Oil, fundamental analysis

Crude prices had a volatile week as traders weighed a potential Israeli attack on Iran against a large inventory build, possible Hurricane Milton demand destruction, China’s economy, and further positive news on inflation. The breach of two key technical barriers led to mid-week selling. WTI saw a high/low range on the week of $78.45/bbl (Tuesday) and $71.50/bbl (Wednesday). Brent hit a high of $81.20/bbl on Monday with a low of $75.15/bbl on Wednesday. Both grades of oil look to settle higher week-on-week. The WTI/Brent spread has tightened to -$4.25.

An attack on Iran by Israel is more of a question of “When? and Where?” at this point which is keeping a floor on oil prices as traders have shown to be reluctant to short crude below $70/bbl. In talks with Israel, President Biden has discouraged the country from attacking Iran’s oilfields. Meanwhile, China’s economy still remains a concern as the central bank there has not announced any new stimulus measures this week but will meet this weekend.

Additional bearish signals emerged as Libya’s oil production has finally returned to pre-control dispute levels of 1.2 million b/d. Meanwhile, Kazakhstan continues to produce more oil than it is supposed to under the OPEC+ quota limits having increased supply by +10% in August. And the Gulf of Mexico oil and gas infrastructure was once again spared the destructive forces of a hurricane as Milton stayed East and cut a path across Florida. Gasoline demand there rose dramatically ahead of the storm’s landfall as residents filled-up to flee the state or to have gasoline in the event of disruptions.

The Energy Information Administration’s (EIA) Weekly Petroleum Status Report indicated that commercial crude oil inventories for last week increased substantially while motor gasoline and distillates fell. Total US oil production rose back to its previous record of 13.4 million b/d vs. 13.3 million b/d last week and 13.2 last year at this time.

The EIA has lowered its 2025 global oil demand forecast by 300,000 b/d to 104.3 million b/d, a 1.2 million b/d increase over 2024. The agency is also reporting that crude shipments through the Arabian Peninsula are down 50% across the first 8 months of 2024 due to Houthi rebel attacks. Tankers are choosing the much more expensive but safer route around the southern tip of Africa.

The Consumer Price Index (CPI), the main measure of inflation, rose 2.4% last month, lower than August’s 2.5% increase. The Producer Price Index stayed flat in September vs. a projected +0.1%, further indicating that inflation is cooling. The Federal Reserves preferred measure of inflation, the PCE, will be released on Oct. 31, 1 week ahead of their next rate-setting meeting. Claims for unemployment benefits rose by 33,000 last week, more than expected. All three major US stock indexes are setting new record highs this week on the encouraging inflation news. USD is also higher week-on-week which is keeping somewhat of a cap on oil’s current rally.

Oil, technical analysis

November 2024 WTI NYMEX futures prices raced towards the 200-day Moving Average this week, having breached the Upper-Bollinger Band limit last week. Failure to hold either level led to some technical selling, but prices remain above the 8-, 13-, and 21-day Moving Averages. Tuesday’s price range was almost $6.00 and replicated the range from Sept. 30, 2024 when the rally began. Volume is below average at 190,000.

The Relative Strength Indicator (RSI) is slightly-bought at the 57 mark. 30 or below is considered very oversold while 70 or above is considered very overbought. Resistance is now pegged at $76.00. Near-term Support is $75.30.

Looking ahead

Whenever Middle Eastern conflicts bring the idea of oil disruptions to the forefront, US crude reserves need to be examined. Currently, US commercial crude stocks stand at 423 million bbl while the SPR is at 383 million for a total of 806 million bbl of refinery feedstock reserves. Current US refinery input is about 16 million b/d and the country is producing 13.4 million b/d. Should the US lose all imports, reserves can supplement domestic production for 270 days. 62% (4.4 million bbl) of the US's current imports come from Canada and risk no interruption.

The US gets 1.5 million b/d from OPEC countries with no one country supplying more than 300,000 b/d. The US is exporting about 4.0 million b/d and would cut those off if needed.

Oil markets remain on alert awaiting an actual attack on Iran by Israel. Traders will be watching for any decision on additional stimulus to be announced by China this weekend. And, given that both Hurricane Helene and Hurricane Milton developed in the Bay of Campeche and, not off the West Coast of Africa, one must wonder if this will be the new normal for hurricane development. The US is almost past the peak hurricane season (Oct. 15), but the full season does not end until Nov. 30.

Natural gas, fundamental analysis

Despite the shrinking storage surplus, November natural gas futures are lower this week as Hurricane Milton not only did not disrupt Gulf of Mexico production but also dampened demand with torrential rainfall and power outages. The week’s high was $2.84/MMbtu on Monday while the low was Thursday’s $2.59. Supply last week was 107.5 bcfd vs. 107.3 the prior week. Demand was 96.6 bcfd, up from 95.7 the week prior with an increase in Residential usage.

Exports to Mexico were 6.3 bcfd vs. 6.6 the prior week. LNG exports were 12.7 bcfd. vs. 12.4 the prior week. The latest European natural gas prices were quoted at about $11.60/MMbtu on rising fears of LNG shipment disruptions in the Middle East. The EIA’s Weekly Natural Gas Storage Report indicated an injection of 82 bcf vs. a forecast of +70 bcf and a 5-year average of +96 bcf.

Total gas in storage is now 3.629 tcf, 3.5% above last year and 57% over the 5-year average. With only 3 weeks left in the traditional injection season and, assuming an average build of 90 bcf, year-end storage totals could reach 3.9 tcf.

Natural gas, technical analysis

November 2024 NYMEX Henry Hub Natural Gas futures are now trading above the 8-, 13-, and 21-day Moving Averages but below the 8-day. Volume is low at 90,000. The RSI is neutral at 53. Support is pegged at $2.60 with Resistance at $2.72.

Looking ahead

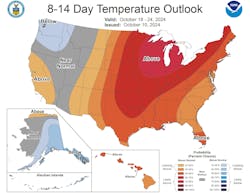

Power outages throughout the US Southeast from Helene and Milton will continue to dampen demand for natural gas-fired generation. The 8–14-day forecast indicates above-normal temperatures for the greater part of the US. The storage surplus will continue to hang over prices especially as temperatures are moderating.

About the Author

Tom Seng

Dr. Tom Seng is an Assistant Professor of Professional Practice in Energy at the Ralph Lowe Energy Institute, Neeley School of Business, Texas Christian University, in Fort Worth, Tex.