Deepwater drilling steady over past 4 years

Despite the amount of capital spent on new drilling vessels from 1997 to 1999, deepwater activity in the Gulf of Mexico (GOM) has remained steady at 91 to 94 wells a year.

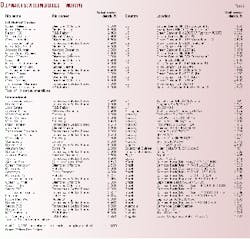

This year also appears on track with 72 deepwater wells drilled to date and 6 deepwater drillships and 19 semisubmersibles actively drilling (Tables 1 and 2, Fig. 1). Offshore (Fig. 1).

"Activity is up in shallow water," says Tom Marsh, an analyst for Offshore Data Services, "but the majors have been dragging their feet in deepwater due to the volatility of oil prices."

Ultra deepwater

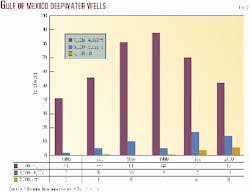

Breaking down deepwater drilling activity into three subcategories, however, provides a different perspective (Fig. 2). The most obvious change of course is the increase in wells drilled in water depths greater than 7,000 ft.

For example, from 1995 to 1998, drillers finished only two wells in this category. Yet from 1999 to October 2000, contractors drilled 10 wells. Furthermore, over this same time period, contractors drilled 31 wells in water depths between 5,000 ft and 6,999 ft, whereas only 22 wells were drilled in this category from 1995 to the end of 1998.

The increase in drilling activity for these two ultra-deepwater categories can be explained by the current rig-construction cycle, from which many vessels were tied to long-term contracts that began in 1997-1998.

When this cycle finishes by yearend 2001 or early 2002 (Table 3), 29 new deepwater vessels, most of which will be able to drill in 5,000 ft of water, will be available to GOM operators.

Click here to view Remaining deepwater new builds

This table is in PDF format and will open in a new window

Next year

Marsh predicts that the deepwater fleet will be fully employed a year from now. "Looking at oil prices before the collapse, we determined there was a potential need for 30 to 40 deepwater rigs just in the GOM, based on historical levels of drilling and discovery rates." At that time there were fewer than 20 rigs in the GOM rated for 1,500 ft of water or greater.

Since the run-up in deepwater vessel construction, however, the GOM deepwater fleet now stands at about 50 available rigs. "Yet based on those scenarios that were projected in the mid-1990s, we still have a potential for a 10-rig shortfall. This isn't a whole lot, but if activity picks up in Brazil and West Africa, we will need those rigs," Marsh said.

Competitive bidding for deepwater rigs may start a new phase as well next year. "No one is signing the contracts that they were before," he added. Between now and the end of the year, however, nine rigs will come off contract.

And into 2001, another eight deepwater rigs will reach the ends of their contractual commitments. "It will be an interesting period for operator and contractor alike as higher demand will lead to some competitive bidding," Marsh noted.