New pelletizer makes higher-value fuel from resid

Devco Cos., Tulsa, and Kellogg Brown & Root Inc. (KBR), Houston, have developed and tested new technology for better handling of asphaltene bottom products from solvent deasphalting units (SDUs).

The new technology, called Aquaform, pelletizes asphaltene from SDUs.

The Aquaform pellets allow refiners to dispose of heavy resid as solid fuel. They have good storage and transportation properties and can be used for cement manufacture or as a utility fuel. Combustion properties make solid asphaltenes an attractive alternative or supplemental fuel to petroleum coke or coal.

Challenges of SDUs

Solvent deasphalting is a popular substitute for coking and visbreaking to upgrade atmospheric or vacuum bottoms because of its low capital and operating costs. The deasphalted oil product is a high-value conversion feedstock which is not subjected to thermal-cracking reactions, as are products from a coker or visbreaker.

Despite the benefits of solvent deasphalting, the challenge of handling and transporting its asphaltene bottoms product has limited its application. The asphaltene product, a high-viscosity liquid, solidifies at ambient temperature. It is often blended with lighter cutter stock to produce heavy fuel oil.

Existing commercial technologies to solidify heavy hydrocarbons are limited. For example, solid asphaltenes produced from traditional methods such as flakers generate a great deal of dust during production, transportation, or storage. These flakers also have low reliability and require frequent maintenance.

Other processes more resistant to dusting are capital intensive and limited in capacity. They also suffer from similar reliability and maintenance problems.

Aquaform produces a stable pellet at a high production rate with low capital and operating costs. At the same time, the process offers higher reliability and availability than its predecessors.

New process

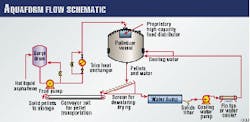

In the Aquaform process (Fig. 1), hot liquid asphaltenes are fed to the surge drum. The feed pump delivers the resid to the pelletizer vessel at a desirable flow rate.

The pelletizer converts liquid asphaltenes to droplets using a proprietary feed distributor. Liquid droplets travel downward to a cooling water bath in the bottom section of the pelletizer. A circulating water stream provides turbulence to aid in removal of the pellets and provides cooling to solidify the droplets to pellets.

The pellets and cooling water flow from the pelletizer to a vibrating screen where the pellets are dewatered. The pellets can be transported to a silo or open area or other loading facility by conveyer belt.

KBR and Devco built and tested a 2 b/d pelletizer pilot plant at the KBR Technology Center, Houston, in October 1998 (Fig. 2). Table 1 shows the properties of the resulting pellets based on a medium and heavy asphaltene.

The pilot plant produced uniform pellets with narrow size distribution (1-3 mm) at high throughput. The pellets have good grindability, storage, and transportation characteristics, as indicated by the high Hardgrove Grindability Index (HGI), storage-test temperature, and low friability.

A high angle of repose provides high capacity on conveyer belts and in storage. A small amount of residual moisture on the pellets helps minimize dust formation.

In addition to being burned neat, the pellets can be added to fuel-grade coke or coal as additives to enhance combustion characteristics. The pellets have 20% higher heating value than fuel grade coke. They also have a low ash content and a high organic carbon content (high boiling point, typically 1,000° F.+) that provide improved combustion characteristics.

KBR and Devco are targeting a commercial scale demonstration later this year.

Economics

Economic benefits from using the new pelletizer process with an SDU vs. a coker derive from two factors: (1) elimination of use of a cutter stock to lower the viscosity of asphaltenes and (2) significantly lower capital costs.

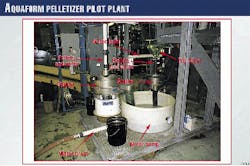

Pelletizing asphaltene eliminates the need to blend away valuable cutter stock like diesel and kerosine to prepare fuel oil from asphaltene. Based on a $5/bbl difference in the price of cutter stock and fuel oil, KBR estimates that a 100,000-b/sd refinery with an SDU processing Arabian medium crude can realize an incremental margin of $10 million/year by installing Aquaform (Fig. 3).

Combining pelletizing with solvent deasphalting reaps additional economic benefits. For a grassroots 100,000-b/sd refinery, while the incremental refinery margin generated from a coking based scheme is only slightly higher than from an SDU/Aquaform based scheme (less than $10 million/year), the incremental capital investment for a coking-based refinery is more than $100 million.