Rystad Energy: High spare capacity keeps oil prices in check for now

Rising geopolitical tensions are pushing oil prices higher this week, with the escalating conflict in the Middle East causing major concerns about supply in the global crude market. However, OPEC+ still has a significant amount of spare capacity available, thanks to production cuts made over the past 2 years. This spare capacity is helping to stabilize prices, even amidst one of the most severe crises in the Middle East in the last 40 years, according to Rystad Energy.

“As of October 2, the crisis in the Middle East is intensifying, with increasing risks to oil supply.

Currently, Iran produces approximately 4 million b/d of crude, exporting about half of that, mostly to China. In the event of a war directly involving Iran, the risk of reduction to its crude exports would become real,” said Rystad chief economist Claudio Galimberti.

“Yet, OPEC+ spare capacity currently sits at more than 5 million b/d, which could be deployed relatively quickly (within 60 days) to fill the gap. However, if the Strait of Hormuz were to be impacted, then all bets would be off. In fact, more than 13 million b/d of crude passed through the strait in third quarter this year, and flows were as high as 15 million b/d in the first half of 2023. Any blockage to the strait would result in runaway prices, increasing quickly and steadily the longer the blockage persists.”

Last week, the US government released its final estimates for GDP growth and the PCE index (Personal Consumption Expenditures Price Index), indicating robust economic expansion and cooling inflation. The final estimate of US GDP showed 3% growth in the second quarter, in line with the consensus, according to data published on Sept. 26. The US PCE price index increased by 0.1% in August, resulting in a year-over-year inflation rate of 2.2%, below the forecasted 2.4% and getting closer to the Federal Reserve’s 2% target, according to Rystad.

Simultaneously, China’s manufacturing sector is facing contraction, fueling concerns about a sluggish economy. As a result, the market is anticipating additional monetary and fiscal support from China, while also monitoring US macroeconomic data to assess the chances of a soft landing.

Rystad Energy’s updated US oil production outlook remains mostly unchanged from the previous update with a marginal upside for the rest of 2024. Crude and condensate supply is estimated to increase by 280,000 b/d in 2024, and 356,000 b/d in 2025. However, Hurricane Helene affected oil and gas operations in the Gulf of Mexico last week, causing a scale back in operations and evacuations from some offshore production sites.

On the refining front, South Korean production is expected to decrease to 2.77 million b/d in September from 2.95 million b/d in August due to weak margins, delayed crude shipments and maintenance, reflecting a wider trend of declining refining margins globally, also due to oversupply associated with lower demand for gasoline and diesel in Europe, Asia, and the US.

In China, the Yulong refinery complex began operating one of its crude units, though the anticipated increase in crude production could lead to a domestic surplus of gasoline and diesel, complicating the refining landscape.

China oil demand

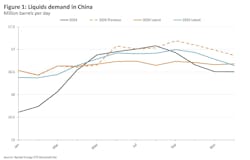

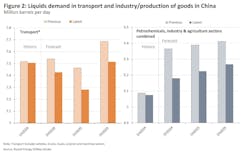

As China's economic landscape evolves, Rystad Energy has revised its forecasts for the country's oil demand in second-half 2024 to an average of 16.7 million b/d, a decrease of 330,000 b/d from the previous outlook. Total demand growth in 2025 is now estimated to be 75,000 b/d, down from 290,000 b/d in the previous outlook.

“China’s manufacturing PMI reported in September rose to 49.8 from 49.1 in the previous month. While the number increased and came out higher than the market expectation of 49.5, it remains below the 50-mark, which still suggests contraction,” Galimberti said.

The global balances are anticipated to remain tight for latter-half 2024, but clear signs of a recovery in Chinese demand are required for bullish sentiment on prices.