IEA increases 2025 global oil demand forecasts

According to the latest Oil Market Monthly Report released by the International Energy Agency (IEA) in February 2025, the forecast for global oil demand growth in 2025 has been slightly raised to 1.1 million b/d, higher than the 1.05 million b/d forecast in January, due to a minor pickup in GDP growth and lower oil prices as per the current forward curve. However, the growth estimate for 2024 has been lowered to 870,000 b/d from 940,000 b/d.

“Weaker-than-expected fourth-quarter 2024 demand came despite a drop in temperatures, which affected all OECD regions as well as China. US November deliveries were particularly weak, contracting by 510,000 b/d y-o-y, their steepest fall since June,” IEA said.

Growth in 2025 will be led by China, even as its share of the global increase slumps to 19%, compared with 60% in the preceding decade, driven entirely by the petrochemical sector. India and Other Asia provide an increasing share of growth, contributing a combined 500,000 b/d. After a slight rise last year, OECD demand is anticipated to resume its structural decline.

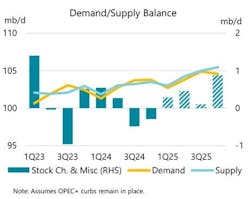

In January, global oil supply fell by 950,000 b/d, reaching 102.7 million b/d, as seasonally colder weather hit North American supply, compounding output declines in Nigeria and Libya. However, supply was still 1.9 million b/d higher than the same period last year, driven mainly by increases in the Americas. Forecasts suggest that global oil supply is set to rise by 1.6 million b/d to reach 104.5 million b/d in 2025, with the majority of this growth coming from non-OPEC+ producers, assuming OPEC+ continues its voluntary cuts.

“Fresh US sanctions on Russia and Iran roiled markets at the start of the year but they have yet to materially impact global oil supply. Iranian crude oil exports are only marginally lower while Russian flows, so far, continue largely unaffected. At the same time, non-OPEC+ oil supplies, led by the Americas, are set to expand by 1.4 million b/d this year – well above projected demand growth. However, improved OPEC+ compliance with agreed targets is slowly chipping away at this year’s projected supply surplus. The producer alliance confirmed on Feb.3 it plans to start unwinding voluntary cuts from April, noting that these additional voluntary production adjustments have ensured the stability of the oil market,” IEA said.

Global crude runs fell by 1 million b/d to 82.9 million b/d in January as a cold snap and planned maintenance work reduced US runs. Throughputs are forecast to average 83.3 million b/d this year, with gains of 580,000 b/d y-o-y led by non-OECD regions. Sour crude refining margins collapsed in Asia in mid-January, as new US sanctions on Russian boosted Dubai crude prices. Atlantic Basin margins benefited from higher middle distillate cracks.

Global observed oil stocks fell 17.1 million bbl m-o-m to 7,647 million bbl in December, as crude oil stocks plunged by 63.5 million bbl and products stocks rose by 46.4 million bbl. OECD industry inventories continued to decline, by 26.1 million bbl to 2,737.2 million bbl, 91.1 million bbl below their 5-year average. Preliminary data show total global inventories falling a further 49.3 million bbl in January, led by a large crude stock draw in China.

In early January, North Sea Dated experienced a surge of $8/bbl, briefly trading at a 5-month high of $83/bbl. This spike was driven by new US sanctions on Russia, along with a cold snap in the Northern Hemisphere. However, most of these gains were subsequently reversed as overall market sentiment worsened, with the prospect of higher US tariffs raising fears of an emerging trade war. By the end of the month, Dated settled at $77/bbl, reflecting a $2.50/bbl increase, and remained around that level in early February.

“It is still too early to tell how trade flows will respond to new US tariffs or the prospect thereof, and what the impact of the escalation of sanctions on Iran and Russia may be in the longer run. But time and again, oil markets have shown remarkable resilience and adaptability in the face of major challenges – and this time is unlikely to be different,” IEA said.