POLITICS HAS STRONG SAY IN WHO BENEFITS FROM OIL

Bob Tippee

Managing Editor-Economics and ExplorationRobert J. Beck

Economics Editor

Value, though, means something beyond price. Economic values ultimately must benefit someone. In a market that gushes price data, it's much easier to measure oil values than it is to determine who benefits from them.

NEW VALUE GAUGES

The price window on values opened wide in the past decade. Until the early 1980s, spot prices provided the best clues about the worth of crude oil and refined products. But spot prices represented volumes traded at the market's margins, mainly to balance supplies. Most oil by far changed hands under long term contracts at fixed prices. The contracts assured continuity of supply and predictability of price but gave buyers and sellers little ability to respond to market changes.

Those days-and those rigidities-began to change when prices turned volatile and financial tools emerged to satisfy traders' needs for flexibility. Now the long term hedge has replaced the long term contract as the main defense against costly surprises from future price moves. And the derivative financial instruments central to the long term hedge futures, options, swaps, and the like-not only enable buyers and sellers of oil to stabilize and manage risk but also provide comprehensive ways of assessing a market in which price volatility is the norm.

Derivatives generate price information in unprecedented amounts. This is what makes oil values so much easier than they were before to assess. Price data are now accessible for broadly traded crudes and petroleum products in all key trading centers. And commodity exchanges spew price data transaction-by-transaction for futures contracts, which serve as proxies for cash market values of underlying crudes and products.

With so much price information so easily available, traders and analysts can tailor values to specific points in the market. Wholesale product prices and a few assumptions about refining yields can show what the average product barrel is worth in a specific area. A comparison of that value with crude costs shows values added through refining. That margin net of operating costs provides a gross indicator of refining profitability, which affects values of both crude and products over time.

Such calculations relate values to specific points in the market. They help answer questions like these: Given conditions in the product markets, what's a barrel of crude worth to refiners? If refining profitability is on the rise, should producers be seeking higher prices for crude? Is the market fairly balanced, with crude and product values moving in roughly the same direction, or heading for some correction, with crude and product price movements at odds with one another?

However well the new financial tools answer questions about oil values themselves, they provide little help with a question as old as petroleum commerce itself: To whose benefit do those oil values accrue?

WHERE VALUES FLOW

Oil values flow in many directions, not least of which are the uses to which products are put by consumers. Energy, after all, is an essential economic input, and oil is one of its most convenient forms. Consumers derive value from consuming energy, which is why they exchange money for it. This seems too basic to mention yet often is forgotten in policy debates.

Oil values also flow to resource owners, which may be governments or private entities with rights to develop the resource if not to own it outright, and to taxing authorities, which are always governments. Consumers, resource owners, and governments thus make the ultimate claims on oil values. Processors-such as refiners and petrochemical manufacturers-and transporters add value and are indispensable but represent intermediate claims.

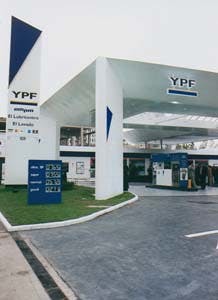

The three ultimate claims on oil values in this context-the owners of resources or the rights to them, consumers, and governments-can and do overlap. Governments often own petroleum resources and tax product consumption as well. Private companies that own resources-or rights to develop resources-also consume energy. Many governments that own petroleum resources and wield power to tax consumption may also own the companies that produce and refine crude and sell products at retail. Governments that don't own resources, or that own them but readily make exploration and production rights available to private companies, usually extract value at both the resource and consumption ends of the market (Fig. 1)(35792 bytes).

The central tension among all these claims on value occurs between governments and private entities, including individual consumers. This special report examines recent trends affecting that tension in three areas:

- The apportionment of values generated by exploration and production activities, represented by the government "take." This claim on oil values varies from country to country. But the global trend is down.

- Values enjoyed by consumers in excess of some measure of oil's normal value as an energy source. Such values result from retail prices deliberately held low by government action-including subsidies of one form or another. Defining and measuring subsidies is tricky business. The governments of countries with official prices significantly below approximate market levels often deny that the disparity results from subsidies. In any case, prices are rising in key areas where they have traditionally been held low.

- Values claimed by governments through consumption taxes, the opposite of subsidies unless the tax applies to an official price held low relative to market levels. When taxes apply to prices free to respond to market forces, consumers bear extra cost and thus are denied full economic value of oil as an energy source. The trend in consumption taxes, like the trend in officially set product prices, is up.

By these measures, a rough pattern takes shape. At the resource end of the market, government takes have declined as countries compete for private exploration and production capital. At the finished-product end of the market, some governments are increasing their claims to value by raising official prices-usually charged, in these cases, by state-owned refiners and marketers-toward market levels, while others are increasing taxes on consumption.

All these trends affect supply of and demand for oil. And what affects those market forces ultimately affects the value of oil itself.

GOVERNMENT TAKE UPSTREAM

The trend toward lower government takes upstream grows out of increasing recognition around the world of oil's potential contributions to economic development. Like any natural resource, petroleum represents potential wealth. Realization of that wealth requires investment of capital, which tends to be scarce in the developing countries that hold most of the world's underexplored and underdeveloped resources of oil and gas.

Private companies have the capital that developing countries need. They also have been discouraged from investing in some of their traditional exploratory theaters, such as the U.S. So there's a supply of capital seeking opportunity and a body of opportunity-rights to explore and develop resources in developing countries-seeking capital. There also are developed countries with mature oil and gas fields that have reduced takes to make marginal prospects attractive and keep mobile capital from moving abroad.

Two recent studies note a decline in government takes, a trend that indicates demand for capital exceeds supply-or at least private companies' demand for E&P opportunities, which determines the supply of capital.

Petroconsultants, Geneva, says in an annual review of fiscal systems released in February that, since publication of the review's first edition in 1994, "a number of countries have made their terms more attractive." The review looks at how 101 fiscal systems in use around the world affect 54 hypothetical oil field development projects. It divides the projects into three categories of gross project net present value (NPV) calculated with a 15% discount rate: $0-2.20/bbl for what it calls marginal fields, $2.30-4.10/bbl for economic fields, and $4.20-9.60/bbl for upside fields.

In each category, the review calculates a "state take"-the government's total cash flow, including direct state participation, expressed as a percentage of the undiscounted gross project cash flow. The undiscounted gross project cash flow represents gross revenue less gross costs,

In a ranking of fiscal regimes assessed in this way, the U.K. stands out as a traditional producer that has improved terms to support economics as the region matures, Petroconsultants says. The U.K.'s state take comes in second to that of less-prospective Ireland. As Calculated by Petroconsultants, countries that rank near the bottom of the fiscal term comparison claim nearly all the economic rent-wealth realized from natural resources-generated by development of marginal fields and nearly 90% of the rent from upside fields (Table 1)(26498 bytes).

"During 1994 a changing perception of the balance of risks and potential rewards prompted a number of countries to alter existing terms in an attempt to redress the balance," Petroconsultants says. For example, Albania and Yemen increased cost recovery ceilings and profit shares available to investors, while Angola, Gabon, Indonesia, Malaysia, and Nigeria offered "frontier terms"-or improvements in terms for high-risk prospects. These efforts appear in a lowering of the state take in the study's marginal field category relative to takes in other categories (Table 2)(20416 bytes). Nigeria's top ranking in the frontier-terms list results from its reducing the state take from projects in very deep water.

Petroconsultants points out, however, that as exploratory activity increases and succeeds, governments sometimes raise their claims on consequent oil values. It cites Colombia, which raised the state take from fields discovered under new contracts from its level under contracts already in effect.

"Not surprisingly, such moves provoked a hostile reaction from the industry, and Colombia is understood to be revising its terms as a result," Petroconsultants said.

New Zealand has rearranged its claims on resource values in such a manner that the state take decreases for some projects and rises for others. The country removed direct state participation in upstream projects and lowered the government's royalty to 5% of gross revenues but added a hybrid royalty of 20% of net profits, which takes effect when the hybrid royalty exceeds the gross revenues levy. So the state, Petroconsultants says, takes less than it did before from very marginal developments but more from economically stronger projects.

"Most of the world's fiscal regimes continue to be regressive and have the potential to deter development of more marginal discoveries," Petroconsultants says, "notably under systems which contain high royalty rates and/or low cost recovery ceilings, such as Egypt and Syria. Systems which allow rapid cost recovery and then increase the state take are progressive but are relatively rare." The study concludes that fiscal regimes in Equatorial Guinea and South Africa and hybrid royalty regimes in Canada for frontier lands "are among the most progressive in the world."

Hybrid royalty schemes, the study says, can help balance the interests of government resource owners and private producers, especially early in the lives of oil and gas development projects, and keep claims to oil values equitable. Hybrid schemes can be designed to assure governments of some revenues during early years of production, when private companies are recovering their costs, and of greater revenues once cost recovery is complete. This makes royalty systems progressive and responds to industry demands for flexibility.

DECADE-LONG TREND

The 12 month declines in state takes noted by Petroconsultants make up part of a trend that has lasted at least a decade. Van Meurs & Associates Ltd., Calgary, in a study supported by the World Bank and available from Barrows Inc., New York, examines 226 fiscal systems in 144 countries and reports that 130 systems were changed during the last decade. In almost all cases, it says, the changes reduced government takes.

The reductions came about as the supply of exploration acreage available to private companies increased, competing for a supply of capital that remained relatively fixed. Areas in which new exploratory acreage became available during the period make an impressive list: the former Soviet Union, Eastern Europe, onshore China, Viet Nam, Cuba, Myanmar, Yemen, and Venezuela. Other countries, such as Argentina and Peru, accelerated their acreage offerings. In all, Van Meurs says, the acreage available for exploration by private companies almost doubled during the last 10 years.

During the same period, the amount of capital available for exploration declined due to falling oil prices and industry cash flows. That reduction effectively reduced demand and thus the "price"-represented by the overall government take-for rights to explore for and produce from reserves. The decline in government take continues, Van Meurs says, as governments struggle to understand that they are in competition with one another for exploration and development capital.

The firm's study rates fiscal systems rather than countries because some countries have several systems each. It bases ratings on economic analyses of standard oil fields-with reserves of 3 million-300 million bbl-assuming the same prices and costs around the world. The fields involve relatively low costs. Sliding scale profitability factors in some fiscal systems, Van Meurs explains, make it necessary to focus on fields that are relatively profitable prior to any government take.

The study ranks fiscal systems in five categories according to attractiveness to investors. Ranking in the top category-the one most attractive to investors-are Ireland, Spain, the U.K., Argentina, New Zealand, Pakistan (Zone 1), and Denmark (fourth round). The bottom category includes Louisiana, Russia (production sharing contract), Venezuela (new model contract), Indonesia (1994 terms), Malaysia (conventional), Angola, Nigeria (Niger Delta), Syria, and Yemen-1.

APPORTIONING VALUES

Important here are not the rankings so much as the analysis and what it says about how governments are apportioning values from petroleum resources and the rights to explore and produce oil from them.

Governments extract wealth in a variety of ways from the resources they own and allow others to explore and develop. In general, the old concession system, in which governments granted companies equity interests in petroleum resources and recovered value through royalties and taxes, has given way to production sharing and other contract systems. Within these categories, many variations are possible. How the variations interact can have great effect on the values ultimately divided between the host government and private company.

A country offering production-sharing terms, for example, might offer a generous production split but detract from overall value to the company with strict cost-recovery terms or high production taxes-or both. The often-complex interplay of terms within a single fiscal regime can make comparisons among regimes difficult. That's why analyses like those of Petroconsultants and Van Meurs calculate government takes. The measurement offers a common basis for comparison of like developments under differing regimes.

Criteria used in the Van Meurs rankings highlight the key factors for assessing takes from the investor's point of view. The study measures fiscal systems against six standards on what it calls a stand-alone basis and two other standards on an incremental basis. It applies four of the standalone standards to six onshore and six offshore fields to show how fiscal systems affect a wide distribution of fields. Those standards include net present value per barrel calculated at a discount rate of 15%, rate of return, and undiscounted government take.

The fourth standard applied in this way is maximum sustainable risk, a ratio that indicates the number of exploration programs that can be paid from the cash flow of one discovery. Van Meurs says the standard indicates the attractiveness of exploration, measuring the maximum geological risk that can be sustained against a particular prospect. Maximum sustainable risk suffers from signature bonuses, rentals, and other payments made during exploration.

One of the two stand-alone standards not applied to a mixture of fields is what Van Meurs calls "bonanza economics"-terms applicable to a 300 million bbl field, which are important to attractiveness of a fiscal regime. The other stand-alone standard is front-end loading, which Van Meurs measures as the government take during the first 6 years of production.

The incremental standards evaluate costs to a company of making new investments in a country in which it already has operations. Some fiscal systems have provisions encouraging such reinvestment in a country or contract area, and some do not. Van Meurs accounted for the presence or absence of such incentives with standards assessing an incremental investment in exploration and an incremental investment in further development wells.

FINDINGS

Competition for resource exploration and development rights does exist, Van Meurs notes, with countries of low prospectivity, high costs, and low wellhead prices generally offering the best terms and those with better geological and economic conditions offering terms less favorable to companies. But the correlation between fiscal terms and geologic and economic conditions applies better on a regional basis than it does globally.

Governments, the study notes, establish terms for private companies mainly in reference to regional, rather than global conditions. Especially in small countries, governments often are more familiar with terms offered by neighbors than with those by governments of distant countries with comparable operating conditions. And governments often feel political pressure not to severely undercut terms offered by neighbors. Countries and regions thus tend to be competitive regionally but not globally. North America is an important example.

The Van Meurs study includes a world average fiscal system calculated as the arithmetic average of all 226 fiscal systems it examined. The average is regressive for small fields; that is, the government take in percentage terms is greater on small and economically marginal fields than it is on large, profitable developments. This amounts to an overall disincentive to develop small fields-or large but costly ones-and parallels the finding of general regressivity in the Petroconsultants study.

The Van Meurs average also shows significant front-end loading. The government take from a standard, 30 million bbl field during the first 6 years of production is 68% in the average fiscal system; in the remainder of the life of production it is 61%.

These features of the average fiscal system-regressivity and front-end loading-suggest ways governments can improve terms as worldwide competition for exploration capital intensifies: They can counter the trend by improving terms for marginal prospects relative to others and by not claiming value from production until companies have recovered costs,

Inevitably, the competition will play out on the basis of government take as a claim against oil values available to companies, which will always weigh those values against prospectivity and costs of the acreage on offer.

SUPPRESSING PRICES

For countries rich in resources, pressures are always high to make oil available to domestic consumers at prices that are, by international standards, low. Opinions vary as to when such practices become outright subsidies. The issue is not just rhetorical: The application of subsidies can hamper developing countries' efforts to borrow money from international lending agencies, which frown on the practice.

To some analysts, any government intrusion that holds prices below levels that would prevail if the market were setting them amounts to a subsidy. By this standard, the U.S. subsidized natural gas in interstate commerce until the Wellhead Decontrol Act of 1989. According to another view, a subsidy exists when the official domestic price for a tradable commodity falls below its international price, the difference between the domestic and export prices being what economists call an opportunity cost. If the commodity cannot be traded, due either to market conditions or lack of export facilities, the subsidization threshold becomes the long term cost of producing the last units needed to satisfy demand-the marginal cost.

Subsidies, of course, constitute an offense to free market economics. But there are sometimes compelling practical reasons for them to exist. In developing countries with unsophisticated financial mechanisms, subsidies of petroleum products can be the best available means of distributing wealth from resource development.

Furthermore, the opportunity costs of subsidies are not always as high as they might initially appear to be in countries that export oil but possess untapped capacity to produce. In a 1994 study for the OPEC Fund for International Development, Adam Seymour and Robert Mabro of the Oxford Institute for Energy Studies use the example of a country with a reserves life of 100 years and negligible production costs-the case in several members of the Organization of Petroleum Exporting Countries: "For this country the foregone value of selling domestically an additional barrel of oil today is the future export price of that barrel discounted over 100 years. Any price discounted over that period of time is effectively nought. The incremental barrel in that country may therefore be sold at a price equivalent to the costs of production as there is virtually no other opportunity cost."

Especially when access to international financing is at stake, it is little wonder that suggestions of oil product subsidization become controversial. The fact remains that in many countries where governments substitute themselves for market forces, product prices are low by any measure.

Governments suppress consumer prices in two overt ways. Where they own crude oil, they can charge refineries-which they also usually own-little or nothing for feedstock. Most economists would say that in these cases retail prices should at least recover refining costs plus whatever feedstock costs are assumed to have transferred from the point of production to the point of processing. Whether opportunity costs get lost in this analysis depends on whether the crude refined and sold cheap domestically displaced volumes that otherwise could have been exported at a higher price. If the oil could have been exported rather than refined and sold domestically, opportunity cost exists and must be reflected in the retail price.

The other overt way governments suppress consumer prices is by simply setting them where they want them to be without regard to feedstock and refining costs. It happens, usually with disastrous results for domestic refining industries.

There are less overt methods of subsidization as well. Governments can manipulate currency values and taxation schemes in ways that hold product prices below market levels. In practice, crafty governments use such covert methods less to subsidize consumption than to offset the costs of overt favors to consumers.

POLITICAL DIMENSION

Whether or not they fit a technical description of subsidization, government efforts to hold oil prices below market levels eventually-if not from the very start-sacrifice economics to politics. Corrections become inevitable unless costs of production can somehow be immunized against market pressures.

That's seldom possible. For a state-owned oil industry in a country dependent upon revenues from oil exports-the type of country most given to domestic product subsidies-production costs effectively include the costs of running the government and providing social benefits. As soon as the government borrows money from abroad, market pressures intrude, however indirectly. Domestic practices that detract from a country's international ability to compete in commodity trade, or that sap the finances of economically crucial state-owned oil companies, also hurt credit-worthiness. By the time the government faces up to the need for higher domestic product prices, however, citizens usually see low prices as a native right.

Venezuela fell victim to this squeeze in the late 1980s. Having borrowed heavily as falling crude prices ravaged revenues from crude oil exports, the government in 1989 nearly doubled domestic gasoline prices in an effort to revive finances of heavily taxed Petroleos de Venezuela SA. When Pdvsa posted prices equivalent to 26/gal for gasoline, taxi drivers and other motorists rioted.

More recently, Mexico stepped onto the political minefield of gasoline pricing with see-saw efforts to adapt product tags to the peso devaluation of late last year. State-owned Petroleos Mexicanos had been setting gasoline prices in line with those in the U.S. In the economic turmoil that followed the currency action, however, the government made Pemex hold gasoline prices below U.S. levels and use an exchange rate that made the product even cheaper in dollar terms. In January, Pemex raised prices along the U.S. border in an effort to discourage U.S. motorists from buying gasoline cheap at its expense. Within 2 days, political pressures forced it to roll back much of the increase.

The struggle didn't end there. Last month, the government announced a controversial austerity program that included an immediate gasoline price hike of 35%, to be followed by further increases of 0.8%/month.

The lesson is obvious: Governments that control retail oil prices sooner or later find themselves caught between the economic necessity to raise prices and political resistance that, if not handled carefully, can turn violent.

OPEC FEELS SQUEEZE

These pressures are increasingly common among members of OPEC, which have had to learn to live with crude oil prices and export revenues that no longer follow the long term upward tendencies once taken for granted (Table 3)(28489 bytes). Especially in the Persian Gulf region, countries that began ambitious development programs in the 1970s, financing them with cash flows from oil exports, have drained their financial reserves and borrowed internationally to keep programs in place.

One of those programs, of course, has been the sharing of national petroleum wealth by way of low product prices at the retail level. Last year, gasoline prices in key OPEC members of the Middle East were a fraction of those in members of the Organization for Economic Cooperation and Development, all of which tax consumption to varying degrees (Table 4)(15501 bytes). In Iran and Iraq, high inflation rates have lowered real prices even further this year. The tide, however, is reversing as governments deal with budget deficits, credit limits, and crude prices that show no sign of rising much anytime soon.

"Historically, prices (in the Middle East) have been very low," notes Michael Williams, an analyst with the International Energy Agency, Paris. "Starting this year there's been a move afoot to increase domestic prices for energy. Governments are either increasing prices or examining the possibility of increasing energy prices."

Saudi Arabia in January issued a decree raising domestic prices by 82% for gasoline, 150% for kerosene, 250% for diesel fuel, and 350% for gas oil. The kingdom also changed the pricing structure for electricity, about doubling charges for large users but leaving costs to households little different.

In Iran, the petroleum ministry proposed, and the prime minister agreed, to double domestic prices of refined products effective Mar. 21. At last report, the Majlis (parliament) had not approved the plan. High inflation probably would keep such a price hike from having much effect on consumption.

In the United Arab Emirates, where product prices are much closer to market levels, the government in January increased electricity costs to expatriates, business, and industry by 50%.

To some extent, countries richly endowed with oil and gas resources will always attempt to favor their citizens with low prices. But the favors come at a cost that sometimes takes years to become apparent. By then, as recent experience shows, corrections can be painful. Whether the corrections just starting in parts of the Middle East can be made without disrupting politics remains to be seen.

TAXING PRODUCTS

At the other end of the spectrum of ways governments manipulate retail oil values, taxes are in high fashion. Especially in industrialized countries, taxes on petroleum products during the past 5 years have risen rapidly.

Increasingly, governments cite the alleged need to cut oil consumption as the reason to pile taxes on petroleum products. Reducing oil use is seen as an environmental virtue and a way to reduce imports, which are construed to varying degrees as economically and strategically threatening.

Taxes on petroleum products also happen to be extremely convenient ways for governments to enrich themselves. They are easy to collect, can be effectively Camouflaged in retail prices, and raise lots of money. Since oil demand takes time to respond to price changes at the consumer level, especially when they occur gradually, governments raising product levies don't need to worry much about immediate revenue offsets from reduced sales volumes.

Countries use a variety of taxation methods, usually starting with excises-charges per volumetric unit-on the various products (Table 5)(100469 bytes). Most industrial countries in Europe also apply value added taxes (VATs)based on retail prices, including excise taxes. Some also have taxes that cover costs of carrying strategic oil inventories. Japan has a road tax. The U.S. and Canada have both federal and state or provincial levies.

In many countries, taxes have become more important than world crude oil prices as factors in final product costs to consumers. Among the industrialized countries that make up the International Energy Agency (IEA), taxes as a share of retail gasoline prices in 1993 ranged from 31% in the U.S. to 79% in France (Table 6)(18741 bytes). And in most cases the percentage has increased in the past 5 years (Table 7)(106160 bytes). The combined effect is strong growth in taxes per barrel of product in a period of stagnant crude prices (Table 8 (24769 bytes) and Fig. 2)(27076 bytes).

CLAIM ON VALUES

The trend-in essence a reduction in the value to consumers of oil as an energy source-has important implications for long term oil demand. A September 1994 study by the Canadian Energy Research Institute (CERI), source of much of the tax data presented here, says that by aggressively raising taxes in a period of falling crude oil prices, the major oil consuming countries have driven an "ever larger fiscal wedge between the crude price and the corresponding product prices." The result is what CERI calls "asymmetry" in the demand response to crude price movements.

"While crude price increases are passed on to consumers through higher product prices, oil price declines are neutralized through upward adjustments in product taxes," CERI says. "If consumers do not see the decline in crude prices reflected in lower product prices, they cannot respond to the lower crude oil price signal. As a result, the demand growth normally associated with declining crude prices becomes muted."

The effect could demand growth significantly below levels currently projected by CERI and others and, consequently, a further weakening of crude values. CERI calls the process of ever-greater product taxation "forced reallocation of crude oil revenue (or rents) from the producers and consumers to the government sector." Another way of saying the same thing might be the rerouting of the streams through which oil values flow.

VALUES IN PERSPECTIVE

A new round thus may be shaping up in the perpetual political contest over oil values.

Opposition to rising product taxation in oil-consuming countries has been a crusade of OPEC for several years-and well it should be. If high product taxes weaken oil demand as CERI says they might, the trend represents a serious economic threat to OPEC members and other countries highly dependent on revenues from oil exports.

OPEC faces a threat from changes to the pull on oil values at the resource level, too. Intensifying competition for exploration capital increases the potential for new oil production from outside of OPEC. In the oil market as it is currently configured, with OPEC supplying enough to satisfy apparent demand, any new production reduces the international call on OPEC crude barrel for barrel.

The good news from OPEC's point of view is that these two threats to its interests partly oppose one another: To the extent that increasing government claims on retail oil values suppress crude prices, incentives to explore decline regardless of the improvement in overall fiscal terms. The offset is not totally effective, however, because technological improvements continuously reduce exploration costs, improving upstream economics in the face of stagnant, even declining, crude prices.

OPEC members will surely take more than rhetorical action at some point if these threats persevere. And they most likely would respond in their realm of greatest influence: marginal crude oil supply. In what CERI calls an unlikely, worst-case scenario, OPEC cuts production enough to counter the asymmetry between crude and product prices and keep crude values on their expected course-but that means group production of 27 million b/d instead of a base-case 40 million b/d in 2009. Such medicine would taste especially bitter to OPEC producers that have already invested heavily to add production capacity in anticipation of a growing call on the group's crude supply. And its effects might well be offset by the strength it would give to OPEC's other problem by shoring up crude prices: more exploration and potential new supply elsewhere.

OPEC might, in fact, take the opposite, if riskier, course. It might raise group production to capacity levels and deliberately erode crude values. The aim would be to show non-OPEC producers and countries seeking exploration capital how crude values have been nicked by the aggressive consumption taxation of industrialized countries, and to enlist their support in resisting the trend. OPEC's Middle Eastern members could raise the pressure on non-OPEC suppliers by relaxing limits to foreign participation in their upstream operations-or at least threatening to do so.

None of this is likely to happen to these extremes, but the conflict is real. And it raises a question about a group that has so far had little to say even as its economic interests have suffered. Consumers in the high-tax industrialized countries have been denied access to values that should be theirs when oil prices fall. Indeed, the range of retail prices for specific products, calculated on the basis of average exchange rates in each year, is wide because of disparities in taxes (Table 9)(87307 bytes). And it exists for products manufactured from a raw material whose price changes nowhere nearly as much as locations change.

It's only natural that European politicians examine such comparisons and declare that product taxes should rise in North America. Equally natural are replies-implicit in the BTU tax debacle 2 years ago in the U.S.-to the effect that North American voters can happily make taxation decisions without resort to European counsel.

The issue, however, hardly ends there. Environmentalists will continue to pursue cuts in oil use. Consuming-nation governments will be lured to that way of thinking by the chance to divert more oil value to national treasuries and away from producers and consumers.

And when those claims sting too much, producers and consumers will resist.

In a market that makes oil values increasingly easy to gauge, conflicts over claims to those values remain as intense as ever.

Copyright 1995 Oil & Gas Journal. All Rights Reserved.