OGJ Newsletter

OPEC may meet to reassess global oil demand

The Organization of Petroleum Exporting Countries may meet to assess the impact on oil supply from the nuclear crisis in Japan as well as continued unrest in North Africa.

"I do suspect members of OPEC would be getting together to assess the situation of demand and supply," said Nigeria's Foreign Minister Henry Odein Ajumogobia, who added that Japan also is likely to affect the oil market and "therefore the prices."

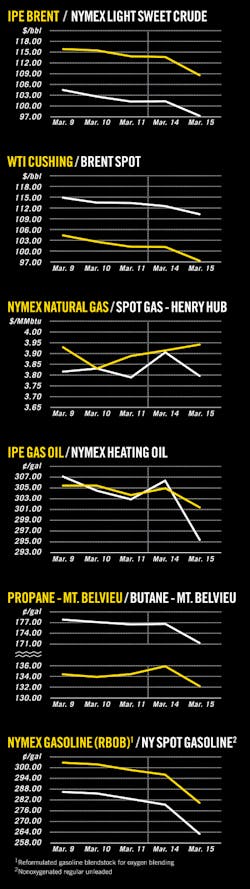

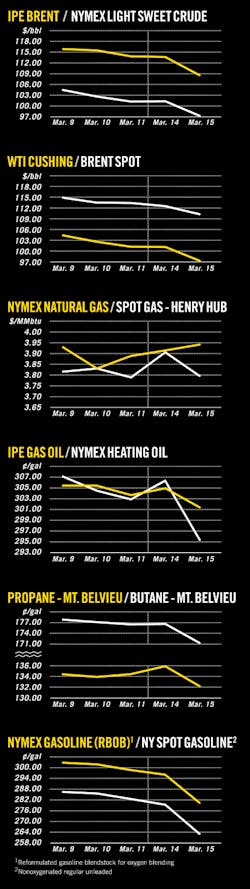

Oil prices fell in the aftermath of a massive earthquake that hit Japan on Mar. 11, after earlier unrest in the Middle East and disruptions of supply in Libya caused prices to rise to almost $120/bbl on Feb. 24.

But Japan, the world's third-largest oil consumer, is likely to require an increase in fuel oil imports to generate electricity in the long-term as a quarter of its nuclear power plants have been taken offline (OGJ Online, Mar. 15, 2011).

"OPEC is currently maintaining its ceiling," Ajumogobia said, while noting that "current events in North Africa will probably inform the decision as to where those ceilings will be increased."

He said, "If OPEC ceilings are increased, then our production will increase by the same token." Ajumogobia said Nigeria produces 2.5 million b/d. "Our OPEC oil output quota is 1.8 million b/d and the rest is condensate."

Ajumogobia's remarks coincided with reports that Eni SPA, the largest foreign energy major in Libya, has halted oil production in the strife-torn nation but is still producing natural gas to supply some of the country's power stations.

Eni Chief Executive Paolo Scaroni explained oil production was stopped due to logistical problems with exports.

Meanwhile, Paris-based International Energy Agency said of Libya: "It is understood that most oil field operations have been shut-in or sharply curtailed, with transport routes choked off (OGJ Online, Mar. 15, 2011)."

US Senate's EPA GHG bill beats House measure to floor

US Sen. James M. Inhofe's (R-Okla.) bill to stop the US Environmental Protection Agency implementation of greenhouse gas emission controls under the Clean Air Act pulled ahead of its House counterpart in a race to the floor when the Senate's chief minority member, Mitch McConnell (R-Ky.), introduced it as an amendment to small business legislation before the full Senate.

McConnell's move came on Mar. 15 as the House Energy and Commerce Committee marked up and passed Chairman Fred Upton's (R-Mich.) similar measure by 34 to 19 votes, and referred it to the House floor for action in the next few weeks. Inhofe, who is the Senate Environment and Public Works Committee's ranking minority member, and Upton jointly circulated drafts of their bills in February and introduced their final versions on Mar. 3.

Noting that Inhofe's stand-alone bill, S. 482, has 43 cosponsors including one Democrat, Joe Manchin of West Virginia, McConnell said that EPA's implementation effort, which the agency has said is a response to a 2007 US Supreme Court decision, is actually "a backdoor national energy tax" and "a strange way to respond to rising [gasoline] taxes."

"They're attempting to do through regulation what they couldn't do through legislation—regardless of whether the American people want it or not," the Senate's top Republican declared. "This is an insult to the millions of Americans who are already struggling to make ends meet or find a job." Majority Leader Harry M. Reid (D-Nev.) said that while he opposes McConnell's amendment, he will allow a vote on it.

Prior to the House committee's approval of HR 910, Upton's bill, Democratic members proposed several amendments calling for congressional acceptance of EPA's finding that GHGs endanger public health and the environment. All were defeated. The single amendment from that side of the aisle which became part of the bill came from Jim Matheson (D-Utah). The "sense of Congress" amendment said that there is "scientific concern over warming of the climate system."

Matheson and two other Democrats on the committee, Mike Ross (Ark.) and John Barrow (Ga.), joined Republicans in sending Upton's bill to the House floor.

Apache Deepwater joins MWCC group

Apache Corp. subsidiary Apache Deepwater LLC has joined Marine Well Containment Co. (MWCC), a not-for-profit organization for responding to a well control incident in the deepwater Gulf of Mexico.

Other MWCC members are ExxonMobil Corp., Chevron Corp., ConocoPhillips, Royal Dutch Shell PLC, and BP PLC.

MWCC has completed an interim containment system for handling as much as 60,000 b/d of fluid in as much as 8,000 ft of water. Work is also under way on an expanded containment system for delivery in 2012 for handling as much as 100,000 b/d of fluid in as much as 10,000 ft of water.

Repsol to sell more of its stake in YPF

Repsol has agreed to sell 3.83% of YPF in a move that will trim its stake in the Argentine producer, refiner-marketer, and chemical manufacturer to 75.9%.

The Spanish company will sell 2.9% of YPF to Lazard Asset Management for clients at a share price of $42.40/share, which makes the transaction worth $484 million.

Repsol also will sell 0.93% to other investors at the same share price in a deal worth $155 million.

Last year, Repsol agreed to sell 3.3% of YPF for $500 million to funds managed by Eton Park Capital Management, Capital Guardian Trust Co., and Capital International Inc.

In recent months it also has sold YPF shares totaling 1.06% of the company on stock markets.

The company says the sales fit a "strategic aim to rebalance its global assets strategy."

Besides Repsol's stake after the new sales, interests will be Peterson Group 15.46%, and 8.64% free float.

YPF has reserves estimated at 1.025 billion boe, 53% crude and gas liquids, from which it produced 550,000 boe/d in the first half of last year.

It operates refineries at La Plata (crude capacity 189,000 b/cd), Lujan de Cuyo (105,500 b/cd), and Plaza Huincul (25,000 b/cd).

Shell unit reports deepwater oil find off Brunei

Brunei Shell Petroleum Co. Sdn. Bhd. (BSP) made an oil discovery in nearly 1,000 m of water about 100 km off Brunei. The well, called Geronggong, was drilled in the 3rd Offshore Acreage Area and is the deepest water depth in which BSP has found hydrocarbons in Bruneian acreage, the company said.

Brunei Shell Petroleum (BSP) made an oil discovery in 1,000 m of water 100 km off Brunei. The well, called Geronggong, was drilled with the Noble Phoenix deepwater dynamic positioning drillship.

Evaluation of the well data continues, BSP reported, although "initial results from the Geronggong well indicate the presence of various hydrocarbon-bearing reservoirs."

BSP said, "Initial data estimates the field could contain several hundred million barrels of oil in place, which makes it a very significant discovery for Brunei."

Ken Marnoch, managing director for BSP, said, "This discovery marks the start of a new chapter in the oil and gas industry of the nation."

BSP drilled the discovery with the Noble Phoenix deepwater dynamic positioning drillship. BSP assured that before the Noble Phoenix's arrival in Brunei, the ship had undergone refurbishment and recertification on its thrusters, riser, and blow out preventer systems, thus complying with the company's high health, safety, and environmental standards.

Follow-up plans involve assessment of the full field recovery potential, including further appraisal drilling over the next 2 years, BSP said.

BHP Billiton latest to get drilling permit for gulf

The US Bureau of Ocean Energy Management, Regulation, and Enforcement issued the second deepwater drilling permit on Mar. 11 under new regulations imposed following the Apr. 20, 2010, Macondo well accident and Gulf of Mexico oil spill. BHP Billiton Petroleum received a revised permit to drill Well SB 201 on Green Canyon Block 653 in the deepwater gulf about 120 miles off Louisiana.

The permit, like the one the US Department of the Interior agency issued to Noble Energy Inc. on Feb. 28, is for activity that was suspended after US Interior Sec. Ken Salazar imposed a moratorium on new deepwater drilling of federal leases on the US Outer Continental Shelf in the accident and spill's wake.

BHP Billiton's well also will use Helix Energy Solutions Group's capping stack containment technology, BOEMRE said on Mar. 13. Initial drilling of the well began on Feb. 16, 2010, in 4,234 ft of water, it indicated.

One oil and gas industry group responded that all new deepwater drilling permits are welcome, but noted that the ones that have been issued so far are for projects that were operating before Salazar's moratorium.

"The administration has chosen to focus on baby steps…instead of taking the steps necessary to produce the domestic resources this country needs," said Erik Milito, American Petroleum Institute upstream director.

Milito added, "The oil and gas industry can and will provide even more jobs, higher economic growth, and increased revenue to the federal treasury when policymakers pursue options that make resources currently off-limits available, and move forward on permitting and licenses at a pace necessary to support domestic production."

BOEMRE seeks nominations for gulf lease sales

BOEMRE is seeking nominations regarding proposed oil and gas leases sales in the Gulf of Mexico's western and central planning areas on the Outer Continental Shelf. Information will primarily identify areas with oil and gas development potential, along with potential environmental effects and potential conflicts, it said.

This information will be in addition to that which is gathered under the National Environmental Policy Act review process, the US Department of the Interior agency said on Mar. 14. It is an early planning and consultation step to ensure that all interests and concerns are considered in leasing decisions, BOEMRE Director Michael R. Bromwich said.

The call covers 10 lease sales: five in the central gulf planning area off Louisiana, Mississippi, and Alabama; and five in the western gulf planning area off Texas. BOEMRE said that it also is preparing a multisale environmental impact statement covering the 10 lease sales concurrent with the call.

It said that nominations and comments must be submitted by Apr. 14.

Drilling & Production — Quick TakesWork starts on spill cap for UK offshore

Manufacturing has begun of a modular well-capping device central to enhancement of oil-spill readiness off the UK after the Macondo blowout and spill in the Gulf of Mexico last year (See artist rendering, Table of Contents).

The apparatus will have an overall working pressure rating of 15,000 psi and be able to cap a well flowing as much as 75,000 b/d in water as deep as 5,500 ft.

It is designed to achieve capping within 20-30 days of an incident, depending on weather and wellsite conditions. Deployment will be possible in sea states up to 16 ft, depending on the vessel used.

The cap will be attachable to various parts of subsea equipment.

Construction follows recommendation of the Oil Spill Prevention & Response Advisory Group (OSPRAG), which was set up by the UK offshore industry after the Macondo tragedy, as well as regulators and trade unions.

The industry group Oil Spill Response Ltd. commissioned the device, which Cameron Ltd. is building in Leeds. OSPRAG's Technical Review Group oversaw design in conjunction with BP PLC, the Macondo operator.

Subsea trees set in Mandy development

Two subsea trees have been installed in 2,460 ft of water in preparation for production start later this year at LLOG Exploration Co. LLC's Mandy oil development on Mississippi Canyon Block 199 off Louisiana.

LLOG made the Pliocene discovery in January 2010 in a well that encountered more than 120 net ft of oil pay. A second well found net oil pay of more than 100 ft in a separate fault block (OGJ, Mar. 8, 2010, Newsletter).

LLOG is completing both wells for tieback via a subsea manifold to the Matterhorn tension-leg platform production system on Mississippi Canyon Block 243. It expects to drill and tie in a third well.

InterMoor installed the trees, each weighing 45 tons, using Shell's Heave Compensated Loading System and the anchor-handling vessel Joshua Chouest. It installed both trees in less than 34 hr.

Two subsea trees have been installed in 2,460 ft of water in preparation for production start later this year at LLOG Exploration Co. LLC's Mandy oil development on MC Block 199 off Louisiana.

Private LLOG, operator with a 50% interest, hasn't reported production rates. Its partner is Apache Corp., which originally held a 15% interest and gained a 35% stake via merger with Mariner Energy Inc.

MWCC lets contract for tanker topsides modules

MWCC has let a contract to Weatherford International Ltd. for the design and construction of topsides process modules for two dynamically positioned tankers that will be part of MWCC's well-containment response system for the Gulf of Mexico.

The modules will have a capacity to handle up to 100,000 b/d of liquid, along with associated gas production and are scheduled to be completed in 2012.

Weatherford also has a letter of intent for the long-term storage and maintenance of the equipment, including providing assistance to deploy and operate the process modules if required to respond to a future underwater well control incident in the deepwater gulf.

ExxonMobil Corp., in partnership with Chevron Corp., ConocoPhillips, and Royal Dutch Shell PLC, are the original sponsors of MWCC. BP PLC later joined the consortium.

PROCESSING — Quick TakesValero to expand McKee refinery

Valero Energy Corp. plans to expand the crude unit capacity of its McKee refinery in Sunray, Tex., by 25,000 b/cd to increase total capacity to 195,000 b/cd.

West Texas Intermediate crude oil from Midland, Tex., will supply the additional oil after the scheduled expansion is completed in 3 years, Valero said.

The crude unit expansion plans follow a previously announced gathering system expansion to bring more Texas Panhandle oil to the refinery.

That project involves looping an existing pipeline from Valero's storage facility in Perryton, Tex., as well as building additional pump stations and storage.

"These expansion plans will enable Valero to capitalize on the production of West Texas and locally produced crudes," said Joe Gorder, Valero's executive vice-president.

The two expansion projects will give the McKee refinery more flexibility and more options, Gorder said.

Saudi Aramco picks NGL project EPC

Saudi Aramco has awarded four lump-sum turnkey contracts for the Shaybah NGL project to Samsung Engineering Co. Ltd. to perform engineering, procurement, and construction.

Scope of this award includes construction of the inlet facilities, NGL-recovery trains, dehydration, residue-gas compression, acid-gas compression, NGL storage and shipping, the upgrade of the gas-handling capacity for the four existing Shaybah gas-oil separation plants, and other associated facilities.

It also includes a major upgrade to increase the power-generation capacity to more than 1 Gw by installing four cogeneration units, seven single-cycle units, a 50-km, 230 kv transmission line, and associated electrical and nonelectrical utilities.

Saudi Aramco is building a grassroots NGL recovery plant at Shaybah field in Rub' al-Khali, also known as the "Empty Quarter."

TRANSPORTATION — Quick TakesFERC gives nod to Golden Pass LNG terminal start-up

The US Federal Energy Regulatory Commission formally approved start of operations at the Golden Pass LNG terminal near Sabine Pass, Tex., along with its pipeline. By yearend, the US Gulf Coast will host more than 92 million tonnes/year of LNG import capacity.

Golden Pass is the fourth along the Texas-Louisiana Gulf Coast to begin operating since 2008, adding nearly 70 million tpy of LNG import capacity to the area.

Trunkline LNG's Lake Charles, La., LNG terminal started up in 1982 and, after expansions, can now import 14 million tpy.

In 2005, Excelerate Energy's Gulf Gateway buoy terminal, 116 miles off Louisiana, added 3.3 million tpy of capacity.

Later this year, Gulf LNG Energy will start up its 5 million tpy terminal at Pascagoula, Miss., some 350 miles east of the southwest Louisiana-Southeast Texas concentration.

According to an announcement by Golden Pass LNG Terminal LLC, Houston, Phase 1 commissioning activities and performance tests of the receiving terminal were successfully completed earlier this month.

The 69-mile interstate pipeline was commissioned earlier in the year.

Phase 1 operations enable nominal sendout capacity of 1 bcfd of natural gas. Phase 2 of the terminal will begin commercial operations in May or June, according to Golden Pass.

When fully operational, the terminal will be able to import 15.6 million tpy of LNG.

The pipeline, with multiple intrastate and interstate connections, has a nominal capacity of 2.5 bcfd.

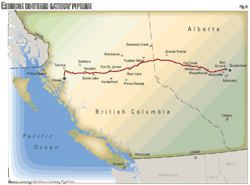

US DOS plans second Keystone XL comment period

The US Department of State will seek additional public comments on the proposed Keystone XL oil pipeline project.

A 45-day comment period on a draft environmental impact statement for the planned 1,700-mile system will begin in mid-April.

Oil and gas industry groups expressed dismay at the news. "This much-studied and much-needed pipeline would provide a critical link to our largest energy supplier, Canada, and its vast resources of nearby and available crude oil," American Petroleum Institute Pres. Jack N. Gerard said.

TransCanada Pipelines Ltd. is seeking a cross-border permit from DOS to expand its Keystone pipeline system so it could move crude from Hardisty, Alta., to terminals near Houston and Port Arthur, Tex.

Environmental organizations oppose it because the oil would be recovered from Canadian oil sands.

DOS said it has held more than 20 public meetings already along the new pipeline's route in Montana, South Dakota, Nebraska, Oklahoma, and Texas, as well as in Washington, DC. It said it would seek more comments and hold another public meeting in Washington once it issues a final environmental impact statement, and it expects to make a final decision before yearend.

Chevron plans for Train 4 at Gorgon

Chevron Australia is planning to enter front-end engineering and design studies for a fourth train at its Gorgon-Jansz LNG project in Western Australia next year.

Jim Blackwell, Chevron Australia Asia Pacific exploration and production president, told a security analyst briefing recently that sufficient gas had been found to underpin Train 4.

The current design is for an initial 3-train plant with a production capacity of 15 million tonnes/year of LNG.

A final investment decision on Train 4 is scheduled for 2013.

Blackwell added that there is sufficient space on the existing site on Barrow Island for yet another train.

The company has made 10 gas discoveries off Western Australia during the last 18 months, which he says will underpin potential expansions at Gorgon-Jansz as well as at the company's proposed Wheatstone project.

Wheatstone is currently planned as a 2-train, 10 million tpy facility. It could be expanded to a 3-train plant, or more.

At the end of 2010 Blackwell said Chevron had estimated total gas resources of 60 tcf.

In the meantime work on the $37.3 billion (Aus.) Gorgon-Jansz project is 20% complete.

The onshore construction village has been completed, dredging is nearing completion, and module fabrication is progressing on schedule.

The new purpose-built drilling rig has been built. The first development well is scheduled for drilling later this year.

More Oil & Gas Journal Current Issue Articles

More Oil & Gas Journal Archives Issue Articles

View Oil and Gas Articles on PennEnergy.com