Price scenarios may alter gas-to-oil strategy for US unconventionals

Ruud Weijermars

Alboran Energy Strategy Consultants and

Delft University of Technology

Delft, Netherlands

Two plausible scenarios for gas price recovery may alter the current shift of North American unconventional gas companies, diverting capital investment into oil rather than gas development projects.

Neither the scenario for a price shock nor smooth recovery is necessarily a correct prediction of the future, but each provides useful insight into what might happen next, based on current changes and trends in the US gas industry. Several lessons also can be drawn from this strategy shift for unconventional gas development worldwide.

US gas producers have paved the way for replacing dwindling domestic gas production from conventional to unconventional resources. Short-term gas delivery contracts dominate the US market, and US gas prices have responded rapidly to economic changes. Consequently, producers of unconventional and conventional gas have seen profit margins evaporate, due to depressed wellhead gas prices during the past 2 years.

Diverting capital expenditure from gas to oil projects is the latest tactical response of US oil and gas companies for capturing value from a quicker recovery of oil prices after the recent recession as compared to natural gas prices.

The strategy shift includes moving gas rigs to liquid-prone areas, as shown in US rig count statistics. The question remains whether this strategy shift of US gas operators, aimed at restoring their corporate earnings, will lead to a timely recovery of wellhead gas prices.

Slowing gas rig activity eventually will lower production output and helps in bringing supply and demand back into balance, thus adjusting the current oversupply and leading to a recovery in wellhead gas price.

Strategy shift

US wellhead gas prices in late 2010 still had not recovered from their steep decline after July 2008 (Fig. 1). The lower prices put pressure on US gas production companies.

Unconventional natural gas production companies are in a business with a high capex demand and tight cash flow, under continual duress by low natural gas prices.

US gas producers have lately maintained financial liquidity using three tactical instruments:1

1. Debt rollover.

2. New equity issuance.

3. Asset lease and sales.

An additional, fourth tactical instrument to improve operational margins is becoming widely adopted by the US natural gas industry: a shift of gas capex to oil capex. The driver behind the strategy shift is the notion that prices for crude have recovered better than for gas since early 2009.

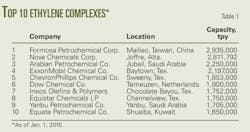

Many gas production companies include oil assets in their portfolios. The table lists the relative share of oil and gas production for 20 companies whose gas resources constitute their principal US and Canada assets.

Leading gas producers have begun to shift capital expenditure in favor of increased oil production. The strategic shift that diverts corporate activity from gas development towards oil assets is supported by 2010 policy statements of Chesapeake Energy Corp.'s management: "The economics just compel you to look for oil rather than natural gas right now," stated Chesapeake Chairman and CEO Aubrey McClendon.2

Chesapeake's second-quarter 2010 report further states, "In 2010, we expect that approximately 32% of our drilling and completion capital expenditures will be allocated to liquids-rich plays [including oil plays], compared to 10% in 2009, and we are projecting that these expenditures will reach 55% in 2012."3 4

Similar shifts from gas to oil drilling have been announced by Petrohawk Energy Corp., EOG Resources Inc., Forest Oil Corp., Quicksilver Resources Inc., and other gas producers.

The recent strategy shift of leading US gas operators toward oil from gas production is an important development that will be followed with great interest by many companies and countries keen on copying the success in North American unconventional gas plays.

Gas remains in vogue as a transition fuel,5 and unconventional gas development projects are now under study in many countries.67 While the US unconventional gas industry has paved the way to replace dwindling indigenous gas supplies from conventionals by unconventionals, several analyst reports have drawn attention to the consistent weak cash flow results for many unconventional natural gas companies in the US.8-12

Serious doubts about the ability of companies to meet wellhead breakeven cost in unconventional gas plays could slow down the emerging global interest in unconventional gas development projects. Maintaining investor confidence is of prime importance and crucial for future success of unconventional gas development projects, both in the US and elsewhere.

This study first analyzes the recent changes in US rig activity, which reveals a marked rise in oil rigs and lagging gas rig activity. Subsequently, it outlines two scenarios for the recovery path of natural gas prices: price shock vs. smooth recovery.

Shift in patterns

Historically, US rig counts have been reliable barometers for up and down cycles in the oil and gas industry.13 Rig counts always drop sharply in step with economic downturns and rise when energy price trends justify increased production (Fig. 2).

The late 1970s exploration and production boom that followed the 1973 oil crisis resulted in a monthly record US rotary rig count of 4,530 rigs in operation during December 1981. This peak was short-lived, however, as a slowing economy and the advent of directional and horizontal drilling and better risking of field reserves led to a decline in rig count from 1981 until 2000 when a noticeable upturn started.

After reaching another peak in July 2008, rig activity rapidly dropped in the US (Fig. 3). In mid-2010, US gas rig counts recovered to only 62% of the 2008 peak, but US oil rig counts rose 152% above their 2008 peak. In fact, these numbers indicate US rig counts are down sharply for gas, and up sharply for oil compared to their respective 2008 peaks.

Gas rig counts have crept up from their July 2009 low when they stood at 42% of the 2008 peak, but have since risen further to only 62% of the 2008 peak.

In contrast, oil rig counts have eclipsed the 2008 peak, and as of June 2010 are at 152% of their November 2008 peak.

The ratio of oil/gas rig counts has shifted sharply within the past year (between June 2009 and June 2010). Gas rig count is down to 60% from 80% of total rigs, and oil rig count is up to 40% from 20% of total rigs (Fig. 4a).

If the rising trend of oil rig counts continues, the number of US oil and gas operating rigs will be equal by yearend 2010-something last seen in the mid-1990s.

The emergence of the unconventional gas plays in the late 1990s led to an increase in US gas rig counts, while oil rig counts continued to decline. The reversal of this trend started in 2005 and accelerated during the past year, due to the strategy shift of unconventional gas operators.

A supposed factor in the decline of US gas rig counts is the success of horizontal drilling and use of multilateral junctions. The number of rigs drilling vertical wells has declined steadily in favor of rigs drilling horizontal wells, a trend that started in 2003 (Fig. 4b). The actual crossover for horizontal drilling compared with vertical drilling occurred in January 2009.

Nonetheless, the steep shift in US rig activity from gas toward oil drilling during the past year (Fig. 4a) reflects the diversion of gas capex into oil capex. This shift in rig counts is led by the recent notion of top management at shale gas companies that more money is to be made in oil plays than in gas plays.

Meanwhile, this redirection of capex has resulted in another, silent but remarkable turnaround of halting the decades-long decline in US oil production, as seen from the modest production upturn during the past 2 years (Fig. 5).

Monthly US gas production shows no sign yet of any downtrend. Production of natural gas in 2010 is slightly above 2009 monthly output (Fig. 6a). The sharp reduction in gas rotary rig counts to 62% of 2008 peaks, and the further shifts in oil/gas rig ratios announced by major operators, however, may result in slowing the growth trend or in a decline in US gas production (Fig 6b). Such a decline could trigger a much awaited upward adjustment of natural gas wellhead prices.

Two price scenarios

The slump in earnings of US unconventional gas producers will result in a delay in drilling new gas wells. Over time, a shut-in of some US gas production capacity will reduce US gas output and this will affect gas prices. Gas price depends on energy demand and its interaction with the upstream, midstream, and downstream supply chain.14

A recent value chain analysis has established that the all-in tariff for a 5-year cost average for gas delivery via the US midstream and downstream gas system is $3/Mcf.1 Regulation of service and asset cost in the midtransportation segment and downstream gas utilities effectively means that all commodity price risk is levied back to the wellhead.1

Price regulation of utility companies ensures them a rate-making mechanism for recovery of their cost of capital plus a fair return on investment. Ironically, this price regulation system in the mid and downstream segments, in conjunction with upstream price deregulation, means that any change in global energy prices is affecting directly the US wellhead price.

One price development scenario, smooth recovery, would respond to a moderation of new unconventional gas developments in the US (Fig. 6b), which leads to a gradual recovery of natural gas prices (Fig. 7a).

An early gas price increase restores profit margins and could improve the liquidity of the majority of US operators. The sources of new cash injections needed to complement their lagging operational income due to low gas prices have largely dried up. The investor community is currently reluctant to provide new debt capital and placement of new equity also is problematic.

Although recent asset sales have temporarily relieved some companies, a structural lift in gas prices would stave off liquidity problems for several operators.12 Past company accounts confirmed the lagging cash flow.15 CEOs and CFOs have been hoping for a timely bail out from a higher gas prices. January 2010 looked promising, but current margins are not bringing the much needed cash flow improvement.

Consequently, a smooth and rapid recovery of natural gas prices throws a lifeline to the US unconventional gas business. Most likely, prices would settle in the much-modeled price range of $5-8/Mcf.16 17 This scenario would lead to no or only rare insolvencies.

Price shock is an alternative scenario in which the US gas industry will consolidate more rapidly than by mergers and acquisitions alone because of the demise of less profitable operators or abandonment of less economic fields.

Gas price shocks, which may now seem unlikely to many, could be caused by a shut-in of subeconomic parts of US shale gas production. The percentage of production threatened by disruptive cash flow, based on US Securities and Exchange Commission filings of the principal shale gas operators, suggests about 10-20% of US shale gas production may be subject to shut in because of the emergence of liquidity problems.

A decline in US shale gas production would occur when wells are shut in as various companies edge toward filing for Chapter 11. This could occur as early as January 2011.

This is a pessimistic vision but something that cannot be claimed to have come as a complete surprise if it unfolds.

In the price-shock scenario, LNG will have to be landed in the US again to supplement the emerging supply gap. LNG imports, increasingly diverted from US terminals since domestic oversupply began to suppress wellhead prices in second-half 2008, may then be needed again in the US to replenish faltering domestic production.

Troubles in the US shale gas sector will, under the price-shock scenario, induce spikes in global LNG prices. Renewed growth of LNG consumption in the US would put upward pressure on global gas prices for both short-term contracts and spot markets.

With short-term contracts dominating US gas markets, price volatility effects could be cascading and compound into price shock. The expectation is that this scenario would begin to unfold in January 2011.

A price hike could be steep and volatile but is likely to be short-lived (Fig. 7b) as US shale gas plays would resume production when prices go up. Bringing shale gas back into production quickly as global gas prices begin to spike will not be easy or instantaneous, as the investor community will want to sort out the debt restructuring of troubled companies first.

In the price-shock scenario, we will see gas prices settle by May 2011 at the earliest, but closer to four times the btu price equivalence of coal rather than the two times of today.

Eventually gas prices in the consolidated supply chain will settle near the top end of the $5-8/Mcf price deck.

The occurrence of a steep price shock would restore natural gas prices for producers (if only temporary) but the associated price volatility would enhance the aversion to price risk of gas and thus deter potential customers.

A smooth recovery of natural gas prices would be better for the image of gas. Its pricing would still increase to become less competitive but without the additional volatility of price shock. The risk profile of a gradual rise in gas fuel cost would be more acceptable to energy consumers than price shock.

Supply changes

Today's unprofitable wellhead economics will delay drilling for more unconventional gas in the US as well as Canada and will lead to higher gas prices by an eventual rebalancing of supply and demand.

The recent strategy shift of North American gas producers will affect their output volumes in the immediate future. Decline may result from delay and reductions in domestic gas field development projects. Such a production decline will help bring US demand and supply back into balance and thus will also affect the gas prices in the US and elsewhere.

The path for price adjustments may be more or less volatile, such as discussed previously. Meanwhile, US gas companies will continue during the next 2 years to consolidate by mergers, acquisitions, and insolvencies.

The previous analysis also highlights that gas prices depend greatly on supply competition between domestically produced pipeline gas (with growth driven by shale gas plays in the Barnett, Haynesville, and Marcellus shales) and LNG imports. Emergence of European and Asian supply gaps in pipeline gas (taking into account both indigenous production as well as imports) in the coming decade will boost the demand for LNG imports in all major gas markets: European Union, Asia, and US. Consequently, further growth of US unconventional gas business is most likely to resume in the medium-term (next 5-10 years) supported by higher global natural gas prices that ensure better than breakeven cost for US production.

Gas companies will continue to be burdened by risk and uncertainty of fuel prices in two ways:

1. Uncertainty associated with timing of price volatility.

2. Risk of sudden price increase.

Price volatility of gas remains a deterrent for potential growth of gas consumption. For example, coal historically is cheaper than gas, and coal prices are more stable than gas prices, which prevents power generators from switching faster from coal to gas. Both factors make gas less competitive as compared to many other energy sources for power generation (nuclear, coal, wind, geothermal, photovoltaic, etc.), and may result in relative loss of market share in the longer term.

Greenhouse-gas emission policies could impose tariffs that favor gas use over coal, but the recent recession has eroded support for the short-term cost to taxpayers.

References

1. Weijermars, R., "Why untenable US natural gas boom may soon need wellhead price-floor regulation for industry survival," First Break, September 2010, pp. 33-38.

2. McClendon, A., "A Push To Oil," 5th Annual Developing Unconventional Gas Conference, Hart Energy, Fort Worth, Mar. 29-31, 2010.

3. Phillips, D., "10-Q detective Chesapeake Energy Turns Tail on Natural Gas, Looks for Oil Instead," http://www.bnet.com/blog/sec-filings/chesapeake-energy-turns-tail-on-natural-gas-looks-for-oil-instead/336, 2010.

4. Phillips, D., "Chesapeake Energy's Shift to Oil won't work without higher Natural gas prices," http://www.bnet.com/blog/sec-filings/chesapeake-energy-8217s-shift-to-oil-won-8217t-work-without-higher-natural-gas-prices/348, 2010.

5. Jaccard, M., Sustainable Fossil Fuels. The unusual suspect in the quest for clean and enduring energy. Cambridge, UK: Cambridge University Press, 2005.

6. Jaffe, A.M., "Shale gas will rock the world," Wall Street Journal, May 10, 2010, from http://online.wsj.com/article/SB10001424052702303491304575187880596301668.html.

7. Knight, H., "Wonderfuel: Welcome to the age of unconventional gas," New Scientist, Vol. 2764, June 2010, pp. 44-47.

8. Schaefer, K., "What is the average breakeven price for natural gas producers? http://www.resourceinvestor.com/News/2009/4/Pages/What-is-the-breakeven-price-for-natural-gas-producers.aspx," 2009.

9. Cohen, D., "A shale gas boom? ASPO-USA," http://www.aspousa.org/index.php/2009/06/a-shale-gas-boom/, 2009.

10. Berman, A., "Will shale plays be commercial?" AAPG Geosciences Technology Workshop, Istanbul, May 24-26, 2010.

11. Nasta, S., "North American shale gas output defies breakeven economics: analysts," http://www.platts.com, 2010.

12. Dell, B.P., and Lockshin, N., "Bernstein E&Ps: More pain ahead for the 45 operators?" Bernstein Research, June 2010.

13. Brooks, G.A., "Musings: Rig Count Downturn Moves into Uncharted Territory," http://www.rigzone.com/news/article.asp?a_id=7406513, 2009.

14. Dahl, C.A., International Energy Markets, Tulsa: PennWell Corp., 2003.

15. Weijermars, R., "Bigger is better when it comes to capital markets and oil company liquidity," First Break, June 2010, pp. 37-41.

16. Hartley, P., and Medlock, K.B. III, "The Baker Institute world gas trade model," Natural Gas and Geopolitics from 1970 to 2040, D.G. Victor, A.M. Jaffe, and M.H. Hayes (editors), Cambridge, UK: Cambridge University Press, 2006.

17. Foss, M.M., United States Natural Gas Prices to 2015, Oxford Institute of Energy Studies, NG 18, 2007, pp. 1-36.

More Oil & Gas Journal Current Issue Articles

More Oil & Gas Journal Archives Issue Articles

View Oil and Gas Articles on PennEnergy.com