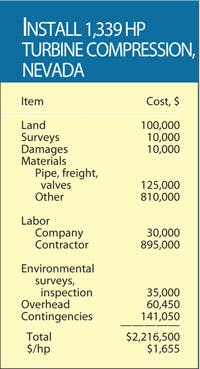

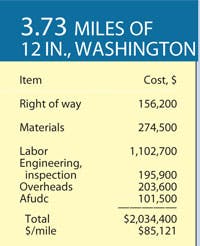

What companies estimated during the 1994-95 period it will cost to construct pipelines or compressor stations is bro-ken out in Tables 4 and 5.

Those tables cover a variety of locations, pipeline sizes, and compressor horsepower ratings. For 1994, no project was filed with the FERC for a compressor station in federal waters.

For any period, not all projects that are proposed are approved; not all approved ones are eventually built.

Based on filings during the 12 months ending June 30, 1995, the immediate future of gas-pipeline construction on U.S. interstate systems looks sparse:

- 725 miles of land pipeline were proposed compared to more than 1,233 miles for the 12 months before June 30, 1994 (Table 4).

- Nearly 78,000 hp of new or additional compression were applied for; compared to more than 183,000 for the year before (Table 5).

Table 4 lists 66 land-pipeline construction projects and 3 marine projects. This compares with 77 land and no marine projects in the 1994 Pipeline Economics Report (Nov. 21, 1994, p. 41) and 88 land and 1 marine project in the 1993 report.

For the 12 months ending June 30, the 66 land projects proposed to FERC amounted to a total cost of more than $472 million. The 3 marine projects (5 miles) were estimated to cost $2.7 million. Total construction proposed July 1994-June 1995 was nearly 730 miles for more than $475 million.

In 1994, more than 1,230 miles of land and marine pipeline carried an estimated price tag of almost $801 million.

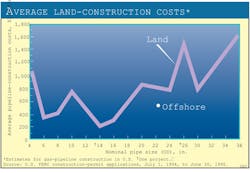

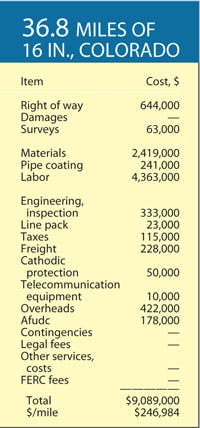

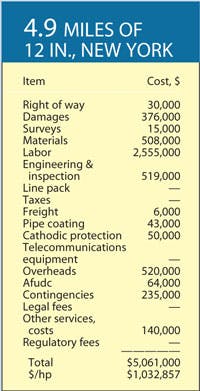

Cost-per-mile figures may reveal more about cost trends than aggregate costs.

For proposed U.S. gas-pipeline projects in the 1994-95 period surveyed, the average land cost per mile was more than $650,000/mile, compared with slightly less than this amount for the 1993-94 period.

No marine projects were proposed to the FERC between July 1, 1993, and June 30, 1994. For the more recent 12-month period, the 5 miles of planned offshore pipeline amounted to an average cost of nearly $550 million.

Cost trends

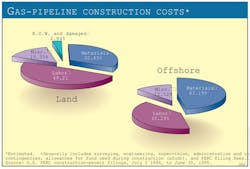

Analyses of the four major categories of pipeline construction costs-material, labor, miscellaneous, and right-of- way (R.O.W.)-can also indicate trends within each group.

Material costs include those for line pipe and pipe coating.

"Miscellaneous" costs generally cover surveying, engineering, supervision, contingencies, allowances for funds used during construction (afudc), administration and overheads, and FERC filing fees.

R.O.W. costs include obtaining fights-of-way and allowing for damages.

For the 66 land and 3 offshore projects surveyed for the 1994-95 period covered in this report, costs-per-mile for the four categories were as follows:

- Material - $213,148/mile

- Labor - $320,277/mile

- Miscellaneous - $599,762/mile

- R.O.W. and damages - $18,401/mile.

Table 4 lists proposed pipelines in order of increasing size (OD) and increasing lengths within each size.

The average cost per mile for the projects shows few clear- cut trends related to either length or geographic area.

In general, however, the cost per mile within a given diameter indicates that the longer the pipeline, the lower the incremental cost for construction. And broadly, lines built nearer populated areas tend to have higher unit (per-mile) costs.

Additionally, road, highway, river, or channel crossings and marshy or rocky terrain each strongly affects pipeline con- struction costs.

Fig. 3, derived from Table 4, shows the major cost-component split for land and offshore pipeline construction costs.

Material and labor for constructing land pipelines make up more than 80% of the cost. For offshore projects, material and labor make up nearly 87.5%.

Fig. 4 plots the average pipeline construction cost for land and offshore gas-pipeline construction projects listed in Table 4.

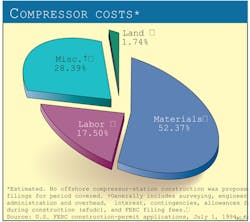

Fig. 5 shows the cost split for land compressor stations based on data in Table 5.

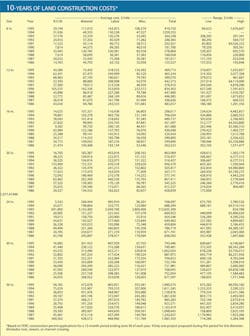

Table 6 lists 10 years of S/mile land-construction costs for natural-gas pipelines with diameters ranging from 8 to 36 in. The table's data consist of estimated costs filed under CP dockets with the FERC, the same data that are shown in Tables 4 and 5.

The average cost per mile for any given diameter, Table 6 shows, may fluctuate from one year to another as projects' costs are affected by geographic locations, terrains, population densities, or other factors.

Costs-per-mile from 1993 to 1994 are mixed with generally higher estimates for labor and, to a lesser extent, for materials.

Yearly fluctuations in these figures are illustrated in construction figures for a l 2-in. pipeline.

These had dropped by more than 30% 1986 to 1987, jumped by more than 47% in 1988, fell again in 1989, leapt by more than 86% in 1990 only to fall sharply in 1991.

WHAT WAS SPENT

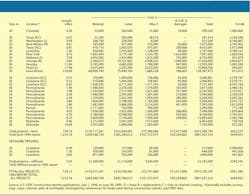

Actual costs for a project which is approved and built must be filed with FERC within 6 months after the pipeline's successful hydrostatic testing or the compressor's being placed in service.

Fig. 6 shows 5 years of estimated vs. actual costs on cost- per-mile bases for project totals.

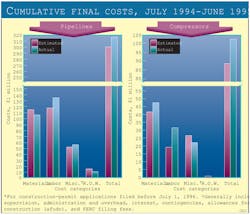

Tables 7 and 8 show such actual costs for pipeline and compressor-station projects reported to the FERC during the 12 months ending June 30, 1995. Fig. 7, for the same period, depicts how total actual costs for each category compared to estimated costs.

Some of these projects may have been proposed and even approved much earlier than the 1-year survey period. Others may have been filed for, approved, and built during the survey period.

And in its initial filing, each pipeline project may have been reported in construction "spreads," or mileage segments, which is how projects are broken out in Table 4.

Completed-projects' cost data, however, are usually reported to the FERC for an entire filing, separating only pipeline from compressor-station (or metering site) costs.

Overall, actual pipeline-construction costs exceeded anticipated ones by nearly $15.6 million (5.3%).

This was due to actual labor costs exceeding estimates by nearly $19.5 million. Miscellaneous actual costs exceeded estimates by more than $6 million.

Costs for right-of-way and damages came in less than estimated by more than $2.3 million. Actual costs for materials were less than estimated: by almost $7.5 million.

Actual unit costs (S/mile) were more than 5% over estimates, exceeding them by more than $48,500/mile.

Table 8 shows that actual costs for installing compression exceeded estimates by more than $13.8 million, nearly 15.6% more.

Labor costs accounted for much of the difference, exceeding estimates by nearly $11.5 million. Actual material costs were nearly $5.2 million over estimates.

Estimated costs for miscellaneous items were greater than actual costs by more than $3 million.

A Look At Various Projects

Copyright 1995 Oil & Gas Journal. All Rights Reserved.