IEA: US Midwest refineries continue to benefit from Canadian crude

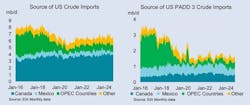

On Feb. 1, 2025, President Trump announced an additional 25% tariff on imports from Canada and Mexico, including a 10% increase on crude oil. This measure was later suspended for at least a month. Canada and Mexico together supply 70% of US crude imports, with Canada alone contributing over 60% (4.1 million b/d in 2024). However, this figure understates the deep interdependence between Canadian crude producers and US refiners, particularly in the Midwest. According to analysis from the International Energy Agency (IEA), US Midwest refineries will continue to benefit from Canadian crude imports despite the incremental costs.

US light tight oil

Over the past decade, crude markets have adapted to the rise of US light tight oil (LTO) production and shifting OPEC supply toward Asia from the Atlantic Basin.

Canadian crude has become a vital feedstock for US refiners, especially as pipeline infrastructure facilitates cost-effective delivery. Significant refinery investments in processing heavy Canadian crude have further cemented this dependence, particularly in the US Midwest, where refineries are optimized for handling heavier grades.

While Mexican crude is primarily directed to Gulf Coast refineries and could theoretically be rerouted to other buyers, the Midwest is highly reliant on Canadian imports. Furthermore, to accommodate rising LTO output, key pipelines that have historically shipped crude from the USGC to the Midwest have been reversed to bring LTO and/or Canadian crude south.

Consequently, Midwest refineries lack access to the necessary infrastructure to secure alternative supplies to domestic shale and Canadian imports. US midstream infrastructure has been wholly reconfigured such that USGC refineries received 480,000 b/d of Canadian crude via the Midwest in 2024, the largest source of foreign crude, and ahead of the combined deliveries of OPEC, or Mexico to the region.

Infrastructure, capacity

Other US refining regions are less dependent on Canadian crude. US East Coast (PADD 1) refiners imported about 150,000 b/d of crude produced on Canada’s East Coast in 2024. This represents nearly a quarter of regional imports that account for nearly 85% of regional crude runs. Similarly, West Coast refiners (PADD 5) imported some 370,000 b/d of crude piped to Canada’s West Coast. This represents almost 30% of imports, which account for around 57% of regional crude supply. “On paper, these coastal US refining hubs can substitute alternative longer-haul imports of similar grades for those from Canada, if suitable qualities and quantities are available in the international market at a competitive price,” IEA said.

However, as IEA noted, the biggest challenge would be in the Midwest (PADD 2 and PADD 4), where Canadian crude made up 100% of the 3.2 million b/d of imports in 2024, accounting for 72% of the region’s 4.5 million b/d of refinery crude runs. Additional supply came from 700,000 b/d piped from PADD 3 and 600,000 b/d of local production.

“From 1990 to 2024, the region’s refiners expanded and adapted their capacity to benefit from these flows, boosting distillation capacity by over 30% and doubling coking capacity. Today the region has a total refining capacity of 4.9 million b/d, including 3 million b/d of refineries equipped with coking units, a necessary component to handle the high proportion of heavy material that requires upgrading,” IEA said.

If tariffs were imposed on Canadian crude, Midwest refiners would struggle to adjust their supply due to infrastructure constraints, according to IEA. The transformation of US pipeline networks since the 2015 crude export authorization has significantly reduced the ability to import crude into PADD 2. Transfers from PADD 3 to PADD 2 have dropped from a peak of 2.1 million b/d in 1999 to just 700,000 b/d in 2024.

Similarly, Canadian barrels have limited egress to markets outside North America, with capacity via the Canada’s TMX pipeline to the Pacific Coast limited to 890,000 b/d (running at close to 700,000 b/d in fourth-quarter 2024) and volumes through the US Gulf Coast below 200,000 b/d.

Canadian crude prices are typically discounted relative to US WTI at Cushing to account for quality differences and transport costs, especially when pipeline capacity is constrained, forcing shipments via costlier rail. Prices at Hardisty are influenced by the last barrel sold, and reliance on rail can widen price differentials. In the past, market imbalances and refinery outages have caused volatility, though Alberta’s government has occasionally limited price declines by curtailing production to align supply with demand.

“If tariffs are imposed, this may not materially impact throughputs, at least in the short term. Midwest refining margins are consistently amongst the highest in the world, having averaged $21.80/bbl since 2021. Furthermore, the access to cost advantaged crude and flexible refinery configurations result in refinery utilization rates that have averaged above 91% since 2021. This suggests that US Midwest refineries would likely continue to maximize operations and Canadian imports, due to their infrastructure dependence and despite the incremental costs. Similarly, Canadian producers may still see value in supplying US refineries, given the poor alternate value for their crude and the logistical constraints they face to access new markets,” IEA said.