Oil, fundamental analysis

Oil prices made slight gains this week mostly on the Gulf of Mexico outages caused by Hurricane Francine along with a modest decline in Libyan output. Prices rose despite ongoing concerns over demand, across-the-board increases in inventories, and remaining uncertainty regarding an interest rate cut.

The high for WTI of $70.32/bbl was set on Friday while the low was Tuesday’s $65.25/bbl, the lowest price since May 2023. Brent crude followed a similar pattern with $73.25/bbl as its high on Friday and the week’s low of $68.75/bbl on Tuesday, the lowest level since January 2022. Both grades of oil look to settle marginally higher week-on-week.

Gulf of Mexico platform evacuations ahead of Hurricane Francine resulted in an estimated shut in of 42% of Gulf of Mexico oil production and 53% of natural gas production, leading to bullish support to prices over the past week (OGJ Online, Sept. 12, 2024). The flip side, is that high winds and flooding rains cause onshore refineries and LNG export plants to curtail or stop operations, dampening demand.

Prices attempted a rally past $70/bbl to the technically-significant 13-day moving average on Friday. Failure to reach that area led to more short-selling and sub-$70 pricing. Global demand concerns remain the overriding bearish factor in the market. Meanwhile, inventories rose across-the-board for the first time in 4 weeks.

The United Nations is mediating talks between the governmental factions in Libya to resolve a standoff continuing to disrupt oil exports, which have fallen by 150,000 b/d so far. This too, however, has not been able to buoy crude prices.

Both the International Energy Agency (IEA) in Paris and OPEC analysts have cut forecasts for global oil demand growth. The IEA has reduced its market demand increase to +903,000 b/d from +970,000 b/d while OPEC forecasts a +2.0 million b/d gain this year and +1.74 million b/d for 2025, both down from their previous outlooks.

China remains the key focus as EV sales continue to increase and more and more diesel is being replaced by LNG. Meanwhile, Ukrainian drone attacks on Russian refineries have reduced available capacity there by an estimated 15%, which could lead to increased exports of the crude feedstocks.

On the economic front, US data indicated lowering inflation as the CPI was reported at +2.5% for August. However, core inflation, which excludes food and energy costs, did rise 0.3% and was above expectations. The Producer Price Index (PPI) came in at +0.2% in line with forecasts. The mixed inflation numbers continue to leave the market guessing as to any rate cut decision the Fed may make at its meeting next week.

The Energy Information Administration’s (EIA) Weekly Petroleum Status Report indicated that commercial crude oil inventories along with gasoline and distillates increased last week while gasoline demand fell, and refineries cut-back on production.

In addition to the inflation data, import prices for August saw the largest drop in 8 months, further suggesting the overall inflation is cooling. And, despite a 2,000 rise in unemployment claims this week, overall claims remain low by historical standards. Meanwhile, as the US waits for any level of interest rate cut, the European Central Bank has cut rates for the second time in 3 months. All 3 major US stock indexes are much higher than at the end of the prior week. The USD is off slightly which provides some level of price support for crude.

Oil, technical analysis

October 2024 WTI NYMEX futures prices moved through the 8-day moving average (MA) but could not hold above $70. Subsequently, they fell back to around the 8-day and below the 13- and 21-day MA. Volume is about average at 350,000. The relative strength indicator (RSI) is oversold at the 41 mark. Thirty or below is considered very oversold while 70 or above is considered very overbought. Resistance is now pegged at $70.32, Friday’s high, with near-term support at $68.50.

Looking ahead

In addition to the Fed meeting next week, several key indicators from China, the world’s No. 2 economy, will be released including industrial production, retail sales, and new home sales. Next Wednesday’s EIA Petroleum Status Report should give a clearer picture of the impact of Francine on Gulf of Mexico supply disruptions. Market analysts are also keeping an eye on the developments in Colombia where the rebel group ELN has resumed attacks on oil infrastructure. ELN opposes the country’s contracts with international oil companies which they say favor the IOCs. Another tropical system in the Central Atlantic bears watching.

Natural gas, fundamental analysis

Natural gas prices stair-stepped higher this week on a lower-than-forecasted storage injection and hurricane-related outages. While Hurricane Francine halted some Gulf of Mexico production and onshore LNG exports, the cooling effect of the torrential rainfall lowered power demand for A/C. The week’s high was $2.405/MMbtu on Friday, while the low was Tuesday’s $2.125/MMbtu. Supply last week was 107.8 bcfd vs. 108.6 the prior week. Demand was 96.8 bcfd, down from 99.1 the week before with lower power demand due to Francine and cooler temperatures nationwide.

Exports to Mexico were 6.8 bcfd vs. 7.0 the prior week. LNG exports were 13.4 bcfd. vs. 13.3 the prior week. The latest European natural gas prices were quoted at $12.25/MMbtu. The EIA’s Weekly Natural Gas Storage Report indicated an injection of +40 bcf vs. a forecast of +50 bcf and the 5-year average of +67. Total gas in storage is now 3.387 tcf, +6.2% above last year and +9.6% over the 5-year average.

Natural gas, technical analysis

October 2024 NYMEX Henry Hub Natural Gas futures are now trading above the 8-, 13- and 21-day moving averages (MA) and remain above the Upper-Bollinger Band level, a pending sell signal. Volume is about average at about 150,000. The RSI is neutral at 57. Support is pegged at $2.25 (8-day MA) with resistance at $2.45.

Looking ahead

While the market has thus far looked at the declining surplus in storage, it’s still a surplus to both the year-ago and 5-year averages. Temperatures are cooling and demand for power generation is declining. Injections will continue until sustained cold temperatures enter the US.

With 8 weeks remaining in the official storage injection season, only +76 bcf/week would put the total at 4.0 tcf. At this point, that is feasible.

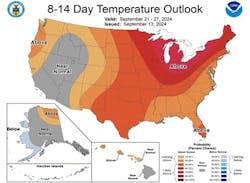

The tropics will be monitored by natural gas traders. Above-normal temperatures are forecasted for large swaths of the country over the next 2-3 weeks. However, given fall is upon us, above-normal may not result in increased demand for power.

About the Author

Tom Seng

Dr. Tom Seng is an Assistant Professor of Professional Practice in Energy at the Ralph Lowe Energy Institute, Neeley School of Business, Texas Christian University, in Fort Worth, Tex.