Gas transit via Ukraine remains a key uncertainty ahead of the winter season

The future of Russian natural gas transit via Ukraine is a key uncertainty ahead of the 2024-25 winter season, as both the transit and interconnector agreements between Russia and Ukraine are set to expire at end-2024, according to the International Energy Agency (IEA).

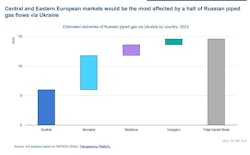

While Russian gas transited via Ukraine met only a small share of total European Union (EU) gas demand in 2023, the halt of these flows would significantly affect some Central and Eastern European markets and Moldova, IEA said.

Gazprom and Naftogaz Ukrainy signed a 5-year transit contract at end-2019. The volumes transited via Ukraine have fallen steeply in recent years, to less than 15 billion cu m (bcm) in 2023 from around 90 bcm in 2019. In 2023, Russian gas transit flows via Ukraine contracted by 28% y-o-y and totaled 14.65 bcm. Of this, around 12.8 bcm was sent to the EU and an estimated 1.8 bcm was delivered to Moldova. The majority of these deliveries are performed under long-term supply contracts with a duration well beyond 2024. The main recipients of Russian piped gas via Ukraine in 2023 were Austria, Hungary, Moldova, and Slovakia.

“While Russian gas transited via Ukraine accounted for less than 4% of total EU gas demand in 2023, the Ukrainian transit route met around 65% of the combined gas demand of Austria, Hungary and Slovakia. Flow data suggest that Hungary effectively reduced its reliance on the Ukrainian transit route in 2024. Furthermore, Ukraine received around 4.3 bcm of gas from the EU and Moldova in 2023. Some of this gas is supplied through the reversal of Russian piped gas flows,” IEA said.

“The transit and interconnector agreements between Ukraine and Gazprom expire at the end of 2024. The Ukrainian gas transmission system operator has publicly stated that the interconnector agreement will not be renewed. While a political agreement might be still found, there are significant risks that transit via Ukraine will be discontinued from January 2025. The ability to reroute transit volumes via Türkiye is limited, as there is no additional capacity available through the TurkStream pipeline system," IEA continued.

IEA’s forecast assumes no Russian piped gas deliveries via Ukraine to Europe from January 2025. The halt of this gas transit would translate into the loss of around 6 bcm of gas supply into the EU in first-quarter 2025 and would necessitate higher European LNG imports in the quarter. This in turn would drive stronger competition with Asian buyers for flexible LNG cargoes and lead to tighter market fundamentals.

“Our assessment indicates that the halt of Ukrainian transit would not pose an immediate supply security risk to Austria, Hungary, or Slovakia considering their ample storage capacity, midstream interconnectivity and indirect access to the global LNG market (including via new FSRUs in Germany and Italy). The vulnerability of Moldova is significantly greater and would require close co-operation between Moldova and regional and international partners to ensure energy supply security over the winter season,” IEA said.