EIA forecasts lower crude oil prices in 2025, 2026

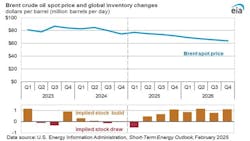

In its February 2025 Short-Term Energy Outlook, the US Energy Information Administration (EIA) projects that OPEC+ production cuts will decrease global oil inventories, maintaining crude oil prices near current levels through first-quarter 2025.

As production gradually increases and global oil demand growth remains relatively weak, global oil inventories are expected to rise in second-half 2025 through 2026, exerting downward pressure on prices. Consequently, the Brent crude oil price is forecasted to average $74/bbl in 2025, dropping to $66/bbl in 2026, compared with $80/bbl in 2024.

Tariffs

On Feb. 1, President Trump also signed an Executive Order announcing the imposition of tariffs on imports from Canada, Mexico, and China. According to EIA, US tariffs placed on imports from China through that Executive Order, as well as China’s retaliatory tariffs placed on select imports from the US, are incorporated in this outlook and remain through the entire forecast period.

“Although the future imposition of tariffs could affect oil trade routes, we do not presently anticipate the tariffs put forward in the Feb. 1 Executive Order would significantly affect global oil supply. Still, the possibility of future tariffs and the new sanctions on Russia are sources of uncertainty for oil prices going forward,” EIA said.

The implementation of tariffs for imports from Mexico and Canada were delayed by 30 days, so the effects of those two policies are not reflected in this outlook.

EIA anticipates a rise in global liquid fuels production by 1.9 million b/d in 2025 and 1.6 million b/d in 2026, driven by supply growth from non-OPEC+ countries and the easing of OPEC+ production cuts. The sanctions on Russia's oil and shipping sectors, announced on Jan. 10, are not expected to significantly impact this production forecast.

Consumption

Oil consumption growth in EIA’s forecast continues to be slower than the pre-pandemic trend.

Global liquid fuels consumption is forecast to increase by 1.4 million b/d in 2025 and 1.0 million b/d in 2026, driven primarily by demand from non-OECD Asia.

India will increase its consumption of liquid fuels by 300,000 b/d in both 2025 and 2026, compared with an increase of 200,000 in 2024, driven by rising demand for transportation fuels. China’s liquid fuels consumption will grow by 200,000 b/d in both 2025 and 2026, up from growth of less than 100,000 b/d in 2024 as China’s economic stimulus efforts increase petroleum consumption.

US distillate fuel oil consumption is expected to grow by 4% in 2025 and remain stable in 2026, influenced by GDP growth and increased industrial activity. Motor gasoline consumption in the US is projected to stay flat in 2025 as fuel efficiency improvements outpace driving increases. In 2026, further efficiency gains and slower employment growth are expected to slightly reduce gasoline consumption.

The Henry Hub spot price averaged $4.13/MMbtu in January, peaking at $9.86/MMbtu on Jan. 17 due to a cold snap across the US, leading to above-average inventory withdrawals. The spot price is expected to rise through 2026, averaging nearly $3.80/MMbtu in 2025, and reaching almost $4.20/MMbtu in 2026.