Gulf of Mexico western gap division agreed, exploration pending

Exploratory drilling isn't imminent on Gulf of Mexico "western gap" territory subject to a recent agreement between the US and Mexico, but seismic exploration could start soon.

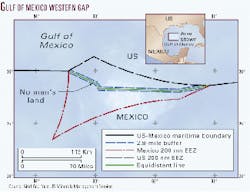

Following more than 2 years of bilateral negotiations, negotiators agreed on a division of the so-called "western gap," a 17,190-sq-km portion of the deepwater gulf that falls beyond the agreed maritime boundary between the two countries. Under the new treaty, signed on President Ernesto Zedillo's visit to the US on June 9, Mexico ends up with 62% of the gap while the US keeps 38%.

The treaty does not take effect until ratified by the senates of both countries. The US Minerals Management Service could wait until the treaty is ratified before offering leases to private companies in the western gap, or it may apply the treaty provisionally and offer leases in advance of ratification.

In either event, Ralph Ainger, chief of the MMS Leasing Division, said he thought it "highly unlikely" that any lease blocks in the gap would be offered in the August 2000 western gulf sale, though the final decision is up to the Secretary of the Interior.

"Industry isn't geared up for it, and we haven't decided things like whether there will be special stipulations on those blocks, or whether we will apply the treaty applications provisionally or wait until ratification occurs" before going ahead with leasing, Ainger said.

Acreage in the gap could involve plays similar to those that spawned major discoveries like Crazy Horse on Mississippi Canyon Block 778 and Mad Dog on Green Canyon Block 562.

Blocks in the western gap could next be offered in the March 2001central gulf sale. MMS first began offering western gap leases at the annual western gulf sale in 1983 but suspended offering the blocks in 1997 following complaints from Mexico, which claimed that the leases were premature before signing a treaty to formally divide the gap.

"We've always asserted that the northern portion of the gap would have been US territory in the end anyway, but it seemed productive to defer offering in those blocks until we agreed on a line," said Ainger.

Ainger, who was involved in the negotiations with Mexico to divide the gap, said that representatives from the US petroleum industry were kept abreast of the talks and support the new treaty. He sees companies as likely to acquire lease blocks in the region when they are next offered.

"There was interest last time we offered blocks in that area." Due to improved drilling technology and knowledge of adjacent areas in the gulf, "my notion is that interest will have increased since we last offered," Ainger said. "Clearly they [oil companies] have been interested and involved in this process, which leads me to conclude they are interested in securing leases out there."

Subsalt play extension

Seismic data and interpretation specialists Veritas DGC plan to make available a complete nonexclusive seismic survey of the western gap by early 2001. The company is betting that operators will want to pick up detailed information on the blocks.

"We have not acquired data in the western gap because up until now the political situation has not made it feasible for us to do a project there," said Robert Hobbs, vice-president of exploration ventures with Veritas. "Now that the western gap situation shows signs of being resolved, we are moving ahead with our plans to shoot 3D seismic over the area."

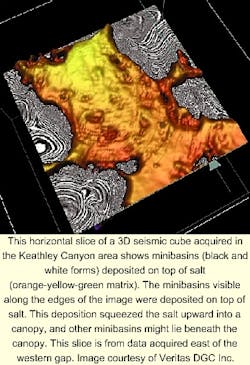

No wells have been drilled in the immediate western gap area, but many companies have picked up leases surrounding the gap and are actively studying the region for prospective deposits. Hobbs said much of the leasing is aimed at subsalt plays just north and east of the gap.

"Companies have been chasing structural plays up underneath these salt canopies southwest from some key discoveries up to the northeast along the compressional fold belt trend," said Hobbs. "The idea is to chase that play farther up underneath these extensive salt sheets in the western gap area," where the targets could be Tertiary-aged reservoirs. I think interest in the western gap is going to be as strong as it has been in other deepwater areas out there like Walker Ridge and Keathley Canyon," said Hobbs. "There's nothing to say that the geological trends these companies are chasing don't extend into the western gap, and we think they do."

A second potential play, found in many regions of the gulf, is for basin floor fan sands sitting in mini-basins situated between salt highs.

The northern part of the western gap covers a portion of the Sigsbee escarpment, a steep, undersea slope that marks the edge of the US continental shelf and the salt canopy's southern extension. While the part of the Sigsbee escarpment in the western gap falls mostly on the US side of the new treaty line, a section of it is on the Mexican side.

South of the Sigsbee escarpment, the gulf floor drops to an abyssal plain at around 3,000 m. Little is known about the hydrocarbon prospectivity of the abyssal plain region or any other possible salt formations in the Mexican part of the gap.

Mexico Energy Secretary Luis Téllez, in a press conference announcing the treaty, said studies by geologists with the state Pemex indicate a "high probability" of finding oil in the Mexican part of the gap. Mexico is unlikely to exploit that potential in the foreseeable future as the country has much more economically-viable deposits in shallower water and onshore, Téllez said.

Prior to the treaty negotiations, Pemex shot over 3,000 line km of 2D seismic in the western gap and purchased 980 km more on the market. The company concluded that the western gap contained "a petroleum system with possibilities of generation, principally Cretaceous rocks, and in very thick sedimentary sequences from the Tertiary and Mesozoic."

Buffer zone moratorium

An unusual provision in the western gap treaty is the creation of a buffer zone of sorts, measuring 2.8 nautical miles straddling the length of the new boundary, which is to remain free from exploitation by either side for 10 years.

The size of the zone was statistically calculated to encompass essentially all potential trans-boundary deposits.

A US State Department official involved in the negotiations commented that "fact finding will be encouraged so that both sides understand what's there with the idea that if there are any trans-boundary reservoirs certain consultative mechanisms will have to occur."

The official agreed that the buffer zone was created mainly to allay Mexican nervousness that US companies, who likely will be ready to produce reservoirs earlier than Pemex, might drain oil or gas from the Mexican side of the boundary. "That might be a fair assessment," the official said. "Clearly the companies working on the US side of the line are a lot farther along to getting into deeper water than Mexico is, and they have some nervousness about that."

The buffer zone is seen as a tool to enable the Mexicans to pass the treaty quickly without opposition from their senate, some of whose members have loudly denounced the possibility that the US is trying to appropriate Mexican oil reserves in the gap.

Although exploitation is prohibited for 10 years in the buffer zone-which covers about 10% of the US part of the gap-both governments will encourage exploration and analysis work, according to treaty stipulations.

Hobbs said Veritas would survey the US side of the buffer zone in its upcoming study. "We're planning on acquiring it," Hobbs said. "1.4 nautical miles is only about a third of an OCS block, which is not significant for us in shooting seismic data."

A second "gap" that exists in the eastern Gulf of Mexico involves Mexico, the US, and Cuba. Because of the political situation in Cuba, US and Mexican officials agreed there is no near prospect for resolving boundaries there. F