Majors pull back from renewable energy investments

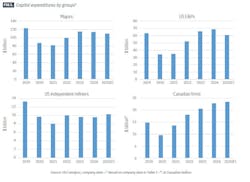

The combined capital expenditures of six major oil companies—ExxonMobil Corp., Chevron Corp., Shell PLC, BP PLC, Equinor ASA, and TotalEnergies SE—are projected to be $108-112 billion in 2025, according to the Oil & Gas Journal’s annual capital spending survey. This is a decrease from $113.7 billion in 2024 and $114.7 billion in 2023 and remains significantly lower than the pre-pandemic level of $123 billion in 2019. Notably, majors are scaling back their earlier aggressive investments in renewable/green energy sources.

ExxonMobil has consistently been the biggest spender among the majors. ExxonMobil is projected to invest $27-29 billion in 2025, indicating a steady increase compared to prior years, partly reflecting the first full year with Pioneer Natural Resources as part of the portfolio. Chevron, BP, and Shell are spending less in 2025, reflecting structural cost reductions and capital discipline.

The spending plans for 2025 indicate that the oil giants are prioritizing efficiency and returns over aggressive growth considering cautious market expectations, especially uncertainties surrounding oil demand and US tariffs. Major oil companies have gradually adjusted ambitions to realities in their approaches to capital investments in renewable and low-carbon businesses, reflecting a complex landscape influenced by financial performance, shareholder expectations, and strategic priorities.

In 2024, Shell reduced its workforce in the low-carbon solutions sector by at least 15%, indicating a strategic shift back to its core oil and gas operations to enhance profitability. Additionally, Shell has relaxed its 2030 carbon reduction target. In its 2025 capital budget, BP revealed plans to boost its investment in oil and gas by about 20% to $10 billion, while cutting back on funding for renewable energy projects. This change reflects a recalibration of BP's strategy to balance traditional energy sources with renewable initiatives. Meantime, in February 2025, Equinor announced a reduction in investments in renewable energy projects, planning to allocate $5 billion over the next 2 years, down from the previously planned $10 billion. This decision reflects a strategic shift towards increasing oil and gas production.

The dashboard of the same survey indicates that a consortium of 22 US-listed exploration and production (E&P) companies plans to allocate $59-62 billion for total capital expenditures in 2025, marking an increase compared with their spending levels for any year since 2019.

However, this increased willingness to raise capital expenditure is likely primarily influenced by heightened merger and acquisition (M&A) activity over the past few years. For instance, Diamondback plans to boost its capital spending to $4 billion in 2025 from $2.9 billion in 2024, a change linked to its merger with Endeavor Energy Resources in September 2024, along with other acquisitions. Similarly, Coterra Energy Inc. is looking to increase its capital spending in 2025 after its recent purchases in the Delaware basin. ConocoPhillips plans a 2025 capital budget of $12.9 billion, up from $12.12 billion in 2024, following its acquisition of Marathon Oil Corp. in November 2024.

When accounting for these M&A activities, which may provide a more uniform basis for comparison across the entire E&P sector, total spending appears to decline in 2025, driven by significant consolidation following extensive M&A activity.

The Permian basin and other high-margin shale plays remain at the forefront of capital allocation efforts, with an emphasis on enhancing efficiency and generating free cash flow (FCF). As indicated by company press releases, 2025 is expected to be a year of strong production growth, particularly in natural gas and natural gas liquids (NGLs).

Even with US President Trump's pro-energy initiatives—such as easing drilling regulations and streamlining permitting processes designed to reduce costs for shale oil companies—there has not been a notable shift in the industry's capital spending approaches. Shale producers remain cautious in their investments, prioritizing financial discipline and returns for shareholders over aggressive expansion.

Meantime, since late 2023, the cost of US shale oil production has experienced its first decline in 3 years, signaling cost deflation. This trend is primarily attributed to falling unit prices for raw materials and oil services. According to the Enverus Day Rate Survey, US drilling day rates plummeted in 2024, ending the year lower than they began for the first time since the COVID-19 pandemic began. The composite day rate dropped for the 11th consecutive month, reaching $22,220 in December 2024, down $1,457 from a year ago. Cost deflation is mostly being spurred by enhanced efficiency, as technological advancements have led to reduced demand for rigs and fracturing fleets. The integration of artificial intelligence (AI) has optimized drilling processes, allowing for more precise operations and reduced manpower. Additionally, the adoption of alternative fuels, such as compressed natural gas (CNG), has contributed to cost reductions. However, Trump's tariffs could pose upward cost risks.

US independent refiners are projected to spend $10.3 billion in 2025, up from $9.6 billion in 2024. Marathon Petroleum remains the largest spender, with a forecast of $3.25 billion in 2025. Valero Energy and Phillips66 also will increase capital spending in 2025.

In 2025, US independent refiners are navigating a complex landscape marked by tightening refining margins and evolving market dynamics, with headwinds such as tariffs on Canadian heavy crude imports and competition from new refineries abroad. The industry is also experiencing refinery closures and restructuring initiatives as it adapts to changing market conditions. Many older, less efficient refinery capacity is expected to shut down due to shrinking margins and reduced product demand. The US Energy Information Administration (EIA) projects that US refinery capacity will decrease to 17.9 million b/d by end-2025, a reduction of about 3% from the beginning of 2024. This decline is due to planned closures, including LyondellBasell's Houston refinery and Phillips 66's Los Angeles refinery, which collectively will remove about 400,000 b/d of refining capacity. Meantime, midstream/chemical operations are viewed increasingly as the jewel of the companies’ long-term portfolio.

Canadian producers are increasing capital outlays, those within our coverage are projected to spend $23-24 billion (Canadian dollars) this year, up from $22.94 billion spent in 2024.

The Trans Mountain Pipeline expansion was completed and began operations on May 1, 2024, after 12 years and a total investment of $34 billion (Canadian dollars). This expansion nearly tripled the pipeline's capacity from Alberta to Canada's Pacific coast, allowing Canadian oil producers to better access global markets. As a result, local crude prices are rising, ultimately boosting capital investment and production levels. In January 2025, the average price for Western Canada Select (WCS), which many Alberta oil producers receive, was $62.86/bbl, a 16.9% increase compared with the same time the previous year. Canadian Natural Resources announced plans to boost production by 12% in 2025. Meantime, the development of LNG export plants such as LNG Canada and Cedar LNG highlight substantial and increasing investment in Canadian LNG infrastructure.

Although the 2025 outlook is positive for Canadian firms, potential challenges like trade tensions and tariff threats could influence investment decisions.

Majors’ spending plans

ExxonMobil reported total capital and exploration expenditures of $27.6 billion for full-year 2024, aligning with its full-year guidance. Upstream spending of $21.8 billion in 2024 increased by $2.1 billion from 2023, reflecting higher investment in the US Permian basin after the Pioneer acquisition. Post-acquisition and integration of Pioneer, ExxonMobil anticipates achieving over $3 billion in annual synergies, exceeding prior guidance by more than 50%. The company now holds the largest contiguous acreage in the Permian basin, with twice the number of low-cost net drilling locations compared with its nearest competitor.

Capital investments in the Product Solutions businesses totaled $4.9 billion in 2024, a decrease of $1.1 billion from 2023, reflecting lower global project spending. Other spend of $0.9 billion primarily reflects investments in the Low Carbon Solutions business to advance carbon capture and storage (CCS), lithium, and virtually carbon-free hydrogen projects and technologies.

In 2025, ExxonMobil anticipates capital expenditures of $27-29 billion, marking the first full year of Pioneer in the portfolio and investment in building new businesses, with base capex remaining flat. Actual spending may vary based on the progress of individual projects and property acquisitions.

According to Darren Woods, ExxonMobil chairman and chief executive officer, through 2030, the operator plans to deploy about $140 billion to major projects and the Permian basin development program. “We expect this capital to generate returns of more than 30% over the life of the investments,” said Woods.

According to a plan published in December 2024, ExxonMobil is pursuing up to $30 billion of low-emission opportunities between 2025 and 2030, with almost 65% spent on reducing emissions for third-party customers. ExxonMobil’s Low Carbon Solutions business focuses on 3 primary verticals: CCS, hydrogen, and lithium.

Chevron Corp. announced organic capital expenditure of $14.5-15.5 billion for consolidated subsidiaries and an affiliate capital expenditure of $1.7-2.0 billion for 2025. The company's 2025 capex and affiliate capex budgets reflect a nearly $2 billion reduction compared with the previous year.

“The 2025 capital budget along with our announced structural cost reductions demonstrate our commitment to cost and capital discipline,” said Chevron chairman and chief executive officer Mike Wirth. “We continue to invest in high-return, lower-carbon projects that position the company to deliver free cash flow growth.” The operator plans to cut as much as a fifth of its workforce as it seeks to cut costs.

Chevron's upstream capex is projected at $13 billion in 2025, a decrease from the $14.3 billion spent in 2024. Of the $13 billion, two-thirds is allocated to the US. This includes $4.5-5 billion for Permian basin development, with the remainder divided between the Denver-Julesburg (DJ) basin and the Gulf of Mexico. Internationally, about $1 billion is designated for Australia.

Downstream capex is estimated at $1.2 billion, with two-thirds allocated to the US, decreasing from $1.7 billion in 2024, $1.8 billion in 2023, and $2 billion in 2022. In fourth-quarter 2024, Chevron's refining business reported a loss for the first time since 2020, primarily due to weak margins and reduced demand for products like jet fuel.

About $1.5 billion of the total capex, included within upstream and downstream budgets, is dedicated to reducing the carbon intensity of operations and expanding new energy businesses, according to Chevron.

Shell’s capital expenditure for full-year 2024 was $21.1 billion, down from $24.4 billion in 2023 thanks to disciplined capital allocation. In 2024, expenditures in the upstream business were $7.9 billion, down from $8.3 billion in 2023. Capital spending on integrated gas totaled $4.76 billion, up from $4.2 billion in 2024. Capital spending on renewable and energy solutions equaled $2.55 billion in 2024, down from $2.68 billion in 2023. Cash capex 2025 range (to be released in March following OGJ’s print deadline) is expected to be lower than 2024.

BP will invest with rigorous discipline within a revised capital frame of $15 billion in 2025, and around $13-15 billion in 2026-27. The operator plans to invest around $10 billion in oil and gas on average per year, 20% more than previous guidance, allowing the company to develop more high-return major projects and enhance exploration. BP also is looking to reduce its workforce by over 5% as part of its cost-cutting initiative.

Of the $10 billion, around 70% is expected to be allocated to oil and 30% to gas. “The upstream is, and will continue to be, bp’s primary cash generating business,” said Murray Auchincloss, chief executive officer.

Downstream spending will be around $3 billion in 2027, about $1 billion less than in 2024. In low-carbon energy, BP expects capital expenditure, on average, will be less than $800 million per year through 2027, around half of which is allocated to hydrogen and CCS projects already through financial investment decision.

TotalEnergies SE’s capital investment in 2024 was $17.8 billion, with $4.8 billion allocated to low-carbon energies. Organic capital spending in 2025 is expected to be $17-17.5 billion, down from a previous guidance of $18 billion. About 40% of the capital is for new oil and gas projects, up from a previous ratio of 34% in 2024.

Equinor ASA's organic capital expenditure is expected to total $13 billion for 2025 and on average for the period 2025-2027. Equinor will reduce investments in renewables over the next 2 years by 50% to $5 billion and will increase its focus on oil and gas production, expecting more than 10% growth from 2024 to 2027.

US E&Ps’ spending plans

ConocoPhillips Co.’s total capital guidance for 2024 was $12.12 billion, up from $11.25 billion in 2023, and $10.16 billion in 2022. ConocoPhillips’ capital expenditures for Alaska projects increased to $3.2 billion in 2024 from $1.7 billion in 2023, supported by continued progress on projects like Willow and Nuna, along with the company’s agreement to acquire certain Chevron oil and gas assets in Alaska.

In November 2024, ConocoPhillips completed the acquisition of Marathon Oil. ConocoPhillips’ total capital guidance for 2025 is rising to $12.9 billion, including funding for ongoing development drilling programs, major projects, exploration and appraisal activities and base maintenance. The company aims to spend 15% less on its Lower 48 assets while ramping up spending for its Willow LNG project in Alaska and LNG projects with Qatar, among others. The 2025 production guidance is 2.34-2.38 MMboe/d.

In 2024, Occidental Petroleum Corp. reported capital expenditures of $7 billion, an increase from $6.3 billion in 2023 and $4.5 billion in 2022. The capex increase for 2024 was driven by ongoing construction of the STRATOS direct air capture plant, heightened domestic development efforts in the oil and gas sector, and continued expansion and conversion activities of OxyChem's Battleground chlor-alkali plant.

Occidental's proposed capital budget for 2025 is $7.6-7.8 billion. Of this, capital expenditures dedicated to oil and gas are projected to be $5.8-6.0 billion, an increase from $5.3 billion in 2024 and $4.96 billion in 2023. Over the next 5 years, Occidental intends to invest roughly $8.7 billion to develop its proved undeveloped (PUD) reserves in the Permian basin.

EOG Resources Inc.’s 2025 capital spending will be $6.0-6.4 billion. The majority of 2025 expenditures will be allocated to US crude oil drilling activities, with increased activity planned for the Utica and Dorado basins, while plans include completing 375 net wells in the Delaware basin, down from 385 in 2024.

Ovintiv Inc. plans to allocate about $2.15 billion to $2.25 billion for its full-year 2025 capital investment program, focusing on maximizing returns from high-margin oil and condensate. This represents a decrease from the $2.3 billion invested in 2024 and $2.74 billion in 2023.

Devon Energy Corp.'s 2025 capital expenditure budget is projected to be about $3.8-4.0 billion, about 7% higher than its 2024 capital expenditure, primarily due to the acquisition of assets from Grayson Mill Energy.

Diamondback's capital expenditures in 2025, accounting for the pending Double Eagle acquisition, are estimated at $3.8-4.2 billion, with $3.13-3.44 billion allocated for horizontal drilling and completions. This marks a 40% increase from the company's 2024 capital expenditures, due to the Endeavor acquisition, the Viper Tumbleweed acquisitions, and the pending Double Eagle acquisition.

In 2025, EQT Corp. expects to spend about $2.3-2.5 billion on total capital expenditures, with around $1.45-1.56 billion to fund reserve development.

Coterra Energy anticipates 2025 capital expenditures of $2.1-2.4 billion, representing a 28% year-over-year increase at the midpoint, driven by additional spending related to its recently completed Delaware basin acquisitions.

Civitas Resources plans to reduce capital investments in 2025 by nearly 5% year-over-year to $1.8-1.9 billion. For the year, slightly more than half of total capital investments are expected to be allocated to the Permian basin, with the remainder to the DJ basin. Additionally, to solidify the low-cost structure, Civitas announced an approximate 10% reduction in its workforce across all levels of the organization.

US independent refiners

Phillips 66 unveiled a capital budget of $2.1 billion for 2025, which consists of $998 million allocated for sustaining capital and $1.1 billion designated for growth initiatives. When factoring in Phillips 66’s proportional share of capital expenditures related to its joint ventures, CPChem and WRB, the company's total projected capital program for 2025 amounts to nearly $3 billion.

The company’s new financial targets for 2025-27 reflect plans to grow midstream and chemicals and maintain total annual capital expenditures and investments of about $2 billion, excluding acquisitions.

In the midstream segment, the capital budget totals $975 million, with $429 million dedicated to sustaining projects and $546 million for growth projects. This budget aims to enhance the integrated NGL wellhead-to-market value chain, reinforcing the company's position in critical basins by expanding gas processing capacity.

In the refining sector, Phillips 66 has earmarked $822 million for investments, with $414 million set for sustaining capital. The refining growth capital of $408 million reflects the company's focus on high-return, low-capital projects. The company’s refining capital spending in 2024 was $582 million.

Marathon Petroleum Corp. (MPC)'s standalone capital spending outlook for 2025 is $1.25 billion, down from $1.52 billion spent in 2024. In the refining and marketing sector, MPC intends to cut low-carbon investments by nearly $300 million in 2025 compared with 2024.

Of the 2025 capital budget, about 70% is focused on value-enhancing capital and 30% on sustaining capital. MPC's 2025 capital spending includes ongoing high-return investments at its Los Angeles, Galveston Bay, and Robinson refineries. In addition to these multi-year investments, the company is executing shorter-term projects that offer high returns through margin enhancement and cost reduction.

Meantime, Marathon Petroleum Logistics (MPLX)'s capital spending outlook for 2025 is $2.0 billion, up from $1.94 billion in 2024. MPLX is expanding its Permian to Gulf Coast integrated value chain, advancing long-haul pipeline growth projects to support expected increased producer activity, and investing in Permian and Marcellus processing capacity.

Valero Energy Corp.’s capital expenditure for 2025 is $1.95 billion, compared with $1.9 billion in 2024 and $1.76 billion in 2023. Valero's refining segment is slated to receive $1.73 billion in 2025, up from $1.63 billion in 2024, $1.49 billion in 2023, but down from $1.76 billion in 2022. Meanwhile, the renewable diesel segment will receive $220 million in 2025, compared with $321 million in 2024, and $294 million in 2023, and $879 million in 2022.

Canadian spending

Financial data for the Canadian segment are presented in Canadian dollars unless otherwise stated.

Suncor Energy Inc. anticipates capital expenditures for 2025 to be $6.1-6.3 billion, compared with $6.16 billion in 2024, and $5.57 billion in 2023. Key economic initiatives planned or in progress for 2025 include replacing the Upgrader 1 coke drums at the Base Plant, developing the Mildred Lake West Mine Extension and West White Rose projects, and implementing enhancements to the Petro-Canada retail network.

E&P capital expenditures are projected to reach $725-775 million in 2025, compared with $862 million in 2024, and $635 million in 2023. For Oil Sands, capital investments are expected to be $4.175-4.25 billion in 2025, up from $4.07 billion in 2024, $3.88 billion in 2023, and $3.41 billion in 2022. Suncor forecasts its upstream production for full-year 2025 to be 810,000-840,000 b/d, with Oil Sands production projected at 765,000-785,000 b/d. Additionally, Suncor's capital expenditure for its downstream operations is anticipated to be $1.175-1.25 billion in 2025, compared with $1.18 billion in 2024, and $1 billion in 2023.

Canadian Natural Resources Ltd.'s 2025 budget is set at $6.15 billion, up from $5.29 billion in 2024 and $4.9 billion in 2023. In 2025, the company targets production of 1.51-1.56 MMboe/d, increasing from 1.36 MMboe/d in 2024 and 1.33 MMboe/d in 2023. Natural gas production in 2025 is targeted at 2.425-2.48 bcfd, with liquids production targeted at 1.11-1.14 million b/d.

Cenovus Energy Inc. plans to invest $4.6-5 billion in 2025, compared with $5 billion in 2024, $4.3 billion in 2023, and $3.7 billion in 2022. Total upstream capital spending of $3.94-4.2 billion is expected in 2025, compared with $4.28 billion in 2024. Oil Sands capital investment of $2.7-2.8 billion is planned in 2025, compared with $2.71 billion in 2024, and $2.38 billion in 2023. Cenovus aims for upstream production of 805,000-845,000 boe/d, an increase of about 4% compared with 2024. The company’s downstream capital spending is set at $650-750 million in 2025, compared with $696 million in 2024, $747 million in 2023, and $1.2 billion in 2022.

Imperial Oil Ltd.’s capital expenditures for 2025 are expected to be about $1.9-2.1 billion, compared with $1.87 billion in 2024, and $1.78 billion in 2023. In the upstream, production is forecasted to grow to 433,000-456,000 boe/d. Higher volume reflects continued growth at Kearl, the first full-year contribution from Grand Rapids at Cold Lake, as well as other optimization initiatives.

National oil companies

Petrobras, Brazil's state-controlled oil company, outlined its capital expenditure plans for the 2025-29 period, reflecting a focus on exploration and production, as well as a commitment to energy transition initiatives. The company's plan totals $111 billion for 2025-29, marking a 9% increase from the 2024-28 plan.

About $77 billion is allocated to E&P activities. Through the plan, Petrobras aims to reach total production of 3.2 MMboe/d, including 2.5 million b/d of oil. Around $20 billion is earmarked for downstream and midstream segments, representing an increase of 17% compared with the previous plan.

Petrobras has increased its budget for low-carbon initiatives by 42%, allocating $16.3 billion over the 5-year period. The investment includes renewable energy generation, bioproducts such as ethanol and biodiesel, low-carbon hydrogen, and carbon capture, utilization, and storage.

Saudi Aramco plans to maintain capital investments of $52-58 billion in 2025, compared with $53.4 billion last year. The company underscored its commitment to ongoing projects and initiatives, with 60% of the budget allocated to E&P and 10% to new energy projects. Aramco anticipates a total dividend of $85.4 billion in 2025, a decrease from last year's distribution of over $124 billion, attributed to a 12% decline in earnings for 2024.

China National Offshore Oil Corp. (CNOOC) projects 2025 capital expenditure of RMB 125-135 billion. About 16% is allocated to exploration, 61% for development, and 20% for production. In 2024, capex was around RMB 132 billion. CNOOC is enhancing its Daxie refinery with a $2.7 billion upgrade, aimed at boosting petrochemical production.

Podcast recap

About the Author

Conglin Xu

Managing Editor-Economics

Conglin Xu, Managing Editor-Economics, covers worldwide oil and gas market developments and macroeconomic factors, conducts analytical economic and financial research, generates estimates and forecasts, and compiles production and reserves statistics for Oil & Gas Journal. She joined OGJ in 2012 as Senior Economics Editor.

Xu holds a PhD in International Economics from the University of California at Santa Cruz. She was a Short-term Consultant at the World Bank and Summer Intern at the International Monetary Fund.

Laura Bell-Hammer

Statistics Editor

Laura Bell-Hammer is the Statistics Editor for Oil & Gas Journal, where she has led the publication’s global data coverage and analytical reporting for more than three decades. She previously served as OGJ’s Survey Editor and had contributed to Oil & Gas Financial Journal before publication ceased in 2017. Before joining OGJ, she developed her industry foundation at Vintage Petroleum in Tulsa. Laura is a graduate of Oklahoma State University with a Bachelor of Science in Business Administration.