EIA: US crude oil imports from Canada hit record following TMX pipeline expansion

US imports of crude oil from Canada hit a record 4.3 million b/d in July 2024 after Canada expanded its Trans Mountain pipeline, according to Petroleum Supply Monthly (PSM) from the US Energy Information Administration (EIA). July is the latest month with available data.

The Trans Mountain Expansion (TMX) increased the line's capacity from 300,000 b/d to three times that amount when it began commercial operation in May 2024, allowing more Alberta crude oil to reach Canada's west coast for export.

“Historically, most crude oil exports out of Alberta have made their way either to refiners in the US Midwest via pipeline or to the US Gulf Coast by rail shipments, where they are either consumed by refiners or loaded onto tankers for seaborne re-exports. TMX was added alongside the previous Trans Mountain pipeline to move larger volumes of crude oil to the coast of British Columbia to then be exported directly to Pacific Ocean buyers,” EIA said.

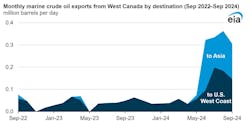

Since TMX came online in May, early data indicate that refiners on the US West Coast have been key buyers of the new export volumes. Between June and September, the US West Coast accounted for just over half of all maritime crude oil exports out of Western Canada, with the rest going to destinations in Asia, according to data from Vortexa Analytics. The US West Coast imported 498,000 b/d of crude oil in July 2024, according to EIA’s PSM, a record high for the region and an increase of 115% compared with July 2023.

The Western Canadian Select (WCS) crude oil spot price at Hardisty serves as a benchmark for Alberta's regional crude production. Historically, WCS prices are significantly lower than other benchmarks due to its quality and landlocked geography, limiting its market. Unlike Brent, the global benchmark, WCS has higher sulfur content and a lower API gravity, with extra costs needed to transport it from inland to coastal seaborne export locations.

Since TMX came online in May, added takeaway capacity has had a mixed impact on WCS prices, EIA noted.

In July 2024, the monthly average Brent price premium to WCS was $21/bbl, $5/bbl higher than it was at the same time last year despite the additional capacity provided by TMX. The August price differential was between the 5-year (2019–23) average and last year’s level. The September average price differential, however, was slightly below the 5-year average level. As of Oct. 29, the Brent price premium to WCS for October is narrower by $10/bbl compared with October 2023, according to EIA data.

“The WCS price differential to Brent and other benchmarks often widens in the fall, when Midwestern refiners reduce runs to undergo maintenance, limiting the pool of buyers from Alberta’s primary customers. If the price differentials remain near current levels through the end of the year, it may suggest that the added TMX capacity has helped to insulate Canada’s crude oil producers from the operational decisions of refiners in the US Midwest,” EIA said.