Helene spares Gulf of Mexico production, demand concerns remain

Oil, fundamental analysis

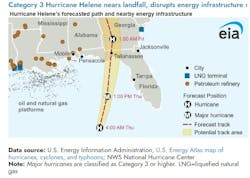

The US oil and gas industry was spared the wrath of the devastating Hurricane Helene this week. The strongest storm on record to hit Florida’s Big Bend area left death and destruction in its wake but was far enough east to avoid the major areas of production in the Gulf of Mexico.

Precautionary evacuations took place earlier in the week. However, the temporary loss of supply did not support crude prices. Additionally, a large draw in inventories, the increasing hostilities between Israel and Hezbollah/Hamas and the announcement of Chinese economic stimulus plans could not overcome demand concerns. WTI saw a weekly high price of $72.50/bbl on Tuesday with the low occurring Thursday at $66.95/bbl, a level seen 2 weeks ago. Brent crude also hit its high on Tuesday at $76.85/bbl and a low of $70.70/bbl on Thursday. Both grades of oil were down week-on-week. The WTI/Brent spread has widened to -$3.80. Overall, crude prices have been on a downward trend since WTI’s July 8 $85/bbl.

Gulf of Mexico evacuations ahead of Helene curtailed a peak estimated 29% of oil production and 17% of natural gas according to the US Bureau of Safety and Environmental Enforcement (BSEE). It is expected that production will resume in short order now that the storm has passed.

Despite the on-going exchange of fire between Israel and Hezbollah/Hamas, oil markets continue to focus on the weaker demand in China due to lax economic growth, the property crisis, increased EV sales, and the growing use of LNG instead of diesel for trucking. President Xi Jinping is calling for additional fiscal spending above and beyond those announced this week to stimulate growth.

OPEC’s analysts and the International Energy Agency continue to differ greatly over crude oil demand this year with the latter seeing less than +1.0 million b/d growth while the former expects a +2.0 million b/d increase. Meanwhile, Saudi Arabia is denying that it has a particular price target in mind when making production policy. The market has always understood its goal was to achieve the $100 level, but non-OPEC producers have thwarted that effort. Speculation now exists that OPEC+ may go ahead with the planned output cuts in December in a move to regain market share lost to others, including the US. The rumors led to Thursday’s precipitous price drop.

An apparent agreement has been reached between the eastern and western administrative districts in Libya over the leadership of its central bank which should lead to the reopening of its oil fields.

The Energy Information Administration’s (EIA) Weekly Petroleum Status Report indicated an across-the-board decrease in petroleum and product stocks last week. The drop in crude was in line with the forecast from the American Petroleum Institute (API). The Strategic Petroleum Reserve rose +1.3 million bbl as the DOE purchases begin deliveries.

Total US oil production held at 13.2 million b/d vs. 12.9 last year at this time.

Key August economic indicators this week included the PCE, the Fed’s preferred measure of inflation, which came in at +0.1% over July and +2.2% year-on-year. The monthly increase was right on forecasts while the annual change was the lowest since early 2021. Expectations are now that more rate cuts could be coming. Personal income was +0.2% vs. expectations of +0.4% while personal spending was +0.2% against forecasts of +%0.3%. August housing sales rose +0.6% but were below the market expectation of +1.0%. All three major US stock indexes are at new record levels on the inflation news. The USD is down on the move into equities which may be the only support for oil presently.

Oil, technical analysis

November 2024 WTI NYMEX futures prices have slipped below the 8-, 13, and 21-day Moving Averages (MA). Volume is below average at 160,000. The Relative Strength Indicator (RSI), a momentum indicator, is oversold at the 40 mark. Thirty or below is considered very oversold while 70 or above is considered very overbought. Resistance is now pegged at $68.20, Thursday’s high, with near-term support at $67.00.

Looking ahead

Israel has denied any interest in a ceasefire in Lebanon despite one being called for by the UN, the US, and other interested parties. At this point, a ceasefire in the Middle East would only be more bearish for oil prices while the market awaits the OPEC+ decision on increasing output in December as announced.

China’s economic woes will not abate in the near future which leaves demand concerns hanging over crude prices. Production in the Gulf of Mexico was largely spared from Hurricane Helene this week, however, there are still 2 weeks left in peak hurricane season, which ultimately doesn't end until Nov. 30. The NWS National Hurricane Center in Miami is watching two systems presently. A low-pressure system is once again forming in the Western Caribbean with a 30% chance of development over the next week. Meanwhile, Tropical Storm Joyce has formed in the Central Atlantic but appears to have a more northeasterly track presently. Seasonal high-pressure fronts coming down from the North may steer tropical systems away from the heart of the Gulf of Mexico, however.

Natural gas, fundamental analysis

Natural gas futures got a boost this week as November became the prompt month and as Gulf of Mexico outages and a shrinking surplus led to a rare gap on the continuation chart. The week’s high was $2.92/MMbtu on Friday while the low was Monday’s $2.46/MMbtu.

Supply last week was 107.2 bcfd vs. 107.2 the prior week. Demand was 97.2 bcfd, up from 95.4 the week prior with an uptick in power. Exports to Mexico were 7.0 bcfd vs. 6.7 the prior week. LNG exports were 12.6 bcfd. vs. 12.9 the prior week. The latest European natural gas prices were quoted at about $10/MMbtu, down considerably on weakening demand.

The EIA’s Weekly Natural Gas Storage Report indicated an injection of +47 bcf vs. a forecast of +53 bcf. Eight bcf was reclassified as working, resulting in an implied flow of +55 bcf. Total gas in storage is now 3.492 tcf, +6.0% above last year and +7.1% over the 5-year average.

Natural gas, technical analysis

November 2024 NYMEX Henry Hub Natural Gas futures are now trading above the 8-, 13-, and 21-day Moving Averages (MA) on the month-to-month roll. November demand is always perceived to be higher than October so, when trading months shift, NYMEX futures reflect that difference. This time, it resulted in a gap between the high for the last trading day of October and the low for November’s first day. Prices remain well-above the Upper-Bollinger Band level, a pending sell signal. Volume is rising to 125,000. The RSI is overbought at 72, another sell signal. Support is pegged at $2.70 with resistance at $2.95.

Looking ahead

EQT Corp., which has curtailed natural gas output in the wake of lower prices, foresees increasing supplies as winter prices are higher and as more LNG production plants come online.

Belgium is again calling for a united EU effort to ban the importation of Russian LNG into the region which could be a boon for US LNG exporters and US producers of natural gas.

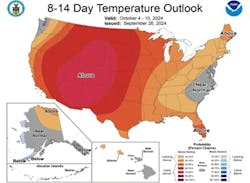

The 8–14-day forecast indicates above-normal temperatures for the western-half of the US which could provide some power generation loads for natural gas. Longer-term, however, we are heading into October which is regarded as a shoulder month for energy demand.

About the Author

Tom Seng

Dr. Tom Seng is an Assistant Professor of Professional Practice in Energy at the Ralph Lowe Energy Institute, Neeley School of Business, Texas Christian University, in Fort Worth, Tex.