IEA lowers its global crude run forecasts for 2024

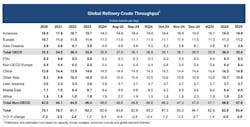

In its latest monthly Oil Market Report (OMR), the International Energy Agency (IEA) has lowered its 2024 global crude run estimates by 180,000 b/d from a previous 83 million b/d to 82.8 million b/d, due to the challenging margin environment. Since the start of the year, IEA’s 2024 crude runs forecasts have slipped by 500,0000 b/d.

According to IEA, signs of strength in the US are insufficient to offset lower activity levels elsewhere. Recent Chinese, Indian, Saudi Arabian, and Russian data were all weaker than expected, suggesting refiners are responding to the anemic margin environment.

“Refiners’ struggles with deteriorating margins are driven in part by the global abundance of refined product stocks which are hovering near 3-year highs while crude oil inventories have plummeted to the lowest level since at least 2017,” IEA said.

At 5.1 billion bbl, forward refining throughput cover is currently at 62 days, compared with a 2019 average of 66 days and a record of 85 days during 2020.

“The shifting changes in the refining crude slate and trade flows are also pressuring the refining outlook and margins. Excluding OECD government inventories and oil on water to account for the increased flow of Atlantic Basin crude oil to Asia, available industry stocks are estimated at just under 3.2 billion bbl. Correspondingly, crude stock cover falls to just under 39 days during third-quarter 2024, below year-ago levels and the recent peak of 51 days reached in the spring of 2020, but above 2019 average levels,” IEA said.

“Conversely, global refined product markets are well supplied, with inventories (excluding OECD government stocks and oil on water) approaching 3-year highs. Overall, the sustained low level of gasoline and middle distillate cracks – which account for almost 75% of OECD yields – has weighed on refinery profitability.”

September product crack improvements were limited to naphtha and residues, both of which are skewed to production from less complex refining assets that have seen increased run cuts.

Regional developments

For Europe, IEA maintains the assumption of 240,000 b/d of economic run cuts in Europe during fourth-quarter2024, but are mindful that more run cuts are possible if margins deteriorate further.

The comparatively limited US refinery disruptions from recent hurricanes have likely contributed to recent falls in US margins. While US natural gas prices recently rallied 50% from exceptionally low levels, this will hardly compromise the region’s competitive advantage thanks to low-cost crude, feedstocks, and utility inputs.

Actually, IEA’s OECD crude run forecasts having been increased by 500,000 b/d since January, largely driven by the US.

However, this upgrade has been more than offset by the cumulative 900,000 b/d reduction in Chinese 2024 throughput estimates, which reflects, in part, the more rapid slowdown in Chinese demand and lower domestic margins.

Product share

“Globally, the increase in crude processing in 2024 is now equivalent to 120% of the combined forecast increase in gasoline, jet fuel and gasoil demand growth. This level of growth is consistent with reported product stock builds year-to-date, as well as the tight crude markets,” IEA said.

Furthermore, higher non-crude volumes such as NGLs and biofuels results in these products gaining market share at the expense of refined fuels. This increase could exacerbate the current poor margin environment, as demand growth is heavily skewed towards petrochemical feedstocks and the potential for NGLs to displace naphtha will further undermine the call on crude runs, according to IEA.

2025 outlook

In line with lower 2024 estimates, 2025 forecasts have been trimmed by 210,000 b/d to 83.4 million b/d. Annual growth is now pegged at 610,000 b/d, a reduction of 20,000 b/d from last month’s Oil Market Report.

Growth next year is driven by the non-OECD, at 1 million b/d, while the OECD will contract by 460,000 b/d y-o-y, as capacity closures in the US and Europe weigh on crude processing.

“The largest swing factor in the annual growth rates is China, where we expect this year’s 260,000 b/d contraction to shift to a gain of 330,000 b/d in 2025. Increased capacity – notably at the Yulong refinery which is reportedly starting trial runs – underpins much of the higher levels. However, we note that projected demand growth of Chinese refined products for 2025 falls well short of the expected increase in runs, presenting a clear downside risk to the forecast rebound if product export quotas are not raised in tandem,’ IEA said.