Global natural gas balance may tighten first-quarter 2025

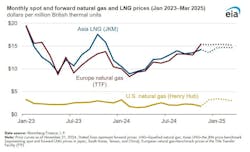

The last two winters in the Northern Hemisphere were exceptionally mild, keeping global natural gas markets well supplied and balanced at relatively low prices. Prices going into this winter are only slightly higher than last year at the same time, based on current forward natural gas and LNG prices in Europe and Asia.

If weather remains mild this winter as in the past two winters, the US Energy Information Administration (EIA) expects a relatively stable global supply-demand balance with prices similar to the previous two winters. But if Europe and Asia experience colder temperatures this winter than in the past 2 years or other operational and market risks materialize, global supply-demand balances could tighten, leading to elevated natural gas prices and potential price spikes.

Several issues could affect global natural gas balances this winter, according to EIA:

• LNG supply growth. EIA expects limited LNG capacity additions to come online this winter, mostly in the US.

• Shifts in pipeline flows. Less natural gas could be supplied by pipeline to Europe if the Russia-Ukraine natural gas transit contract set to expire at the end of 2024 is not renewed.

• Operational issues. There could be delays in the start-up of new projects, issues with availability of natural gas feedstock for exports, unplanned outages at LNG plants, and geopolitical events that could alter LNG trade flows, potentially reducing available supply.

• Below normal temperatures. A cold winter with sustained, lower-than-normal temperatures in one or more regions in the Northern Hemisphere could occur as El Niño changes to La Niña this year. This change in climate patterns may increase natural gas demand, creating competition for spot LNG supplies between Europe and Asia. Colder weather in the US could reduce storage inventories and increase domestic Henry Hub prices, affecting LNG export prices from the US. Other LNG import markets, including Brazil and Egypt, could also increase LNG demand, intensifying competition for spot LNG among regions, further tightening balances.

• Power generation. Issues related to electricity supply could affect demand for LNG as a fuel source for power generation, such as nuclear availability and restarts in Europe and Asia, renewable energy output, and fuel availability and costs to power stations.

In 2024, LNG front-month futures prices continued to decline and remained consistently lower than in 2022 and 2023. This year, global natural gas prices at key benchmarks in East Asia (JKM) and in Europe at the Title Transfer Facility (TTF) decreased by more than 50% compared with 2022 and by more than 20% compared with 2023, according to data from Bloomberg Finance LP as reported by EIA.

So far this year (January–October), JKM prices in East Asia averaged $11.47/MMbtu and TTF prices in Europe averaged $10.37/MMBtu. Natural gas prices continued to decline in 2024 mainly in response to high inventories in Europe, less natural gas consumption, and relatively stable global natural gas supplies. Current forward prices at TTF and JKM for the upcoming winter average around $15/MMBtu.

Limited LNG capacity additions

EIA expects limited LNG capacity additions to come online this winter. Most of the new LNG export projects are in the US, including the first of seven mid-scale trains of Cheniere Energy Inc.’s 10-million tonne/year (tpy) Corpus Christi LNG Stage 3 expansion, Venture Global Inc.’s 13.3-million tpy Plaquemines LNG Phase 1 (consisting of 18 mid-scale trains), and additional capacity at Freeport LNG Development’s 15.45-million tpy plant achieved through engineering and operational optimization.

Other markets are also adding LNG export capacity. In Mexico, a new LNG plant on the country’s east coast—New Fortress Energy Inc.’s 1.4-million tpy Fast LNG Altamira—shipped its first cargo in August 2024 and reached full production capacity in October. The 2.3-million tpy Phase 1 of bp PLC’s Greater Tortue Ahmeyim LNG project offshore Senegal and Mauritania is on track to start LNG production by end 2024 according to EIA. After shipping several cargoes, however, PAO Novatek’s 19.8-million tpy Arctic 2 LNG plant shut down in October mainly because of sanctions and may not produce LNG this winter.

During the past two winters spanning 2022–23 and 2023–24, exceptionally mild weather reduced heating demand in both Europe and Asia. In both 2023 and 2024, Europe ended the winter heating season with record storage inventories. In 2024, the European Union (EU) extended coordinated demand-reduction measures through March 2025, aiming to reduce natural gas consumption by at least 15% on an annual basis compared with the average during the previous 5 years (Apr. 1, 2017-Mar. 31, 2022). Since these policies were implemented starting in 2022, natural gas consumption in the EU declined by more than 15% in both 2023 and 2024 compared with the 5-year (2017–22) average, according to EIA.

In Asia, a decline in Japan’s LNG imports last winter was more than offset by increased LNG imports into China as part of its post-COVID economic recovery. South Korea’s LNG imports have remained relatively flat over the past several winters since 2020.

Nearly full European storage

Natural gas storage inventories in Europe are nearly full ahead of winter 2024–25, while increased LNG imports in Asia amid mild temperatures in September and October may indicate a rapid refilling of inventories. Natural gas storage inventories in the EU as of Oct. 31, 2024, were 95% full. Since the EU enacted policies requiring storage operators to maximize injections during the refill season, the EU’s natural gas storage inventories have been full ahead of the winter heating season in both 2023 and 2024.

Storage capacity in East Asia is mostly limited to above-ground cryogenic storage tanks co-located with LNG regasification terminals, and helps meet seasonal peaks in demand. LNG inventories in Japan and South Korea were relatively low at the end of this past winter heating season but remained close to 2023 peak levels in subsequent months. In China, where natural gas storage capacity can meet about 12% of the country’s annual natural gas consumption, record LNG imports from August to October 2024 may indicate strong refill of storage inventories ahead of winter, according to EIA. In the US—the world’s largest LNG exporter—storage inventories were close to maximum volumes as of Nov. 8, 2024, exceeding last year’s inventories by 3%.

US LNG exports will continue to help balance global natural gas markets this winter. In EIA’s November 2024 Short-Term Energy Outlook, the agency forecast that US LNG exports will average 13.7 bcfd in the 2024–25 winter, 8% (1 bcfd) more than in the previous winter, as new and expanded projects come online in the next several months.

EU countries expanded LNG import capacity by more than one-third between 2021 and 2024 and expect more regasification capacity expansions this winter. EIA estimates regasification capacity to expand in Germany, Italy, Greece, and Poland by a combined 3.5 bcfd by January 2025.

The potential expiration of the Russia-Ukraine natural gas transit contract at the end of December 2024 could reduce natural gas pipeline flows into Europe. After declining by more than 40% in 2022, Russia’s pipeline exports to the EU via the sole remaining route transiting Ukraine consistently averaged 1.2-1.4 bcfd in 2023–24. Imports by pipeline from Norway and North Africa have limited potential for growth. Europe would have to offset the further loss of Russian supply mainly by importing more LNG and drawing down natural gas in storage.