China launches massive gas pipeline campaign

China now sees natural gas as a major industry and has decided to capitalize on its gas resources in order to ease pollution and provide stimulus for economic growth for the next 10 years.

The government plans to boost gas consumption from the current 24 billion cu m/year (bcm/year) to 50 bcm/year in 2005 and further to 100 bcm/year in 2010.

The plan involves enormous capital input and offers businesses to Chinese and foreign investors ranging from natural gas exploration and development to downstream operations, such as gas utility equipment services.

Of the entire gas business chain, from upstream through midstream to downstream, China has placed top priority on the construction of a gas infrastructure-gas pipeline construction in particular-to pave the way for the large-scale development of a natural gas industry.

Gas pipeline push

As a first step to boost gas utilization, China has included gas pipeline construction as part of an infrastructure construction program in its next 5-year planning period (2001-05).

The government has launched a massive gas pipeline construction spree to link gas fields in western China's Tarim, Qaidam, and Ordos basins with gas markets in eastern China. The western part of China holds about 22 quadrillion cu m of natural gas resources, accounting for 58% of the national total.

Currently, China's gas pipeline network is still in the initial stage of development. The bulk of China's natural gas is transported to areas close to gas fields for consumption in chemical plants.

The most extensive gas pipeline network has been built in southwestern China's Sichuan Province, where the network consists of 8,770 km of pipeline carrying gas from Sichuan gas fields to chemical plants as well as to household consumers in the province and in the neighboring provinces of Yunnan and Guizhou. Sichuan is currently China's largest gas production center, with gas output in 1999 reaching 7.6 bcm, accounting for 33% of the national total.

In addition to Sichuan, China is now operating two major long-haul gas pipelines. The Jingbian-Beijing pipeline is China's first long-haul onshore gas pipeline. The 864-km pipeline was completed in 1997, with annual throughput capacity of 3 bcm. The gas supply for the pipeline is from the Changqing oil and gas field for industrial and household consumption in Beijing as well as in Tianjin in northern China.

The other one is a pipeline in the South China Sea, linking ARCO's Ya 13-1 gas field and a power plant in Hong Kong. The 778-km pipeline has been in operation since 1996. It moves 2.9 bcm/year of gas to Hong Kong and 520 million cu m/year (MMcm) to Hainan province.

Foreign investment

However, the existing pipeline infrastructure is far from adequate to meet the needs of both the upstream (exploration and production) and downstream (consumption) sectors. The absence of a substantial pipeline system has also caused potential investors to be ambivalent about the prospects of China's gas business.

China encourages foreign participation in gas pipeline construction, but many foreign companies are interested in gas exploration and production and marketing. Without being able to secure enough gas reserves and an adequate gas market, foreign companies are not eager to incur the risk of pipeline construction.

The largest foreign participant in China's onshore gas sector is Royal Dutch/ Shell. Last September, Shell signed a $3 billion contract with China National Petroleum Corp. to jointly explore and develop gas resources in northwestern China's Ordos basin.

The contract allows Shell to tap gas reserves on the Changbei block, which covers 1,600 sq km, build a gas pipeline, and establish a sales network.

The pipeline will extend through Inner Mongolia, Beijing, Tianjin, Hebei Province, and Shandong Province.

The Changbei project is the first onshore upstream petroleum project initiated by Shell in China and also the largest project launched by CNPC with foreign investors. Upon completion, the project will supply 3 bcm/year of natural gas to eastern China for 20 years. The project is expected to start up in 2004.

Last year, Enron Development Corp. and CNPC undertook a plan to build a 503-km pipeline to move 3 bcm/year of gas from Sichuan's Zhongxian area to Hubei Province. Enron took a 45% share of the 1.9 billion yuan project, which is expected to be completed this year.

BP Amoco PLC is another major that has shown interest in China's gas business, but it is not likely to engage in domestic gas pipeline construction. BP Amoco is more interested in the retail gas sector in eastern China.

As part of the concession to encourage BP Amoco to invest in the initial public offering of PetroChina Co. Ltd., a unit of CNPC, PetroChina has agreed to set up a joint venture with BP Amoco to market the gas produced in Xinjiang's Tarim basin in areas around Shanghai in eastern China. BP Amoco contributed up to 20% to PetroChina's $3 billion IPO.

BP Amoco's new position with PetroChina will enable it to form a joint gas-marketing venture as well as to build or acquire as many as 150 service stations in China over the next year.

Although China encourages foreign participation in domestic gas transmission pipeline construction, the country still bans in principle foreign investment in town-gas (local distribution company) pipeline construction.

The government plans to lift the ban and select a few cities to allow foreign companies to become involved in China's LDC pipeline grid business on a build-operate-transfer basis, in order to attract foreign capital and technology.

Xinjiang-Shanghai pipeline

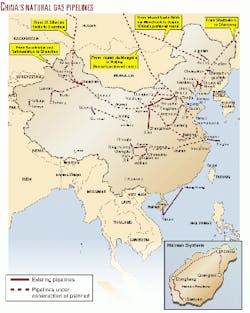

China is now embarking on several major gas pipeline construction projects (see map). The centerpiece of the construction campaign is one that links Xinjiang with Shanghai.

The 811-mm diameter, 4,212-km pipeline will pass through 15 major cities before reaching Shanghai. The pipeline will have a designed capacity of 20 bcm/year.

The 15 cities are Korla, Turpan, Shanshan, and Hami in Xinjiang; Liuyuan, Zhangye, Wuwei, Lanzhou, Dingxi, and Liquan in Gansu; Zhengzhou and Xinyang in Henan; Hefei in Anhui; and Nanjing and Changzhou in Jiangsu.

PetroChina submitted its project proposal to the State Development Planning Commission (SDPC) for approval last September and is targeting completion of engineering design this year.

The construction will be divided into two phases. Construction of the 1,581-km first section from Tarim to Jingbian in northwest China's Shaanxi province is to start next year for completion in 2002. Construction of the second, 2,586-km section from Jingbian to Shanghai is to start in 2002 for completion in 2003.

However, PetroChina will allow a throughput of only 12 bcm/year for 30 years, of which 10 bcm will be for consumption in eastern China-including Shanghai and Jiangsu, Zhejiang, and Anhui provinces-and 2 bcm will be designated for consumption in locales en route. PetroChina is prepared to scale down the initial pipeline throughput to 4 bcm/year, in case the market in eastern China is ready before 2004.

The government stresses the simultaneous development of gas resources, pipeline, and downstream projects, but PetroChina cannot offer any assurances that all the downstream gas projects will be ready by the time the pipeline construction is completed.

The complexity of building natural gas-based projects, including power plants and LDC networks, centers on extensively aligning efforts of multigovernment offices and financial institutions, because such projects will mean shifting away from an existing energy system based on coal-fired power plants and liquid fuels for home heating facilities.

Based on the pipeline operation economics and purchasing capacity of the end-users in Shanghai, SDPC is likely to set the price of Xinjiang gas at about 1.3 yuan/cu m at the Shanghai city gate.

All these related projects, including gas exploration and development in Tarim basin, the pipeline, and downstream projects, are expected to cost a total of about 120 billion yuan, including 38 billion for the pipeline construction and 60 billion for the downstream projects.

Chinese Premier Zhu Rongji said in March in Beijing that foreign investors can take a majority stake in the pipeline and that foreign companies are allowed to control the management of it.

China's willingness to allow foreign companies to control the pipeline operation indicates China's urgency to share foreign management expertise.

However, foreign companies are lukewarm to the pipeline construction proposal. They are more interested in gas production at Tarim and retail gas sales in eastern China.

Moreover, few companies are willing to invest in the project without a local partner, given the risks involved and huge capital requirement.

China's preference for foreign involvement in the pipeline is to form a joint-venture consortium between foreign and local companies.

Some companies are interested in involvement in the retail part of the Xinjiang-Shanghai gas business chain, while others are interested in gas exploration and production in the Tarim basin, the gas supply source for the pipeline.

However, PetroChina has ruled out the possibility of allowing foreign companies to become involved in gas production in Tarim, because the company has confirmed enough reserves for the pipeline. PetroChina mostly encourages foreign companies to participate in exploration that involves risk.

PetroChina has proved more than 400 bcm of natural gas reserves in the Tarim basin. The company is trying to discover more this year.

Other western pipelines

In another major example of the gas infrastructure build-up, PetroChina started building another natural gas pipeline in northwestern China in April.

The pipeline will extend 953 km from the Sebei gas fields in Qinghai Province to Xining, capital of Qinghai Province, and Lanzhou, capital of Gansu Province.

The pipeline will have an annual transportation capacity of 3-5 bcm of gas, of which 1.7 bcm will be for consumption in Xining and 2.8 bcm will be for Gansu.

PetroChina has decided to spend 600 million yuan on natural gas exploration and production this year in the Sebei fields.

The Sebei fields cover 7,000 sq km and have gas reserves estimated collectively at 500 bcm. The fields are in the eastern part of the 120,000 sq km Qaidam basin, where PetroChina says gas reserves total 900 bcm.

PetroChina plans to produce 5 bcm/year of natural gas in the basin by 2005. Qaidam's gas production last year was 360 million cu m, up 34% on the year.

Meanwhile, PetroChina is moving a step closer to building a natural gas pipeline from Sichuan Province in southwest China to Wuhan, capital of Hubei Province, in central China.

China International Engineering Consulting Corp. has completed its assessment of the feasibility study done by PetroChina on the 711-mm diameter, 700-km pipeline and has submitted the project proposal to SDPC for approval.

The pipeline is scheduled for completion in 2002. Sichuan has proven gas reserves of 589.5 bcm, 56% of which are in the eastern part of the province. Gas from Sichuan will supply Wuhan for 30 years at a required 1-1.2 bcm/year.

In addition to Wuhan, the Sichuan gas will also supply 10 cities in Hubei: Yichang, Jingzhou, Jingmen, Xiangfan, Lichuan, Enshi, Zhijiang, Qianjiang, Xiantao, and Yidu.

Gas demand in Hubei province is estimated to rise to 650 MMcm in 2005 and to 1.5 bcm in 2010. From Wuhan, the pipeline will be extended further after 2002 to the Yangtze River delta region, including Shanghai and the provinces of Jiangsu and Zhejiang in eastern China.

Also under construction is a 53.6-km pipeline from Xi'an, the capital of Shaanxi Province, to Weinan, which is north of Xi'an. The 59 million yuan pipeline will have an annual delivery capacity of 380 MMcm of natural gas. This pipeline will transport natural gas produced from Changqing oil and gas field. Xi'an has an existing gas pipeline that connects the city with Jingbian, the site of the Changqing oil and gas field. The pipeline has an annual delivery capacity of 400 MMcm.

Also in the west, China completed a major natural gas pipeline linking Jingbian to Baoji via Xi'an and Xianyang in northwest China last September. The pipeline extends 147 km between the two industrial cities. It moves gas produced from Changqing field for local industrial and residential consumption.

Changqing, in the Ordos basin, holds proven gas reserves of 310 bcm as of the end of 1998. Plans call for the field to increase proven gas reserves by another 120 bcm by 2003.

China has also decided to build a natural gas pipeline from Changqing gas field in northwest China to Inner Mongolia in north-central China.

The pipeline will extend 471 km eastward from Ushen county in western Inner Mongolia and terminate in Huhhot. The pipeline, with an annual capacity of 1 bcm, is slated for completion by the end of this year.

In a separate development, China's Hainan province is seeking foreign investment to jointly build and operate the second and third sections of an integrated natural gas pipeline grid in order to capitalize on the use of gas produced from the South China Sea.

The 700-km pipeline will skirt the island province, passing through 12 cities and counties from Shanya to Qionghai.

The 2.2 billion yuan pipeline project is divided into three sections, with the first section brought into operation in 1996. The three sections will have a combined transportation capacity of 3-5 bcm/year of gas.

Foreign companies can participate in the construction of the second and third sections through direct investment or technology transfer.

The first section, spanning 116 km from Shanya to Dongfang, has the capacity to transport 500-700 MMcm/year of gas. This section has been transporting gas produced from the Ya (Yacheng) 13-1 gas field in the South China Sea to an ammonia-urea plant since 1996.

The second section, spanning 300 km from Dongfang to Haikou, the provincial capital, will transport gas from the offshore Dongfang 1-1 gas field, currently under development by China National Offshore Oil Corp. (CNOOC), to residential and industrial consumers along the route. It will have an annual delivery capacity of 2.8 bcm.

Construction of the second section began in 1999, and its completion is scheduled for 2002, 2 years later than originally scheduled because of a lack of funds and a delay in the gas field's development.

Hainan doesn't have a timetable for construction of the third section of the pipeline, which has a design length of 300 km, extending from Shanya to Qionghai. The construction of this section is still pending approval from the central government.

This section will transport gas from Ledong 15-1 gas field in the South China Sea, which is currently being delineated by CNOOC and ARCO (recently acquired by BP Amoco).

CNOOC produced 4.39 bcm of natural gas in 1999, 70% of which was produced from Ya 13-1 field, which is currently operated by CNOOC and ARCO.

At Dongfang 1-1, CNOOC has proven gas reserves of 100 bcm. The field's start-up is expected in 2002.

Transnational pipelines

For China's energy security reasons and to push earlier development of natural gas resources in host countries, China and some central and northern Asian countries are in talks over building several transnational gas pipelines from Russia, Kazakhstan, and Turkmenistan to China. At least five such pipeline proposals are now in consideration by the Chinese government.

Of the five, three would extend from the western of part of central Asia and terminate at Shanshan in northwestern China's Xinjiang region.

The first of the three is the 1,865-km gas pipeline from Western Siberia to Shanshan. The $3.62 billion pipeline would be able to transport 30 bcm/year of gas to China. The second would extend from Kazakhstan's supergiant Karachaganak gas, condensate, and oil field to Shanshan. The line would extend 3,370 km and be able to move 25 bcm/year of gas to China. Karachaganak has 1.3 trillion cu m of gas reserves. The last of the three would extend 2,150 km from Turkmenistan to Shanshan and is designed to transport 25 bcm/year of gas at a cost of about $4.7 billion.

The other two would extend from eastern Russia to northeastern and northern China.

One of the two links is Sakhalin I in Russia to Shenyang in northeastern China. The 2,416-km pipeline is designed to transport 5 bcm/year of gas for consumption in northeastern China, including Heilongjiang, Jilin, and Liaoning provinces. Sakhalin I holds about 250 bcm of gas reserves.

The other would extend from Irkutsk's Kovyktinksoye field to northern China. Of the five gas pipelines under discussion, this one is most likely to materialize.

China and Russia are in the midst of completing a feasibility study for the pipeline, which would extend from Irkutsk to China and then to South Korea (OGJ, May 15, 2000, p. 74). BP Amoco has a 25% stake in Kovyktinksoye field, which has gas reserves estimated at 1.4 trillion cu m.

China and Russia now differ on the routing of the pipeline. Russia suggests the line should enter China via Mongolia because this route is shorter, while China insists it go directly to northeastern China via Manzhouli.

Roughly, the $12-13 billion pipeline would extend 4,000 km from Russia's Irkutsk basin gas fields in eastern Siberia to northern China.

BP Amoco and its partner, the consortium Rusia Petroleum, target 2005 for the arrival of first gas in China. China expects the pipeline to transport 20-25 bcm/year of gas to China, while South Korea expects to receive 10 bcm/year.

Russia, China, and South Korea will soon sign a trilateral contact to extend a natural gas pipeline from Russia via China to South Korea.

China said it will build the Sino-Russian gas pipeline along with a 2,400-km crude pipeline that is to extend from Angarsk in eastern Siberia to northeastern China in order to minimize costs and land use.

According to an agreement signed in March by Russian Minister of Fuel and Energy Victor Kalyuzhnyi and Zeng Peiyan, minister for China's SDPC, China and Russia have agreed to begin building the crude pipeline in 2003, and completion is scheduled in 2005.

About 1,630 km of the pipeline will be built within Russia at a cost of $950 million, while the remainder will be built in China at a cost of $650 million.

However, just as with the gas pipeline, China and Russia still haven't agreed on the routing of the pipeline, with the Russians insisting on cutting the pipeline's distance by running it through Mongolia, with the Chinese calling for skipping Mongolia for security reasons.